Life Insurance Plans Chapter 9 Lesson 5

Life Insurance Plans Chapter 9 Lesson 5 - Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance… Web life insurance for a specified amount of time; Long term care insurance(60years old) 6. Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. T/f false the purpose of insurance is to transfer risk so that an accident or injury does not devastate you financially. Web describes the type of coverage in an insurance agreement. Chapter 5, general regulation of life insurers; Web true term life insurance is more expensive because it funds a savings plan. If an insurance plan is completed by one applicant but signed by another. Free insurance lesson plans, activities and more for grades 9.

Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. Start completing the fillable fields and carefully type in required information. Part 2, life and disability insurance; Web name life insurance plans chapter 9, lesson 5 joe is 30 years old, married, and his wife is expecting their first baby. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance. Free insurance lesson plans, activities and more for grades 9. Web life insurance for a specified amount of time; Of the three types of insurance in the “lessons on insurance and credit” teaching kit, life insurance is the most difficult for students to comprehend. Web describes the type of coverage in an insurance agreement. Method used to determine an adequate amount of life insurance based on the survivors' needs and the amount of.

Whole life insurance (or cash value) life insurance that lasts for the life. Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies. Web name life insurance plans chapter 9, lesson 5 joe is 30 years old, married, and his wife is expecting their first baby. Part 2, life and disability insurance; Use get form or simply click on the template preview to open it in the editor. Web describes the type of coverage in an insurance agreement. At the death of the policyholder, the insurance company pays the death benefit to the beneficiaries. T/f false the purpose of insurance is to transfer. Those choices dictate the third variable. Web true term life insurance is more expensive because it funds a savings plan.

canonprintermx410 25 Images What Is A Private Insurance Company

Web true term life insurance is more expensive because it funds a savings plan. Web life insurance for a specified amount of time; Method used to determine an adequate amount of life insurance based on the survivors' needs and the amount of. Web study with quizlet and memorize flashcards containing terms like you should buy life insurance policy that's _____.

[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and

Face amount, premium, and type of plan; Who does not need life insurance. Web describes the type of coverage in an insurance agreement. Web study with quizlet and memorize flashcards containing terms like you should buy life insurance policy that's _____ times your annual salary, what's the payment you make each time you visit the doctor?, hdhp insurance. Use get.

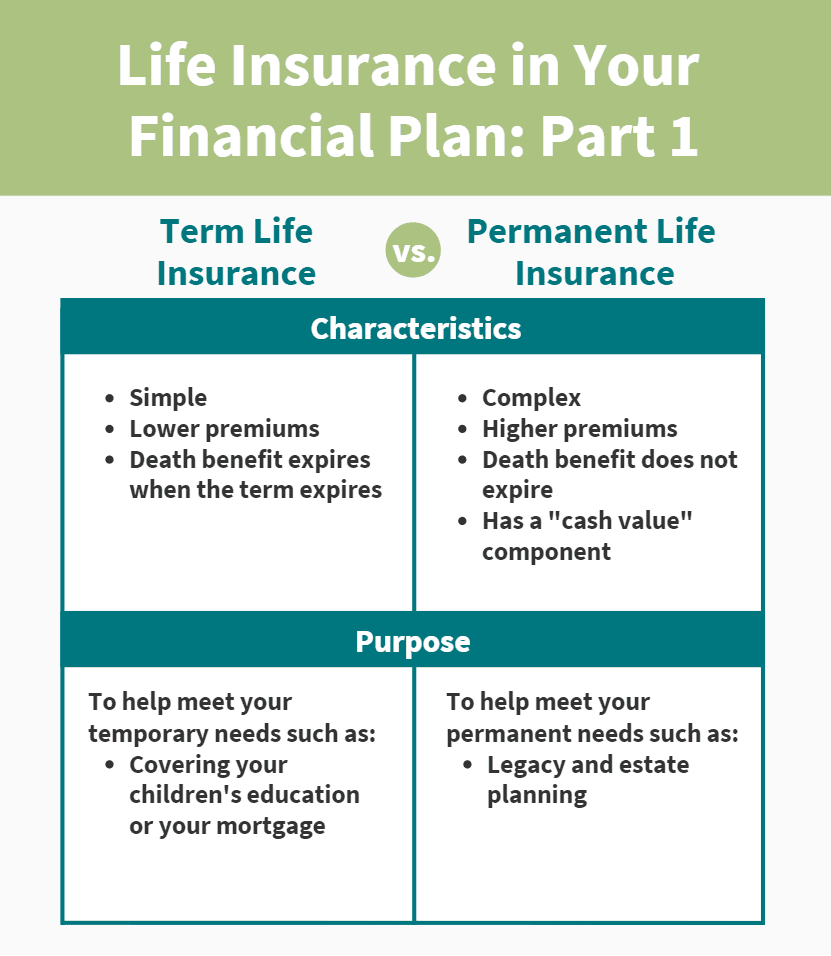

Life Insurance in Your Financial Plan Part 1 Aspen Wealth Management

Those choices dictate the third variable. Web life and health chapter 9 learn with flashcards, games, and more — for free. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Persuade an audience to get life insurance by explaining the. In order for an insurance contract to be valid, insurable interest must be.

Taxsaving life insurance plans you need to consider this yearAegon

T/f true term life insurance is for a specified period, is more expensive, and has no savings plan. Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. Differentiate between the different forms of life insurance. Those choices dictate the third variable. Web teach your students about protecting their assets with.

Life Insurance 101 Everything You Need to Know [Infographic

Click the card to flip 👆. Web life and health chapter 9 learn with flashcards, games, and more — for free. Part 2, life and disability insurance; Face amount, premium, and type of plan; Start completing the fillable fields and carefully type in required information.

Does Whole Life Insurance Work as Part of a Retirement Strategy

T/f true term life insurance is more expensive because it funds a savings plan. Chapter 5, general regulation of life insurers; T/f true term life insurance is for a specified period, is more expensive, and has no savings plan. Web terms in this set (15) life insurance. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1.

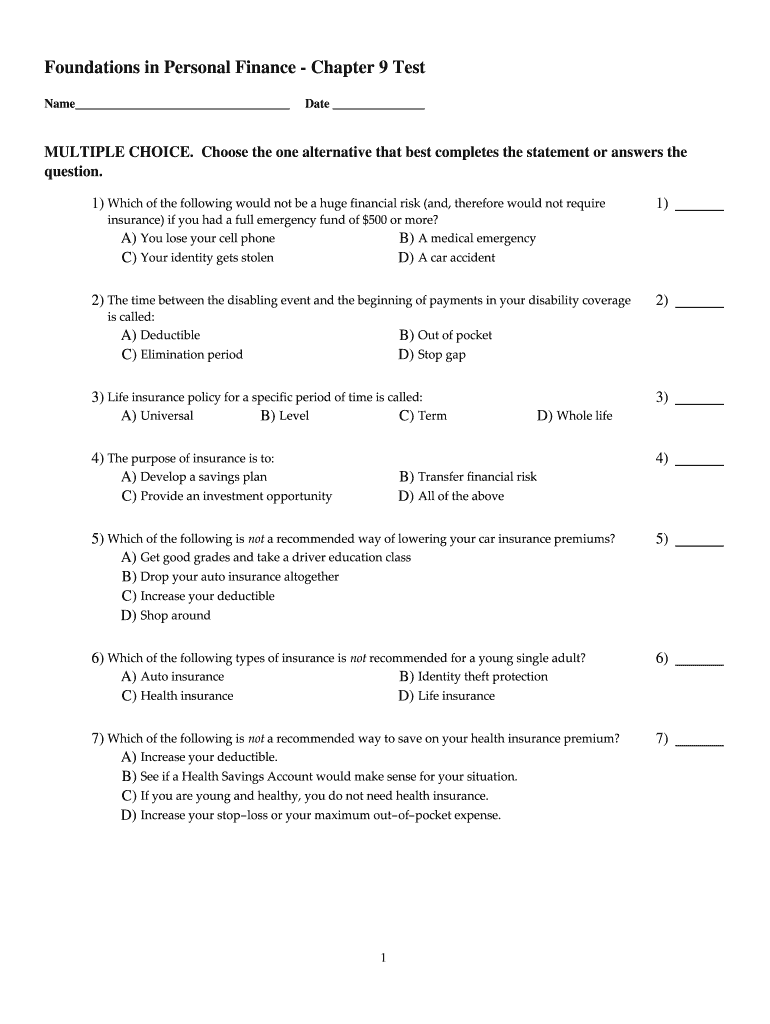

Foundations In Personal Finance Chapter 9 Answer Key Pdf Fill Online

Web true a good homeowner's insurance policy will include guaranteed replacement cost. Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. Use get form or simply click on the template preview to open it in the editor. Of the three types of insurance in the “lessons on insurance and credit”.

Types of Life Insurance Plans

Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Web life and health chapter 9 learn with flashcards, games, and more — for free. Web codes division 2, classes of insurance; Part 2, life and disability insurance; Long term care insurance(60years old) 6.

Essential Tips to Get Started with Life Insurance Plans

If an insurance plan is completed by one applicant but signed by another. Those choices dictate the third variable. Method used to determine an adequate amount of life insurance based on the survivors' needs and the amount of. Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies. T/f true term life insurance.

Need and Benefits of Buying Life Insurance Plan by Alankit Insurance

T/f false the purpose of insurance is to transfer risk so that an accident or injury does not devastate you financially. T/f false the purpose of insurance is to transfer. Web true a good homeowner's insurance policy will include guaranteed replacement cost. Web terms in this set (15) life insurance. Web study with quizlet and memorize flashcards containing terms like.

At The Death Of The Policyholder, The Insurance Company Pays The Death Benefit To The Beneficiaries.

Long term care insurance(60years old) 6. Homeowner's or renter's insurance 2. Web describes the type of coverage in an insurance agreement. ____ life is a policy in which the policyowner chooses two of three variables:

Web Page 2 Of 3 Life Insurance Plans Chapter 9, Lesson 5 1.

Web codes division 2, classes of insurance; Of the three types of insurance in the “lessons on insurance and credit” teaching kit, life insurance is the most difficult for students to comprehend. Method used to determine an adequate amount of life insurance based on the survivors' needs and the amount of. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance.

Web Strengthen Your Preparations For The Life & Health Insurance Exam By Taking Advantage Of The Resources In This Online Course.

Joe makes $48,000 per year and has $200 budgeted per month to spend on life. Whole life insurance (or cash value) life insurance that lasts for the life. Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies. Click the card to flip 👆.

Persuade An Audience To Get Life Insurance By Explaining The.

Web true term life insurance is more expensive because it funds a savings plan. Use get form or simply click on the template preview to open it in the editor. Article 8, requirements for replacement of life insurance and annuity policies; T/f true term life insurance is for a specified period, is more expensive, and has no savings plan.

![[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and](https://www.slideteam.net/wp/wp-content/uploads/2020/01/Life-Insurance-Policies-And-Plan.png)