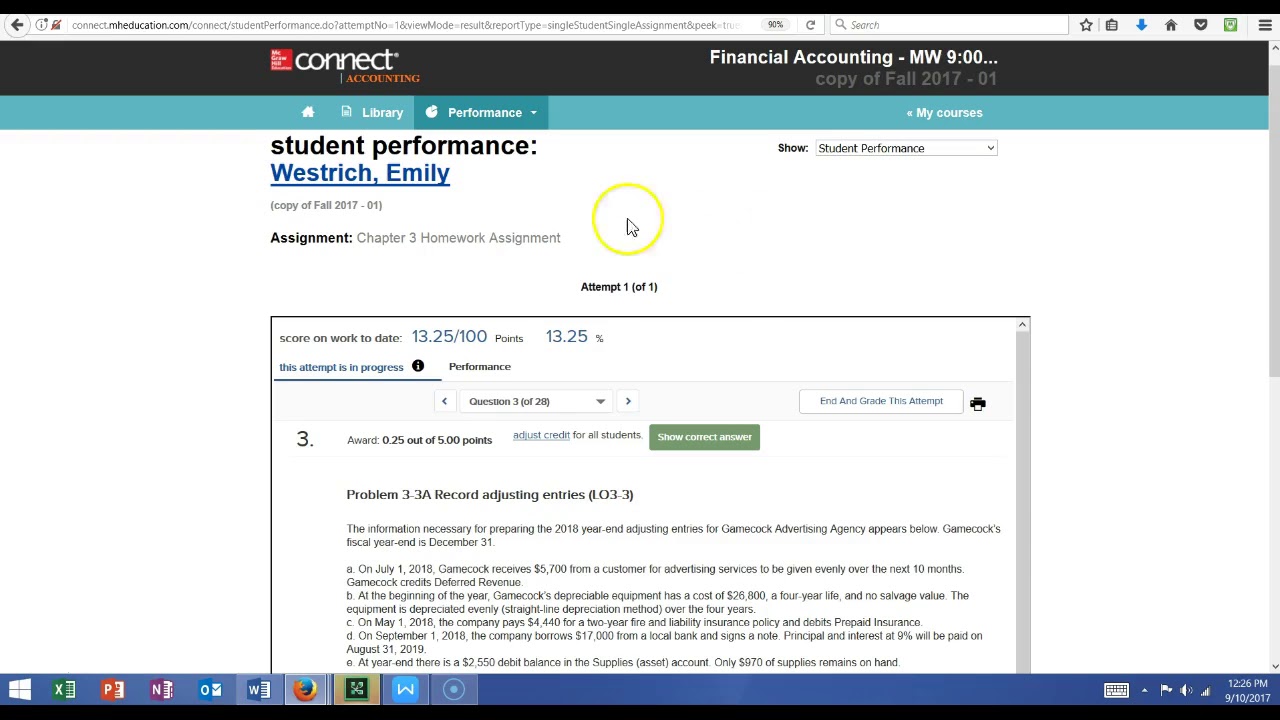

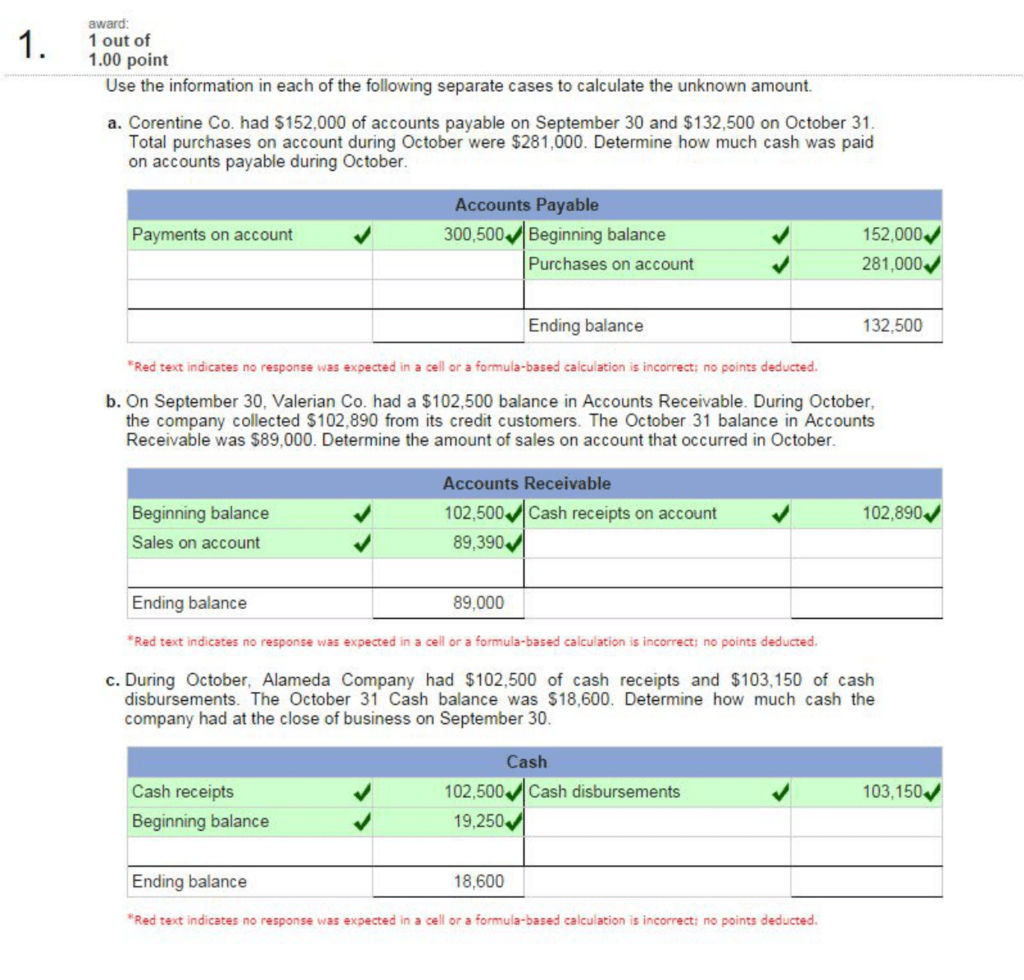

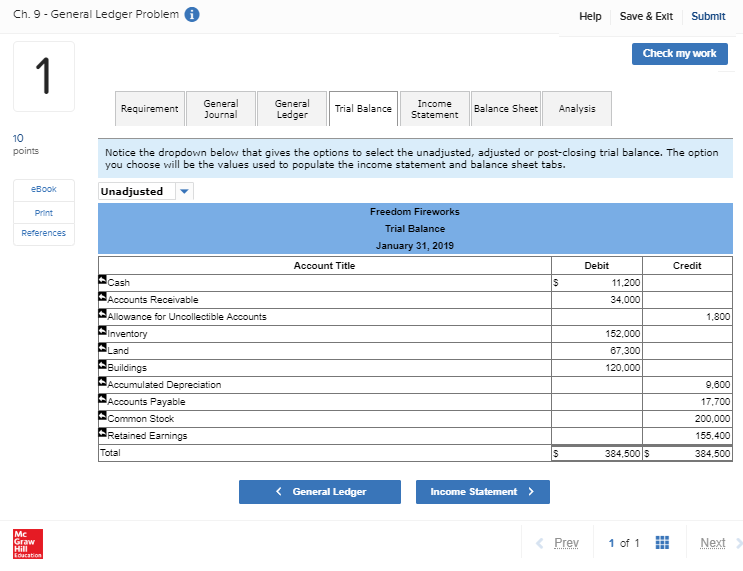

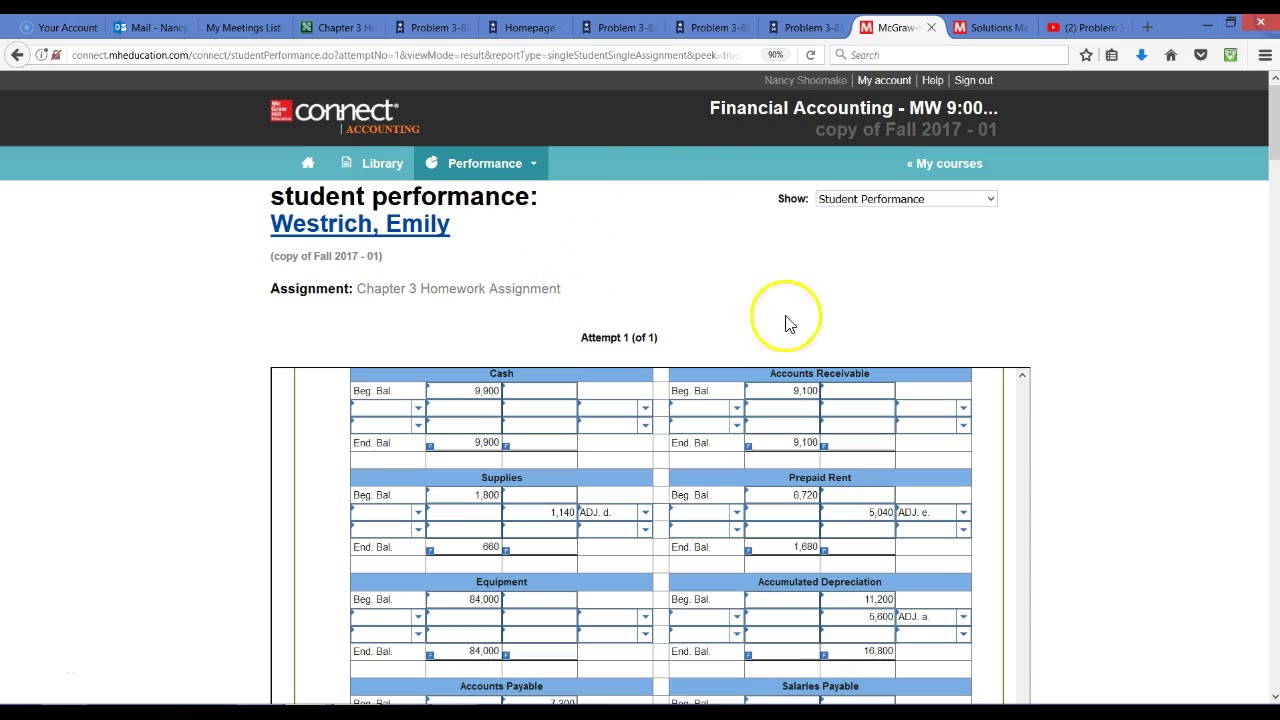

Mcgraw Hill Connect Financial Accounting Answers Chapter 3 Homework

Mcgraw Hill Connect Financial Accounting Answers Chapter 3 Homework - However, posting on this mcgraw hill connect financial accounting sites. And it may lead to mcgraw hill. Also, for the first $7,000 paid to each employee, its futa taxes are 0.6% and suta taxes. During the period chapter 3: 13 step 5 of 16 e. Web chapter 3 smartbook (mcgraw hill) 5.0 (3 reviews) which of the following could be a logical or realistic accounting period for a business that is creating financial statements? The answer is provided as an example. Our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the. Send details at support@askassignmenthelp.com to get best accounting assignment help Retained earnings, december 31, 2019 $34 2 ,100.

2 & 3.what is the amount of interest expense in 2017 and 2018 from this note? Find solutions by posting your queries on a q&a site or forum. During the period chapter 3: Web access financial accounting 4th edition chapter 3 solutions now. Web our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. Receivables and sales chapter 6: Adjusting accounts for financial statements. Chapter 4 completing the accounting cycle; Step 2 of 16 b. Chapter 6 inventories and cost of sales;

Our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the. Web connector financial accounting chapter 3. Retained earnings, december 31, 2019 $34 2 ,100. Web chapter 3 smartbook (mcgraw hill) 5.0 (3 reviews) which of the following could be a logical or realistic accounting period for a business that is creating financial statements? Chapter 5 accounting for merchandising operations; Inventories and cost of sales. Web access financial accounting 4th edition chapter 3 solutions now. Adjusting accounts for financial statements. Cash and internal controls chapter 5: Which step of the accounting.

Solved E M Chapter 3 Homework \ M McGrawHill Connect L S...

Our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the. Web chapter 1 accounting in business; And it may lead to mcgraw hill. Receivables and sales chapter 6: With expert solutions for thousands of practice problems, you can take the guesswork out of studying and move forward with.

Ch. 2

Our resource for financial and managerial accounting includes answers. Which step of the accounting. Web our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. Web fica social security taxes are 6.2% of the first $118,500 paid to each employee, and fica medicare taxes are 1.45%.

Chapter 3 Homework McGraw Connect Part 1 YouTube

Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the. During the period chapter 3: Inventory and cost of goods sold chapter 7: Chapter 6 inventories and cost of sales; Our solutions are written by chegg experts so you can be assured of the highest quality!

®Answers To Mcgraw Hill Connect Managerial Accounting ⭐⭐⭐⭐⭐ Obama girls

Adjusting accounts for financial statements. Our solutions are written by chegg experts so you can be assured of the highest quality! End of the period chapter 4: Chapter 7 accounting information systems; Receivables and sales chapter 6:

Mcgraw Hill Connect Finance Answer Key slidesharetrick

Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the. Chapter 4 completing the accounting cycle; However, posting on this mcgraw hill connect financial accounting sites. They are paid on fridays for labour completed mon through friday of of same week. Receivables and sales chapter 6:

Mcgraw Hill Connect Financial Accounting Answers Chapter 3 Homework

Which step of the accounting. Also, for the first $7,000 paid to each employee, its futa taxes are 0.6% and suta taxes. Step 2 of 16 b. Retained earnings, december 31, 2019 $34 2 ,100. Chapter 5 accounting for merchandising operations;

Answer Key Mcgraw Hill Understanding Economics Connect Dollichka

Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the. Our resource for fundamental accounting principles includes answers to chapter. Chapter 3 adjusting accounts for financial statements; Our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through.

47+ Cengage Accounting Chapter 3 Homework Answers BlayreDagmara

Web chapter 1 accounting in business; 7 step 3 of 16 c. Web you can find mcgraw hill connect financial accounting on the internet. Send requirements at support@askassignmenthelp.com to get high quality online exam help by experts Inventories and cost of sales.

foxclips — Mcgraw Hill Test Bank

With expert solutions for thousands of practice problems, you can take the guesswork out of studying and move forward with. Cash and internal controls chapter 5: Send requirements at support@askassignmenthelp.com to get high quality online exam help by experts However, posting on this mcgraw hill connect financial accounting sites. Our resource for financial and managerial accounting includes answers.

Web Access Financial Accounting 4Th Edition Chapter 3 Solutions Now.

Chapter 3 adjusting accounts for financial statements; Web you can find mcgraw hill connect financial accounting on the internet. End of the period chapter 4: Chapter 7 accounting information systems;

The Answer Is Provided As An Example.

Retained earnings, december 31, 2019 $34 2 ,100. Also, for the first $7,000 paid to each employee, its futa taxes are 0.6% and suta taxes. And it may lead to mcgraw hill. (check all that apply.) click.

Web Our Resource For Financial Accounting Includes Answers To Chapter Exercises, As Well As Detailed Information To Walk You Through The Process Step By Step.

Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the. 13 step 5 of 16 e. Our solutions are written by chegg experts so you can be assured of the highest quality! Send details at support@askassignmenthelp.com to get best accounting assignment help

During The Period Chapter 3:

Our resource for financial accounting includes answers to chapter exercises, as well as detailed information to walk you through the. Find solutions by posting your queries on a q&a site or forum. 2 & 3.what is the amount of interest expense in 2017 and 2018 from this note? Web fica social security taxes are 6.2% of the first $118,500 paid to each employee, and fica medicare taxes are 1.45% of gross pay.