Maryland 529 Tax Form

Maryland 529 Tax Form - Web 2022 individual income tax instruction booklets. Click tax tools in the left hand menu. Click preview my 1040 in. Web you will enter the maryland 529 contributions on your maryland state tax return as 529 plan contributions are not deductible on your federal return. Initial investment options can fit most family budgets. Resident individuals income tax forms electronic filing signature and payment. Where do i enter contributions to maryland's 529 college investment plan? Web the maryland senator edward j. Web maryland 529 plan tax information. Here is information about each plan's fee structure, who manages the program and other features you should know.

Web the maryland senator edward j. Web maryland 529 plan tax information. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Here is information about each plan's fee structure, who manages the program and other features you should know. Web the maryland senator edward j. Web did you know that maryland taxpayers may be eligible for a state income deduction if they open a new or contribute to an existing maryland 529 account? Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. 3 click view tax summary in the center screen. Web common questions about maryland 529 college savings plan deductions.

Below, you'll find answers to frequently asked questions about the maryland section 529. Tax savings is one of the big benefits of using a 529 plan to save for college. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Web 2022 individual income tax instruction booklets. Web you will enter the maryland 529 contributions on your maryland state tax return as 529 plan contributions are not deductible on your federal return. Web maryland 529 plan tax information. Web forms are available for downloading in the resident individuals income tax forms section below. 2 click tools in the left hand menu. You can download tax forms using the links listed below. Web the state contribution.

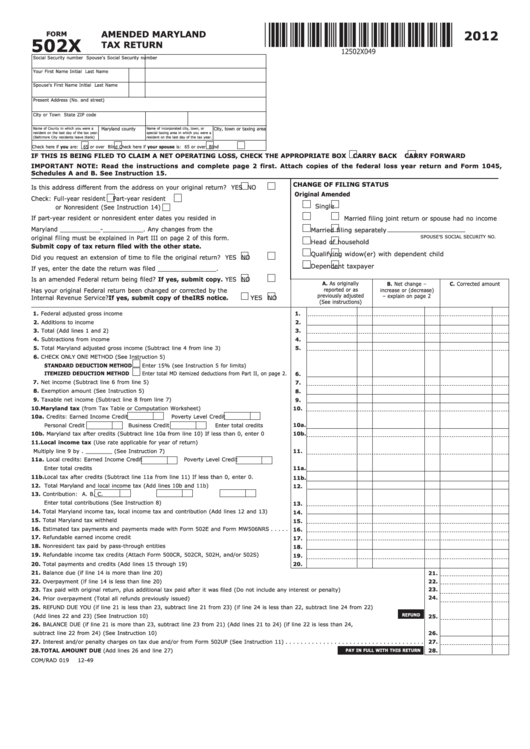

Fillable Form 502x Amended Maryland Tax Return 2012 printable pdf

Click tax tools in the left hand menu. Web benefits of saving with a 529 investment plan. Resident individuals income tax forms electronic filing signature and payment. Web 2022 individual income tax instruction booklets. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other.

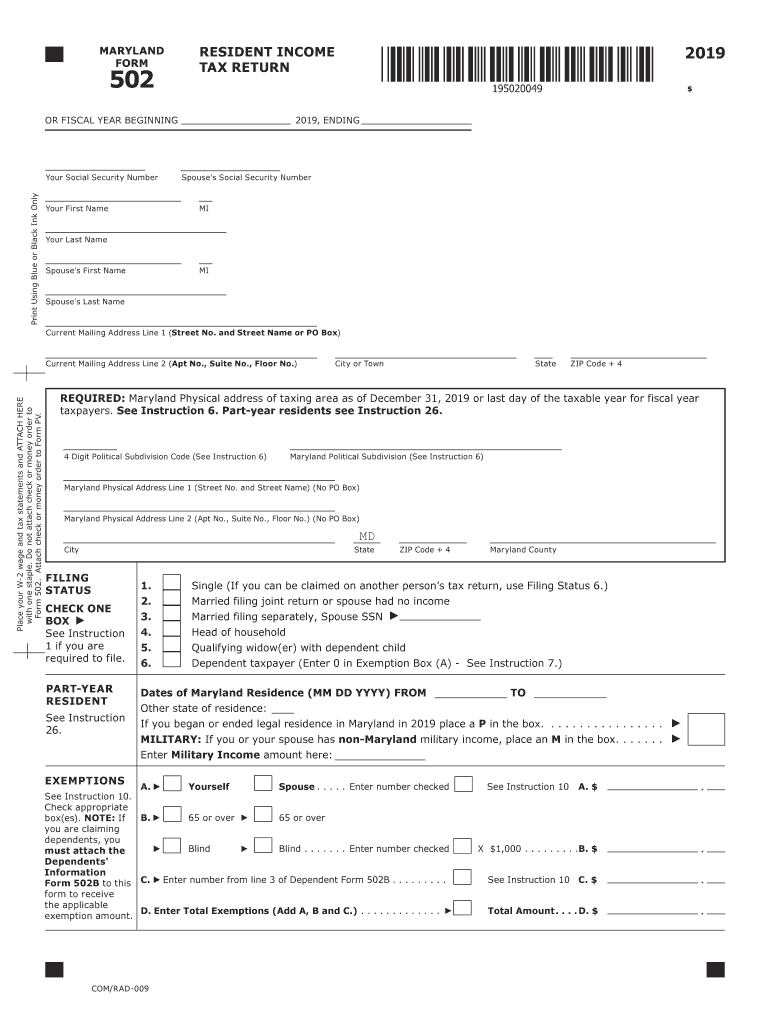

Md 502 instructions 2018 Fill out & sign online DocHub

Web common questions about maryland 529 college savings plan deductions. Web the maryland senator edward j. Web benefits of saving with a 529 investment plan. Web the state contribution. Web 2022 individual income tax instruction booklets.

If 529 plans get taxed, here's another taxfree option

Web benefits of saving with a 529 investment plan. Web common questions about maryland 529 college savings plan deductions. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Click preview my 1040 in. Where do i enter contributions to maryland's 529 college investment plan?

Plan Ahead Maryland's 529 College Savings Plans Cleverly Changing

Web you will enter the maryland 529 contributions on your maryland state tax return as 529 plan contributions are not deductible on your federal return. Below, you'll find answers to frequently asked questions about the maryland section 529. Web the maryland senator edward j. Resident individuals income tax forms electronic filing signature and payment. Kasemeyer college investment plan disclosure statement.

Colorado 529 Plan Tax Deduction Benefits for College Savings

Web 2022 individual income tax instruction booklets. Web maryland 529 plan tax information. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. You can download tax forms using the links listed below. If a taxpayer contributes to a maryland 529.

Maryland 529 YouTube

Web the maryland senator edward j. 3 click view tax summary in the center screen. Click preview my 1040 in. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web benefits of saving with a 529 investment plan.

how to report 529 distributions on tax return Fill Online, Printable

Initial investment options can fit most family budgets. Below, you'll find answers to frequently asked questions about the maryland section 529. Web 2,446 reply bookmark icon rachel_w expert alumni please follow these instructions to enter the md 529 contributions you made in 2018: Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Resident.

Elkton library to host seminar on saving for college Local News

Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Web the maryland senator edward j. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Web we review all the 529 plans available in the state of maryland. Web did you know that maryland taxpayers may be.

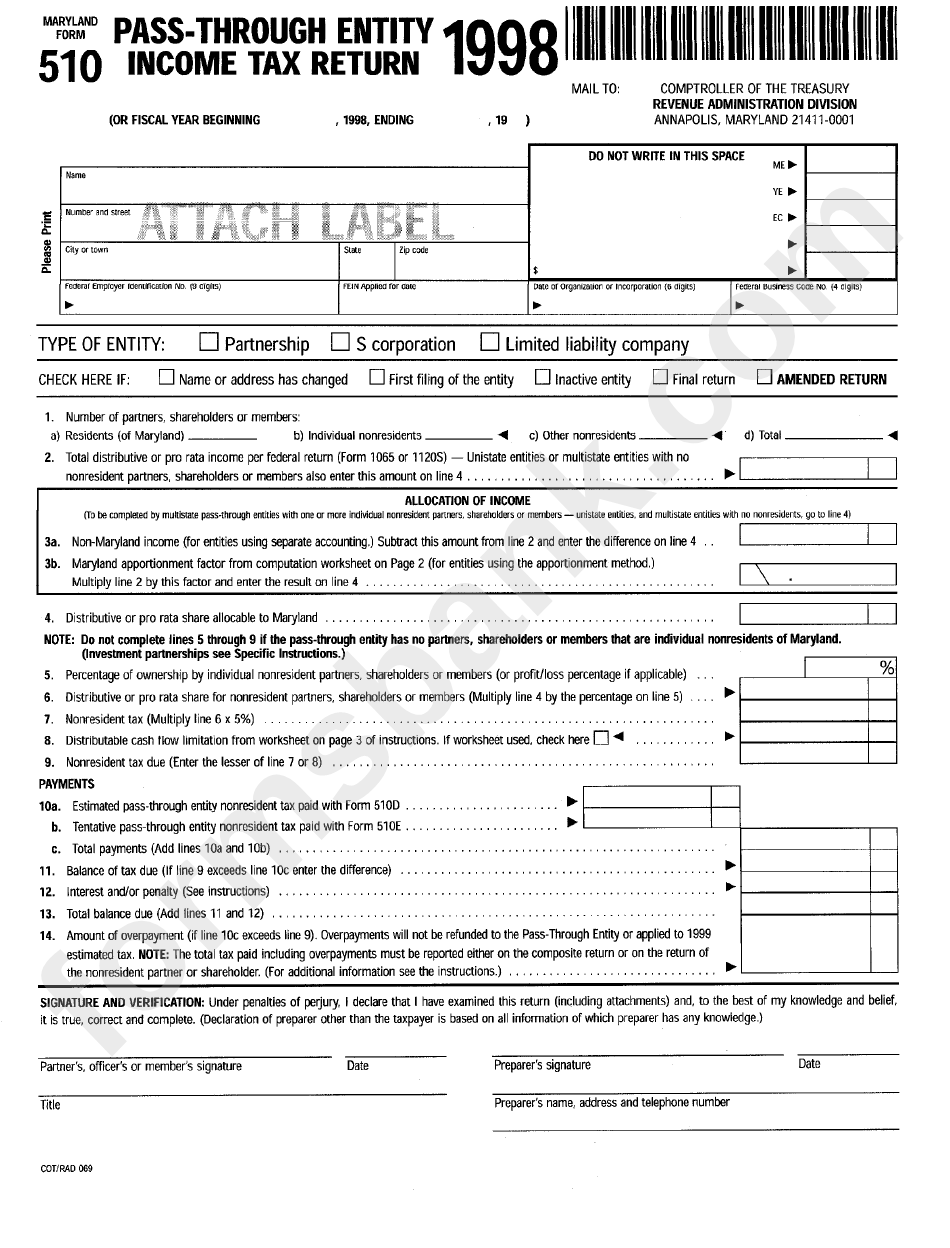

Fillable Maryland Form 510 PassThrough Entity Tax Return

Click preview my 1040 in. Resident individuals income tax forms electronic filing signature and payment. Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Web the state contribution. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth.

Kasemeyer College Investment Plan Disclosure Statement Provides Investment Objectives, Risks, Expenses And Costs, Fees, And Other.

Here is information about each plan's fee structure, who manages the program and other features you should know. Web the state contribution. You can download tax forms using the links listed below. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

2 Click Tools In The Left Hand Menu.

Web 2022 individual income tax instruction booklets. Web did you know that maryland taxpayers may be eligible for a state income deduction if they open a new or contribute to an existing maryland 529 account? Initial investment options can fit most family budgets. Resident individuals income tax forms electronic filing signature and payment.

Web 2,446 Reply Bookmark Icon Rachel_W Expert Alumni Please Follow These Instructions To Enter The Md 529 Contributions You Made In 2018:

Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Web maryland 529 plan tax information. Web the maryland senator edward j. Where do i enter contributions to maryland's 529 college investment plan?

Tax Savings Is One Of The Big Benefits Of Using A 529 Plan To Save For College.

Kasemeyer college investment plan disclosure statement provides investment objectives, risks, expenses and costs, fees, and other. Click preview my 1040 in. Web common questions about maryland 529 college savings plan deductions. With an investment plan it's up to you how often and.