Mileage Form 2023

Mileage Form 2023 - This website revision is forwarded for information purposes. For 2023, it's been raised to $0.655. It indicates a way to close an interaction, or. Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks. This rate is adjusted for inflation each year. This website revision is effective on january 1,. The irs and general services administration initiated this revision. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half.

Web the irs mileage rates for 2023 are: The irs and general services administration initiated this revision. This rate is adjusted for inflation each year. It indicates a way to close an interaction, or. 22 cents per mile driven for medical, or moving purposes. Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 65.5 cents per mile driven for business use. For 2023, it's been raised to $0.655. It indicates the ability to send an email. 14 cents per mile driven in service of.

65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022. Web the mileage figures of the 2023 kia seltos facelift have been officially revealed. 22 cents per mile driven for medical, or moving purposes. 14 cents per mile driven in service of. 1984 to present buyer's guide to fuel efficient cars and trucks. For 2023, it's been raised to $0.655. It indicates a way to close an interaction, or. Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). The irs and general services administration initiated this revision.

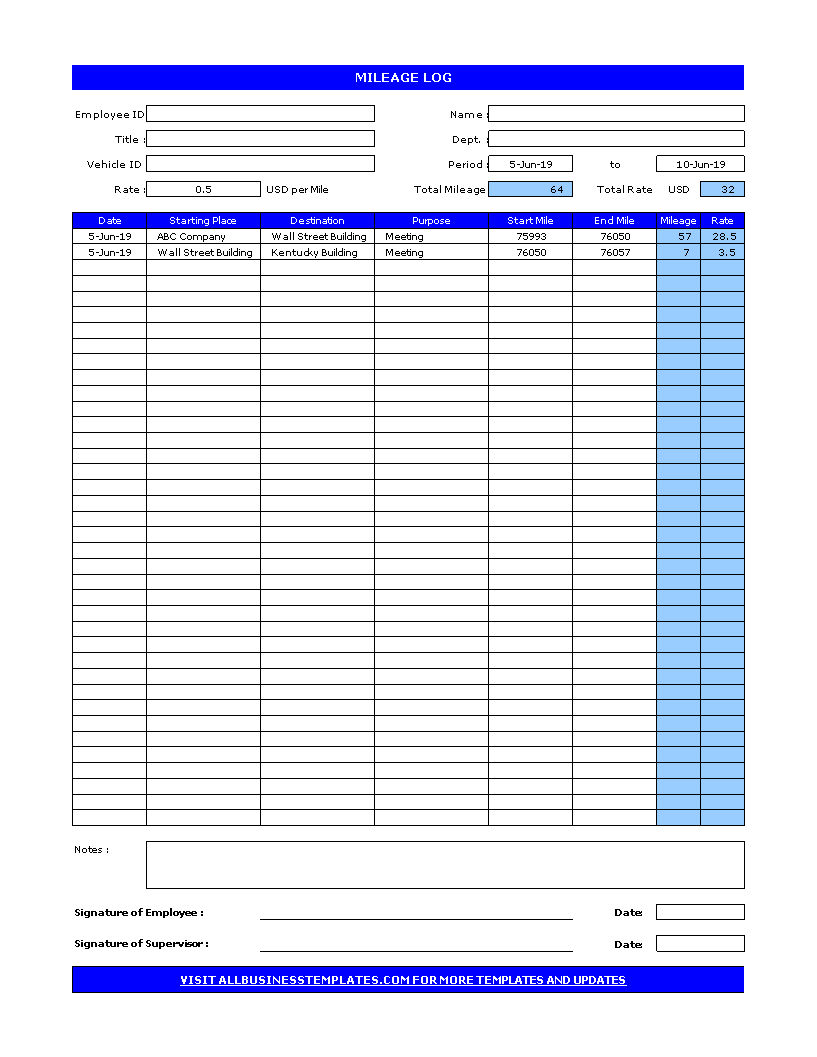

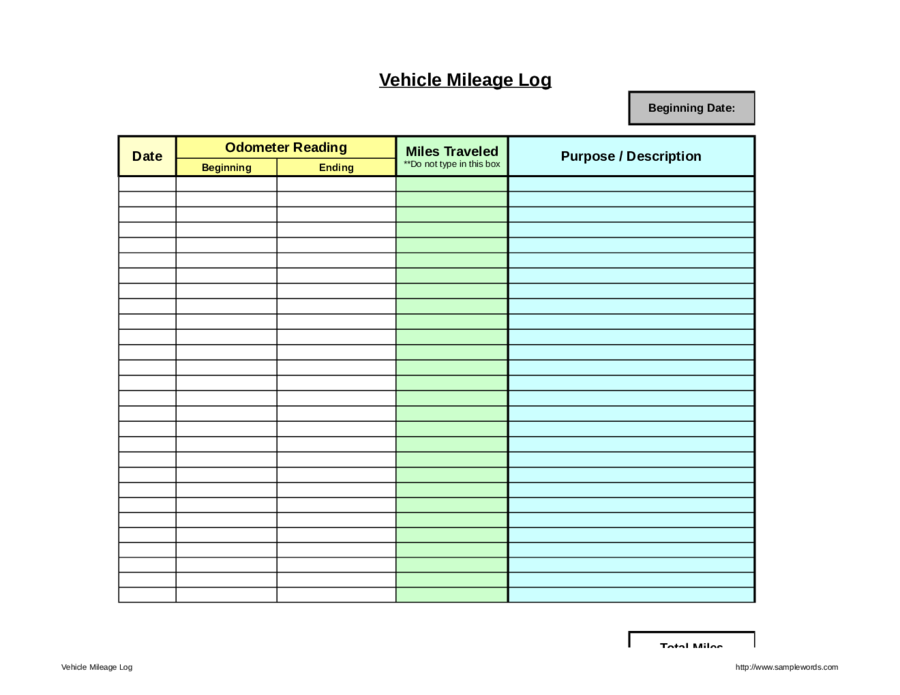

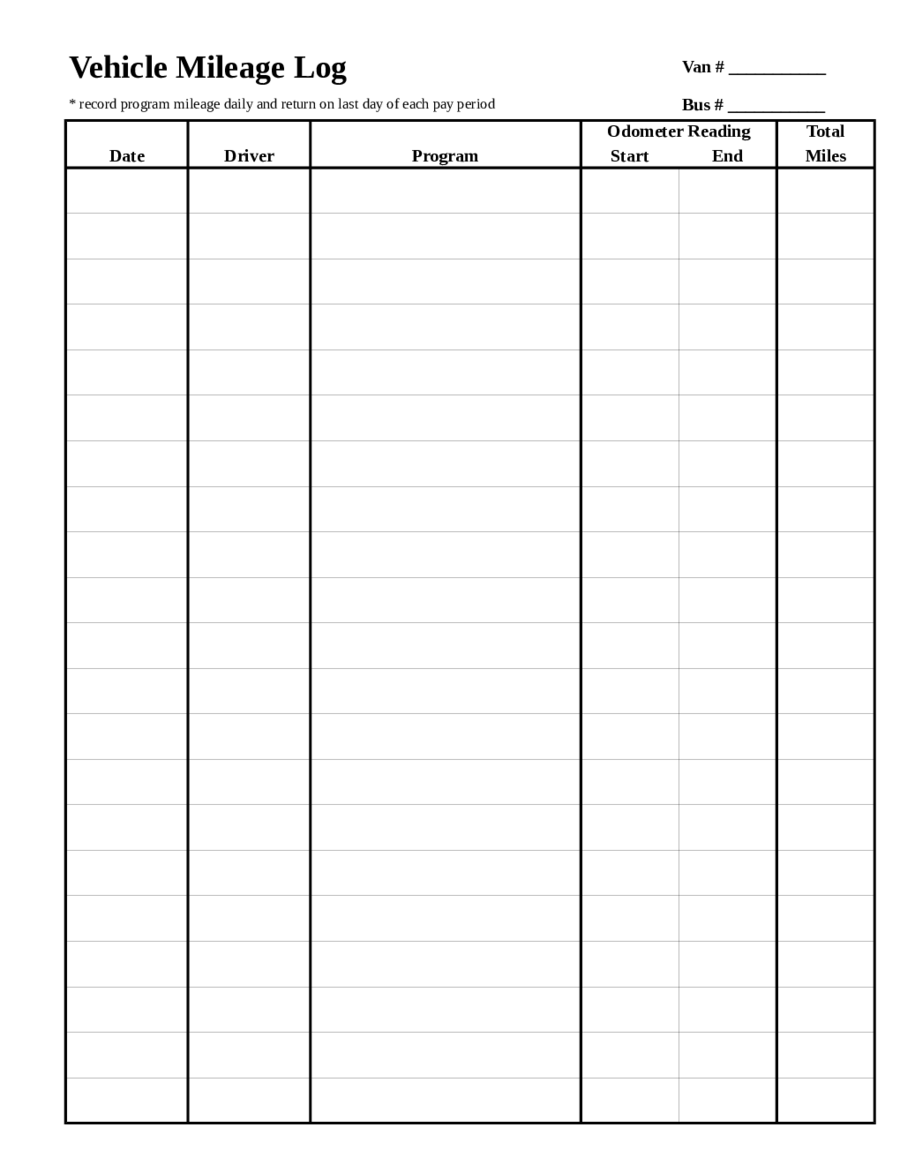

Vehicle Mileage Log Template Free Of 2019 Mileage Log Fillable

Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks. This website revision is forwarded for information purposes..

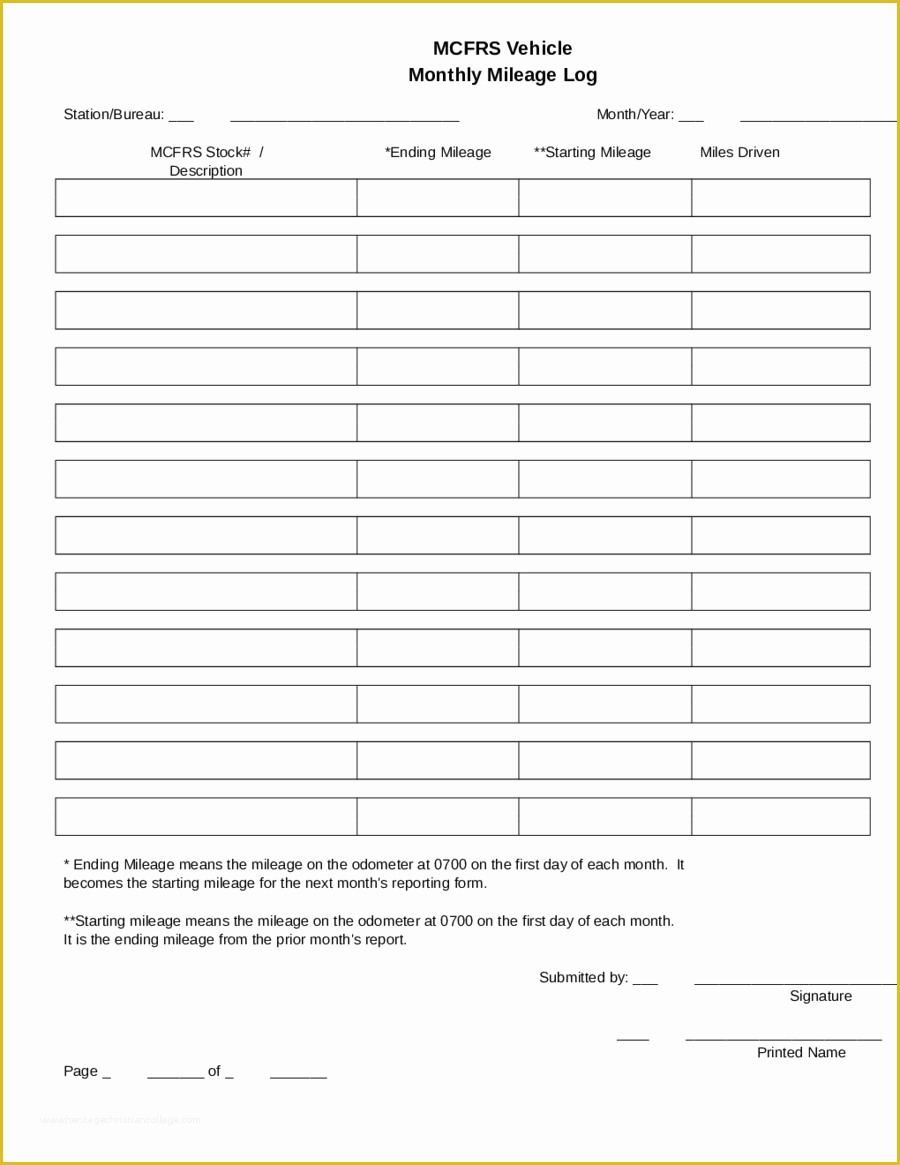

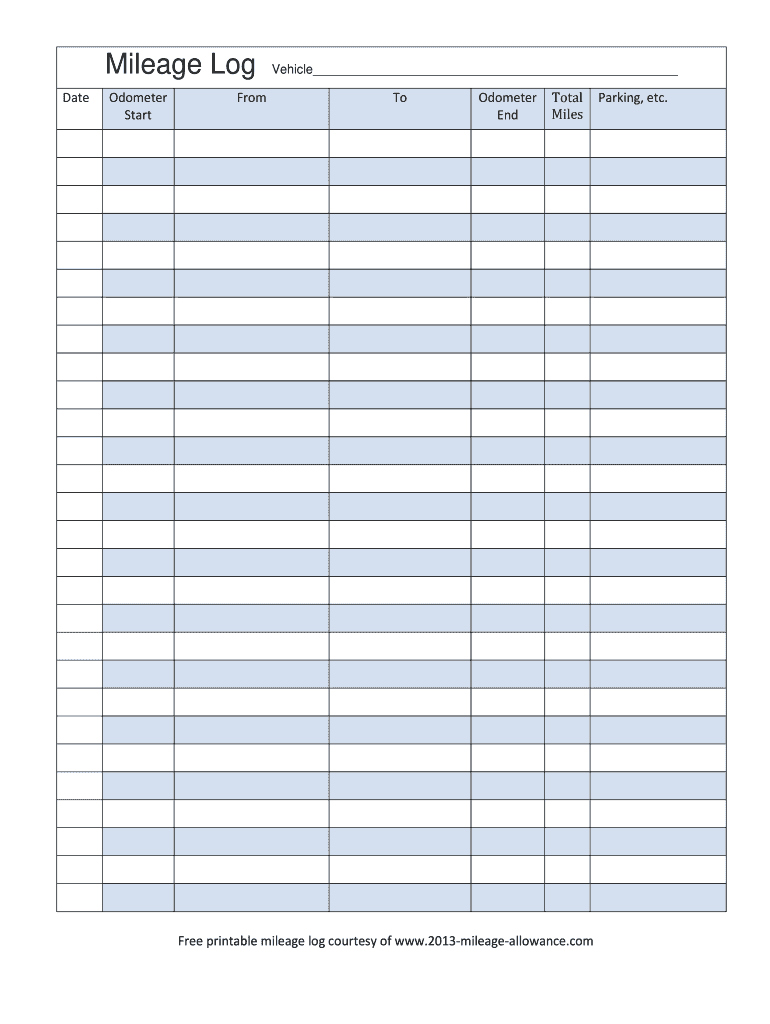

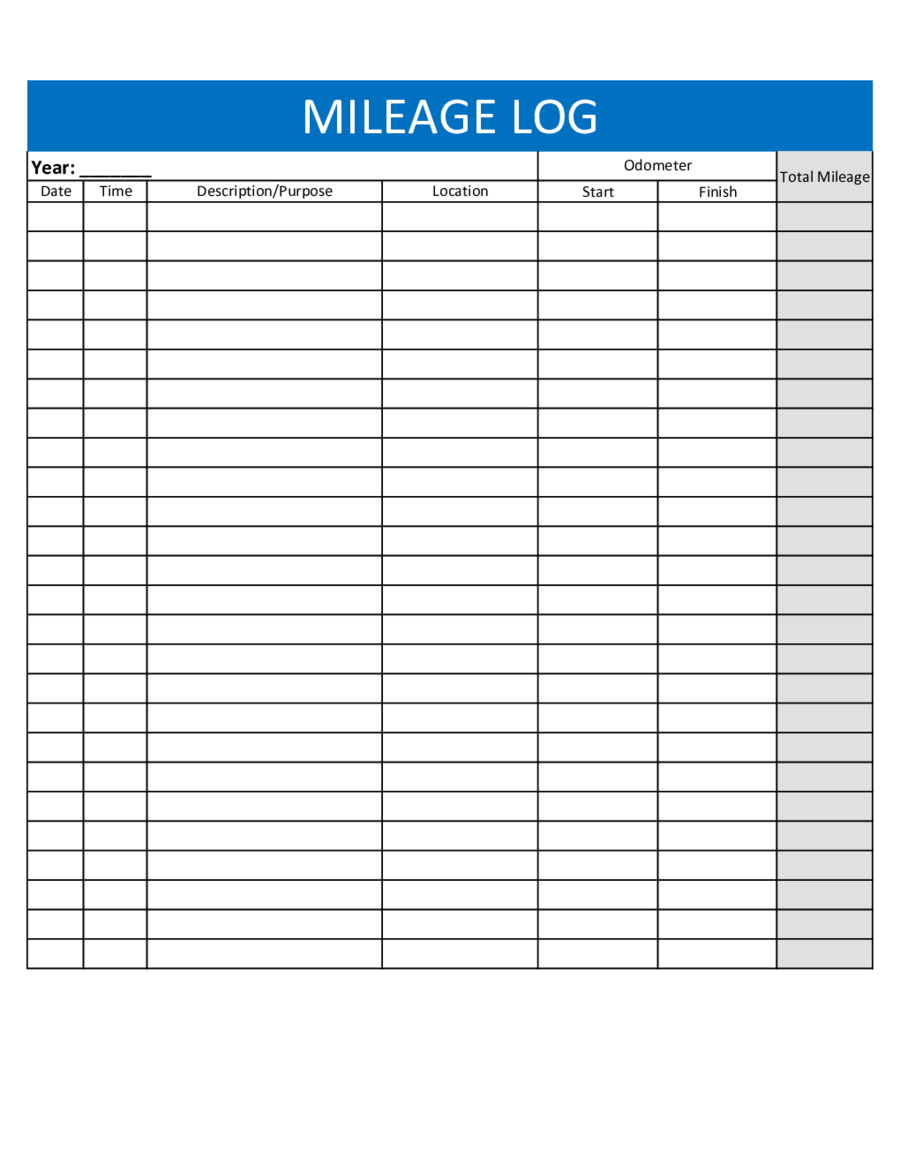

Mileage Log Templates at

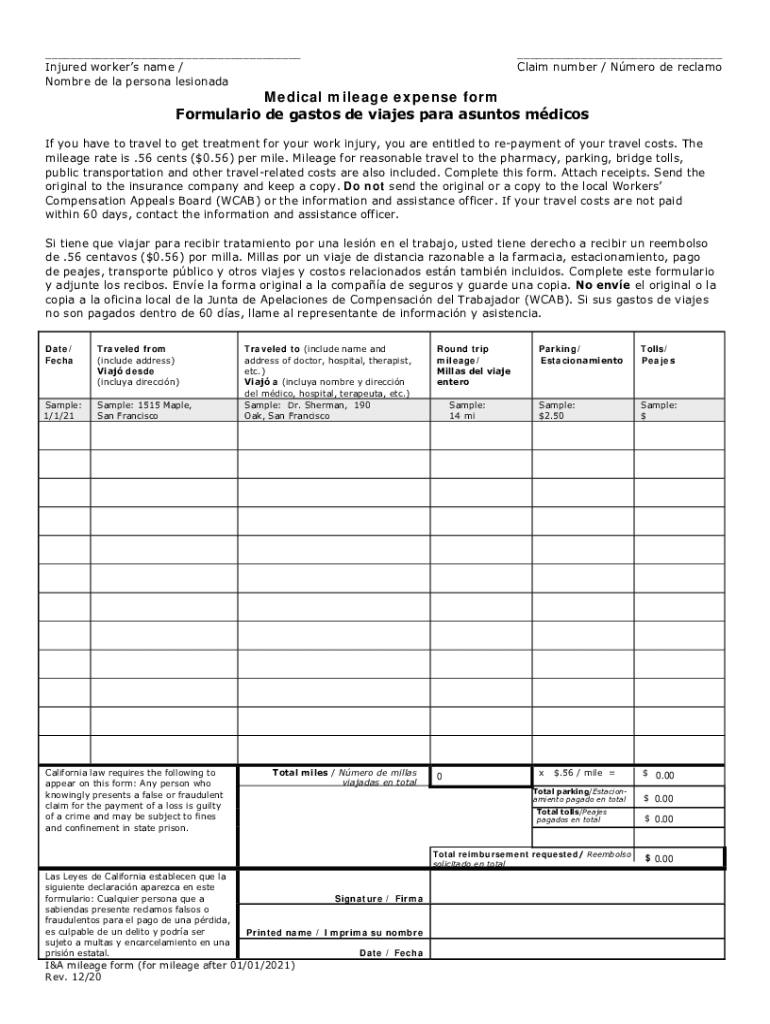

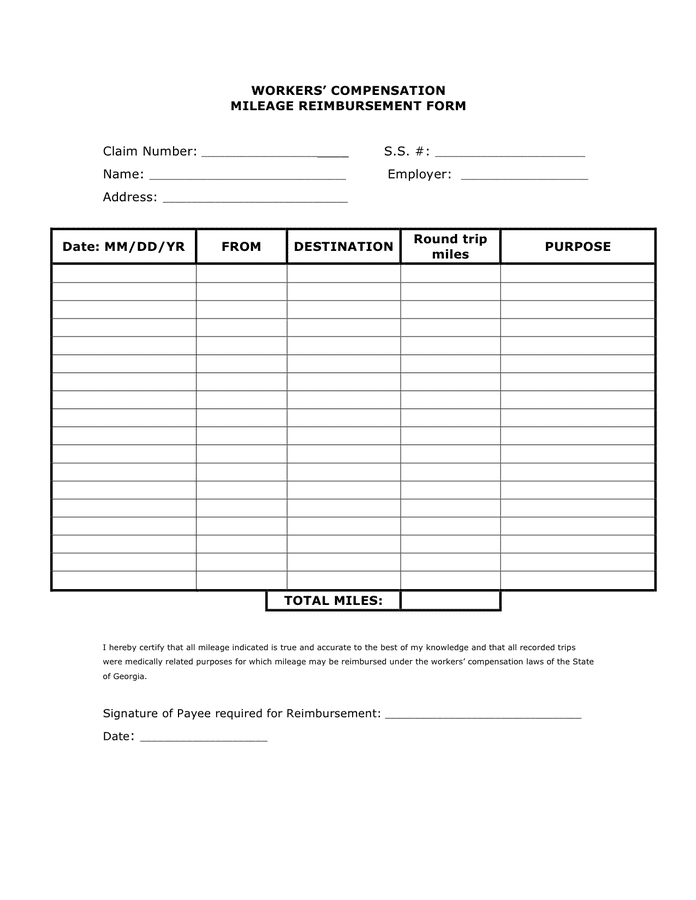

Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service.

Mileage Reimbursement 2021 Pa

Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. This website revision is effective on january 1,. Web the mileage figures of the 2023 kia seltos facelift have been officially revealed. This website revision is forwarded for information purposes. 14 cents per mile driven in service of.

Irs Business Mileage Form Armando Friend's Template

It indicates the ability to send an email. 1984 to present buyer's guide to fuel efficient cars and trucks. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:.

2023 Mileage Log Fillable, Printable PDF & Forms Handypdf

It indicates the ability to send an email. Two crossed lines that form an 'x'. It indicates a way to close an interaction, or. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). 65.5 cents per mile driven for business use.

Mileage verification form Fill out & sign online DocHub

Web the irs mileage rates for 2023 are: Web the mileage figures of the 2023 kia seltos facelift have been officially revealed. Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. For 2022, that’s $0.585 for the.

Workers' compensation mileage reimbursement form in Word and Pdf formats

1984 to present buyer's guide to fuel efficient cars and trucks. For 2023, it's been raised to $0.655. 22 cents per mile driven for medical, or moving purposes. The irs and general services administration initiated this revision. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed.

Sample Mileage Log The Document Template

Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please.

Printable Mileage Reimbursement Form Printable Form 2022

For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. For 2023, it's been raised to $0.655. It indicates the ability to send an email. Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023 in wisconsin is also 65.5 cents per mile. This rate.

2023 Mileage Log Fillable, Printable PDF & Forms Handypdf

This website revision is forwarded for information purposes. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. It indicates the ability to send an email. Web the.

Web Beginning On January 1, 2023, The Standard Mileage Rates For The Use Of A Car (Also Vans, Pickups Or Panel Trucks) Will Be:

Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. For 2023, it's been raised to $0.655. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks.

This Rate Is Adjusted For Inflation Each Year.

This website revision is forwarded for information purposes. Web the irs mileage rates for 2023 are: The irs and general services administration initiated this revision. It indicates a way to close an interaction, or.

Web The Mileage Figures Of The 2023 Kia Seltos Facelift Have Been Officially Revealed.

Two crossed lines that form an 'x'. 65.5 cents per mile driven for business use. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). This website revision is effective on january 1,.

1984 To Present Buyer's Guide To Fuel Efficient Cars And Trucks.

14 cents per mile driven in service of. It indicates the ability to send an email. 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half.