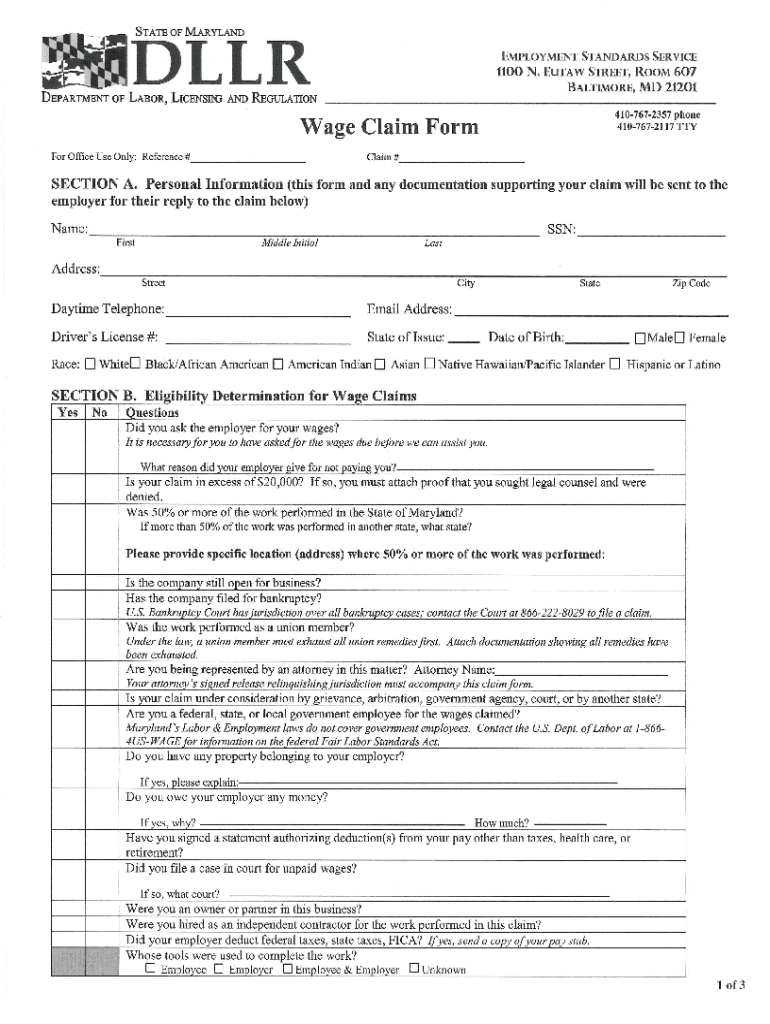

Maryland Wage Claim Form

Maryland Wage Claim Form - Web all necessary forms are supplied by the workers' compensation commission at no charge. Attorneys must login and use the claim form with entry of appearance. Web forma para el reclamo de sueldos ( word) mail or email completed, signed form to: Web welcome to our easy, guided online employee claim form. Maryland department of labor division of labor and industry employment standards. Ad download or email wage claim & more fillable forms, register and subscribe now! Who can file a claim in maryland? And other income, including income. Be sure to answer all questions and follow directions when completing the form. Web i am having problems collecting my wages, overtime, tips or pay for leave:

Web all necessary forms are supplied by the workers' compensation commission at no charge. What are my wage and hour solution options? Enter on line 1 below, the number of personal. The employee claims exempt as a. Signnow allows users to edit, sign, fill and share all type of documents online. Fica claim certification fica claim certification instructions. Maryland department of labor division of labor and industry employment standards. Please provide form name, quantity and mailing information when ordering wcc. Any individual who performed more than 50% of their work in maryland, and who believes their wages have. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to.

Web consider completing a new form mw507 each year and when your personal or financial situation changes. Web you also should attach to the wage claim form the following documents that support your claim, if available: Web for maryland income tax and withholding from their wages is required. Enter on line 1 below, the number of personal. Fica claim certification fica claim certification instructions. Web completing withholding forms for maryland state employees. Be sure to answer all questions and follow directions when completing the claim. Edit, sign and save wage claim instr form. Please provide form name, quantity and mailing information when ordering wcc. Using beacon, you will be able to file a claim for unemployment insurance (ui) benefits.

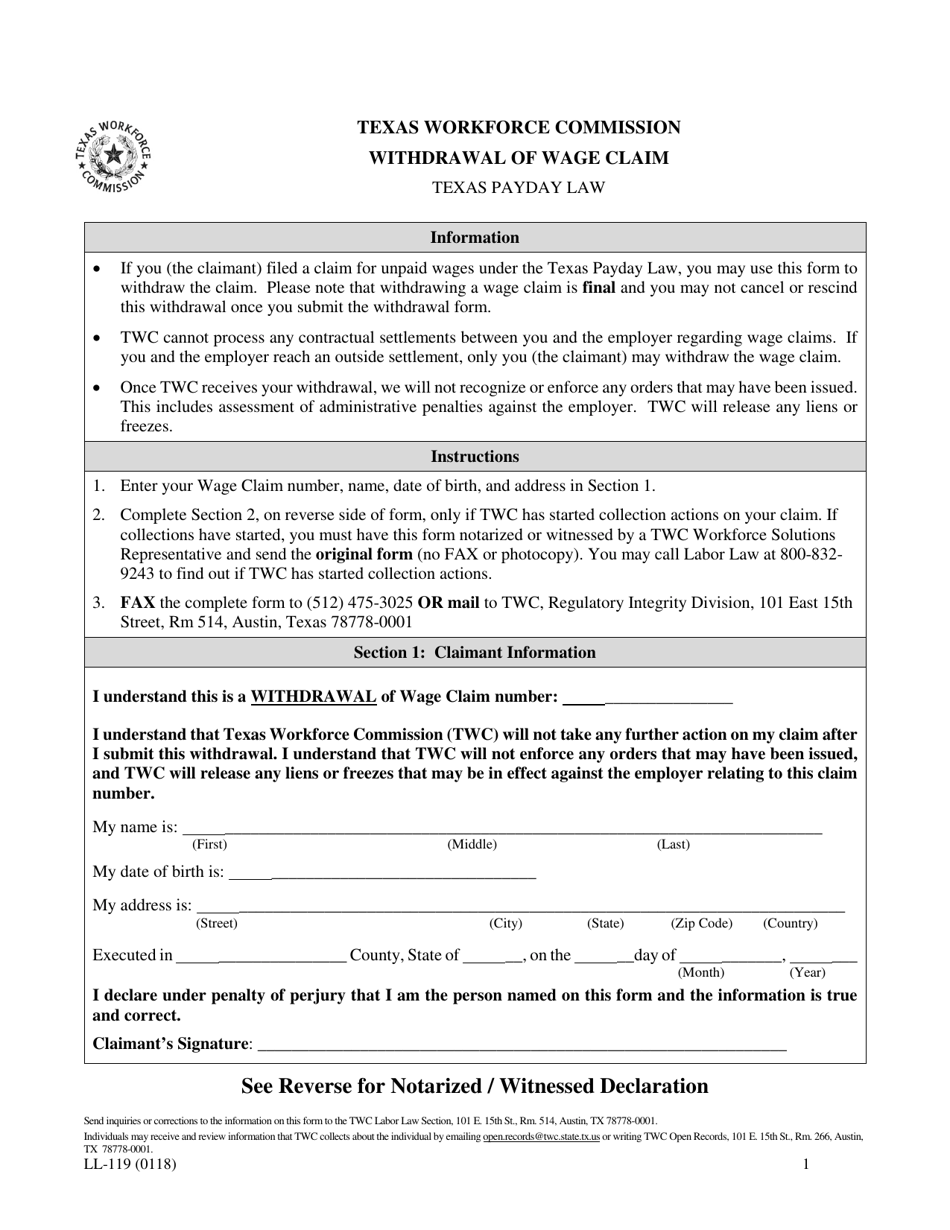

Form LL119 Download Printable PDF or Fill Online Withdrawal of Wage

Web all necessary forms are supplied by the workers' compensation commission at no charge. Income includes all of your wages. D.o.l., wage and hour division: Need to file a claim?. Using beacon, you will be able to file a claim for unemployment insurance (ui) benefits.

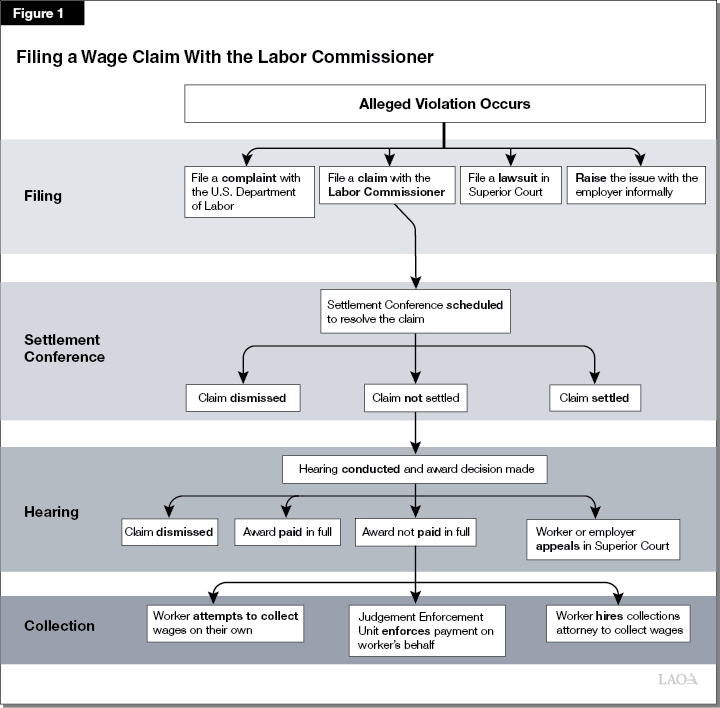

The 202021 Budget Improving the State's Unpaid Wage Claim Process

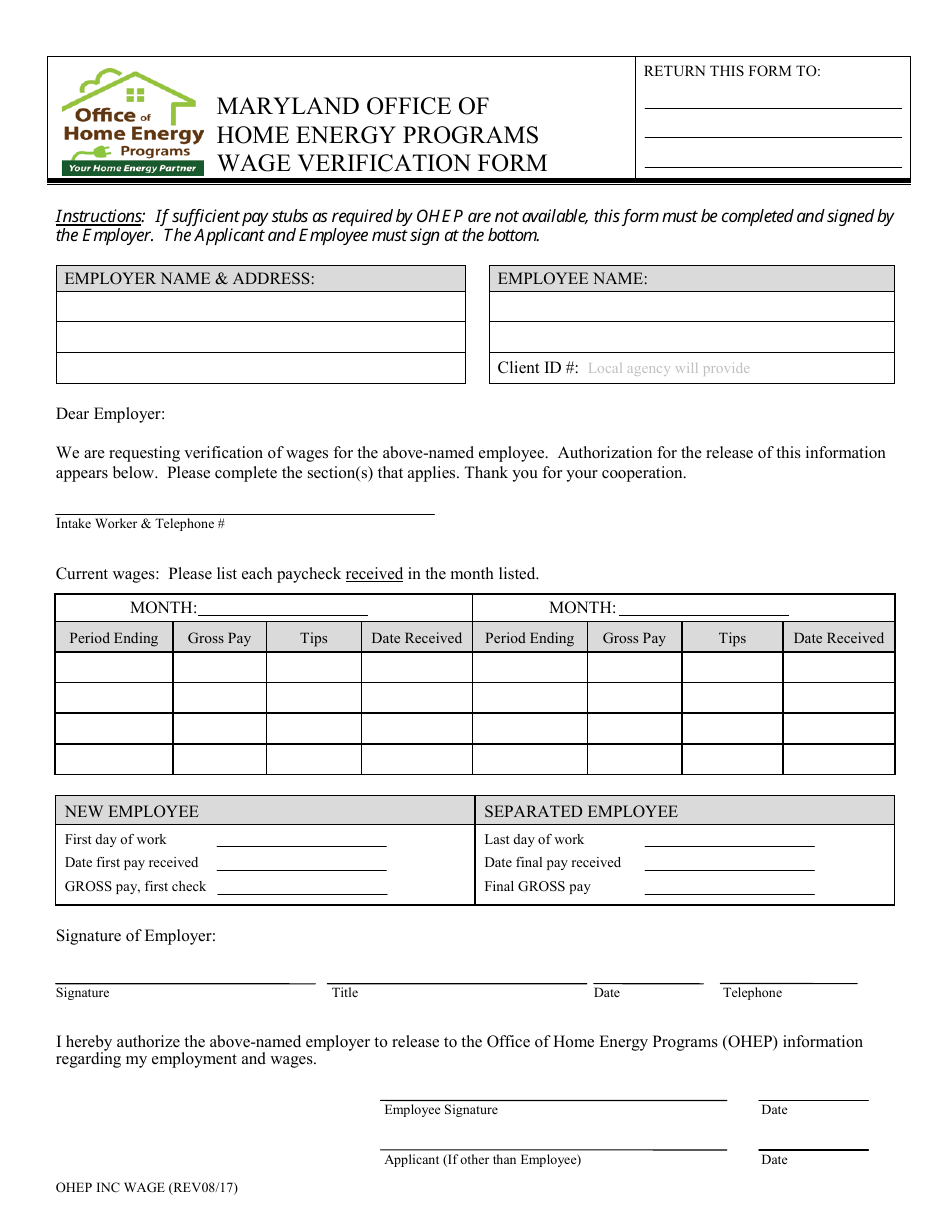

Web of labor and industry, prevailing wage unit: Web wage claims who is eligible to recover unpaid wages under the law? An employment contract and/or wage agreement, time sheets and/or. Signnow allows users to edit, sign, fill and share all type of documents online. Please provide form name, quantity and mailing information when ordering wcc.

Maryland Wage Claim Form Fill Out and Sign Printable PDF Template

Enter on line 1 below, the number of personal. Web maryland income tax withholding for annuity, sick pay and retirement distributions. Please provide form name, quantity and mailing information when ordering wcc. Ad download or email wage claim & more fillable forms, register and subscribe now! Here are a few important tips:

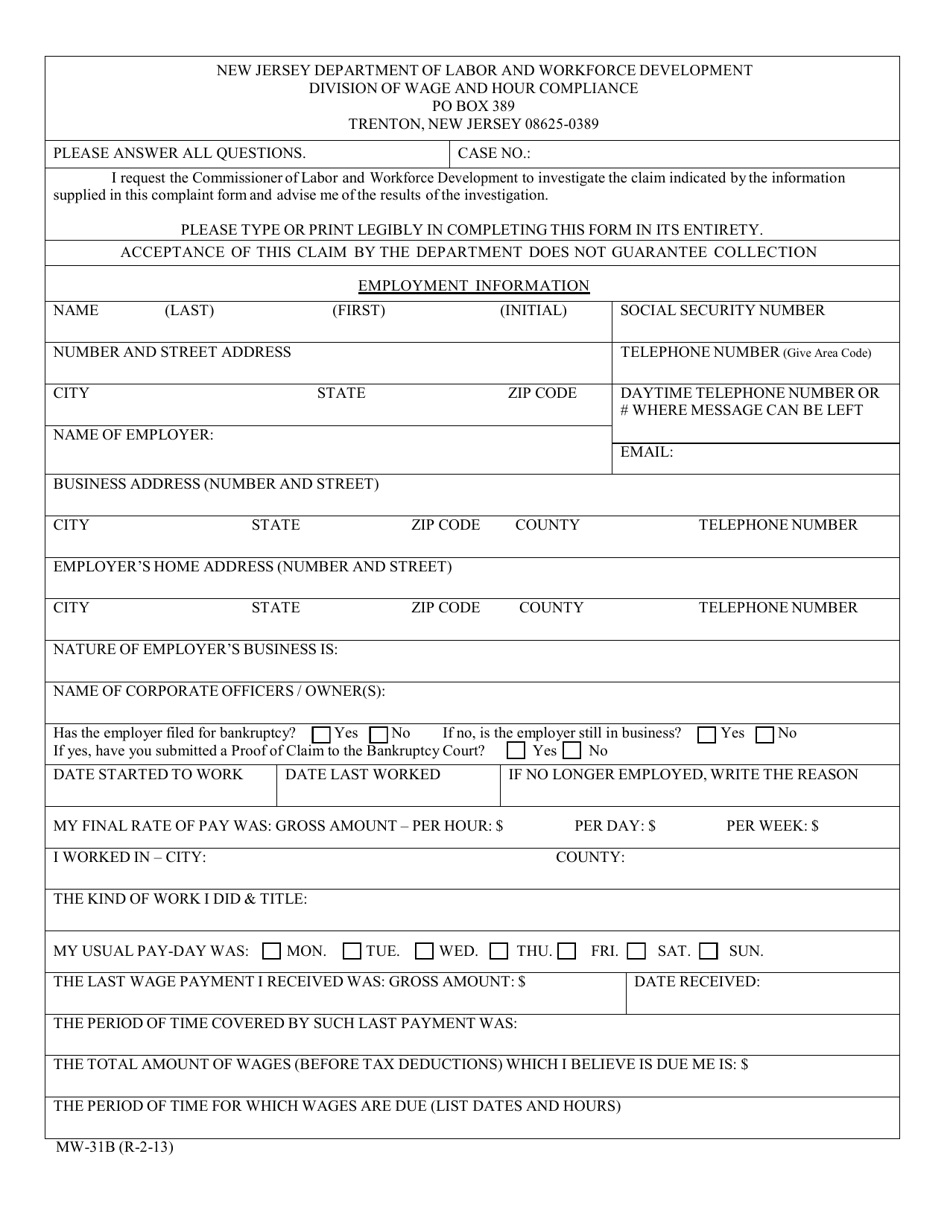

Form MW31B Download Fillable PDF or Fill Online Wage Claim for Non

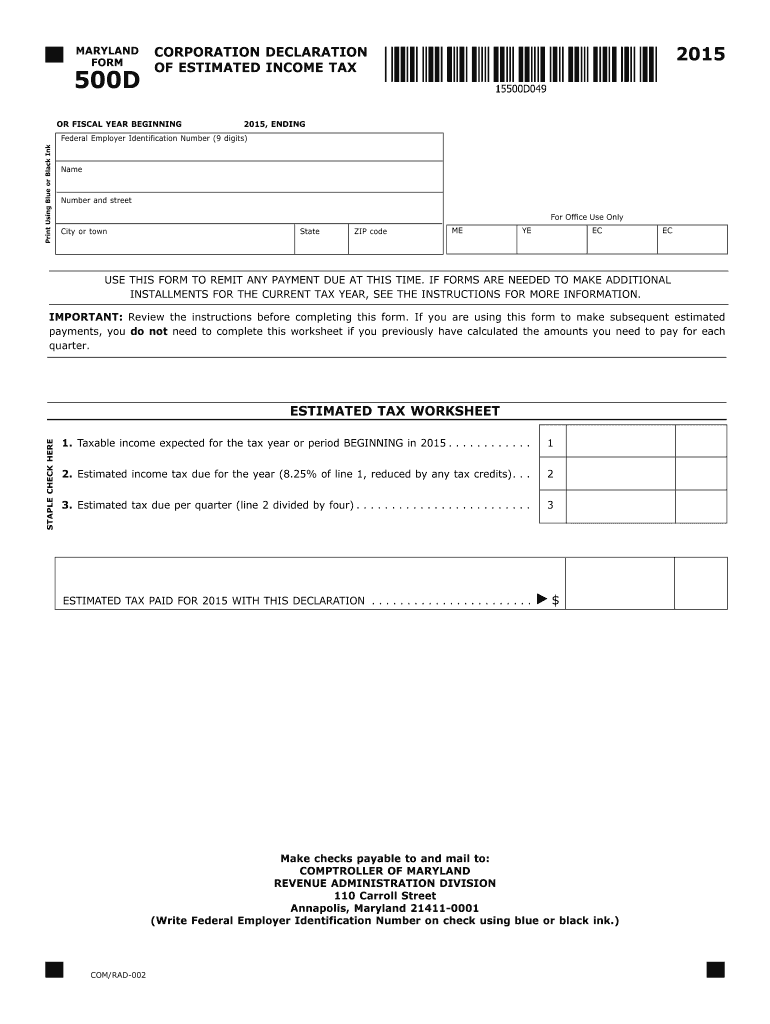

Web the 7.75 percent tax must be paid to the comptroller of maryland with form mw506 (employer's return of income tax withheld). Any individual who performed more than 50% of their work in maryland, and who believes their wages have. Web this booklet is a publication of the maryland division of labor and industry, department of labor and only pertains.

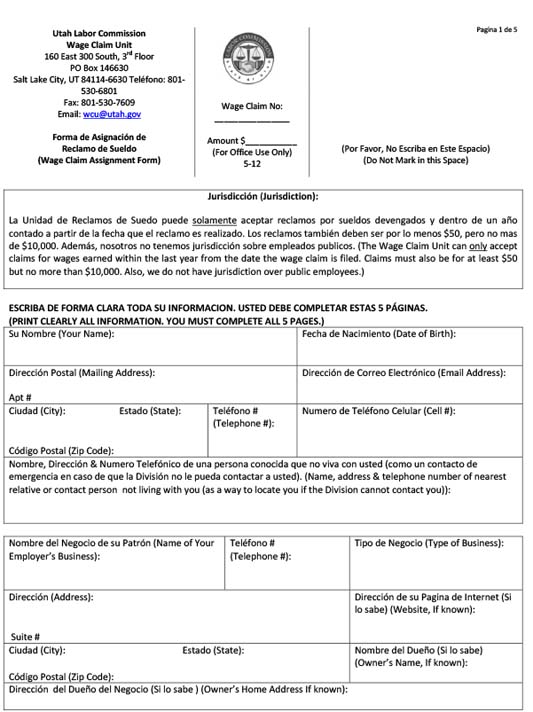

UALD Forms Utah Labor Commission

Web welcome to our easy, guided online employee claim form. Web security form to allow access to address change report on rmds: Web of labor and industry, prevailing wage unit: Who can file a claim in maryland? Web you also should attach to the wage claim form the following documents that support your claim, if available:

Maryland Living Wage Law Poster Poster Guard

Using beacon, you will be able to file a claim for unemployment insurance (ui) benefits. Web security form to allow access to address change report on rmds: Signnow allows users to edit, sign, fill and share all type of documents online. Who can file a claim in maryland? Income includes all of your wages.

Maryland Wage and Hour Attorney The Law Firm of J.W. Stafford, L.L.C.

Need to file a claim?. Web you also should attach to the wage claim form the following documents that support your claim, if available: If you are domiciled in the district of columbia, pennsylvania or virginia and maintain a place of abode in. Web i am having problems collecting my wages, overtime, tips or pay for leave: Here are a.

Maryland Form 500D Fill Out and Sign Printable PDF Template signNow

Web forma para el reclamo de sueldos ( word) mail or email completed, signed form to: Any individual who performed more than 50% of their work in maryland, and who believes their wages have. Web security form to allow access to address change report on rmds: Maryland department of labor division of labor and industry employment standards. D.o.l., wage and.

Maryland Wage Verification Form Office of Home Energy Programs

Need to file a claim?. Web completing withholding forms for maryland state employees. Web consider completing a new form mw507 each year and when your personal or financial situation changes. Fica claim certification fica claim certification instructions. Attorneys must login and use the claim form with entry of appearance.

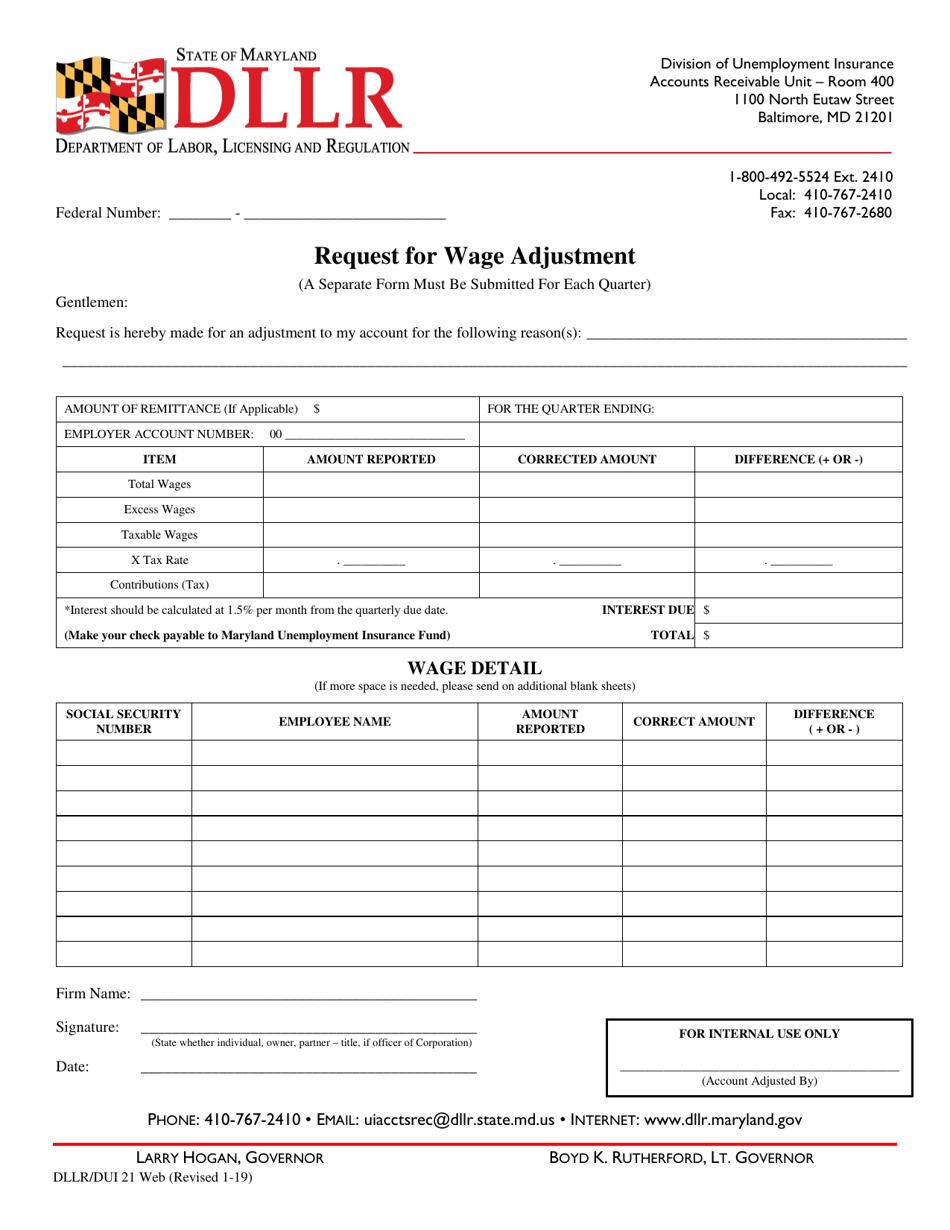

Form DLLR/DUI21 Download Printable PDF or Fill Online Request for Wage

Web completing withholding forms for maryland state employees. Ad download or email wage claim & more fillable forms, register and subscribe now! Income includes all of your wages. Please provide form name, quantity and mailing information when ordering wcc. Edit, sign and save wage claim instr form.

And Other Income, Including Income.

Web maryland income tax withholding for annuity, sick pay and retirement distributions. Ad download or email wage claim & more fillable forms, register and subscribe now! All claim forms must include your original. Ad download or email wage claim & more fillable forms, register and subscribe now!

Signnow Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

What are my wage and hour solution options? An employment contract and/or wage agreement, time sheets and/or. Web forma para el reclamo de sueldos ( word) mail or email completed, signed form to: Web for maryland income tax and withholding from their wages is required.

Form Used By Recipients Of Annuity, Sick Pay Or Retirement Distribution Payments That Choose To.

Who can file a claim in maryland? Here are a few important tips: Income includes all of your wages. D.o.l., wage and hour division:

The Employee Claims Exempt As A.

Maryland department of labor division of labor and industry employment standards. Web the 7.75 percent tax must be paid to the comptroller of maryland with form mw506 (employer's return of income tax withheld). Web you also should attach to the wage claim form the following documents that support your claim, if available: Any individual who performed more than 50% of their work in maryland, and who believes their wages have.