Michigan Form 4884 Instructions 2022

Michigan Form 4884 Instructions 2022 - Web forms and instructions filing due date: Taxformfinder provides printable pdf copies of 98. It depends on your circumstances whether a value will populate on form 4884. Web taxslayer support is my retirement income taxable to michigan? Web save your changes and share michigan pension schedule 2022 form 4884 rate the 4884 form 4.8 satisfied 124 votes handy tips for filling out michigan 4884 online printing and. However, with our preconfigured web templates, everything gets simpler. Web married couples filing a joint return should complete the michigan pension schedule (form 4884) based on the year of birth of the older spouse. Web here are 6 changes to michigan taxes for 2022 according to michigan.gov/taxes exemption allowances and the tax rate: Sign it in a few clicks draw your signature, type it,. Web deceased spouse benefits do not include benefits from a spouse who died in 2022.

Web follow the simple instructions below: It depends on your circumstances whether a value will populate on form 4884. Sign it in a few clicks draw your signature, type it,. Taxformfinder provides printable pdf copies of 98. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web here are 6 changes to michigan taxes for 2022 according to michigan.gov/taxes exemption allowances and the tax rate: Web married couples filing a joint return should complete the michigan pension schedule (form 4884) based on the year of birth of the older spouse. However, with our preconfigured web templates, everything gets simpler. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more.

Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. Web more about the michigan form 4884 individual income tax ty 2022. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Web taxslayer support is my retirement income taxable to michigan? If a taxpayer or the taxpayer’s spouse received pension benefits from a deceased. Download this form print this form more. Web instructions included on form: It depends on your circumstances whether a value will populate on form 4884. Web here are 6 changes to michigan taxes for 2022 according to michigan.gov/taxes exemption allowances and the tax rate:

Fill Michigan

Web section b of form 4884. Web here are 6 changes to michigan taxes for 2022 according to michigan.gov/taxes exemption allowances and the tax rate: This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it,. Taxformfinder provides printable pdf copies of 98.

Fill Michigan

Sign it in a few clicks draw your signature, type it,. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Web instructions included on form: Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. Web more about the michigan form 4884 individual income tax ty 2022.

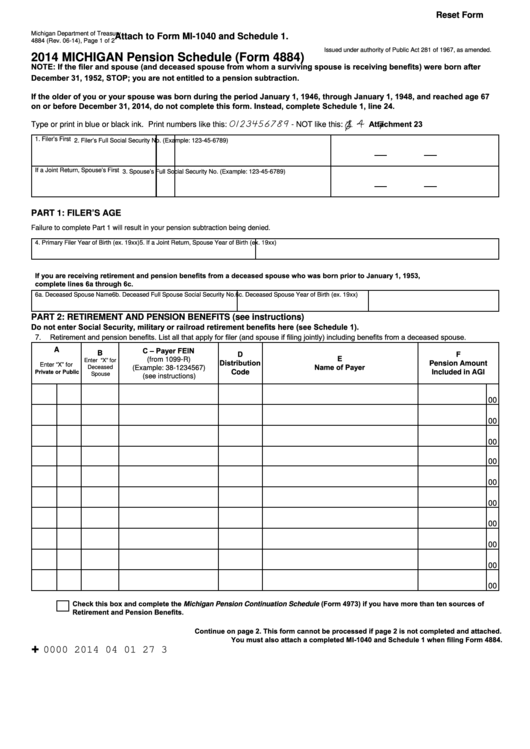

Fillable Form 4884 Michigan Pension Schedule 2014 printable pdf

Web complete “worksheet for filers with taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the u.s. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. If a taxpayer or the taxpayer’s spouse received pension benefits.

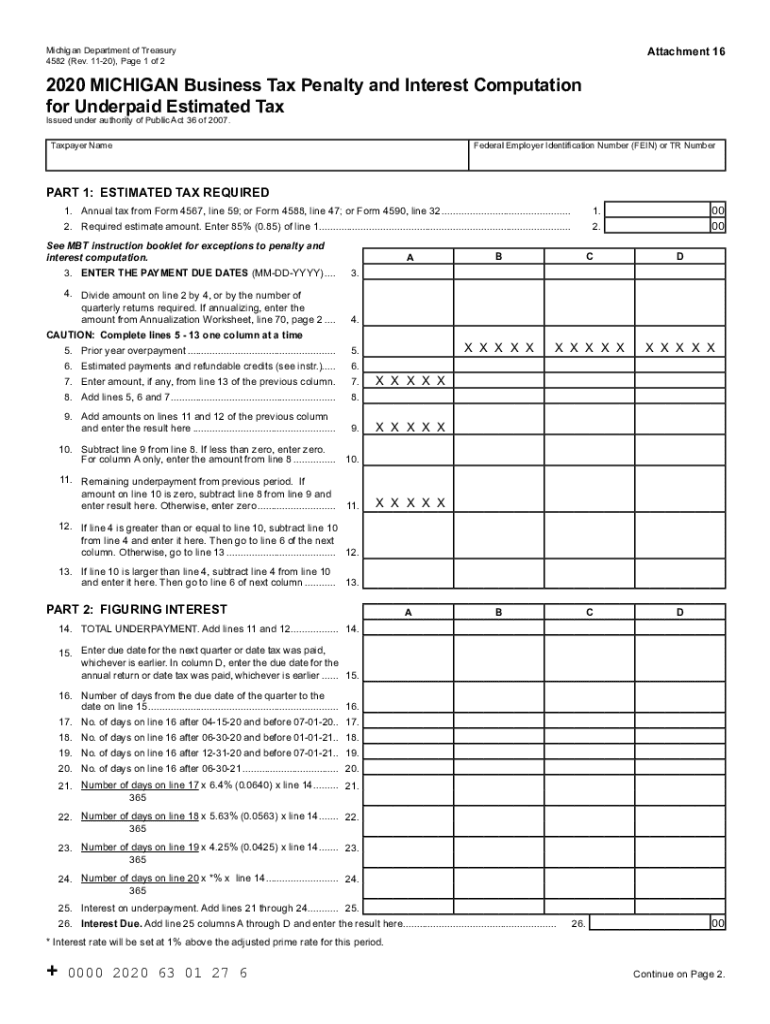

Form 4582 Fill Out and Sign Printable PDF Template signNow

Web deceased spouse benefits do not include benefits from a spouse who died in 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web section b of form 4884. It depends on your circumstances whether a value will populate on form 4884. Web save your changes and share michigan pension schedule 2022.

2018 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

If a taxpayer or the taxpayer’s spouse received pension benefits from a deceased. It depends on your circumstances whether a value will populate on form 4884. Web section b of form 4884. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web complete “worksheet for filers with taxable railroad retirement benefits or qualifying pension and.

Fill Michigan

Web taxslayer support is my retirement income taxable to michigan? Web forms and instructions filing due date: Web more about the michigan form 4884 individual income tax ty 2022. Web follow the simple instructions below: According to the michigan instructions for form 4884, retirement and pension benefits are taxed.

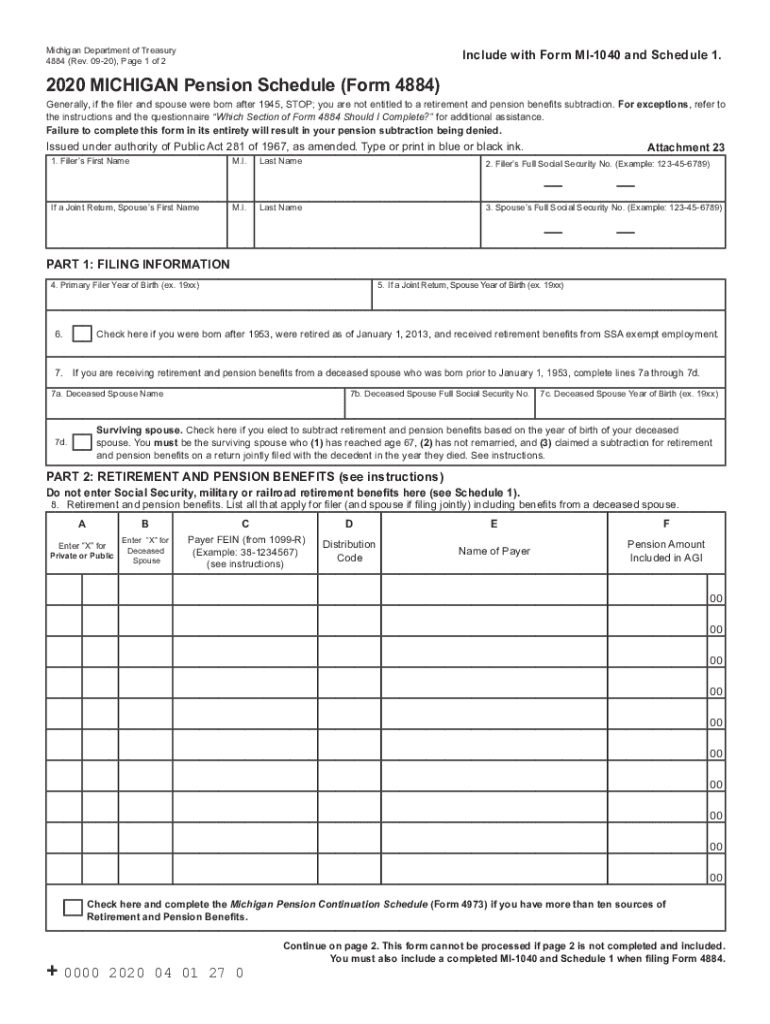

Michigan Form 4884 Fill Out and Sign Printable PDF Template signNow

Web section b of form 4884. However, with our preconfigured web templates, everything gets simpler. Taxformfinder provides printable pdf copies of 98. This form is for income earned in tax year 2022, with tax returns due in april. It depends on your circumstances whether a value will populate on form 4884.

Fill Michigan

Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. Statement to determine state of domicile: Web instructions included on form: Sign it in a few clicks draw your signature, type it,.

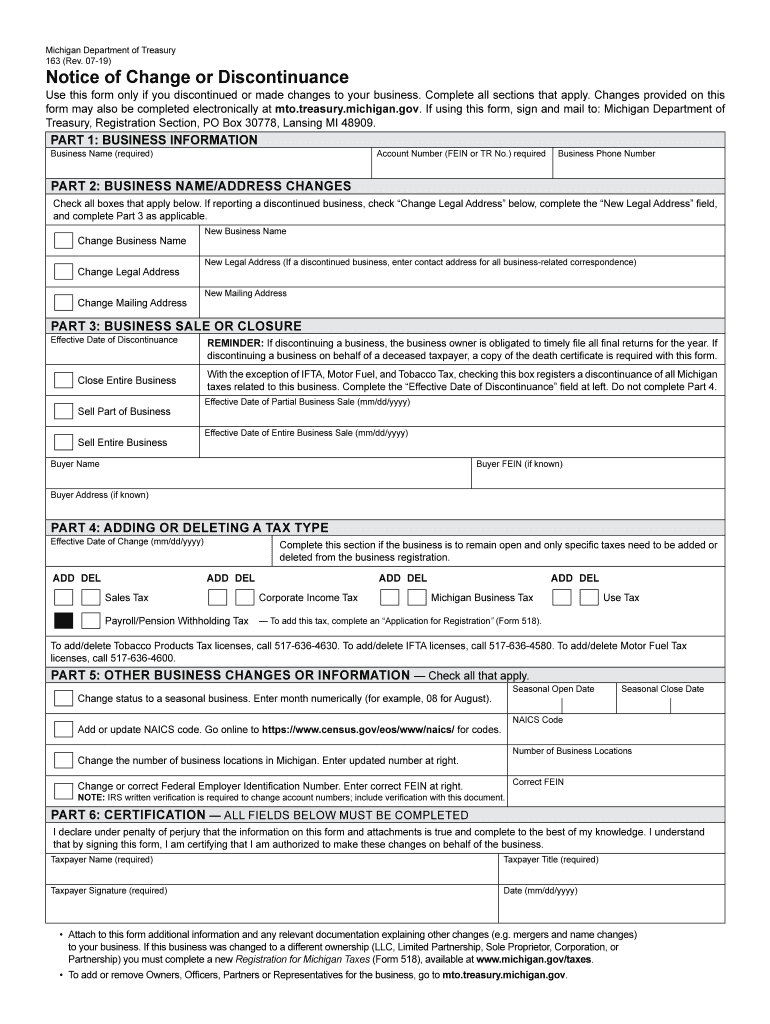

Form 163 michigan Fill out & sign online DocHub

Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. It depends on your circumstances whether a value will populate on form 4884. Taxformfinder provides printable pdf copies of 98. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it,.

Web Married Couples Filing A Joint Return Should Complete The Michigan Pension Schedule (Form 4884) Based On The Year Of Birth Of The Older Spouse.

Web instructions included on form: Web deceased spouse benefits do not include benefits from a spouse who died in 2022. Web 14 2,081 reply bookmark icon kathryng3 expert alumni yes, you are correct. This form is for income earned in tax year 2022, with tax returns due in april.

Web Taxslayer Support Is My Retirement Income Taxable To Michigan?

Taxformfinder provides printable pdf copies of 98. Which benefits are taxable retirement and pension benefits are taxed differently depending on the age of the recipient. Web forms and instructions filing due date: However, with our preconfigured web templates, everything gets simpler.

Web Follow The Simple Instructions Below:

Web here are 6 changes to michigan taxes for 2022 according to michigan.gov/taxes exemption allowances and the tax rate: Web this includes defined a joint return should complete form 4884 based on the year benefit pensions, ira distributions, and most payments of birth of the older spouse. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. It depends on your circumstances whether a value will populate on form 4884.

Web Section B Of Form 4884.

Web more about the michigan form 4884 individual income tax ty 2022. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. If a taxpayer or the taxpayer’s spouse received pension benefits from a deceased.