Louisiana L3 Form

Louisiana L3 Form - First quarter employer's return of louisiana withholding. Deadline to file form 1099 and. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Sign it in a few clicks draw your signature, type. Web how it works open the l 3 form and follow the instructions easily sign the form l3 with your finger send filled & signed l3 form or save rate form 4.7 satisfied 40 votes handy tips. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. You must also file the annual reconciliation. Beginning january 1, 2014, all employers filing. Any form 1099 that is reporting louisiana income tax withheld;

Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Web second quarter employer's return of louisiana withholding tax. You must also file the annual reconciliation. Deadline to file form 1099 and. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Retail dealers of vapor products; Get everything done in minutes. Web how it works open the l 3 form and follow the instructions easily sign the form l3 with your finger send filled & signed l3 form or save rate form 4.7 satisfied 40 votes handy tips. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. First quarter employer's return of louisiana withholding.

Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Get everything done in minutes. You must also file the annual reconciliation. If a billing notice is issued, a collection fee may also be imposed. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You must file copies of: Line 1 line 2 line 3 line 4 enter the amount of louisiana withholding tax withheld or required to be withheld from. Sign it in a few clicks draw your signature, type. First quarter employer's return of louisiana withholding. Web louisiana l3 form 2021.

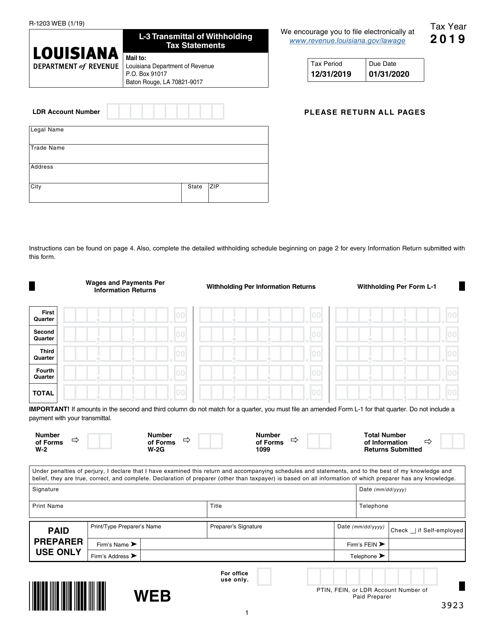

Instructions for form l3

Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Deadline to file form 1099 and. Web second quarter employer's return of louisiana withholding tax. Web louisiana l3 form 2021. You must also file the annual reconciliation.

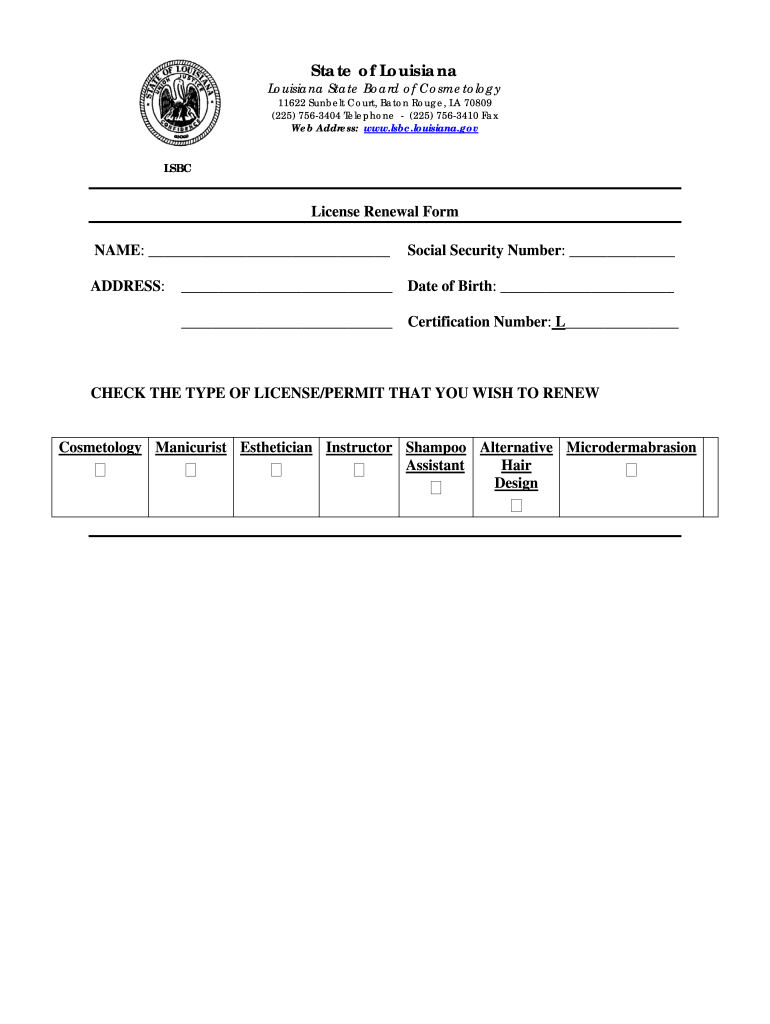

Louisiana State Board of Cosmetology Form Fill Out and Sign Printable

Get everything done in minutes. You must file copies of: If a billing notice is issued, a collection fee may also be imposed. Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Edit your louisiana l3 form online type text, add images,.

Harris and L3 form 33.5 billion defence giant

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web second quarter employer's return of louisiana withholding tax. Line 1 line 2 line 3 line 4 enter the amount of louisiana withholding tax withheld or required to be withheld from. Sign it in a few clicks draw your signature, type..

Louisiana Rental Application Free Download

Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Any form 1099 that is reporting louisiana income tax withheld; Line 1 line 2 line 3 line 4 enter the amount of louisiana withholding tax withheld or required to be withheld from. Web louisiana l3 form 2021. Retail dealers of vapor products;

L32 Louisiana Association of FFA

Get everything done in minutes. Sign it in a few clicks draw your signature, type. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Line 1 line 2 line 3 line 4 enter the amount of louisiana withholding tax withheld or required to be withheld from. Retail dealers of vapor products;

Form L3 (R1203 WEB) Download Fillable PDF or Fill Online Transmittal

You must file copies of: Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. If a billing notice is issued, a collection fee may also be imposed. You must.

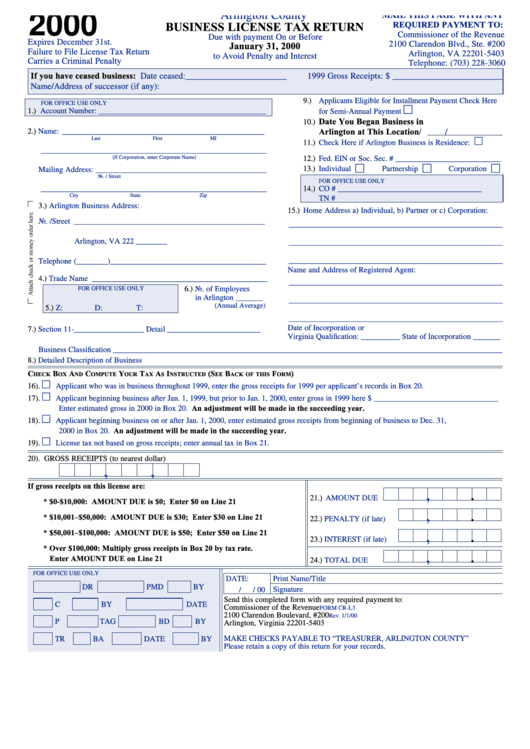

Form CrL3 Business License Tax Return printable pdf download

Web louisiana l3 form 2021. You must file copies of: Please enter the amount withheld in the appropriate 1st and 2nd half boxes. You must also file the annual reconciliation. First quarter employer's return of louisiana withholding.

L3 Systems International Orders

Beginning january 1, 2014, all employers filing. Get everything done in minutes. Retail dealers of vapor products; First quarter employer's return of louisiana withholding. If a billing notice is issued, a collection fee may also be imposed.

Louisiana form l 3 Fill out & sign online DocHub

You must file copies of: Sign it in a few clicks draw your signature, type. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Web second quarter employer's return of louisiana withholding tax. If a billing notice is issued, a collection fee may also be imposed.

Interpolation of K l3 form factors with the fit forms based on the NLO

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Edit your louisiana l3 form online type text, add images, blackout confidential details, add comments, highlights and more. Beginning january 1, 2014, all employers filing. Sign it in.

Beginning January 1, 2014, All Employers Filing.

First quarter employer's return of louisiana withholding. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Web second quarter employer's return of louisiana withholding tax. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer.

Retail Dealers Of Vapor Products;

Web how it works open the l 3 form and follow the instructions easily sign the form l3 with your finger send filled & signed l3 form or save rate form 4.7 satisfied 40 votes handy tips. Any form 1099 that is reporting louisiana income tax withheld; Sign it in a few clicks draw your signature, type. Edit your louisiana l3 form online type text, add images, blackout confidential details, add comments, highlights and more.

Web When Filing An Amended Return, You Must Use The Correct Form For The Quarter Being Amended, Report The Corrected Amounts, And Mark The “Amended Return” Box.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You must file copies of: If a billing notice is issued, a collection fee may also be imposed. Web louisiana l3 form 2021.

You Must Also File The Annual Reconciliation.

Deadline to file form 1099 and. Get everything done in minutes. Line 1 line 2 line 3 line 4 enter the amount of louisiana withholding tax withheld or required to be withheld from.