Maryland Form 500

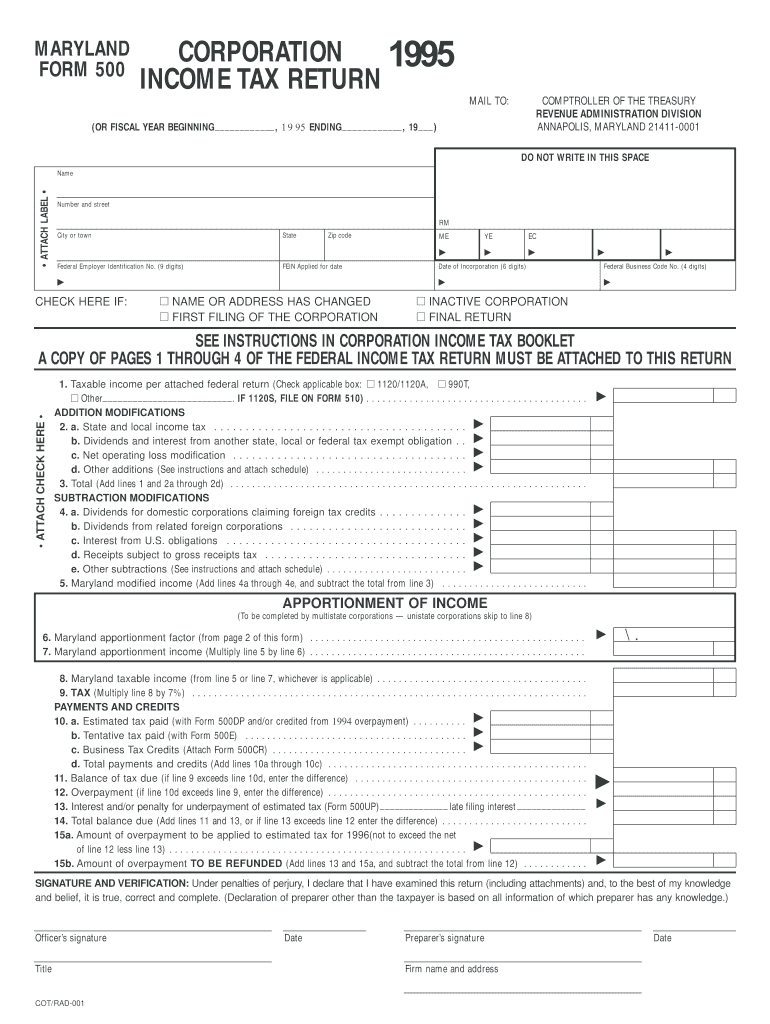

Maryland Form 500 - Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. We offer several ways for you to obtain maryland tax forms, booklets and instructions: Web front of form 500. You can download or print current or past. Edit your comptroller of maryland form 500 online. Web maryland form 500cr 2016. Type text, add images, blackout confidential details, add comments, highlights and more. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period.

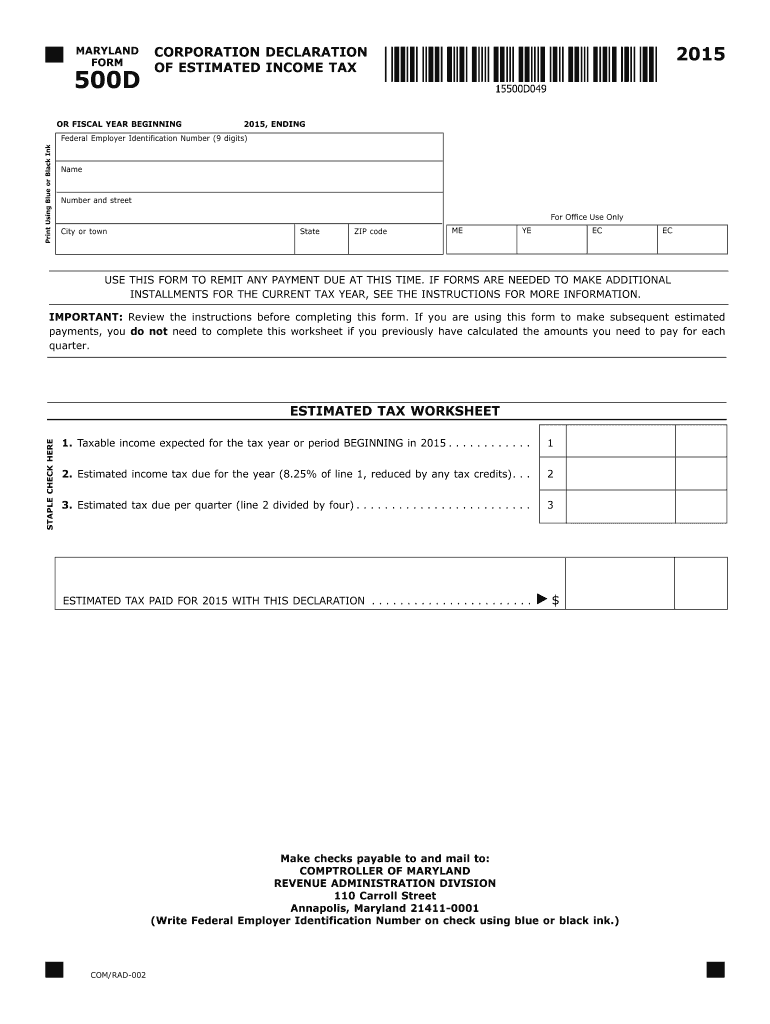

Sign it in a few clicks. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Are new employees or employees rehired after being laid off for more than one year; Web we last updated the decoupling modification in january 2023, so this is the latest version of form 500dm, fully updated for tax year 2022. Ad download or email md form 500 & more fillable forms, register and subscribe now! Maryland corporation income tax return: Edit your comptroller of maryland form 500 online. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Web we last updated the declaration of estimated corporation income tax in january 2023, so this is the latest version of form 500d, fully updated for tax year 2022. Or fiscal year beginning 2021, ending.

Edit your comptroller of maryland form 500 online. Web front of form 500. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web individual tax forms and instructions. Print using blue or black ink only staple check. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Type text, add images, blackout confidential details, add comments, highlights and more. Or fiscal year beginning 2022, ending. In addition to filing form 500 to calculate and pay the corporation income tax, also file form 510. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022.

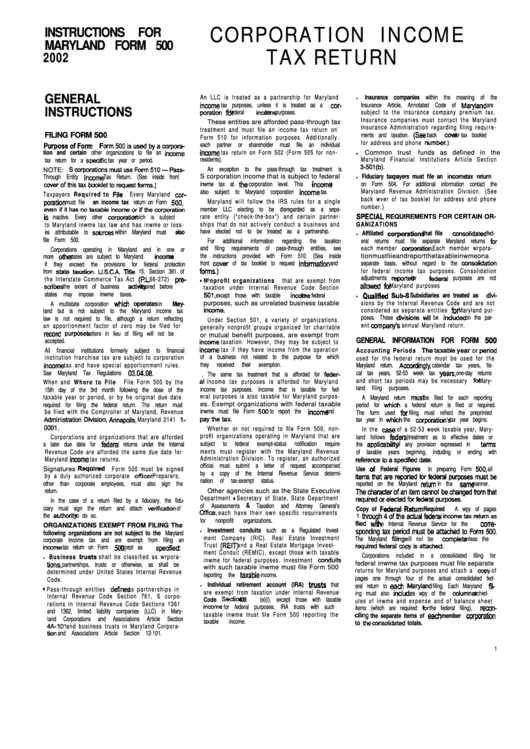

Instructions For Maryland Form 500 Corporation Tax Return

This system allows instant online electronic filing of the 500e/510e forms. Maryland corporation income tax return: Print using blue or black ink only staple check. Web welcome to the comptroller of maryland's internet extension request filing system. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period.

Maryland Form 500D Fill Out and Sign Printable PDF Template signNow

Maryland corporation income tax return: Ad download or email md form 500 & more fillable forms, register and subscribe now! You can download or print current or past. Are new employees or employees rehired after being laid off for more than one year; Web every maryland corporation must file a corporation income tax return, using form 500, even if the.

Maryland Form 500 Fill Online, Printable, Fillable, Blank PDFfiller

Web front of form 500. Print using blue or black ink only staple check. Web we last updated the decoupling modification in january 2023, so this is the latest version of form 500dm, fully updated for tax year 2022. You can download tax forms using. Form used by a corporation and certain other organizations to file an income tax return.

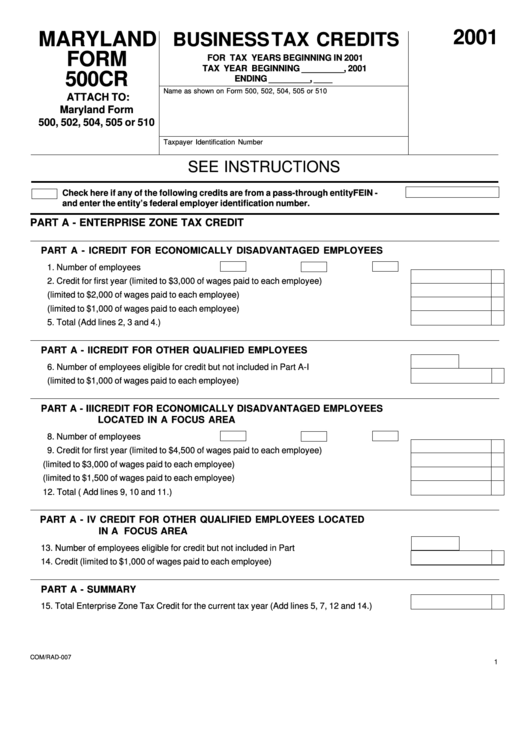

Fillable Form 500cr Maryland Business Tax Credits 2001 printable

This system allows instant online electronic filing of the 500e/510e forms. We offer several ways for you to obtain maryland tax forms, booklets and instructions: Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Or fiscal year beginning 2021, ending. Edit your comptroller of maryland form 500.

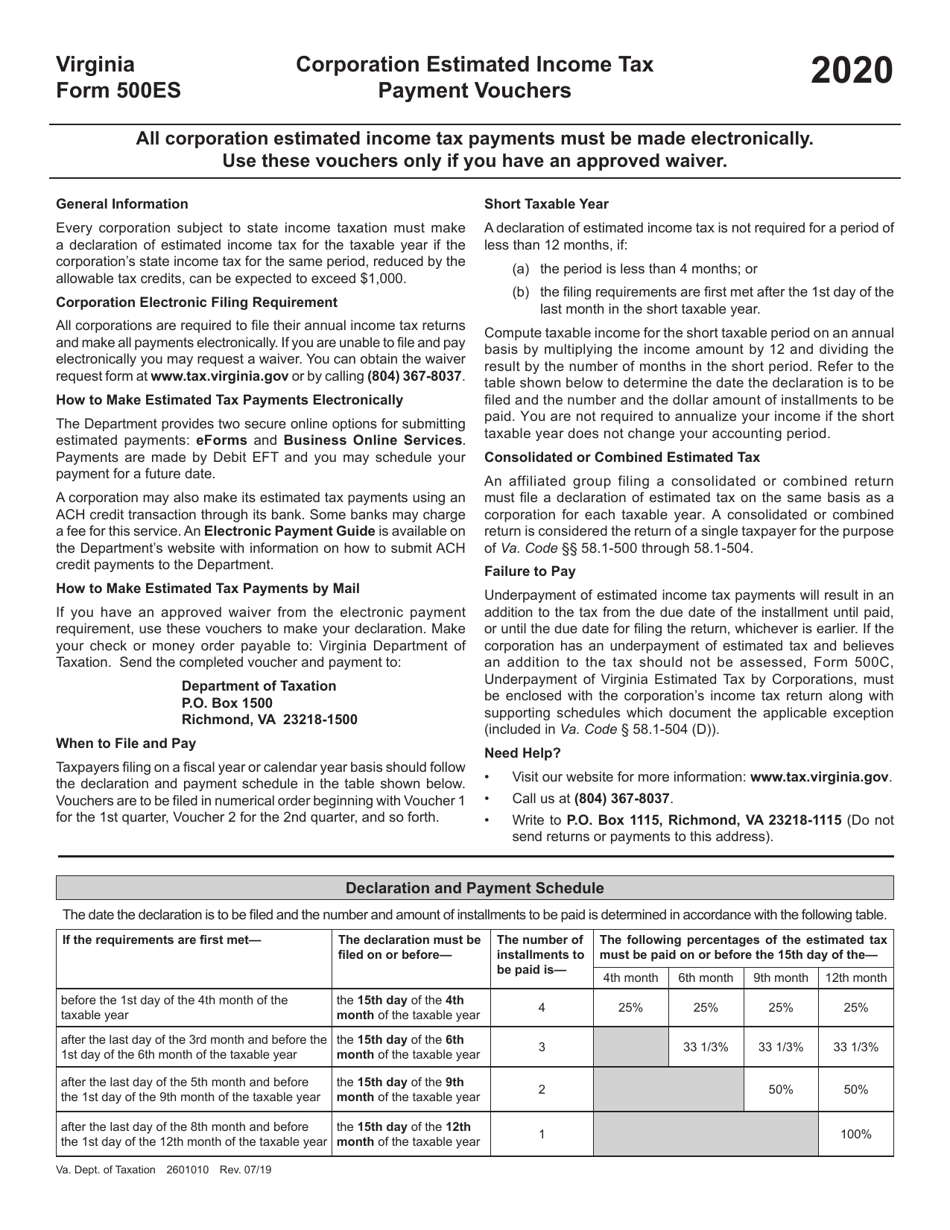

Form 500ES Download Fillable PDF or Fill Online Corporation Estimated

This system allows instant online electronic filing of the 500e/510e forms. Or fiscal year beginning 2021, ending. Ad download or email md form 500 & more fillable forms, register and subscribe now! We offer several ways for you to obtain maryland tax forms, booklets and instructions: Or fiscal year beginning 2022, ending.

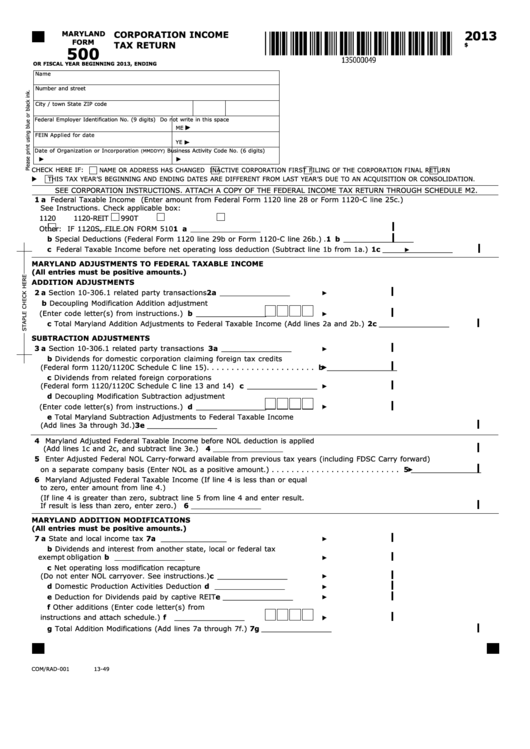

Fillable Maryland Form 500 Corporation Tax Return 2013

Web individual tax forms and instructions. We offer several ways for you to obtain maryland tax forms, booklets and instructions: This form is for income earned in tax year 2022, with tax returns due in april. Print using blue or black ink only staple. Are new employees or employees rehired after being laid off for more than one year;

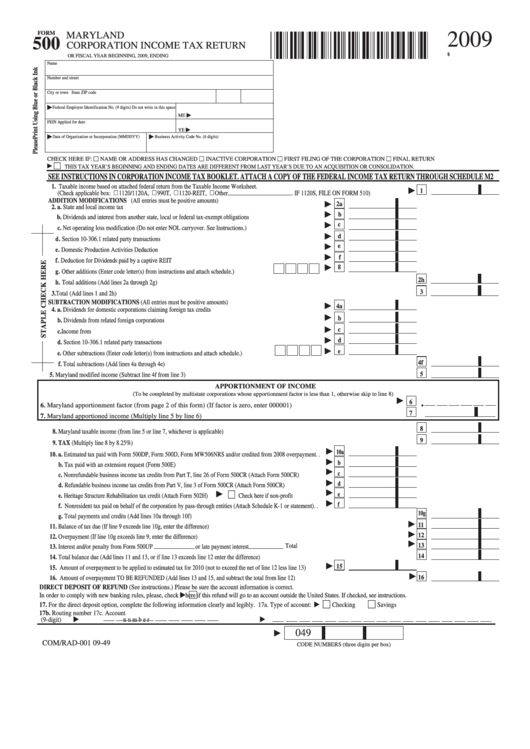

Fillable Form 500 Maryland Corporation Tax Return 2009

This form is for income earned in tax year 2022, with tax returns due in april. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web individual tax forms and instructions. Type text, add images, blackout confidential details, add comments,.

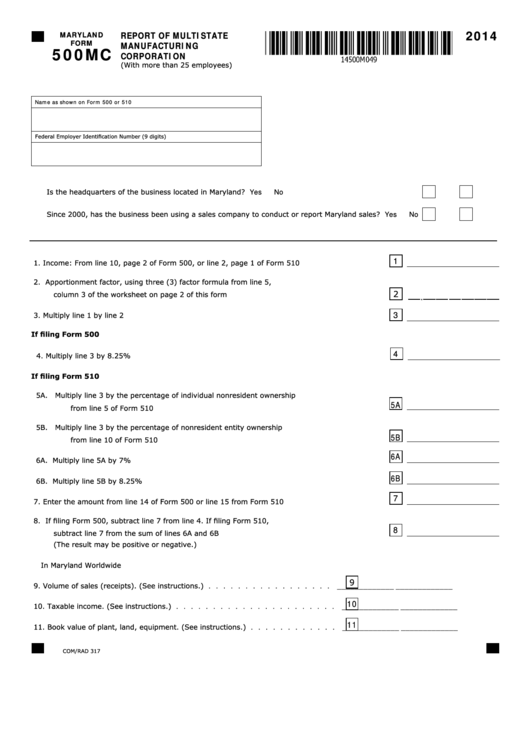

Top 23 Maryland Form 500 Templates free to download in PDF format

Web we last updated the decoupling modification in january 2023, so this is the latest version of form 500dm, fully updated for tax year 2022. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Are new employees or employees rehired after being laid off.

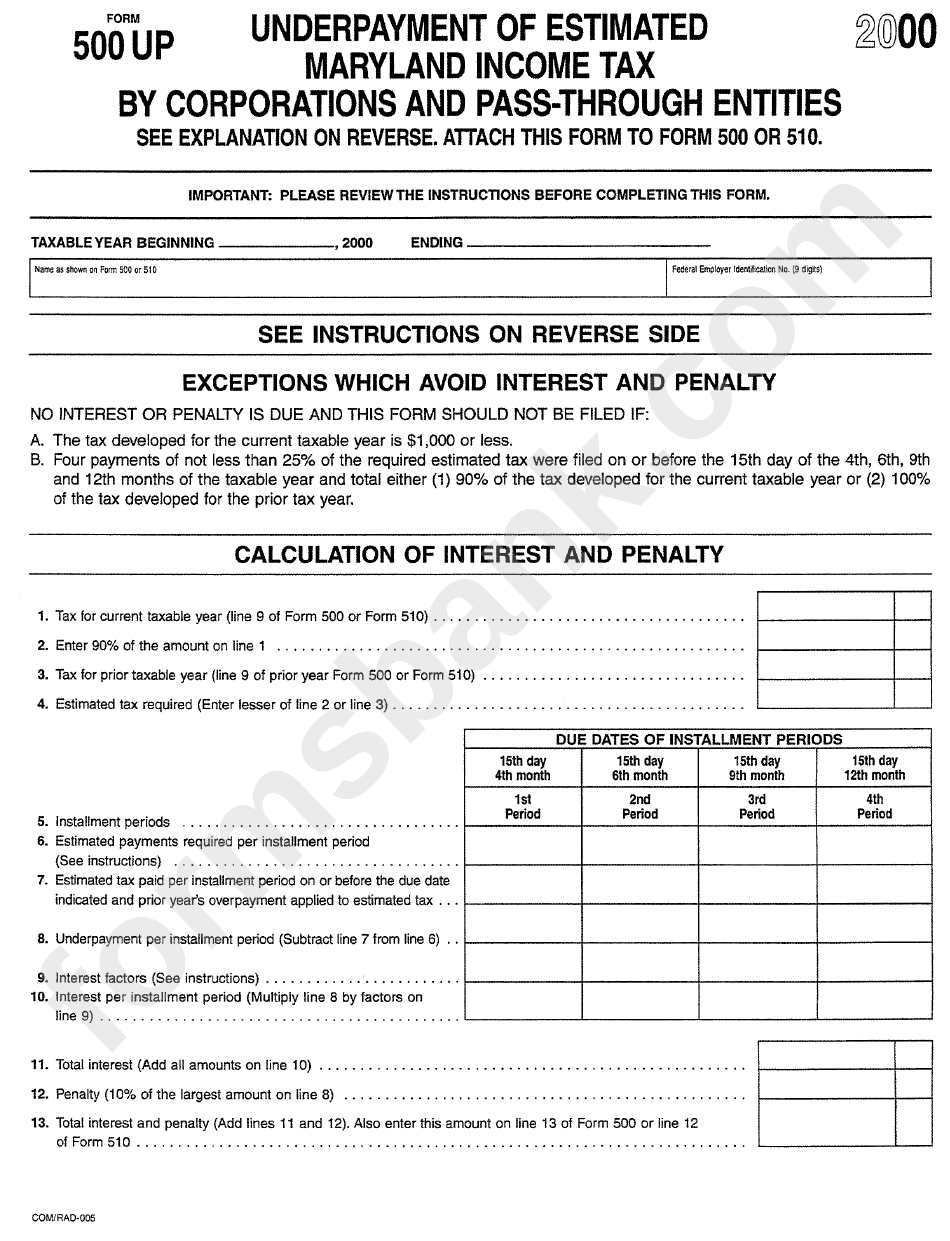

Form 500 Up Underpayment Of Estimated Maryland Tax By

Web we last updated the decoupling modification in january 2023, so this is the latest version of form 500dm, fully updated for tax year 2022. You can download tax forms using. Maryland corporation income tax return: Are new employees or employees rehired after being laid off for more than one year; This system allows instant online electronic filing of the.

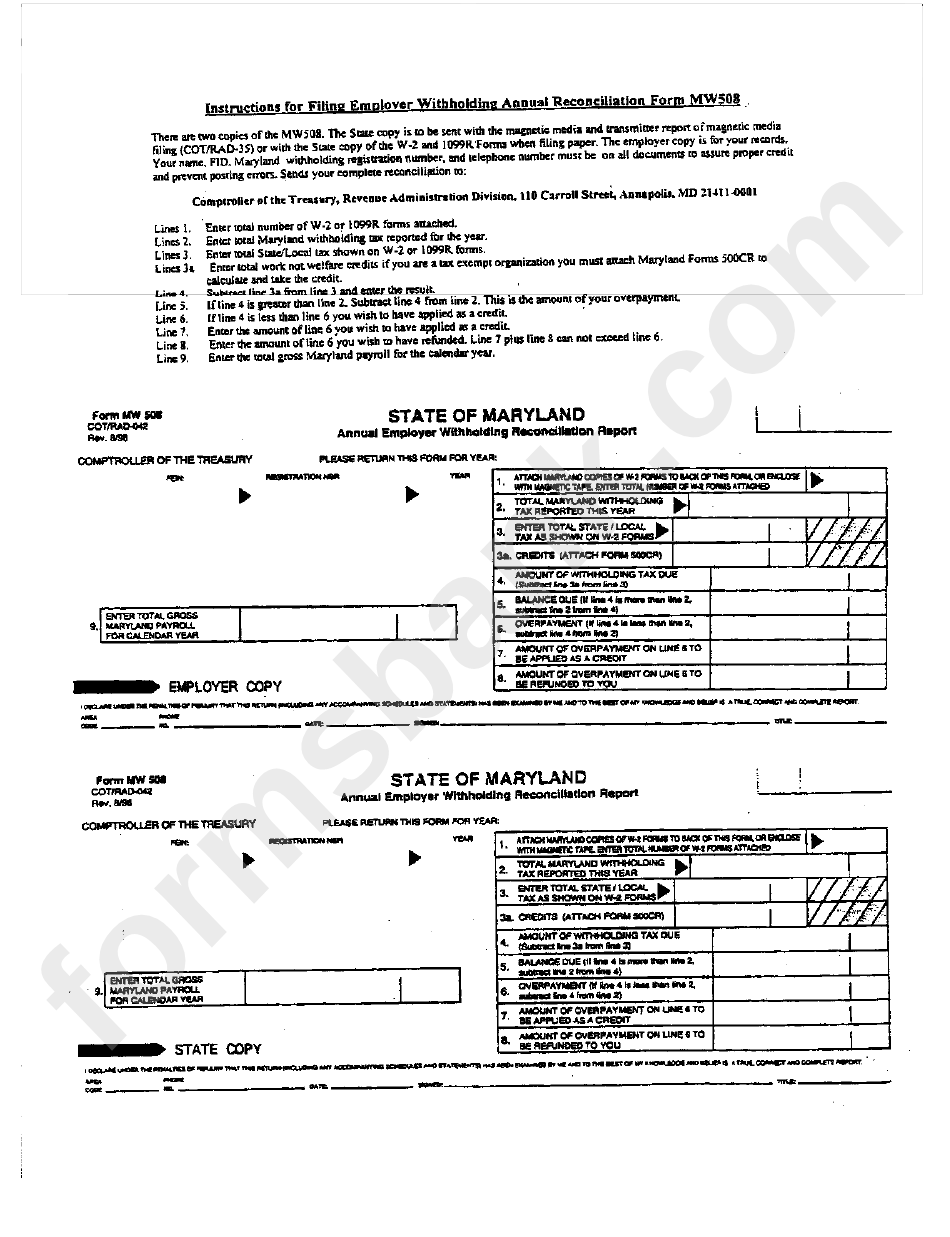

Form Mv500 State Of Maryland Annual Employer Withholding

Type text, add images, blackout confidential details, add comments, highlights and more. Maryland corporation income tax return: Are new employees or employees rehired after being laid off for more than one year; Web front of form 500. Sign it in a few clicks.

Or Fiscal Year Beginning 2021, Ending.

Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. You can download tax forms using. 5 other matters extension of time to file if unable to file. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period.

Maryland Corporation Income Tax Return:

Web welcome to the comptroller of maryland's internet extension request filing system. Print using blue or black ink only staple check. Edit your comptroller of maryland form 500 online. Or fiscal year beginning 2022, ending.

Are New Employees Or Employees Rehired After Being Laid Off For More Than One Year;

Print using blue or black ink only staple. Ad download or email md form 500 & more fillable forms, register and subscribe now! Web form 500e is a maryland corporate income tax form. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web front of form 500. Web individual tax forms and instructions. Web we last updated the declaration of estimated corporation income tax in january 2023, so this is the latest version of form 500d, fully updated for tax year 2022.