Ma Form 1 Instructions 2021

Ma Form 1 Instructions 2021 - Indicate the date to the sample with the date option. Massachusetts resident income tax return. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. If you need to change or amend an accepted massachusetts state income tax return for the current or previous tax year you need to complete form 1 (residents). Sign it in a few clicks draw your signature, type. Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Web massachusetts personal income tax forms and instructions. Get form taxable ira/keogh plan qualified charitable ira 1. Download past year versions of this tax.

Click on the sign button and make a signature. Get form taxable ira/keogh plan qualified charitable ira 1. Save or instantly send your ready documents. Sign it in a few clicks draw your signature, type. Massachusetts resident income tax return (english, pdf 247.35 kb) 2021 form 1. Web taxable ira distribution worksheet (from ma form 1 instructions for schedule x, line 2) since massachusetts does not allow a deduction for amounts. Massachusetts resident income tax return. This form is for income earned in tax year. You will also find prior. Dor has released its 2022 massachusetts personal income tax forms.

You will also find prior. There are three easy and convenient ways to do it. Easily fill out pdf blank, edit, and sign them. If you need to change or amend an accepted massachusetts state income tax return for the current or previous tax year you need to complete form 1 (residents). Edit your form 1 instruction online type text, add images, blackout confidential details, add comments, highlights and more. Click on the sign button and make a signature. Save or instantly send your ready documents. Sign it in a few clicks draw your signature, type. This form is for income earned in tax year. Web taxable ira distribution worksheet (from ma form 1 instructions for schedule x, line 2) since massachusetts does not allow a deduction for amounts.

MA FORM 1 MUNONYANYA DZUNGU ZIM COMEDY YouTube

Save or instantly send your ready documents. Be found on page 21 of the form 1. Web we last updated massachusetts form 1 instructions in january 2023 from the massachusetts department of revenue. Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type.

20132021 Form MA DoR M433I Fill Online, Printable, Fillable, Blank

Web massachusetts department of revenue 2021 form 1 massachusetts resident income tax return taxpayer’s first name m.i. You will also find prior. Web taxable ira distribution worksheet (from ma form 1 instructions for schedule x, line 2) since massachusetts does not allow a deduction for amounts. If you need to change or amend an accepted massachusetts state income tax return.

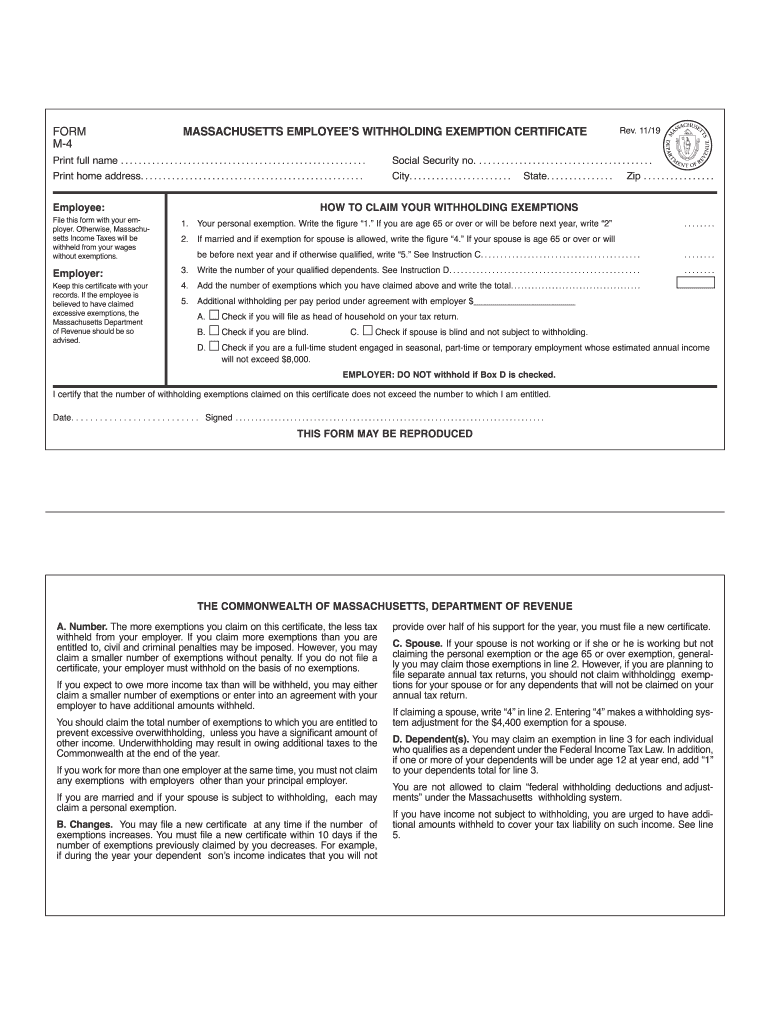

Massachusetts M 4 Form 2021 2022 W4 Form

Indicate the date to the sample with the date option. If you need to change or amend an accepted massachusetts state income tax return for the current or previous tax year you need to complete form 1 (residents). Massachusetts resident income tax return (english, pdf 247.35 kb) 2021 form 1. Get form taxable ira/keogh plan qualified charitable ira 1. Sign.

Ma Form Fill Out and Sign Printable PDF Template signNow

Edit your form 1 instruction online type text, add images, blackout confidential details, add comments, highlights and more. Web we last updated massachusetts form 1 instructions in january 2023 from the massachusetts department of revenue. Sign it in a few clicks draw your signature, type. Massachusetts resident income tax return (english, pdf 247.35 kb) 2021 form 1. Get form taxable.

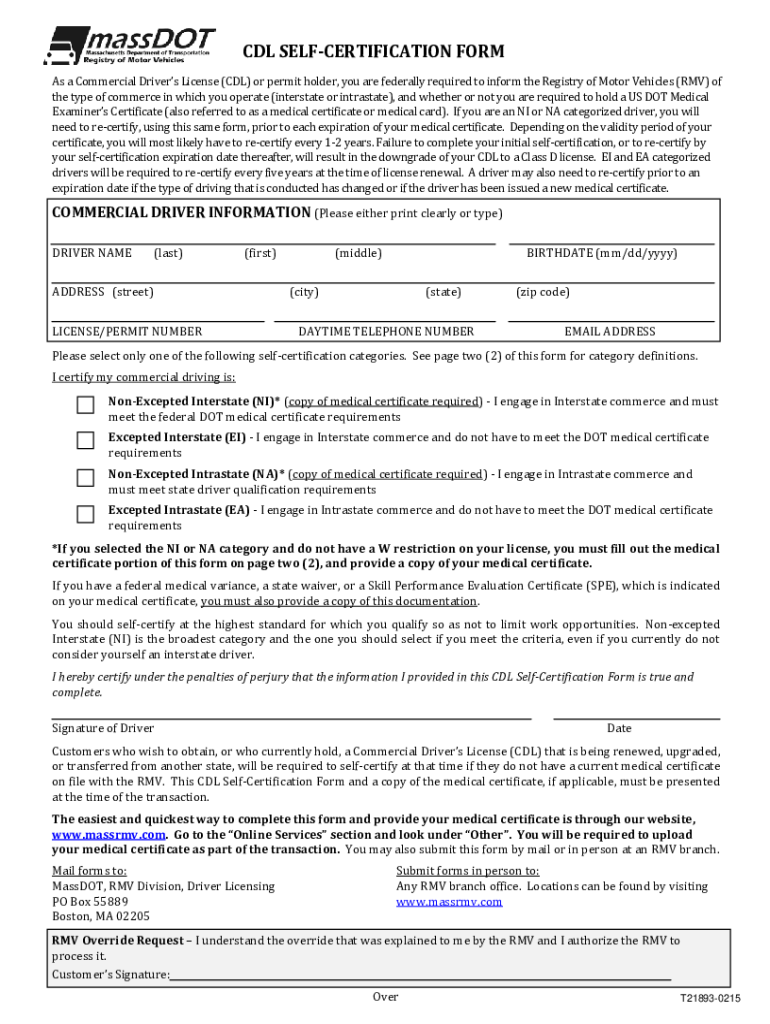

20152021 massDOT Form T21893 Fill Online, Printable, Fillable, Blank

Download past year versions of this tax. Save or instantly send your ready documents. Click on the sign button and make a signature. You will also find prior. There are three easy and convenient ways to do it.

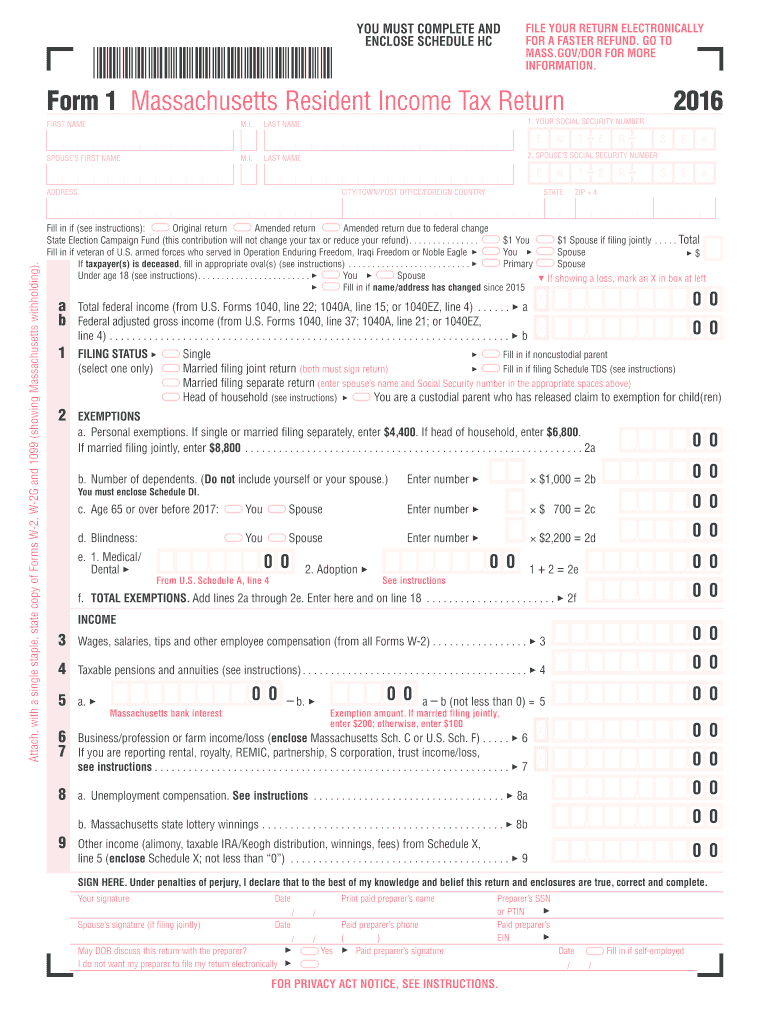

2016 MA Form 1 Fill Online, Printable, Fillable, Blank pdfFiller

Web use a massachusetts form 1 instructions 2021 template to make your document workflow more streamlined. Be found on page 21 of the form 1. Web massachusetts personal income tax forms and instructions. Edit your form 1 instruction online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year.

MA Form PC 20162021 Fill and Sign Printable Template Online US

Dor has released its 2022 massachusetts personal income tax forms. You will also find prior. Get form taxable ira/keogh plan qualified charitable ira 1. Edit your form 1 instruction online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type.

MA RMV1 2022 Form Printable Blank PDF Online

Be found on page 21 of the form 1. Web massachusetts personal income tax forms and instructions. Dor has released its 2022 massachusetts personal income tax forms. Sign it in a few clicks draw your signature, type. Web taxable ira distribution worksheet (from ma form 1 instructions for schedule x, line 2) since massachusetts does not allow a deduction for.

Form 1 Massachusetts Resident Tax Return YouTube

Be found on page 21 of the form 1. Save or instantly send your ready documents. Dor has released its 2022 massachusetts personal income tax forms. Web we last updated massachusetts form 1 instructions in january 2023 from the massachusetts department of revenue. Easily fill out pdf blank, edit, and sign them.

Ma Form Fill Online, Printable, Fillable, Blank pdfFiller

Web massachusetts department of revenue 2021 form 1 massachusetts resident income tax return taxpayer’s first name m.i. Web massachusetts personal income tax forms and instructions. Web we last updated massachusetts form 1 instructions in january 2023 from the massachusetts department of revenue. If you need to change or amend an accepted massachusetts state income tax return for the current or.

Web Taxable Ira Distribution Worksheet (From Ma Form 1 Instructions For Schedule X, Line 2) Since Massachusetts Does Not Allow A Deduction For Amounts.

Click on the sign button and make a signature. Web massachusetts personal income tax forms and instructions. Web use a massachusetts form 1 instructions 2021 template to make your document workflow more streamlined. Edit your form 1 instruction online type text, add images, blackout confidential details, add comments, highlights and more.

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In Either A Tax.

This form is for income earned in tax year. Web we last updated massachusetts form 1 instructions in january 2023 from the massachusetts department of revenue. There are three easy and convenient ways to do it. Easily fill out pdf blank, edit, and sign them.

Web Here You Will Find An Updated Listing Of All Massachusetts Department Of Revenue (Dor) Tax Forms And Instructions.

Get form taxable ira/keogh plan qualified charitable ira 1. Web massachusetts department of revenue 2021 form 1 massachusetts resident income tax return taxpayer’s first name m.i. Be found on page 21 of the form 1. Save or instantly send your ready documents.

Massachusetts Resident Income Tax Return (English, Pdf 247.35 Kb) 2021 Form 1.

You will also find prior. Massachusetts resident income tax return. Indicate the date to the sample with the date option. If you need to change or amend an accepted massachusetts state income tax return for the current or previous tax year you need to complete form 1 (residents).