Missouri Tax Extension Form

Missouri Tax Extension Form - Missouri grants an automatic extension of time to file corporation. Web if you cannot file on time, you can get a missouri tax extension. Web the missouri extension to file a corporate tax return is a separate form. Even if you filed an extension, you will still need to file your mo tax return. If you would like to file an extension, you. Web you will automatically receive a missouri extension if you have no state tax liability or if you’re owed a state refund. You seek a missouri extension exceeding the federal. Web attach a copy of the federal extension to the missouri return when filed. On the other hand, if you do owe missouri tax, you can. Web extension payments can only be filed between january 1st and october 31st for the prior calendar year's taxes due.

Web the 2022 missouri state income tax return forms for tax year 2022 (jan. Missouri grants an automatic extension of time to file corporation. You seek a missouri extension exceeding the federal. Web if you cannot file on time, you can get a missouri tax extension. Web make an extension payment; Web extension payments can only be filed between january 1st and october 31st for the prior calendar year's taxes due. In care of name (attorney, guardian,. Web corporate extension payments can also be made under this selection; Web attach a copy of the federal extension to the missouri return when filed. Locate nearby community servicessuch as hospitals, driver's license.

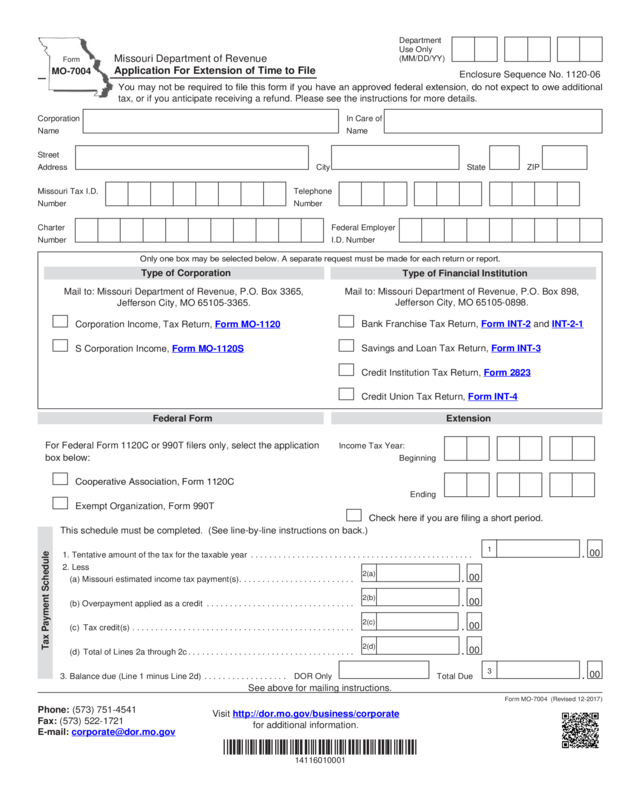

Web application for extension of time to fileenclosure sequence no. On the other hand, if you do owe missouri tax, you can. Web extension payments can only be filed between january 1st and october 31st for the prior calendar year's taxes due. Web you will automatically receive a missouri extension if you have no state tax liability or if you’re owed a state refund. Make a personal income tax estimated payment (mo. Even if you filed an extension, you will still need to file your mo tax return. Web make an extension payment; Web the missouri extension to file a corporate tax return is a separate form. Web corporate extension payments can also be made under this selection; A missouri extension will give you 6 extra months to file your return, moving the deadline to october 15 (for.

Form Mo7004 Application For Extension Of Time To File Edit, Fill

A missouri extension will give you 6 extra months to file your return, moving the deadline to october 15 (for. You seek a missouri extension exceeding the federal. Web the missouri extension to file a corporate tax return is a separate form. Web missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you.

Madonna! 12+ Fatti su Irs Extension? You can file an extension for your

A missouri extension will give you 6 extra months to file your return, moving the deadline to october 15 (for. Web the missouri extension to file a corporate tax return is a separate form. Web taxation driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name.

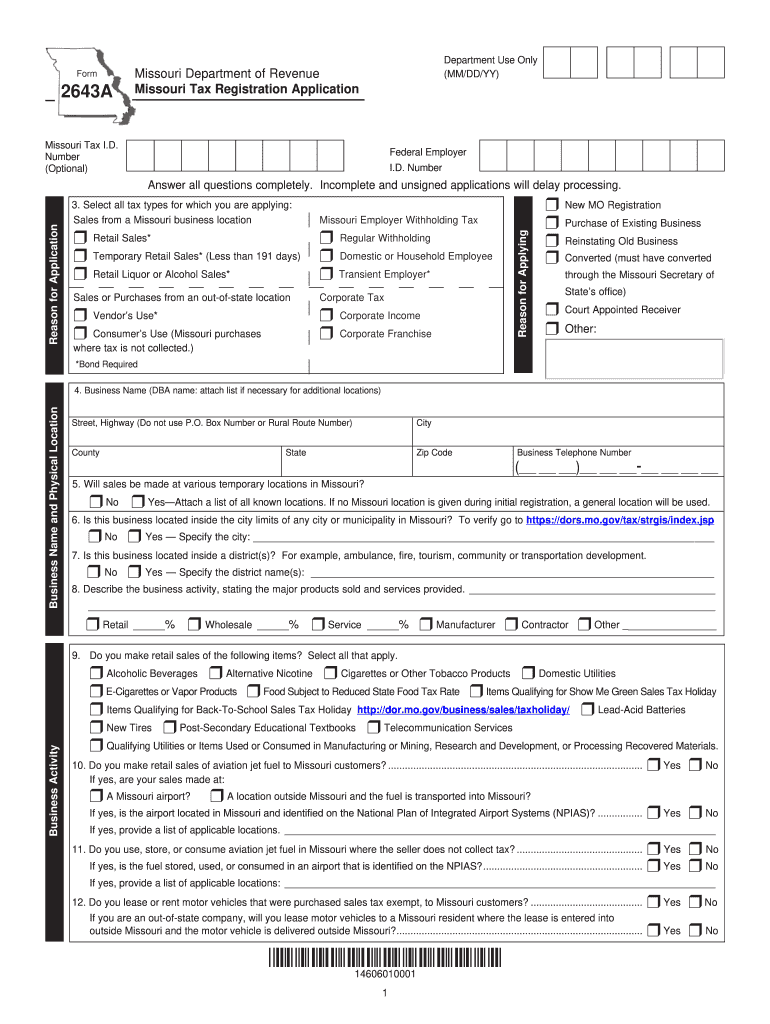

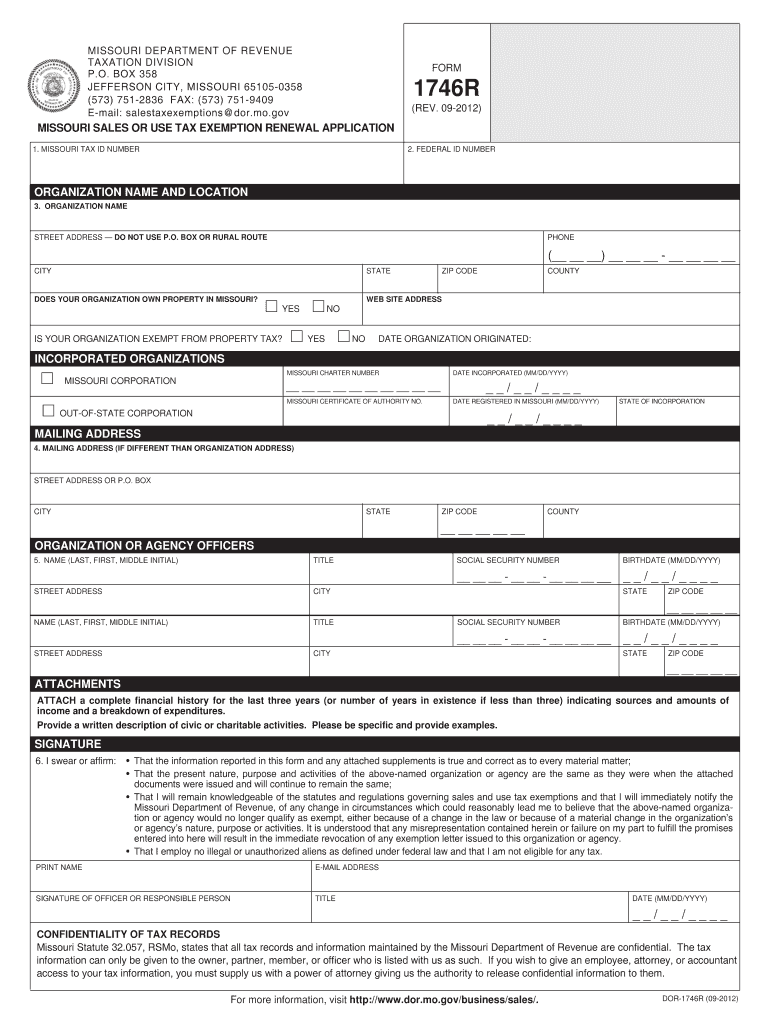

Missouri Tax Registration Form Fill Out and Sign Printable PDF

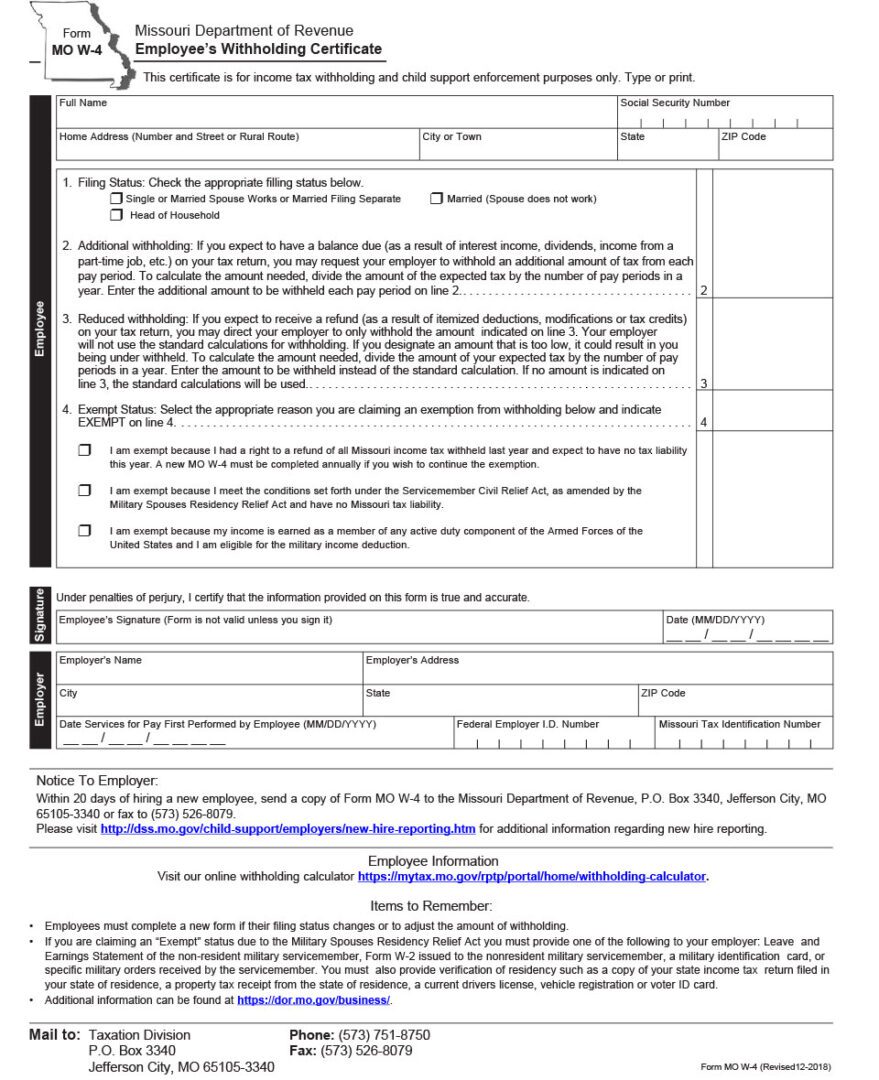

Make a personal income tax estimated payment (mo. Web make an extension payment; Locate nearby community servicessuch as hospitals, driver's license. Web extension payments can only be filed between january 1st and october 31st for the prior calendar year's taxes due. In care of name (attorney, guardian,.

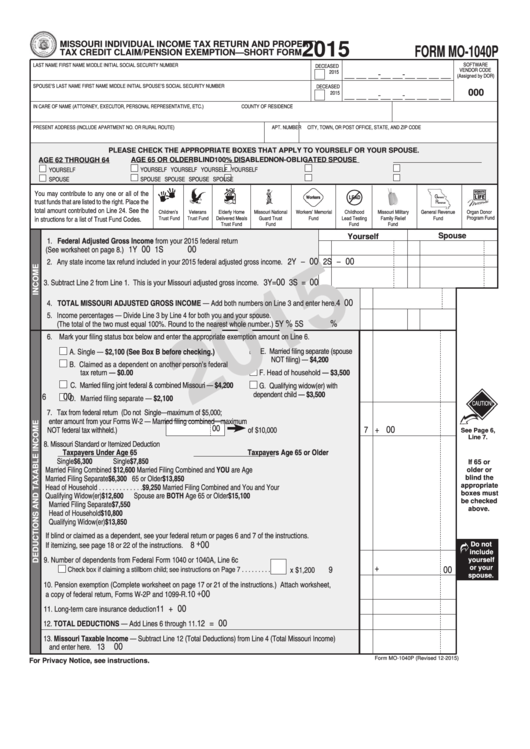

Which missouri tax form to use

Missouri grants an automatic extension of time to file corporation. In care of name (attorney, guardian,. Web missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you filed a federal extension. You seek a missouri extension exceeding the federal. Even if you filed an extension, you will still need to file your mo.

Form Mo1040p Missouri Individual Tax Return And Property Tax

Web corporate extension payments can also be made under this selection; If you would like to file an extension, you. Locate nearby community servicessuch as hospitals, driver's license. Missouri grants an automatic extension of time to file corporation. Web attach a copy of the federal extension to the missouri return when filed.

Form 8816 Fill Out and Sign Printable PDF Template signNow

Missouri grants an automatic extension of time to file corporation. In care of name (attorney, guardian,. A missouri extension will give you 6 extra months to file your return, moving the deadline to october 15 (for. Make a personal income tax estimated payment (mo. Web the missouri extension to file a corporate tax return is a separate form.

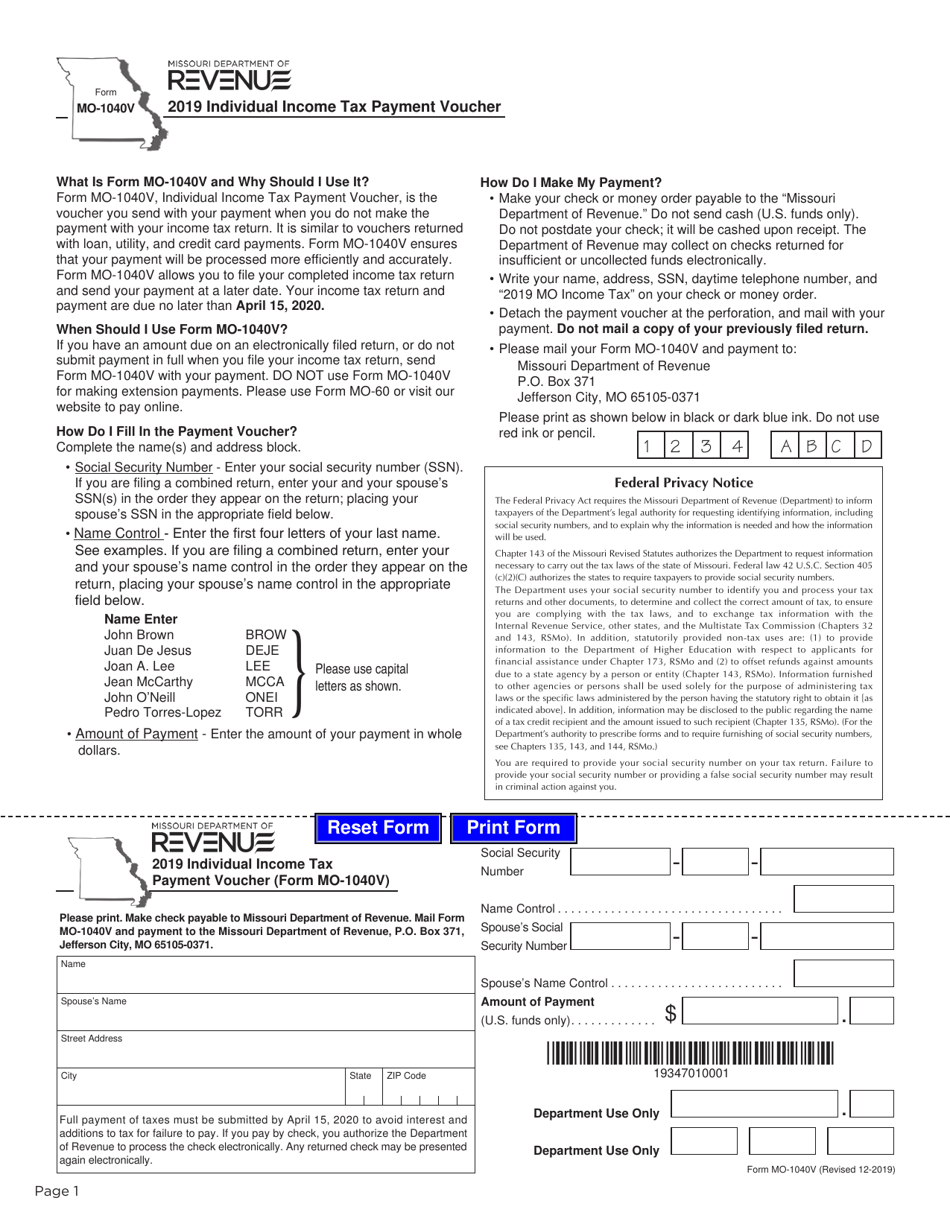

Form MO1040V Download Fillable PDF or Fill Online Individual

On the other hand, if you do owe missouri tax, you can. In care of name (attorney, guardian,. Web corporate extension payments can also be made under this selection; Web the 2022 missouri state income tax return forms for tax year 2022 (jan. A missouri extension will give you 6 extra months to file your return, moving the deadline to.

Missouri Fillable Tax Forms Universal Network

Web the 2022 missouri state income tax return forms for tax year 2022 (jan. Web if you cannot file on time, you can get a missouri tax extension. Web application for extension of time to fileenclosure sequence no. In care of name (attorney, guardian,. Locate nearby community servicessuch as hospitals, driver's license.

How Do I Apply For A Missouri Tax Id Number Tax Walls

In care of name (attorney, guardian,. If you would like to file an extension, you. Web attach a copy of the federal extension to the missouri return when filed. Web if you cannot file on time, you can get a missouri tax extension. Web the 2022 missouri state income tax return forms for tax year 2022 (jan.

Computer Information Concepts Missouri Tax

Web application for extension of time to fileenclosure sequence no. Web taxation driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or. Addition to tax and interest calculator; Web corporate extension payments can also be made under this selection; Web the missouri extension to.

Missouri Grants An Automatic Extension Of Time To File Corporation.

Web missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you filed a federal extension. If you would like to file an extension, you. A missouri extension will give you 6 extra months to file your return, moving the deadline to october 15 (for. Even if you filed an extension, you will still need to file your mo tax return.

Web You Will Automatically Receive A Missouri Extension If You Have No State Tax Liability Or If You’re Owed A State Refund.

In care of name (attorney, guardian,. Web taxation driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or. On the other hand, if you do owe missouri tax, you can. Addition to tax and interest calculator;

Web If You Cannot File On Time, You Can Get A Missouri Tax Extension.

Web the missouri extension to file a corporate tax return is a separate form. Make a personal income tax estimated payment (mo. You seek a missouri extension exceeding the federal. Web the 2022 missouri state income tax return forms for tax year 2022 (jan.

Web Attach A Copy Of The Federal Extension To The Missouri Return When Filed.

Web make an extension payment; Web application for extension of time to fileenclosure sequence no. Web extension payments can only be filed between january 1st and october 31st for the prior calendar year's taxes due. Locate nearby community servicessuch as hospitals, driver's license.