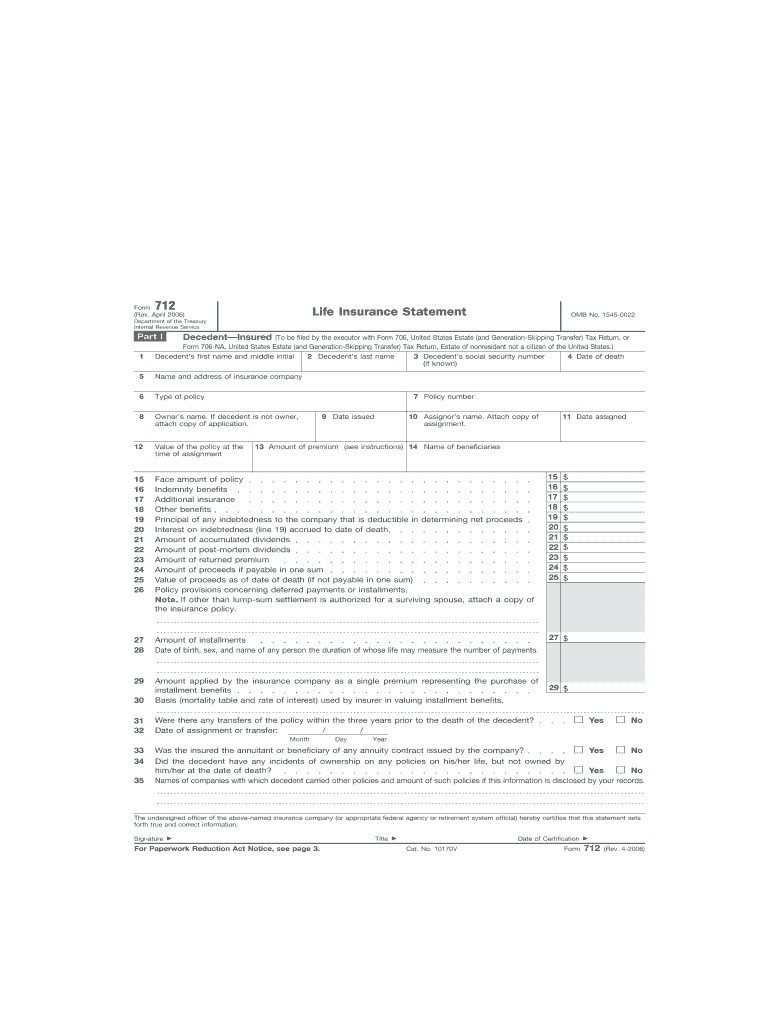

Life Insurance Form 712

Life Insurance Form 712 - Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. April 2006) life insurance statement omb no. Call or send your request, including the policy number(s). If the deceased is the policy owner, please include an address for. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger than. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Get an irs form 712? If you are required to file form 706, it would be a good idea to have a tax attorney or cpa who specialized in estates prepare the form, as it is very complex.

Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Call or send your request, including the policy number(s). Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web form 712 reports the value of life insurance policies for estate tax purposes. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. If you are required to file form 706, it would be a good idea to have a tax attorney or cpa who specialized in estates prepare the form, as it is very complex. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. If the deceased is the policy owner, please include an address for.

Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Get an irs form 712? Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Web form 712 reports the value of life insurance policies for estate tax purposes. Call or send your request, including the policy number(s). April 2006) life insurance statement omb no.

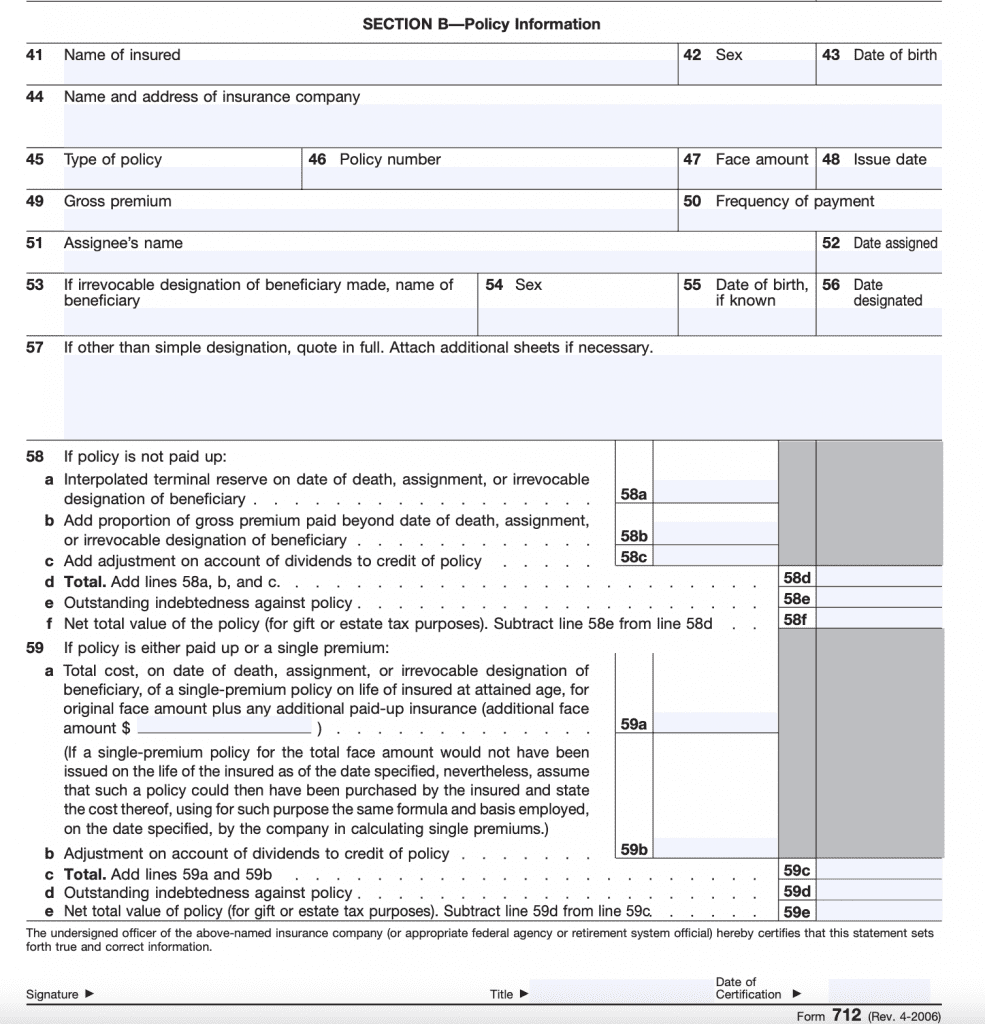

Fill Free fillable Form 712 Life Insurance Statement 2006 PDF form

If you are required to file form 706, it would be a good idea to have a tax attorney or cpa who specialized in estates prepare the form, as it is very complex. Get an irs form 712? If the deceased is the policy owner, please include an address for. Web form 712 reports the value of life insurance policies.

Form 712 Life Insurance Statement (2006) Free Download

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger than. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Call.

IRS Form 712 A Guide to the Life Insurance Statement

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Get an irs form 712? Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. April 2006) life insurance statement omb no. If the deceased is.

Closeup of Life Insurance Form Stock Image Image of bank, china

Call or send your request, including the policy number(s). Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web form 712 reports the value of life insurance policies for estate tax purposes. Web life insurance death proceeds form 712 if your mother's.

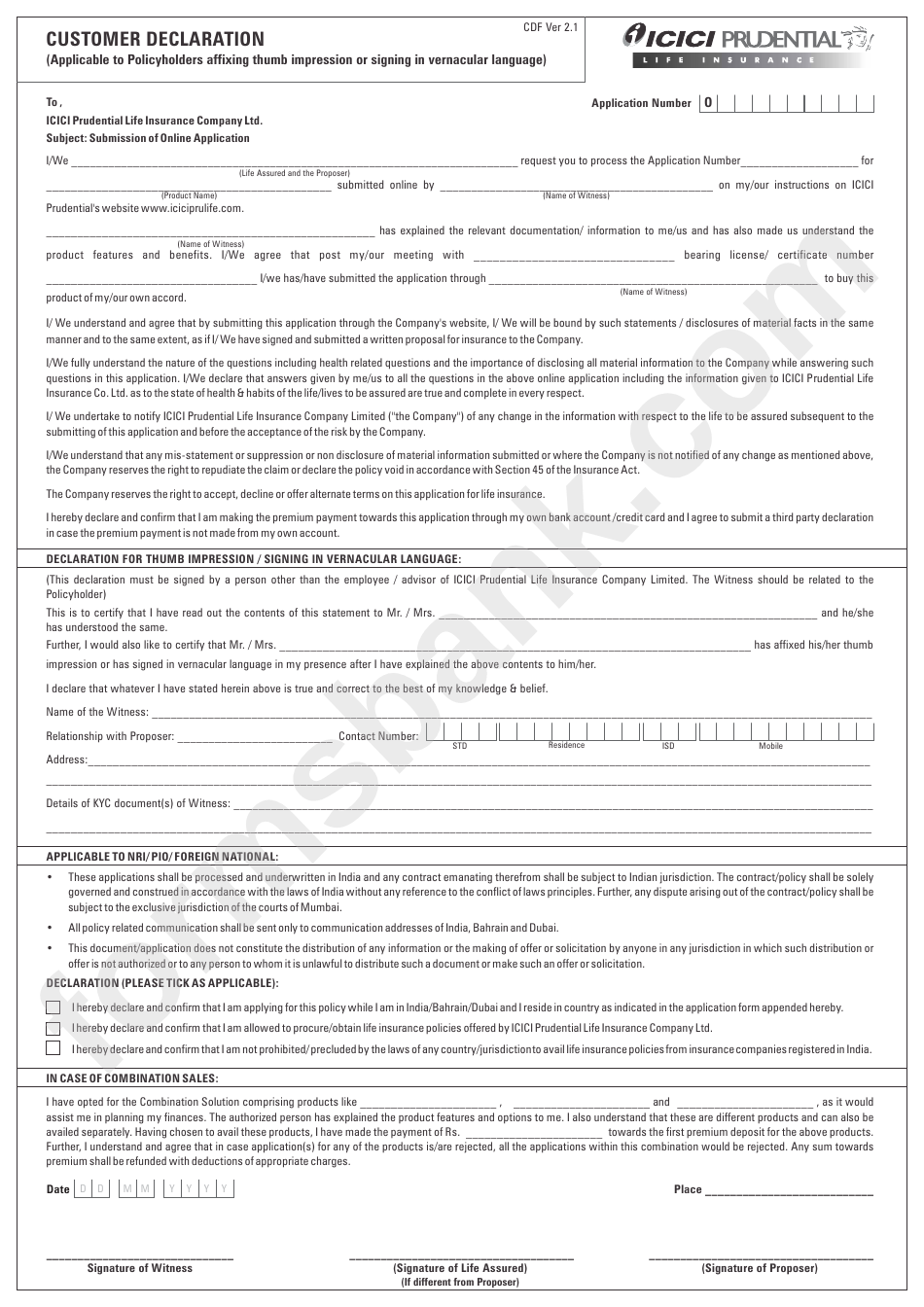

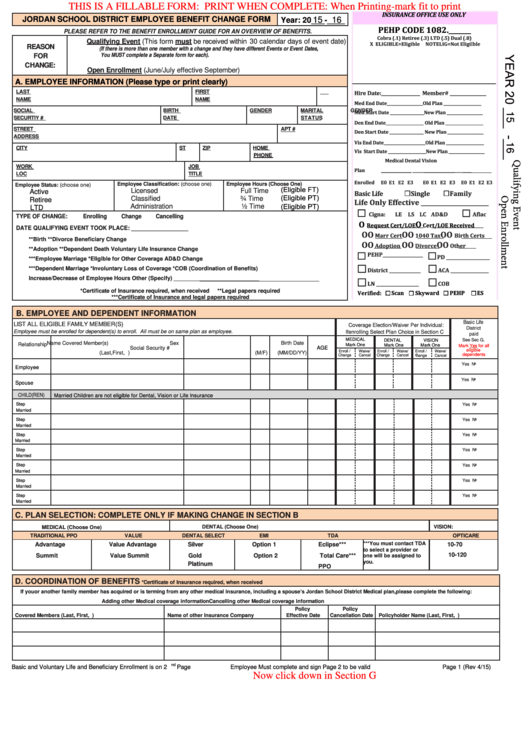

Fillable Employee Life Insurance Form printable pdf download

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Get an irs form 712? April 2006) life insurance statement omb no. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a.

712 life insurance form Fill out & sign online DocHub

If the deceased is the policy owner, please include an address for. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. This form is not filed by itself, but as an accompaniment.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Call or send your request, including the policy number(s). Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

If the deceased is the policy owner, please include an address for. April 2006) life insurance statement omb no. If you are required to file form 706, it would be a good idea to have a tax attorney or cpa who specialized in estates prepare the form, as it is very complex. Web irs form 712 is a statement that.

Financial Concept about Form 712 Life Insurance Statement with Phrase

Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger than. Get an irs form 712? Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web information about form 712, life insurance statement, including.

If You Are Required To File Form 706, It Would Be A Good Idea To Have A Tax Attorney Or Cpa Who Specialized In Estates Prepare The Form, As It Is Very Complex.

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Get an irs form 712? Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger than. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file.

Web Life Insurance Death Proceeds Form 712 If Your Mother's Estate Was Less Than (Approximately) $5.4 Million, You Are Not Required To File Form 706.

Call or send your request, including the policy number(s). Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return.

If The Deceased Is The Policy Owner, Please Include An Address For.

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: April 2006) life insurance statement omb no. Web form 712 reports the value of life insurance policies for estate tax purposes. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death.