Md Form 510 Instructions 2021

Md Form 510 Instructions 2021 - Payment instructions include a check or money order made payable to comptroller of maryland. Payments made with the previously filed form. Web what is missouri partnership tax and who must file? Web form 510d is a maryland corporate income tax form. Please use the link below to. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. You can download or print current. Last year i did not owe any maryland. Web marylandtaxes.gov and download another form 510d.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. See instructions and check boxes that apply. These where to file addresses. Please use the link below to. Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. Identify the irs processing center location based on your current resident state or irs tax return mailing address, the address based on the form, and whether your owe. Payments for crops covered by crop insurance, the erp. Last year i did not owe any maryland. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Payment instructions include a check or money order made payable to comptroller of maryland.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Payments for crops covered by crop insurance, the erp. Web (investment partnerships see specific instructions.) 5. You can download or print current. Identify the irs processing center location based on your current resident state or irs tax return mailing address, the address based on the form, and whether your owe. Payments made with the previously filed form. Please use the link below to. Web marylandtaxes.gov and download another form 510d.

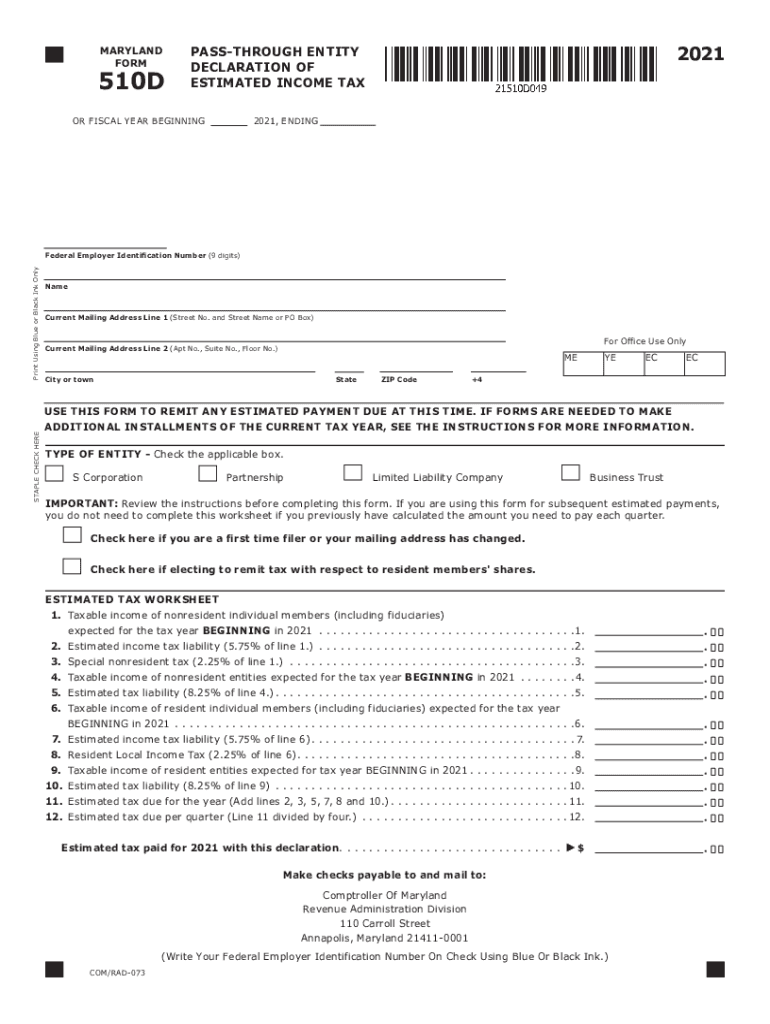

Md 510D Fill Out and Sign Printable PDF Template signNow

Identify the irs processing center location based on your current resident state or irs tax return mailing address, the address based on the form, and whether your owe. You can download or print current. Web i claim exemption from withholding because i do not expect to owe maryland tax. Web form and instructions for filing a maryland estate tax return.

maryland form 510 instructions 2021

Web i claim exemption from withholding because i do not expect to owe maryland tax. Please use the link below to. Payments made with the previously filed form. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Payments for crops covered by crop insurance, the erp.

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web (investment partnerships see specific instructions.) 5. Web marylandtaxes.gov and download another form 510d. Last year i did not owe any maryland. Web form 510d is a maryland corporate income tax form.

elliemeyersdesigns Maryland Form 510

Web i claim exemption from withholding because i do not expect to owe maryland tax. Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web marylandtaxes.gov and download another form 510d..

elliemeyersdesigns Maryland Form 510

Web form 510d is a maryland corporate income tax form. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. These where to file addresses. Web taxpayers that have already made the pte.

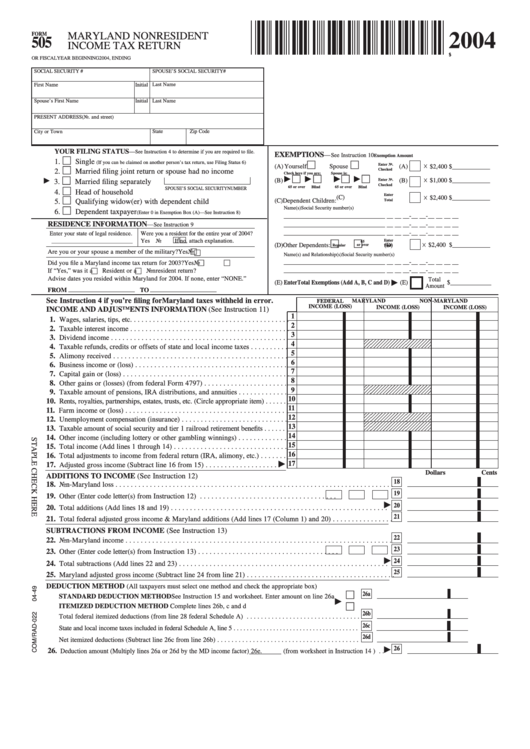

Fillable Form 505 Maryland Nonresident Tax Return 2004

Web i claim exemption from withholding because i do not expect to owe maryland tax. Payments for crops covered by crop insurance, the erp. These where to file addresses. Payment instructions include a check or money order made payable to comptroller of maryland. You can download or print current.

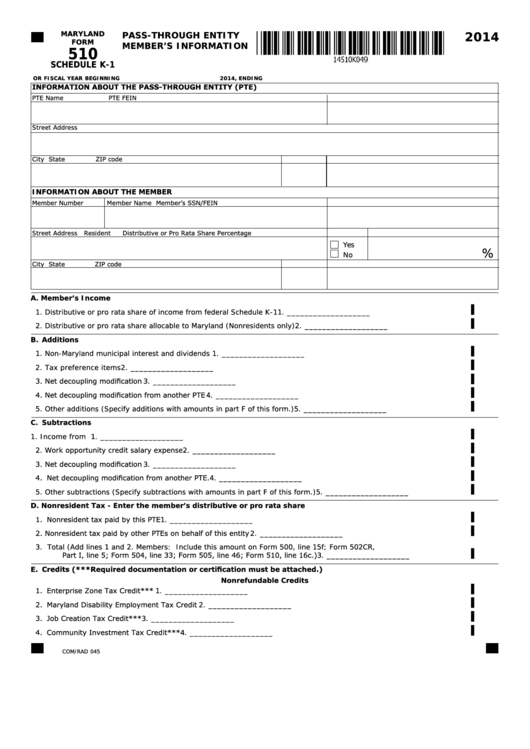

Fillable Form 510 Schedule K1 PassThrough Entity Member'S

Web (investment partnerships see specific instructions.) 5. Last year i did not owe any maryland. See instructions and check boxes that apply. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web what is missouri partnership tax and who must file?

2017 MD Form 548 Fill Online, Printable, Fillable, Blank pdfFiller

Web i claim exemption from withholding because i do not expect to owe maryland tax. You can download or print current. Payment instructions include a check or money order made payable to comptroller of maryland. Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. Payments for.

MD 510 _ _3

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Payments made with the previously filed form. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. See instructions and check boxes that apply. Web form and instructions for filing a maryland estate.

MD Form MET 2 ADJ 2011 Fill out Tax Template Online US Legal Forms

These where to file addresses. Web marylandtaxes.gov and download another form 510d. Identify the irs processing center location based on your current resident state or irs tax return mailing address, the address based on the form, and whether your owe. Web what is missouri partnership tax and who must file? Web taxpayers that have already made the pte election by.

Web I Claim Exemption From Withholding Because I Do Not Expect To Owe Maryland Tax.

See instructions and check boxes that apply. Payment instructions include a check or money order made payable to comptroller of maryland. Identify the irs processing center location based on your current resident state or irs tax return mailing address, the address based on the form, and whether your owe. Web marylandtaxes.gov and download another form 510d.

Web What Is Missouri Partnership Tax And Who Must File?

Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. Please use the link below to. Web form 510d is a maryland corporate income tax form. Web (investment partnerships see specific instructions.) 5.

Payments Made With The Previously Filed Form.

You can download or print current. Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing.

Percentage Of Ownership By Individual Nonresident Members Shown On Line 1B (Or Profit/Loss.

Last year i did not owe any maryland. Payments for crops covered by crop insurance, the erp. These where to file addresses. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.