L4 Tax Form

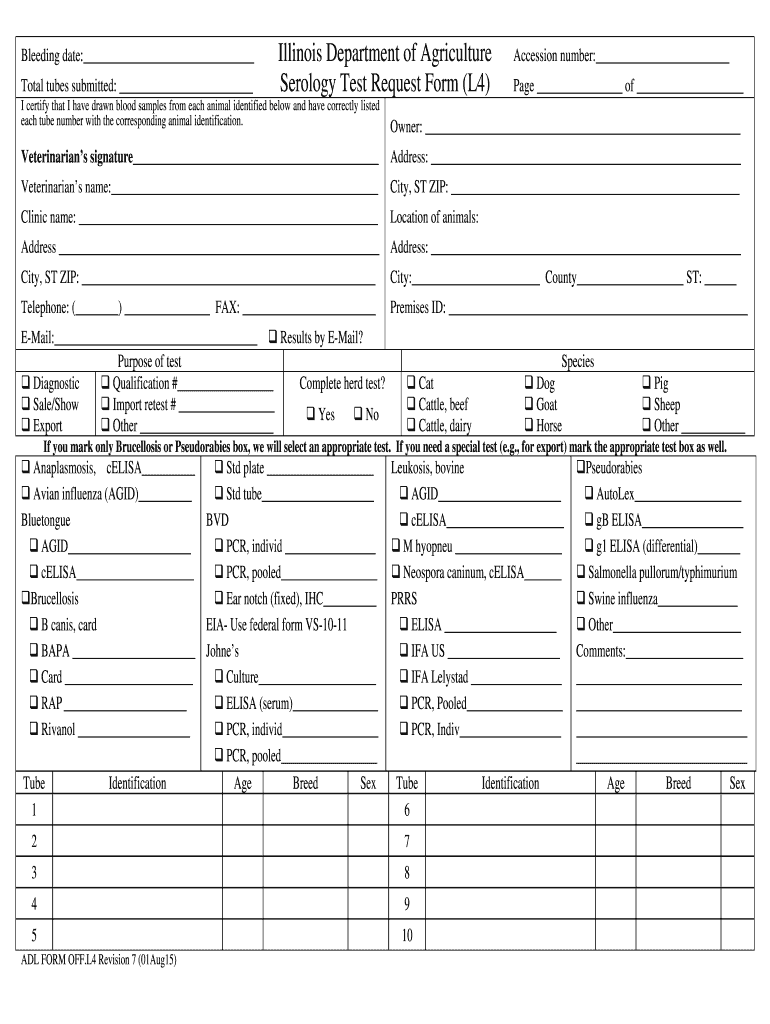

L4 Tax Form - Or all beneficiaries are class a, but estate does not qualify to. Ad don't leave it to the last minute. Open the employee withholding exemption certificate l 4 and follow the instructions. Employees who are subject to state. Web follow the simple instructions below: (check a box below) incurred no tax liability in the prior year and anticipate no tax. Individual tax return form 1040 instructions; A complete inheritance or estate tax return cannot be completed yet; Employees who are subject to state. Web quick tax quick tax is the city’s online tax filing system.

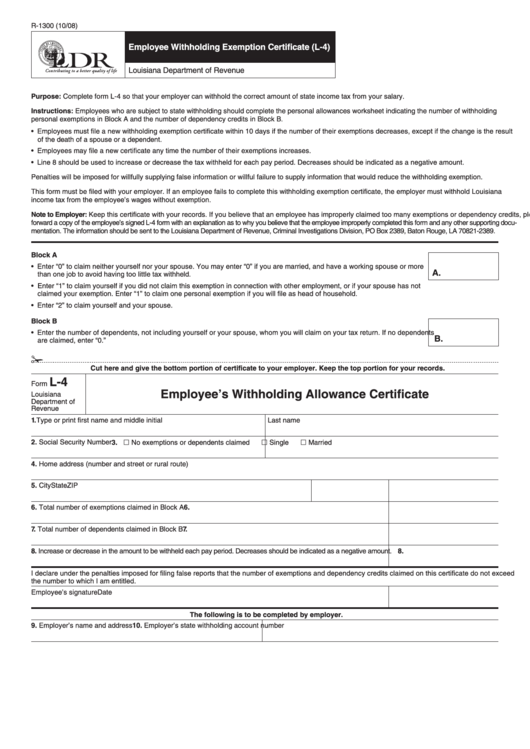

Our platform provides you with a wide library of. File your form 2290 online & efile with the irs. Web quick tax quick tax is the city’s online tax filing system. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Or all beneficiaries are class a, but estate does not qualify to. A complete inheritance or estate tax return cannot be completed yet; Edit your la form online. Employees who are subject to. Once you sign up, you will be able to submit returns and payments for all tax types electronically. Employees who are subject to state.

Are you seeking a quick and efficient solution to fill out l4 form 2020 at an affordable price? Web popular forms & instructions; Individual tax return form 1040 instructions; Ad don't leave it to the last minute. Our platform provides you with a wide library of. File your form 2290 online & efile with the irs. A complete inheritance or estate tax return cannot be completed yet; Once you sign up, you will be able to submit returns and payments for all tax types electronically. Get irs approved instant schedule 1 copy. Web follow the simple instructions below:

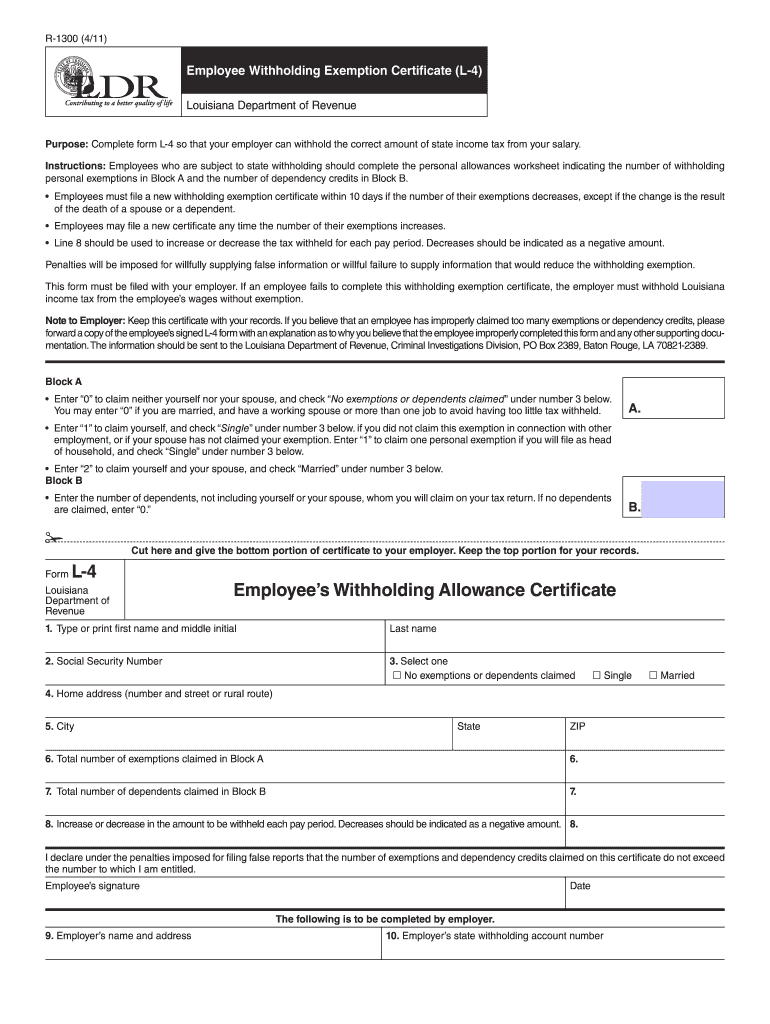

Louisiana Form Exemption Fill Out and Sign Printable PDF Template

(check a box below) incurred no tax liability in the prior year and anticipate no tax. Ad don't leave it to the last minute. Web send louisiana dept of revenue form r 1312 9 17 via email, link, or fax. Get irs approved instant schedule 1 copy. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

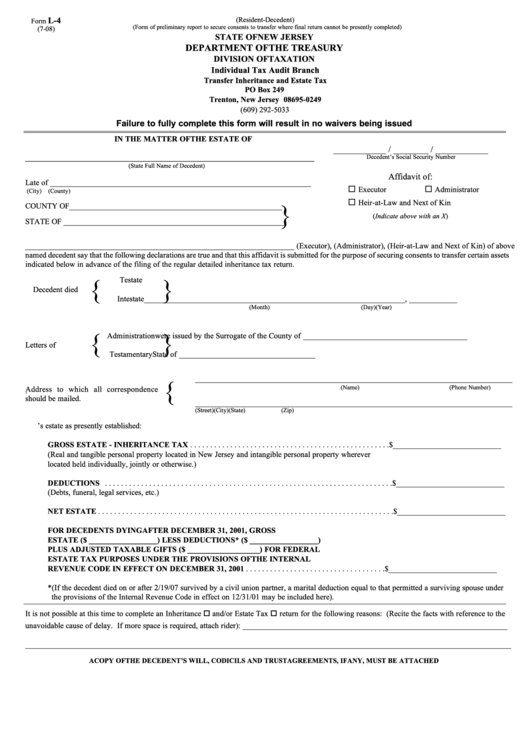

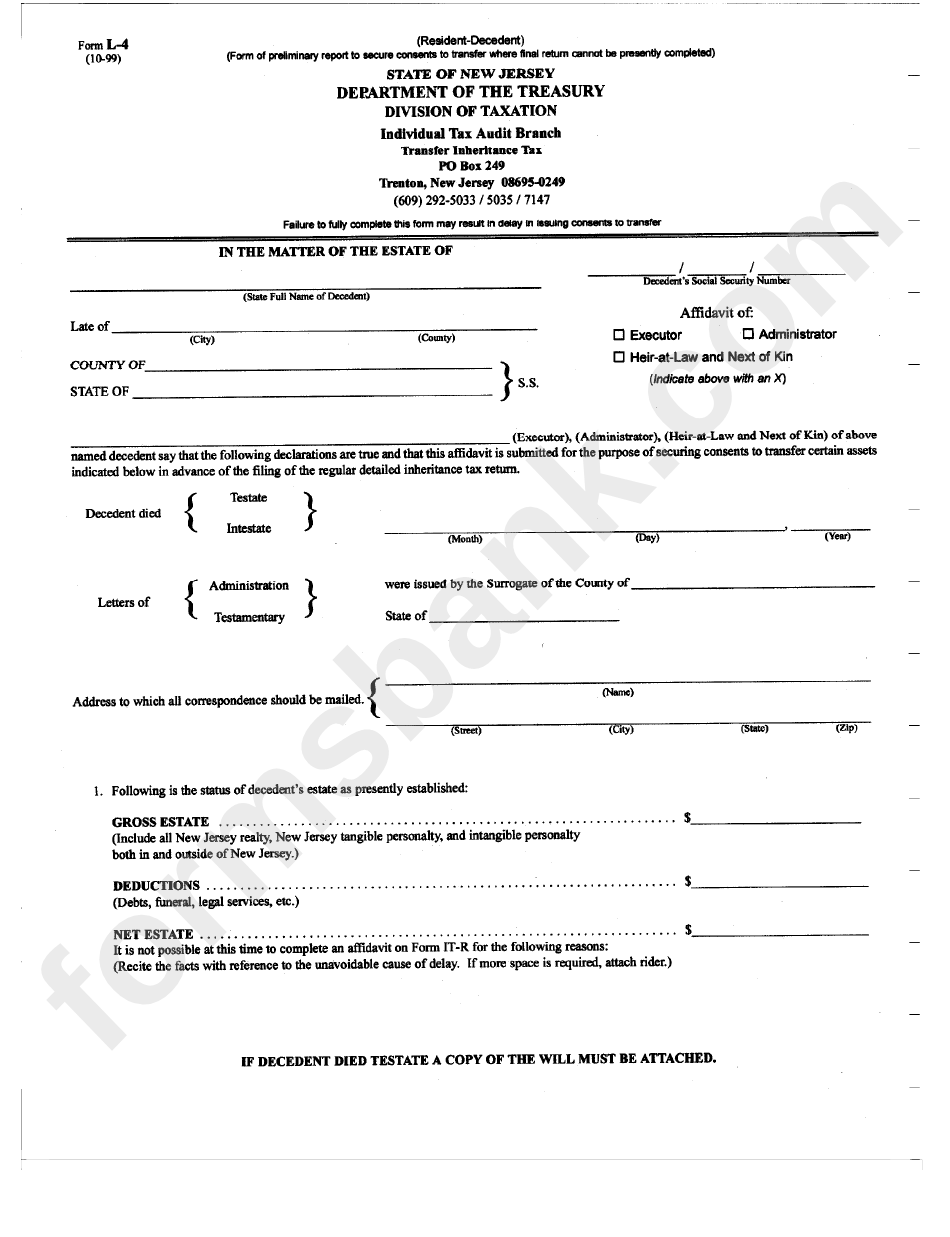

Fillable Form L4 Transfer Inheritance And Estate Tax Individual

Web quick tax quick tax is the city’s online tax filing system. Easily sign the louisiana l 4 with your finger. Are you seeking a quick and efficient solution to fill out l4 form 2020 at an affordable price? You can also download it, export it or print it out. Employees who are subject to.

Form R1300 Employee Withholding Exemption Certificate (L4

You can also download it, export it or print it out. Employees who are subject to state. A complete inheritance or estate tax return cannot be completed yet; File your form 2290 online & efile with the irs. Employees who are subject to state.

L4 Form Fill Out and Sign Printable PDF Template signNow

(check a box below) incurred no tax liability in the prior year and anticipate no tax. A complete inheritance or estate tax return cannot be completed yet; Employees who are subject to state. Web follow the simple instructions below: Employees who are subject to state.

Ms State Withholding Form

Get irs approved instant schedule 1 copy. Edit your la form online. Employees who are subject to state. (check a box below) incurred no tax liability in the prior year and anticipate no tax. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

Form L4 Transfer Inheritance Tax New Jersey Department Of Treasury

Web popular forms & instructions; Web follow the simple instructions below: Employees who are subject to state. (check a box below) incurred no tax liability in the prior year and anticipate no tax. Employees who are subject to state.

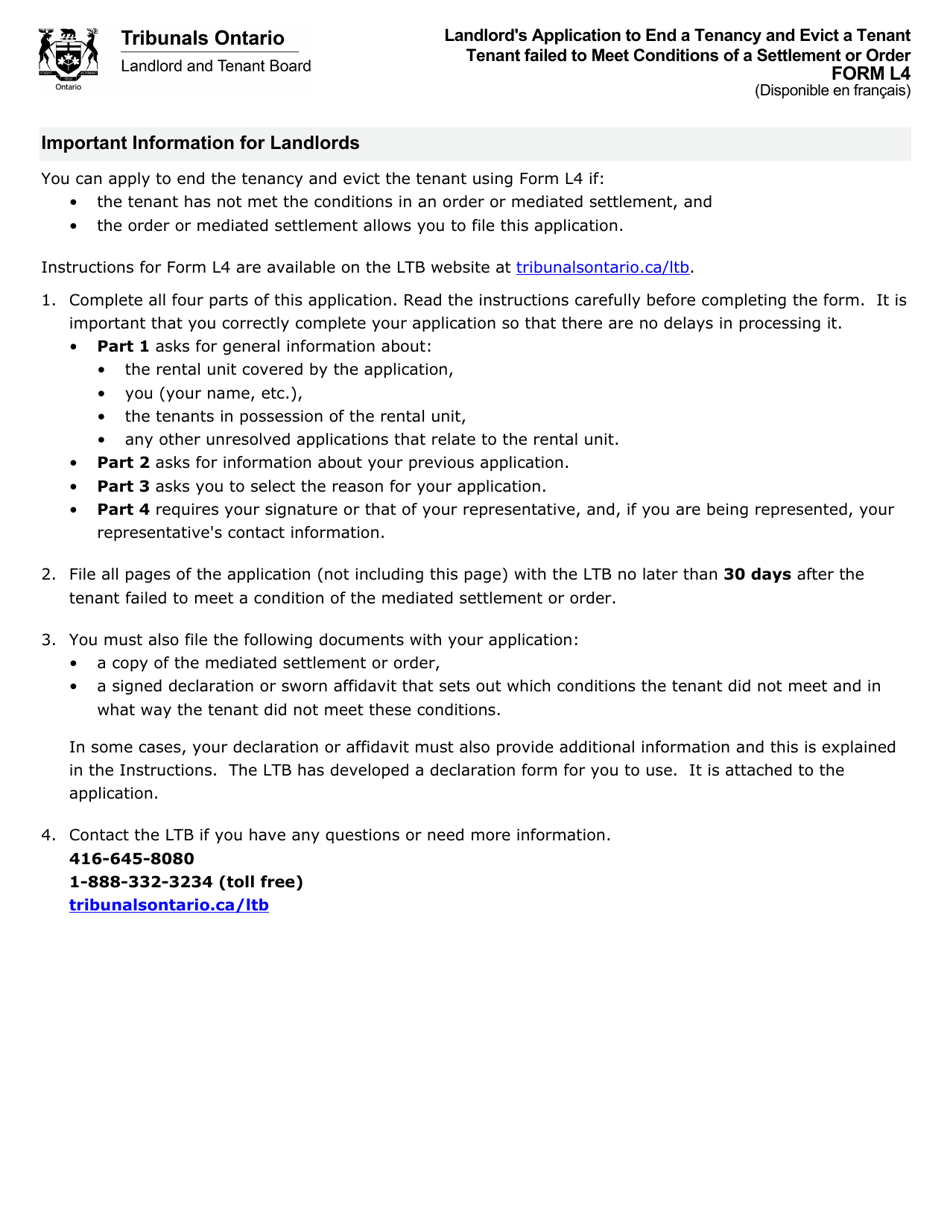

Form L4 Download Fillable PDF or Fill Online Landlord's Application to

Ad don't leave it to the last minute. File your form 2290 online & efile with the irs. Employees who are subject to state. Once you sign up, you will be able to submit returns and payments for all tax types electronically. (check a box below) incurred no tax liability in the prior year and anticipate no tax.

L4 Advance Tax, Interest, TDS, TCS Concept, and Problems Nishant

Edit your la form online. Ad don't leave it to the last minute. Easily sign the louisiana l 4 with your finger. Individual tax return form 1040 instructions; You can also download it, export it or print it out.

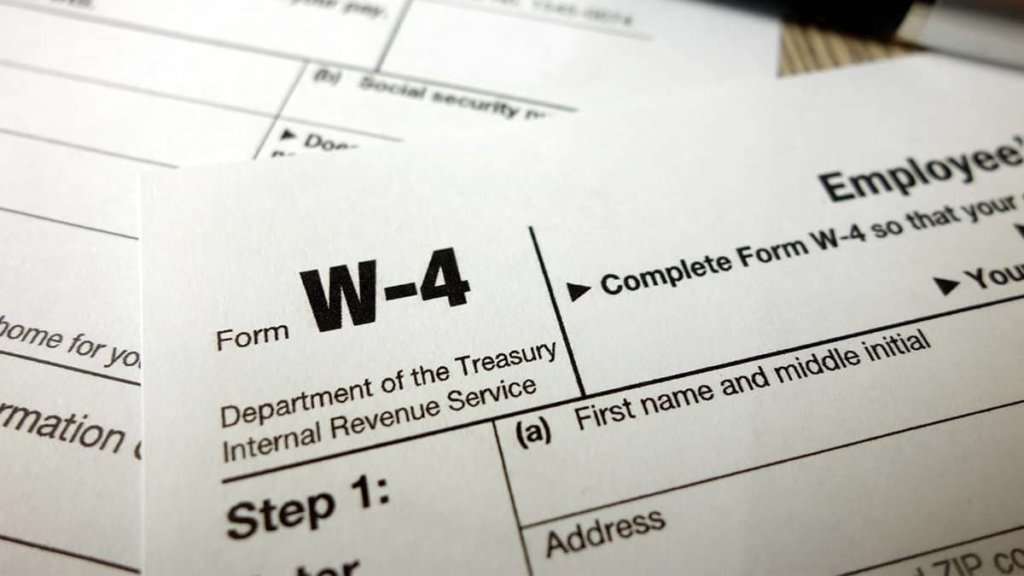

W4 Form Fillable 2023 W4 Forms Zrivo

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Once you sign up, you will be able to submit returns and payments for all tax types electronically. Web popular forms & instructions; Web follow the simple instructions below: Send filled & signed 2023 form.

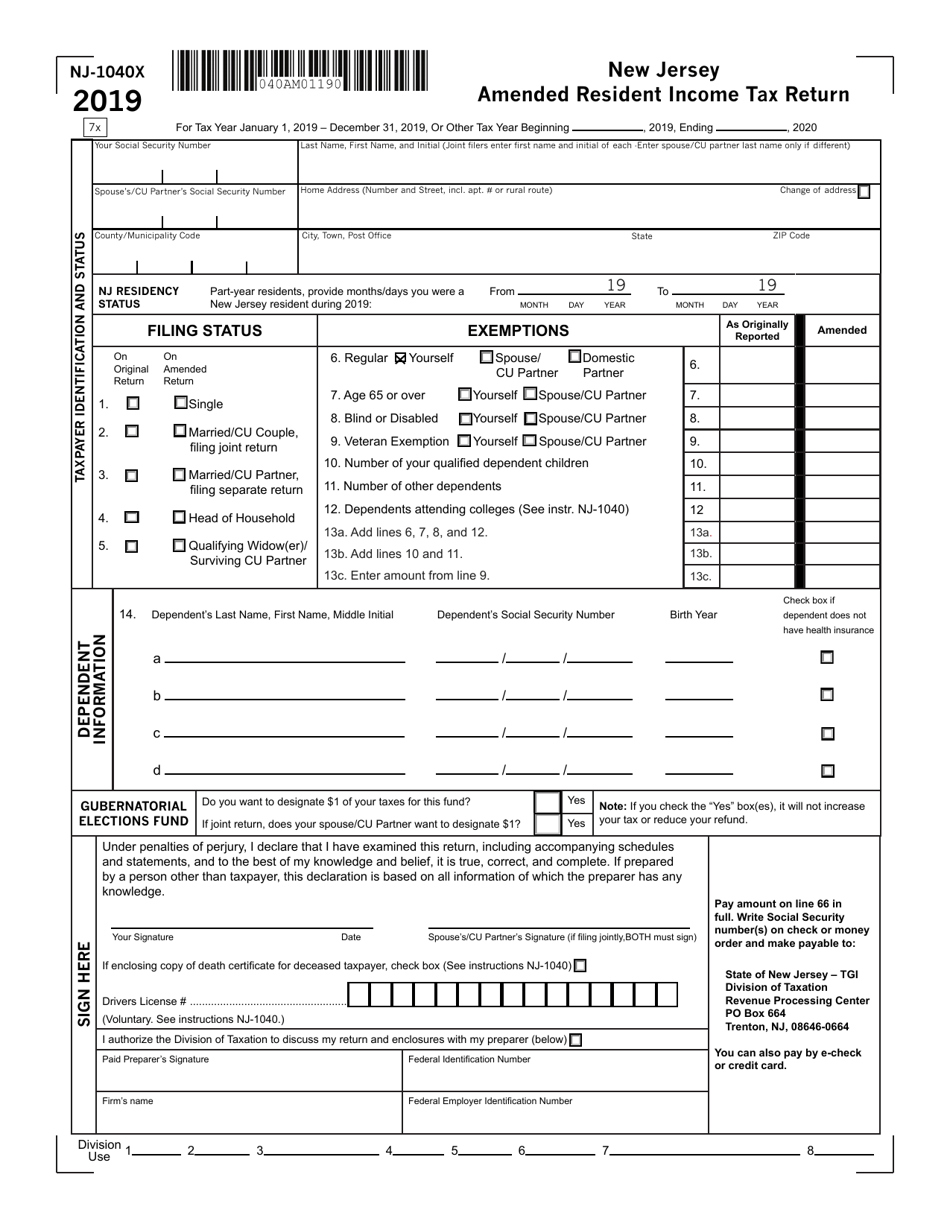

Form NJ1040X Download Fillable PDF or Fill Online New Jersey Amended

Employees who are subject to state. Individual tax return form 1040 instructions; Employees who are subject to state. Once you sign up, you will be able to submit returns and payments for all tax types electronically. Easily sign the louisiana l 4 with your finger.

You Can Also Download It, Export It Or Print It Out.

Ad don't leave it to the last minute. Are you seeking a quick and efficient solution to fill out l4 form 2020 at an affordable price? Web popular forms & instructions; Once you sign up, you will be able to submit returns and payments for all tax types electronically.

Employees Who Are Subject To State.

Web quick tax quick tax is the city’s online tax filing system. Individual tax return form 1040 instructions; Edit your la form online. Send filled & signed 2023 form.

Open The Employee Withholding Exemption Certificate L 4 And Follow The Instructions.

(check a box below) incurred no tax liability in the prior year and anticipate no tax. Web follow the simple instructions below: Or all beneficiaries are class a, but estate does not qualify to. Web send louisiana dept of revenue form r 1312 9 17 via email, link, or fax.

Employees Who Are Subject To State.

File your form 2290 online & efile with the irs. Employees who are subject to. Get irs approved instant schedule 1 copy. A complete inheritance or estate tax return cannot be completed yet;