Maryland Form 505 2022

Maryland Form 505 2022 - From to check here for maryland taxes withheld in error. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web maryland individual form availability. Use form 500 to calculate the amount of maryland corporation income tax. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. For forms, visit the 2022 individual tax forms or business tax forms pages. Web we last updated the maryland nonresident amended tax return in january 2023, so this is the latest version of form 505x, fully updated for tax year 2022. Web use a maryland form 505 2022 template to make your document workflow more streamlined. Web maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local income taxes. Show details we are not affiliated with any brand or entity on this form.

Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. 2021 maryland nonresident income tax return. Web maryland individual form availability. Get ready for tax season deadlines by completing any required tax forms today. For forms, visit the 2022 individual tax forms or business tax forms pages. Web 2022 instruction booklets note: Web maryland form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax calculation, follow the. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. (1) enter the corporation name,.

2022 individual income tax instruction booklets 2022 business. Web subject to maryland corporation income tax. Web city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in. Web 2022 instruction booklets note: This form is for income earned in tax year 2022, with tax returns due in april. Web use a maryland form 505 2022 template to make your document workflow more streamlined. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web maryland individual form availability. (1) enter the corporation name,.

Maryland Form 202 20202022 Fill and Sign Printable Template Online

Web city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in. Get ready for tax season deadlines by completing any required tax forms today. 2021 maryland nonresident income tax return. Web maryland state and local nonresident.

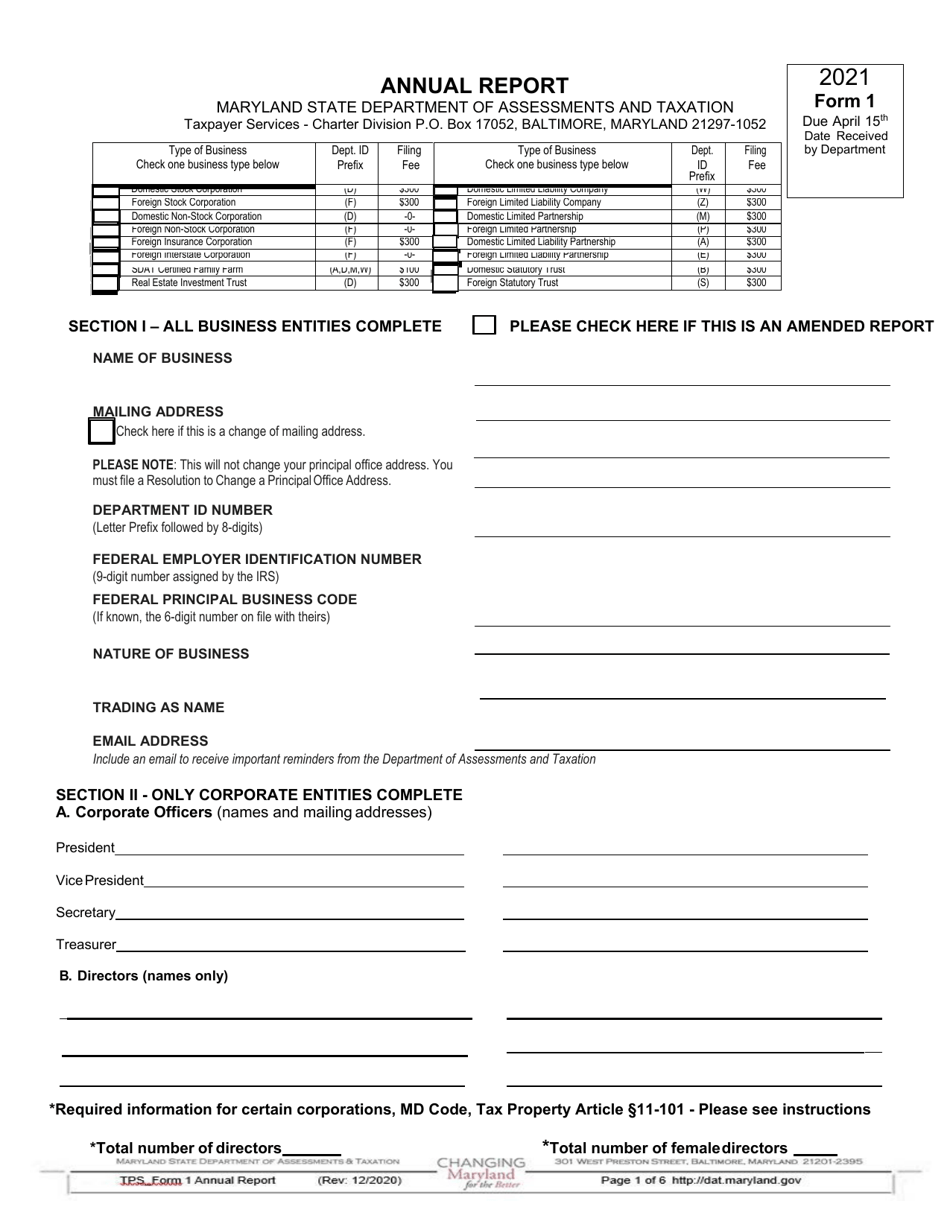

Form 1 Download Fillable PDF or Fill Online Annual Report 2021

Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web we last updated the maryland.

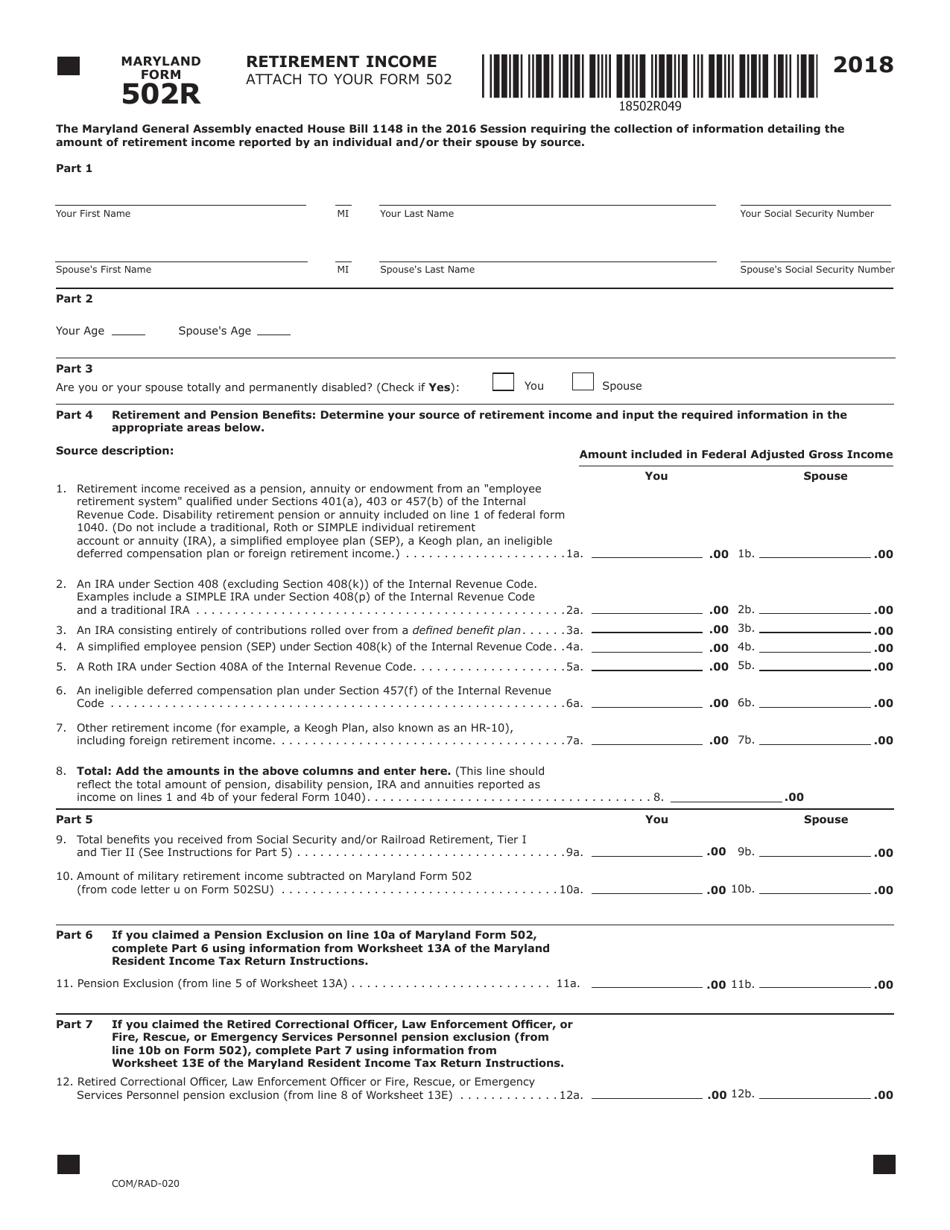

Form COM/RAD020 (Maryland Form 502R) Download Fillable PDF or Fill

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in. Show details we are not affiliated with.

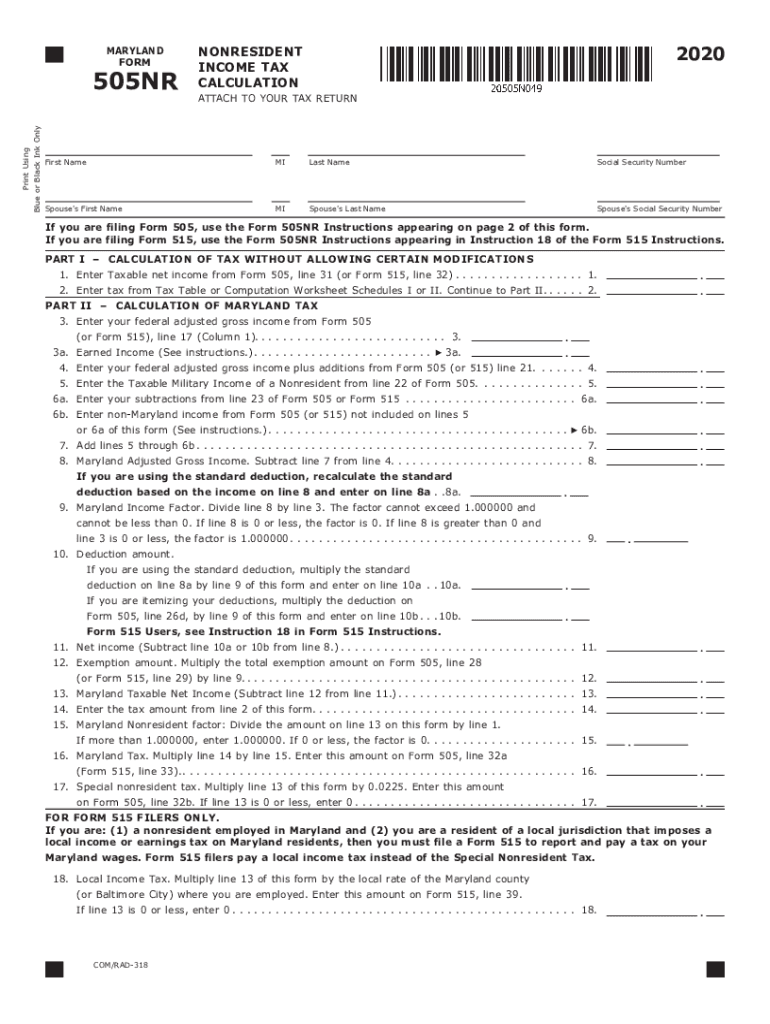

2020 Form MD 505NR Fill Online, Printable, Fillable, Blank pdfFiller

From to check here for maryland taxes withheld in error. Maryland form 502tp, computation of tax preference income. Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and. If you lived in maryland only part of the year, you. (1) enter the corporation name,.

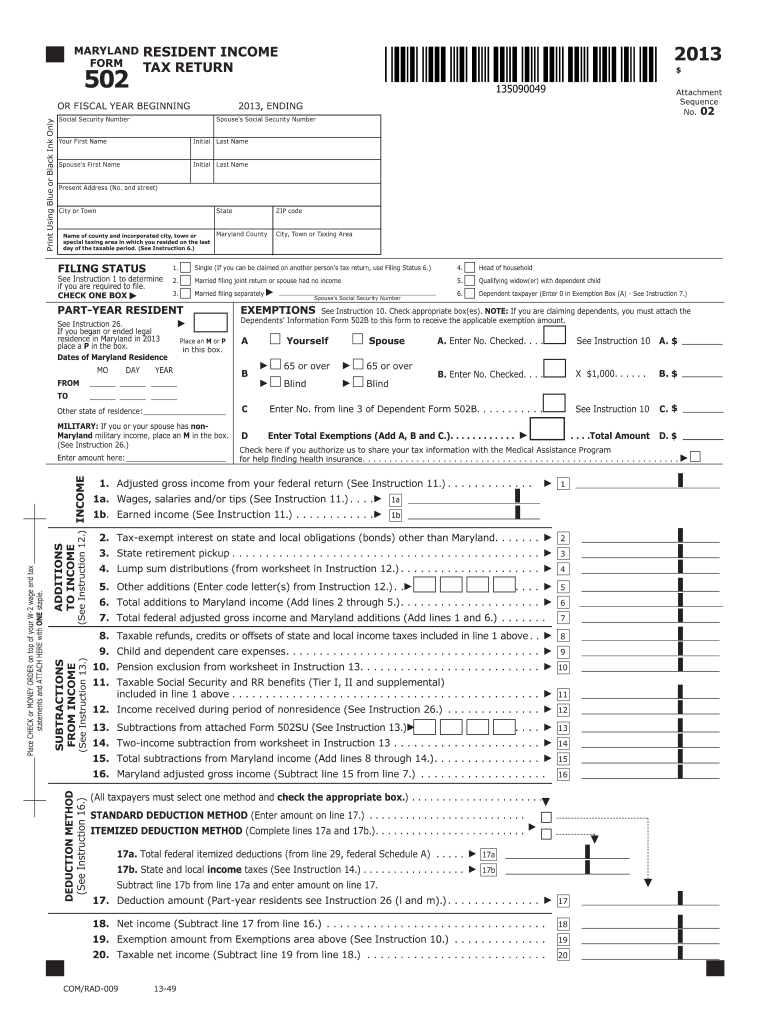

Fill Free fillable forms Comptroller of Maryland

Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income. Web we last updated the maryland nonresident amended tax return in january 2023, so this is the latest version of form 505x, fully updated for tax year 2022. Web 2022 instruction booklets note: Web.

Fill Free fillable forms Comptroller of Maryland

Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web maryland form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax calculation, follow the. Web resident dates you resided in maryland for 2021. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident.

Fill Form 505 2020 NONRESIDENT TAX RETURN MARYLAND

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web maryland individual form availability. Web overview use this screen to enter residency information for maryland forms.

Fillable Md 502 Form Fill Out and Sign Printable PDF Template signNow

Web maryland individual form availability. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web this form maybe used by taxpayers to report income modifications and credits applicable to tax year 2022 that are enacted after december 31, 2022. Get.

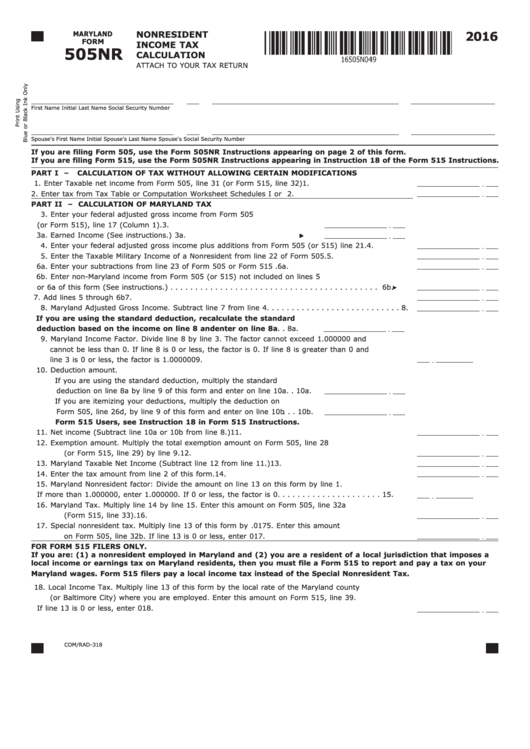

Fillable Nonresident Tax Calculation Maryland Form 505nr

For forms, visit the 2022 individual tax forms or business tax forms pages. Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. From to check here for maryland taxes withheld in error. Web maryland individual form availability. Web we last updated the nonresident income.

2021 Form MD Comptroller 505X Fill Online, Printable, Fillable, Blank

Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web this form maybe used by taxpayers to report income modifications and credits applicable to tax year 2022 that are enacted after december 31, 2022. Web maryland individual form availability. Web if you are a nonresident of maryland, you are required to file form.

Complete, Edit Or Print Tax Forms Instantly.

Maryland form 505, nonresident income tax return. From to check here for maryland taxes withheld in error. Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022.

Web City, Town Or Taxing Area Name Of County And Incorporated City, Town Or Special Taxing Area In Which You Were Employed On The Last Day Of The Taxable Period If You Earned Wages In.

Get ready for tax season deadlines by completing any required tax forms today. Web 2022 instruction booklets note: Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web use a maryland form 505 2022 template to make your document workflow more streamlined.

Web Payment Voucher With Instructions And Worksheet For Individuals Sending Check Or Money Order For Any Balance Due On A Form 502 Or Form 505, Estimated Tax Payments, Or.

2021 maryland nonresident income tax return. Web this form maybe used by taxpayers to report income modifications and credits applicable to tax year 2022 that are enacted after december 31, 2022. You can download or print. For forms, visit the 2022 individual tax forms or business tax forms pages.

Maryland Form 502Tp, Computation Of Tax Preference Income.

Use form 500 to calculate the amount of maryland corporation income tax. If you lived in maryland only part of the year, you. This form is for income earned in tax year 2022, with tax returns due in april. Show details we are not affiliated with any brand or entity on this form.