Maryland Form 202 Sales And Use Tax

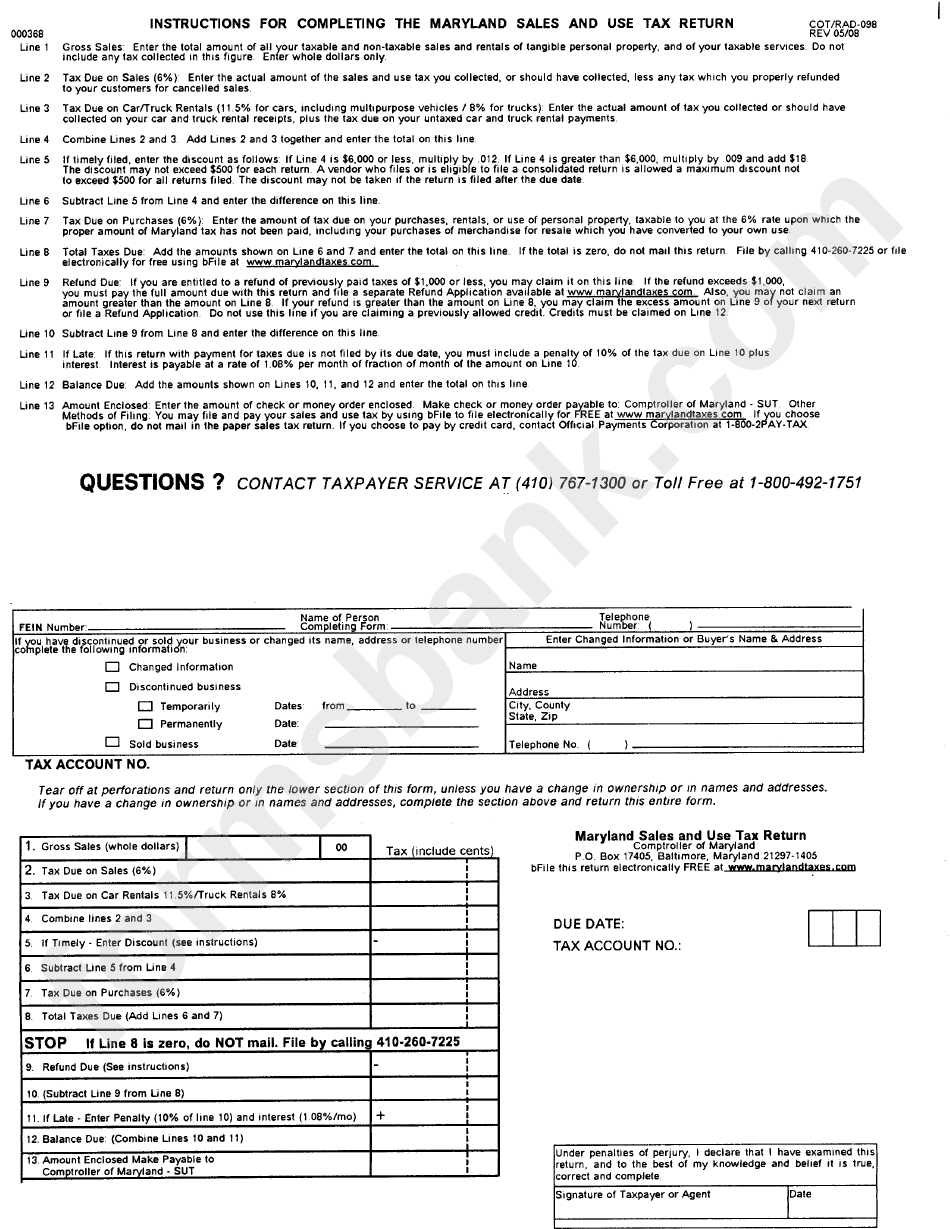

Maryland Form 202 Sales And Use Tax - 2021 sales and use tax forms. Web 2021 sales and use tax forms. Web handy tips for filling out maryland form 202 sales and use tax online. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! If you need to correct a previously submitted. 2018 sales and use tax. 2020 sales and use tax forms. Line 1 gross sales enter the. Sales of digital products and digital code subject to 6% rate. Web maryland form 202 sales and use tax return check here if:

Complete, edit or print tax forms instantly. Web bfile help system new sales and use tax return previously submitted returns confirmation number period ending due date line 1 check box line 2 check box gross. Web maryland sales and use tax return form 202, maryland form 202 pdf, maryland form 202: Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of sut202fr, fully updated for tax year 2022. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Name or address has changed (attach completed change of name or address form) july. Tax due on sales of alcoholic beverages. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f.

Web the maryland sales use tax form 202 is a paper form that's used to report sales and use tax on tangible personal property purchased in the state. 2020 sales and use tax forms. The form can be filled out. Printing and scanning is no longer the best way to manage documents. Form used by consumers to report and pay the use tax. Sales of digital products and digital code subject to 6% rate. Name or address has changed (attach completed change of name or address form) july. Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. Do not use this option if. Web maryland form 202 sales and use tax return check here if:

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Web sales and use tax is a tax on the purchase of goods and services. Web maryland form 202 sales and use tax return check here if: Get ready for tax season deadlines by completing any required tax forms today. Do not use this option if. 2018 sales and use tax.

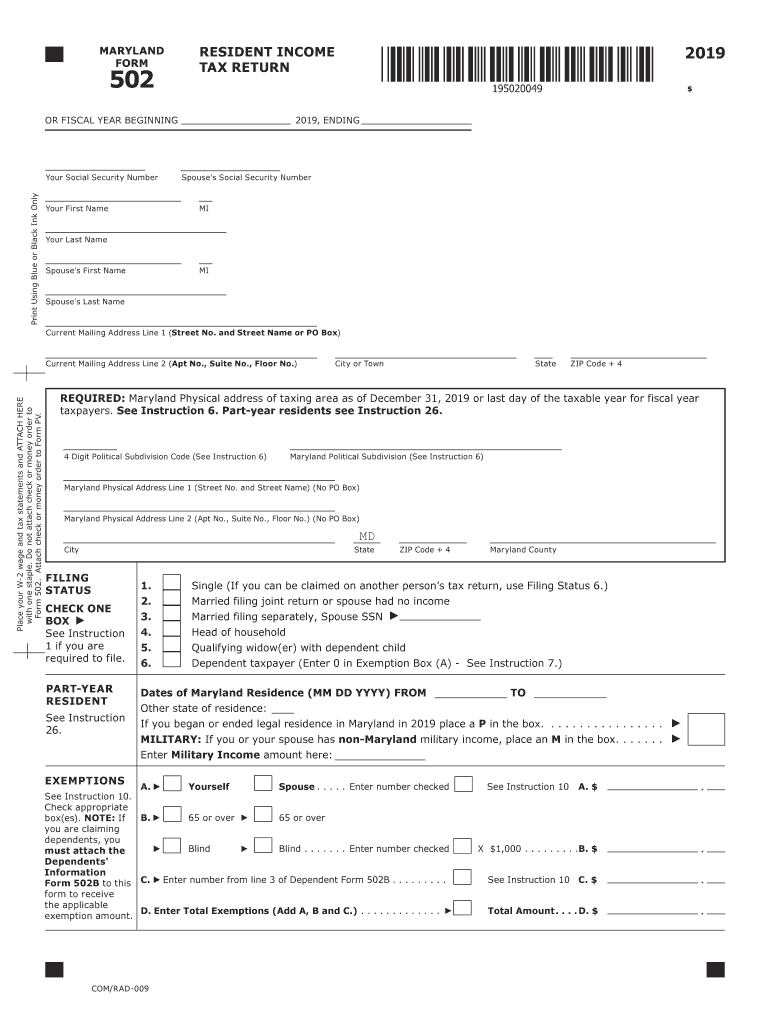

2019 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

2019 sales and use tax forms. Web the maryland sales use tax form 202 is a paper form that's used to report sales and use tax on tangible personal property purchased in the state. If you need to correct a previously submitted. Line 1 gross sales enter the. 2018 sales and use tax.

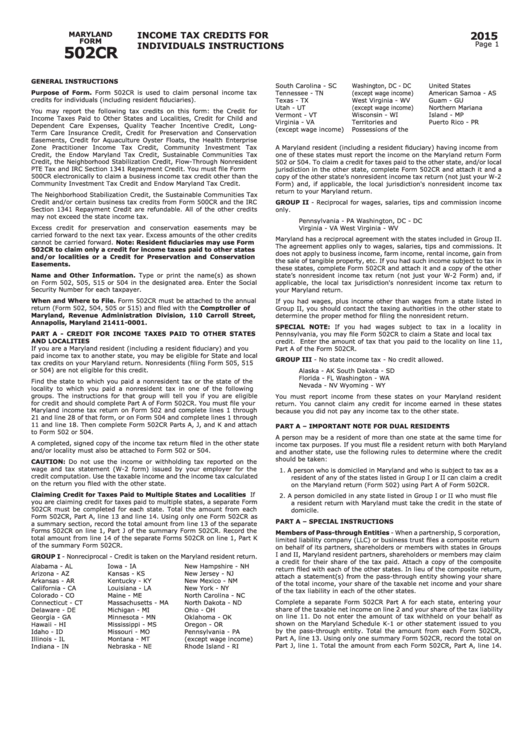

Instructions For Maryland Form 502cr Tax Credits For

Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Web 2021 sales and use tax forms. The maryland sales use tax form 202 is used to report and pay the sales and use tax. 2020 sales and use tax forms. Web.

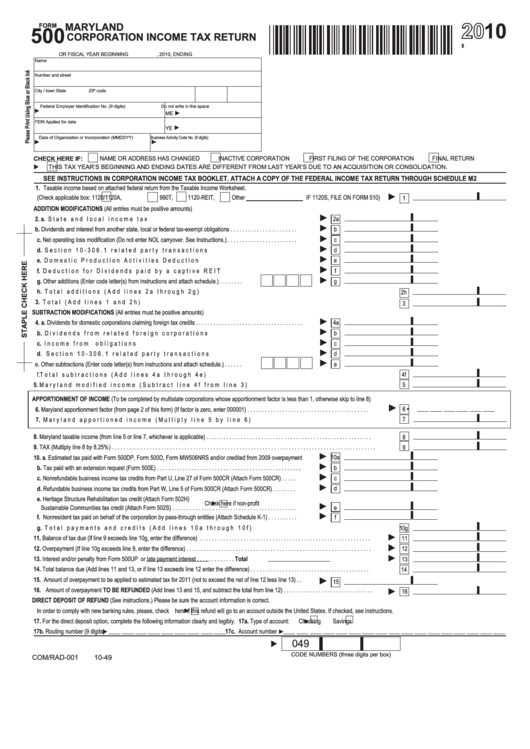

Fillable Form 500 Maryland Corporation Tax Return 2010

In box 5a enter the. 2019 sales and use tax forms. Sales of digital products and digital code subject to 6% rate. Form 202f is used by marketplace facilitators to report sales and use tax collected on. Web 2021 sales and use tax forms.

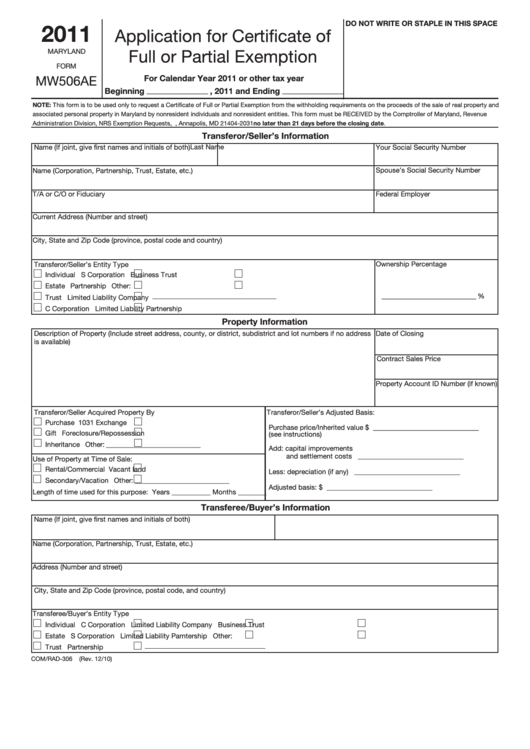

Fillable Maryland Form Mw506ae Application For Certificate Of Full Or

The form is due on. Complete, edit or print tax forms instantly. Web bfile help system new sales and use tax return previously submitted returns confirmation number period ending due date line 1 check box line 2 check box gross. The form can be filled out. Web you may use this application to file withholding and sales and use tax.

How to File and Pay Sales Tax in Maryland TaxValet

Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Form used by consumers to report and pay the use tax. Sales of digital products and digital code subject to 6% rate. Go digital and save time with. Form 202f is used.

Maryland Sales and Use Tax form 202 Beautiful Blog

Web maryland sales and use tax return form 202, maryland form 202 pdf, maryland form 202: Tax due on sales of alcoholic beverages. Web sales and use tax is a tax on the purchase of goods and services. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of.

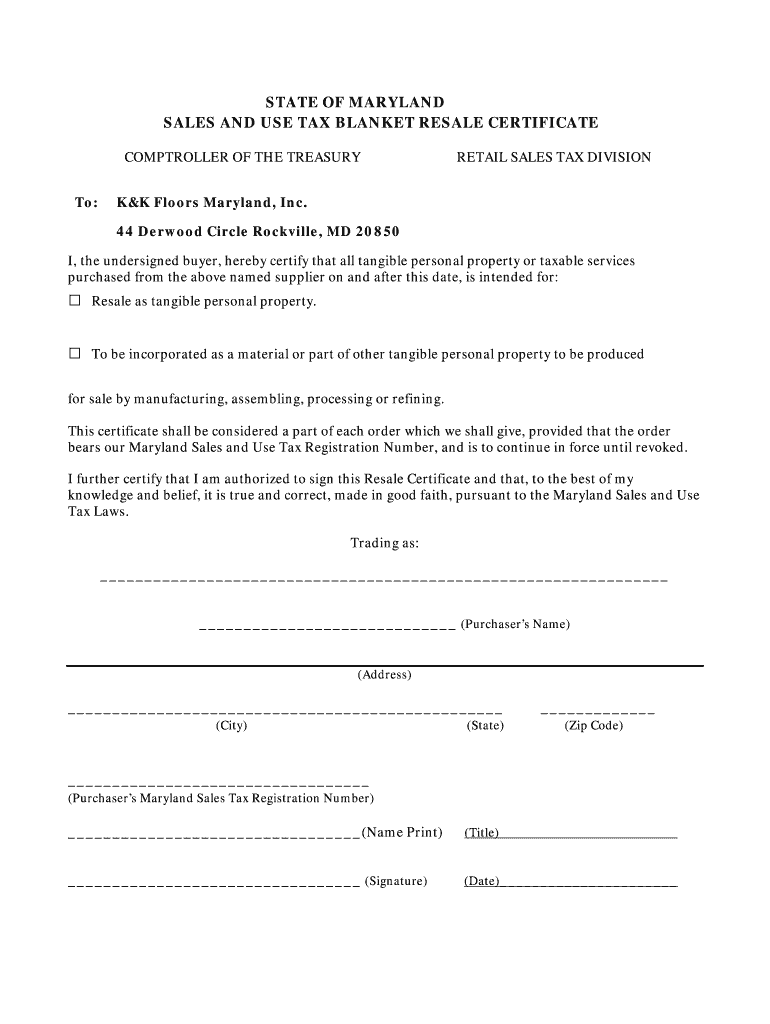

Maryland Resale Certificate Form Fill Out and Sign Printable PDF

Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. The form can be filled out. Get ready for tax season deadlines by completing any required tax forms today. If you need to correct a previously submitted. Go digital and save time with.

Maryland Power Of Attorney Form Free Printable Printable Templates

Tax due on sales of alcoholic beverages. Web maryland sales and use tax return form 202, maryland form 202 pdf, maryland form 202: Web handy tips for filling out maryland form 202 sales and use tax online. The form can be filled out. Complete, edit or print tax forms instantly.

Form Cot/rad098 The Maryland Sales And Use Tax Return 2008 printable

Form 202f is used by marketplace facilitators to report sales and use tax collected on. The form can be filled out. Go digital and save time with. Form used by consumers to report and pay the use tax. Web new sales and use tax return ( table of contents ) using this option is equivalent to filing a maryland sales.

Sales Of Digital Products And Digital Code Subject To 6% Rate.

Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Web bfile help system new sales and use tax return previously submitted returns confirmation number period ending due date line 1 check box line 2 check box gross. 2018 sales and use tax. Web 2021 sales and use tax forms.

Web You May Use This Application To File Withholding And Sales And Use Tax Returns For Periods Beginning After December 31, 2020.

2019 sales and use tax forms. The form can be filled out. Form used by consumers to report and pay the use tax. The maryland sales use tax form 202 is used to report and pay the sales and use tax.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

Sales of digital products and digital code subject to 6% rate. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Web handy tips for filling out maryland form 202 sales and use tax online. Web new sales and use tax return ( table of contents ) using this option is equivalent to filing a maryland sales and use tax return for the period you select.

Web Do Not Include Sales And Use Tax Collected For Facilitated Sales, Which Is Reported On Form 202F.

Go digital and save time with. Web the maryland sales use tax form 202 is a paper form that's used to report sales and use tax on tangible personal property purchased in the state. Complete, edit or print tax forms instantly. The form is due on.