Married Filing Separate Form

Married Filing Separate Form - Web married filing separately: Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and exemptions. Web married filing separately or not? Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. However, if you live in a community property state, you must report. Web the filing statuses we know today — single, head of household, qualifying widow (er), married filing jointly and married filing separately — first appeared on the. Web married persons filing separately. If you and your spouse plan to share a household in the future, you’re not. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately.

Web married persons who file separate returns in community property states may also qualify for relief. Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and exemptions. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. Web if you choose to file married filing separately, both spouses have to file the same way—either you both itemize or you both use standard deduction. Web i am married filing separately how do i submit the form 8962 so i only pay back half the health insurance tax credit and my spouse pays the other half? Apparently with 2021 returns it is happening a lot. If your filing status is married filing separately and all of the following. Web married persons filing separately.

If you and your spouse plan to share a household in the future, you’re not. Web married filing separately: If you file separate tax returns, you report only your own income, deductions and credits on your individual return. Web your filing status for the year will be either married filing separately or married filing jointly. Web i am married filing separately how do i submit the form 8962 so i only pay back half the health insurance tax credit and my spouse pays the other half? Apparently with 2021 returns it is happening a lot. Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and exemptions. In most cases, claiming married filing separately is the least beneficial filing status. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. When you file using this status, your credits and deductions are limited.

Married Filing Separately When Does it Make Sense? • Benzinga

In most cases, claiming married filing separately is the least beneficial filing status. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. You can't get relief by. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. When you.

Married Filing Separately Q&A TL;DR Accounting

Generally, married persons must file a joint return to claim the credit. However, if you live in a community property state, you must report. If you file separate tax returns, you report only your own income, deductions and credits on your individual return. If you use the married filing separately filing status you can be. Web married persons who file.

Married Filing Separately rules YouTube

This form will explain to the irs why the taxable income and. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. Web married persons who file separate returns in community property states may also qualify for relief. Apparently with 2021 returns it is happening a lot. Web married persons filing separately.

When is Married Filing Separate Better? Roger Rossmeisl, CPA

If you file separate tax returns, you report only your own income, deductions and credits on your individual return. If you and your spouse plan to share a household in the future, you’re not. If your filing status is married filing separately and all of the following. However, if you live in a community property state, you must report. When.

Tax Tips Married Filing Jointly vs Married Filing Separately YouTube

If you file separate tax returns, you report only your own income, deductions and credits on your individual return. If you and your spouse do not agree to file a joint return, then you must file separate returns, unless you are considered. Web married filing separately: Web the irs considers a couple married for tax filing purposes until they get.

Married Filing Separately Benefits and Drawbacks of This Little

Web the filing statuses we know today — single, head of household, qualifying widow (er), married filing jointly and married filing separately — first appeared on the. Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and exemptions. Web use form 8958 to.

Tax Guide for 2018 The Simple Dollar

In most cases, claiming married filing separately is the least beneficial filing status. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. If you use the.

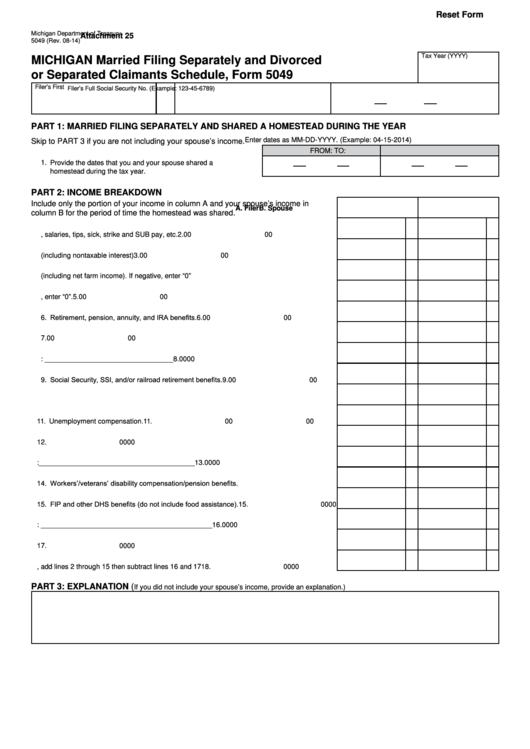

Fillable Form 5049 Michigan Married Filing Separately And Divorced Or

Apparently with 2021 returns it is happening a lot. You can't get relief by. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. This form will explain.

Married Filing Separate and N400 Applications CitizenPath

The new form doesn’t have married but withhold at higher single rate is. If you use the married filing separately filing status you can be. Web married persons who file separate returns in community property states may also qualify for relief. When you file using this status, your credits and deductions are limited. If you and your spouse do not.

Married Filing Separately How it Works & When to Do It Personal Capital

Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. In most cases, claiming married filing separately is the least.

The New Form Doesn’t Have Married But Withhold At Higher Single Rate Is.

If you file separate tax returns, you report only your own income, deductions and credits on your individual return. Web your filing status for the year will be either married filing separately or married filing jointly. Web married filing separately: Web the new form changes single to single or married filing separately and includes head of household.

Apparently With 2021 Returns It Is Happening A Lot.

If your filing status is married filing separately and all of the following. See community property laws for more information. If you and your spouse plan to share a household in the future, you’re not. A spouse is considered part of your household even if he or she is gone for a temporary absence.

Web Use This Form To Determine The Allocation Of Tax Amounts Between Married Filing Separate Spouses Or Registered Domestic Partners (Rdps) With Community.

Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web the irs considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance. When you file using this status, your credits and deductions are limited. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights.

You Can't Get Relief By.

Web the filing statuses we know today — single, head of household, qualifying widow (er), married filing jointly and married filing separately — first appeared on the. Web if you choose to file married filing separately, both spouses have to file the same way—either you both itemize or you both use standard deduction. If you and your spouse do not agree to file a joint return, then you must file separate returns, unless you are considered. Generally, married persons must file a joint return to claim the credit.