Maine State Tax Extension Form

Maine State Tax Extension Form - Web a state of maine extension request form is not necessary. Pay all or some of your maine income taxes online via: This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign into your efile.com account and check acceptance by the irs. Explore more file form 7004 and extend your federal business income tax return deadline up to 6 months. Extended deadline with maine tax extension: The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends). In addition to interest, a penalty is assessed for late filing. Web maine filing due date: At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time.

On march 18, 2021, governor janet mills announced that the. Maine state income tax forms for tax year 2022 (jan. Real estate withholding (rew) worksheets for tax credits. Web extension of state income tax deadline to may 17, 2021. Maine personal extensions are automatic, which means there is no form or application to submit. If you cannot file by that date, you can get a maine tax extension. Web the new pslf regulations relax some rules regarding qualifying employment that should allow more borrowers to qualify for student loan forgiveness. Web in order to receive an automatic extension for your maine tax return, you must pay at least 90% of your state tax liability by the original due date. And $35,000 for tax years beginning on or after january 1, 2024. Details on how to only prepare and print a maine 2022 tax return.

At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. Electronic request form to request individual income tax forms. Sign into your efile.com account and check acceptance by the irs. Maine ez pay is an online application that allows maine taxpayers to make payments online, quickly and easily. In addition to interest, a penalty is assessed for late filing. Maine individual income tax returns are due by april 15, in most years. Explore more file form 7004 and extend your federal business income tax return deadline up to 6 months. Portal.maine.gov/ezpay for more information, please visit the maine revenue services website: The forms below are not specific to a particular tax type or program. Web an extension allows only additional time to file;

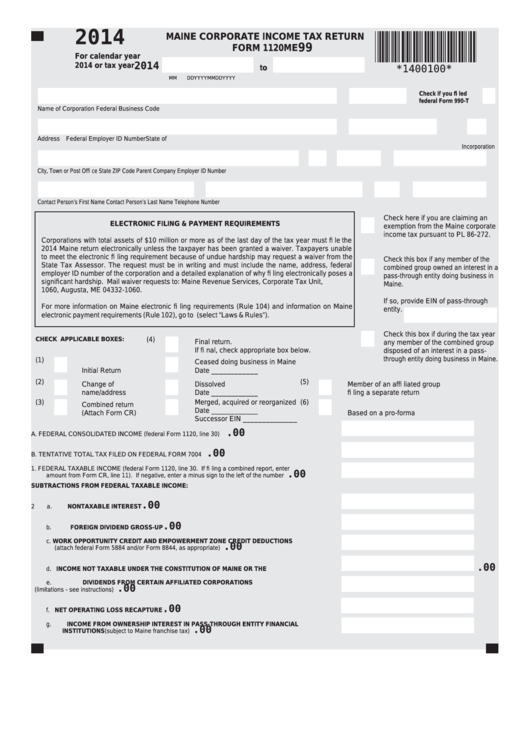

Fillable Form 1120me Maine Corporate Tax Return 2014

Owe maine taxes option 1: Or you can make a tax payment online via maine ez pay: Web mrs’s mission is to fairly and efficiently administer the state’s tax laws with integrity and professionalism. Web this form is a voucher for individuals who are in need of an extension of their income tax payments. In addition to interest, a penalty.

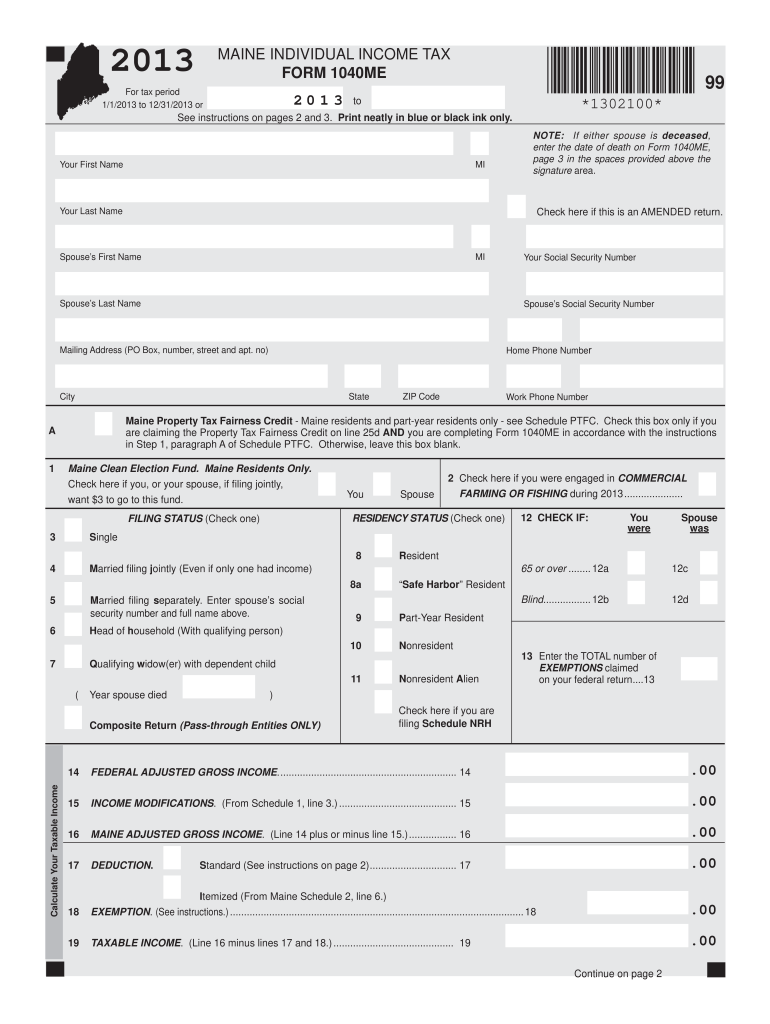

MAINE INDIVIDUAL TAX FORM 1040ME *1302100* 00 Fill Out and

Check your irs tax refund status. Portal.maine.gov/ezpay/welcome for more information, please visit the maine revenue services website: Maine individual income tax returns are due by april 15, in most years. The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends). Web.

Ms State Tax Form 2022 W4 Form

Web an extension allows only additional time to file; We will update this page with a new version of the form for 2024 as soon as it is made available by the maine government. Web a state of maine extension request form is not necessary. Web the new pslf regulations relax some rules regarding qualifying employment that should allow more.

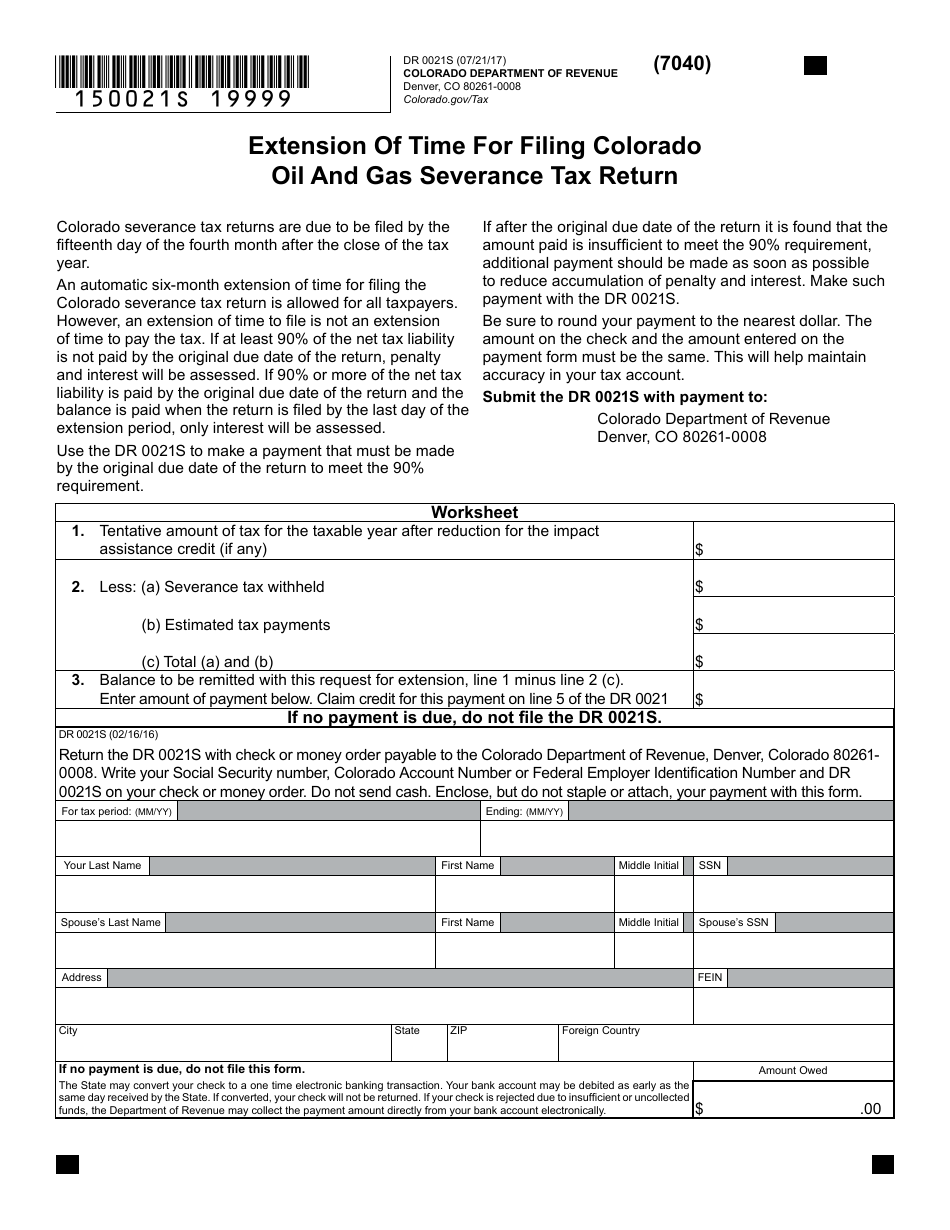

Form DR0021S Download Fillable PDF or Fill Online Extension of Time for

State of maine has moved the. Web a state of maine extension request form is not necessary. Electronic request form to request individual income tax forms. The penalty for late filing is $25 or 10% of the tax due, whichever is. Check your irs tax refund status.

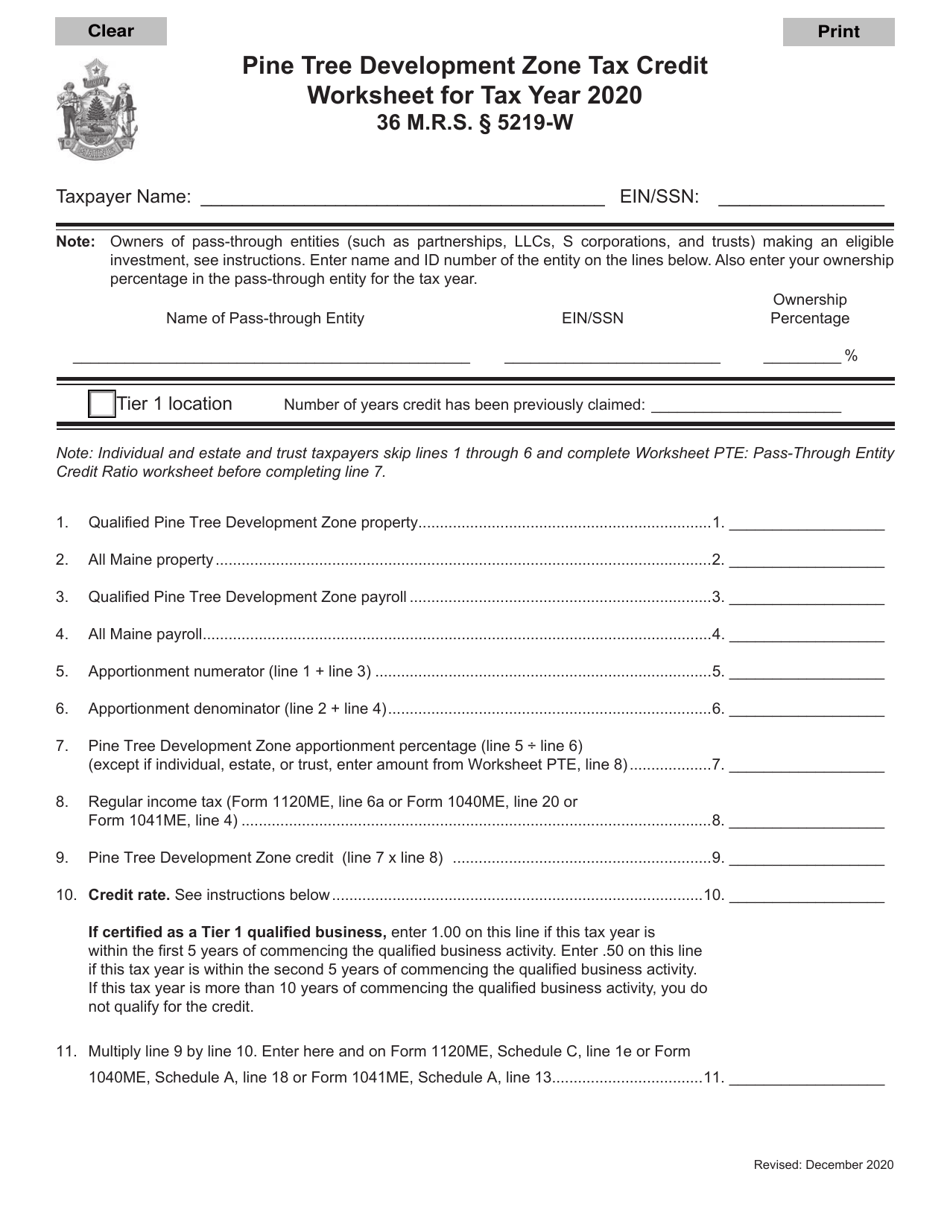

2020 Maine Pine Tree Development Zone Tax Credit Worksheet Download

Sign into your efile.com account and check acceptance by the irs. Application for tax registration (pdf) application for tax registration. At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. Or you can make a tax payment.

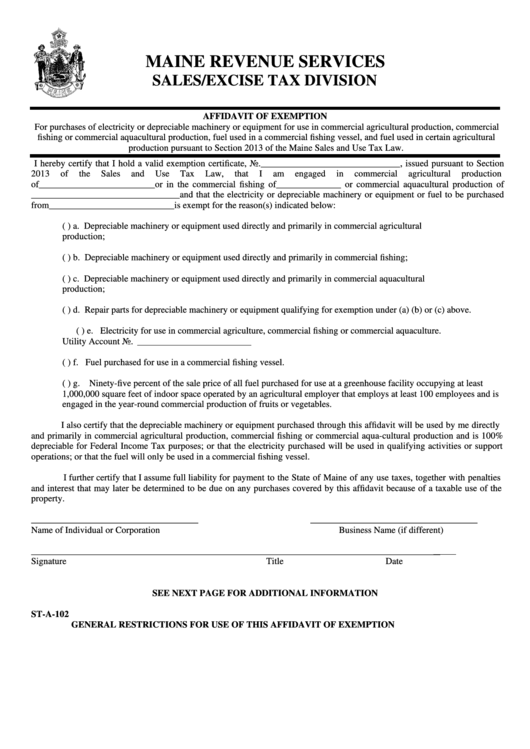

Form StA102 Affidavit Of Exemption Maine Revenue Services

Web in order to receive an automatic extension for your maine tax return, you must pay at least 90% of your state tax liability by the original due date. Sign into your efile.com account and check acceptance by the irs. Extended deadline with maine tax extension: Web the new pslf regulations relax some rules regarding qualifying employment that should allow.

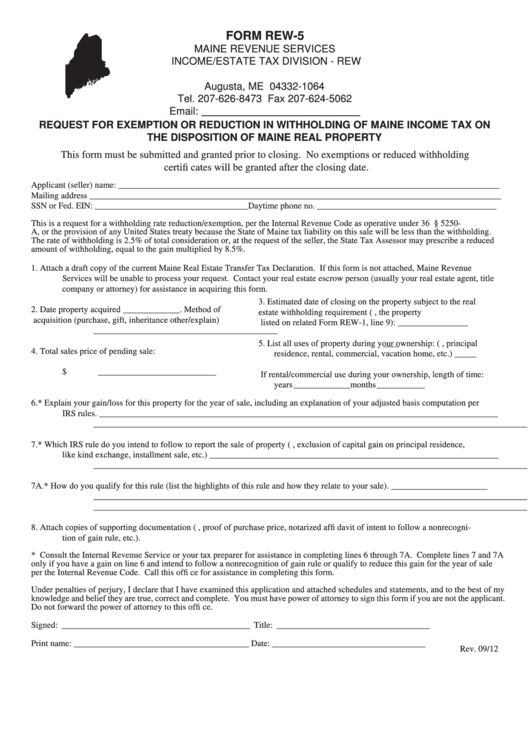

Form Rew5 Request For Exemption Or Reduction In Withholding Of Maine

Web the new pslf regulations relax some rules regarding qualifying employment that should allow more borrowers to qualify for student loan forgiveness. Details on how to only prepare and print a maine 2022 tax return. And $35,000 for tax years beginning on or after january 1, 2024. Corporate income tax returns are due by march 15 — or by the.

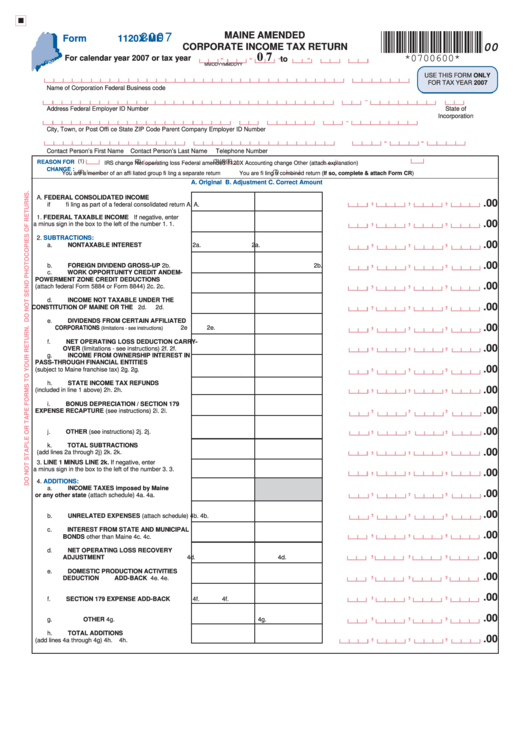

Form 1120xMe Maine Amended Corporate Tax Return 2007

Check your irs tax refund status. Maine ez pay is an online application that allows maine taxpayers to make payments online, quickly and easily. First, the new regulations simplify the. Explore more file form 7004 and extend your federal business income tax return deadline up to 6 months. Web maine personal tax return due date is extended to may 17.

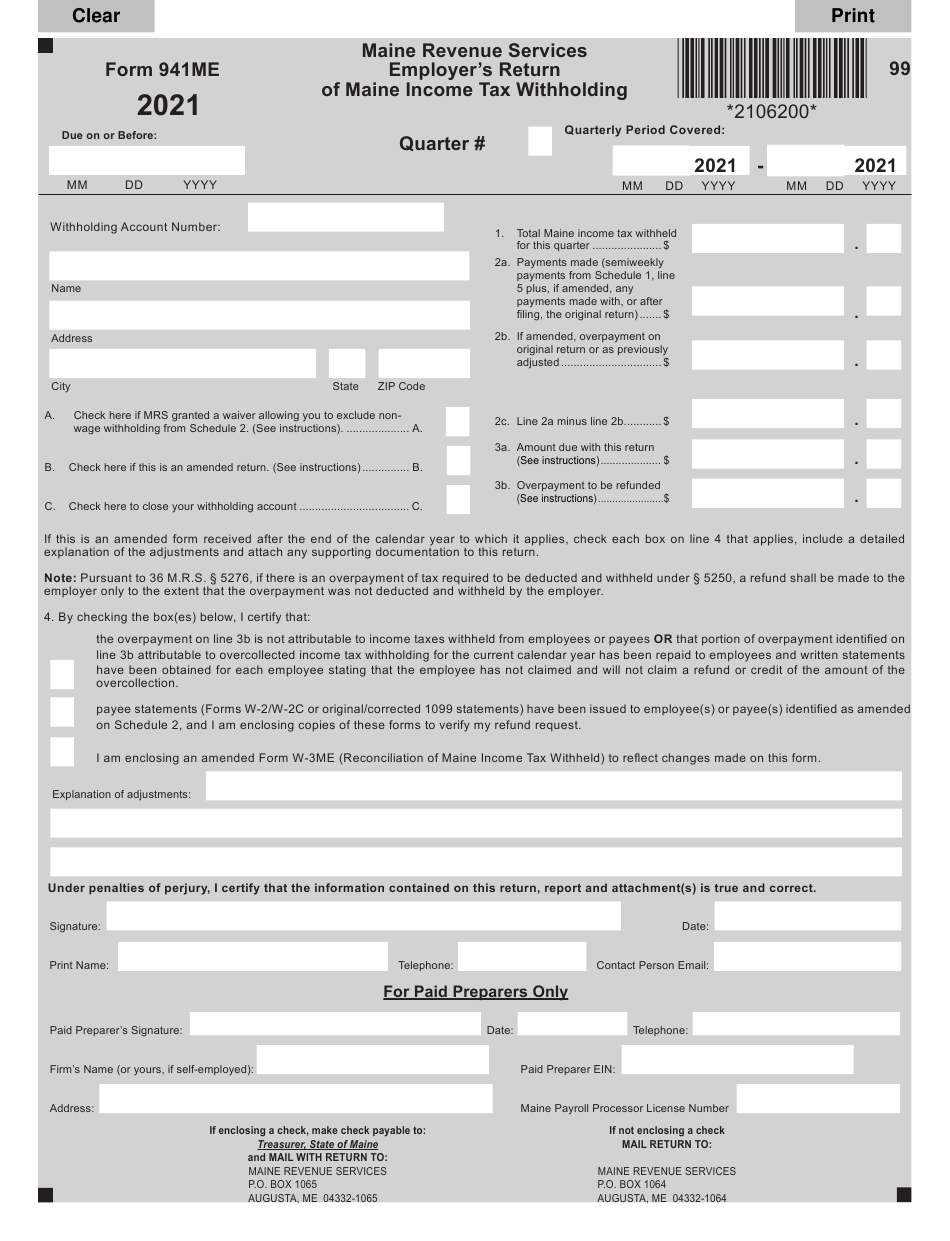

Maine Tax Withholding 2021 2022 W4 Form

Web to make a payment of tax due, complete and submit this voucher by the original due date of your return. Web march 18, 2021 governor janet mills announced today that the state of maine will move the deadline for maine individual income tax payments from april 15, 2021 to may 17, 2021. Real estate withholding (rew) worksheets for tax.

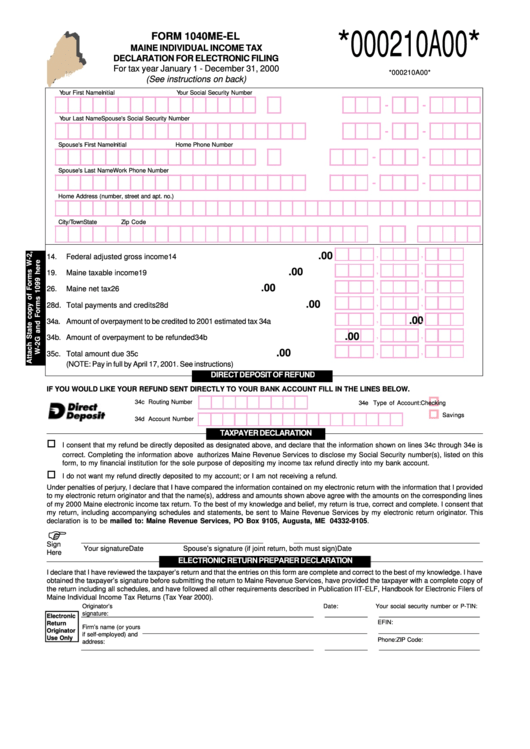

Form 1040meEl Maine Individual Tax Declaration For Electronic

Owe maine taxes option 1: The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends). Web maine filing due date: Web mrs’s mission is to fairly and efficiently administer the state’s tax laws with integrity and professionalism. Details on how to.

Explore More File Form 7004 And Extend Your Federal Business Income Tax Return Deadline Up To 6 Months.

First, the new regulations simplify the. The penalty for late filing is $25 or 10% of the tax due, whichever is. We will update this page with a new version of the form for 2024 as soon as it is made available by the maine government. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Portal.maine.gov/Ezpay/Welcome For More Information, Please Visit The Maine Revenue Services Website:

Maine personal extensions are automatic, which means there is no form or application to submit. The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends). Or you can make a tax payment online via maine ez pay: Maine individual income tax returns are due by april 15, in most years.

$30,000 For Tax Years Beginning In 2023;

Web extension of state income tax deadline to may 17, 2021. Web an extension allows only additional time to file; The change aligns with the federal government’s recent extension of the federal tax filing and payment deadline. Web a state of maine extension request form is not necessary.

Maine State Income Tax Forms For Tax Year 2022 (Jan.

In addition to interest, a penalty is assessed for late filing. Real estate withholding (rew) worksheets for tax credits. Application for tax registration (pdf) application for tax registration. At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time.