Nationwide 457 Rollover Form

Nationwide 457 Rollover Form - Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) / 401(k) plans unless an exception applicable to 401(a) / 401(k) plans applies. Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Save time and file a claim online. C phone c email rollover funds from plan type (select one): Web rollover and transfer funds 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. Nationwide neither endorses nor recommends the rollover of your existing account. Need to file an insurance or death benefit claim? Nationwide retirement solutions mail check to: How would you like to be contacted if additional information is required? Key person forms mutual fund account forms

If you haven’t already done so, please complete our automatic rollover application. Web rollover funds from (select plan type): Box 183150 columbus, oh 43218 amount to rollover/transfer: C 457(b) plan c 401(a) plan c 401(k) plan make check payable to: C phone c email rollover funds from plan type (select one): Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) / 401(k) plans unless an exception applicable to 401(a) / 401(k) plans applies. Web rollover and transfer funds 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. Web download and print the nationwide form you need. Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. We need a completed application on file so we can:

C all c 457(b) c 401(a) c 403(b) c 401(k) rollover funds from (select source)*: Web download and print the nationwide form you need. Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Save time and file a claim online. C partial dollar amount $ c total balance Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) / 401(k) plans unless an exception applicable to 401(a) / 401(k) plans applies. C 457(b) plan c 401(a) plan c 401(k) plan make check payable to: Nationwide retirement solutions fbo (participant name, ssn) p.o. Box 183150 columbus, oh 43218 amount to rollover/transfer: How would you like to be contacted if additional information is required?

Vanguard 401k Withdrawal Form Universal Network

Nationwide retirement solutions fbo (participant name, ssn) p.o. If you haven’t already done so, please complete our automatic rollover application. How would you like to be contacted if additional information is required? Nationwide retirement solutions mail check to: Web rollover funds from (select plan type):

401k Rollover Form Charles Schwab Form Resume Examples MoYo65B9ZB

Please complete a separate form for each plan you are exchanging, transferring, or rolling from. Web rollover funds from (select plan type): If you haven’t already done so, please complete our automatic rollover application. 457(b) to 457(b) under the same employer Web download and print the nationwide form you need.

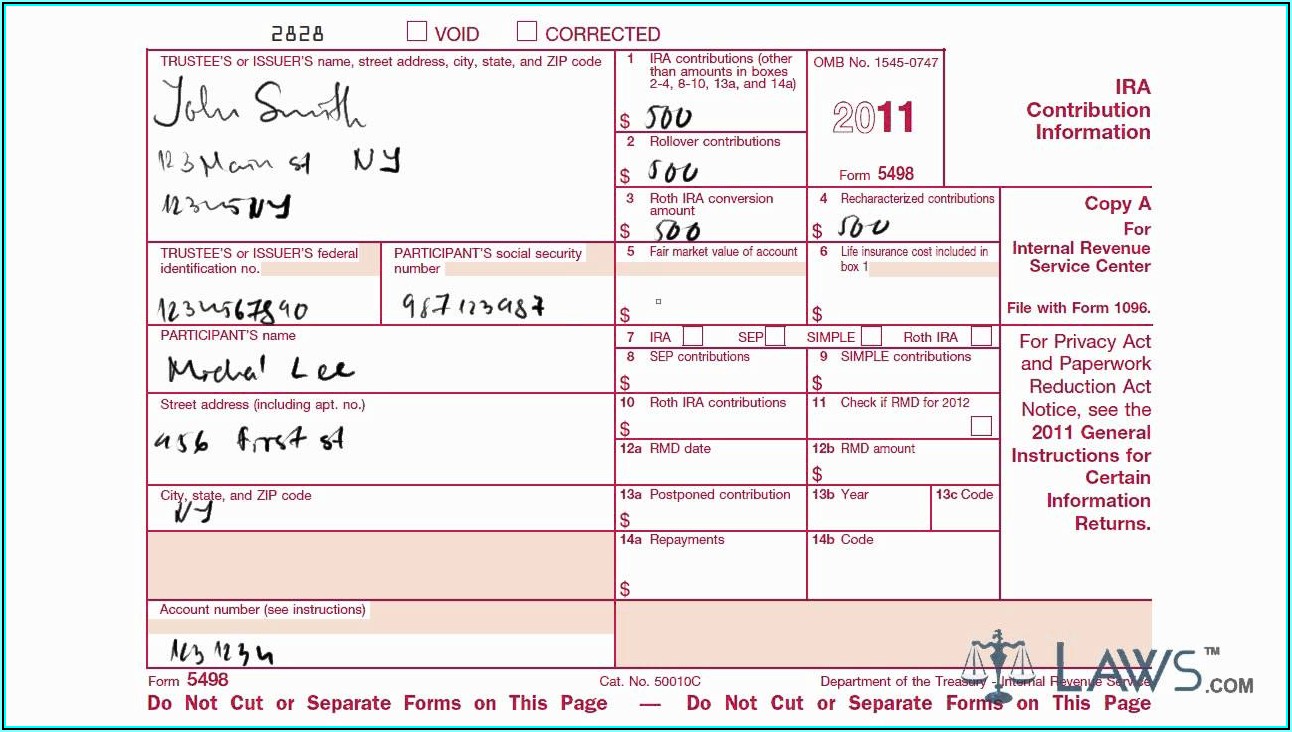

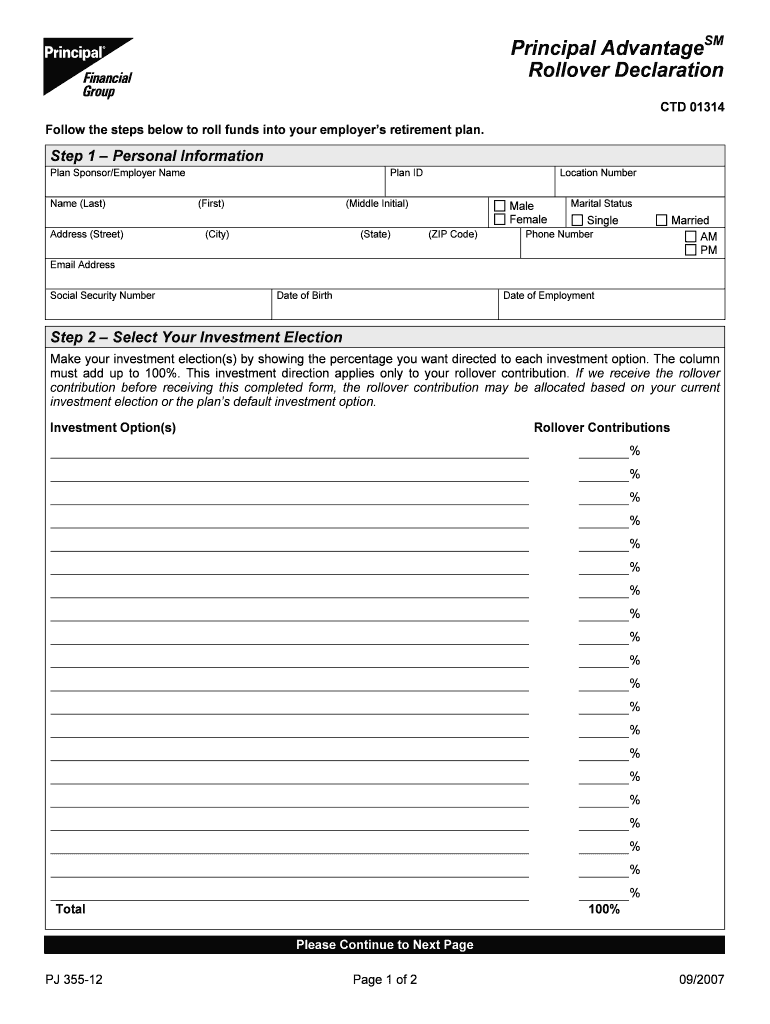

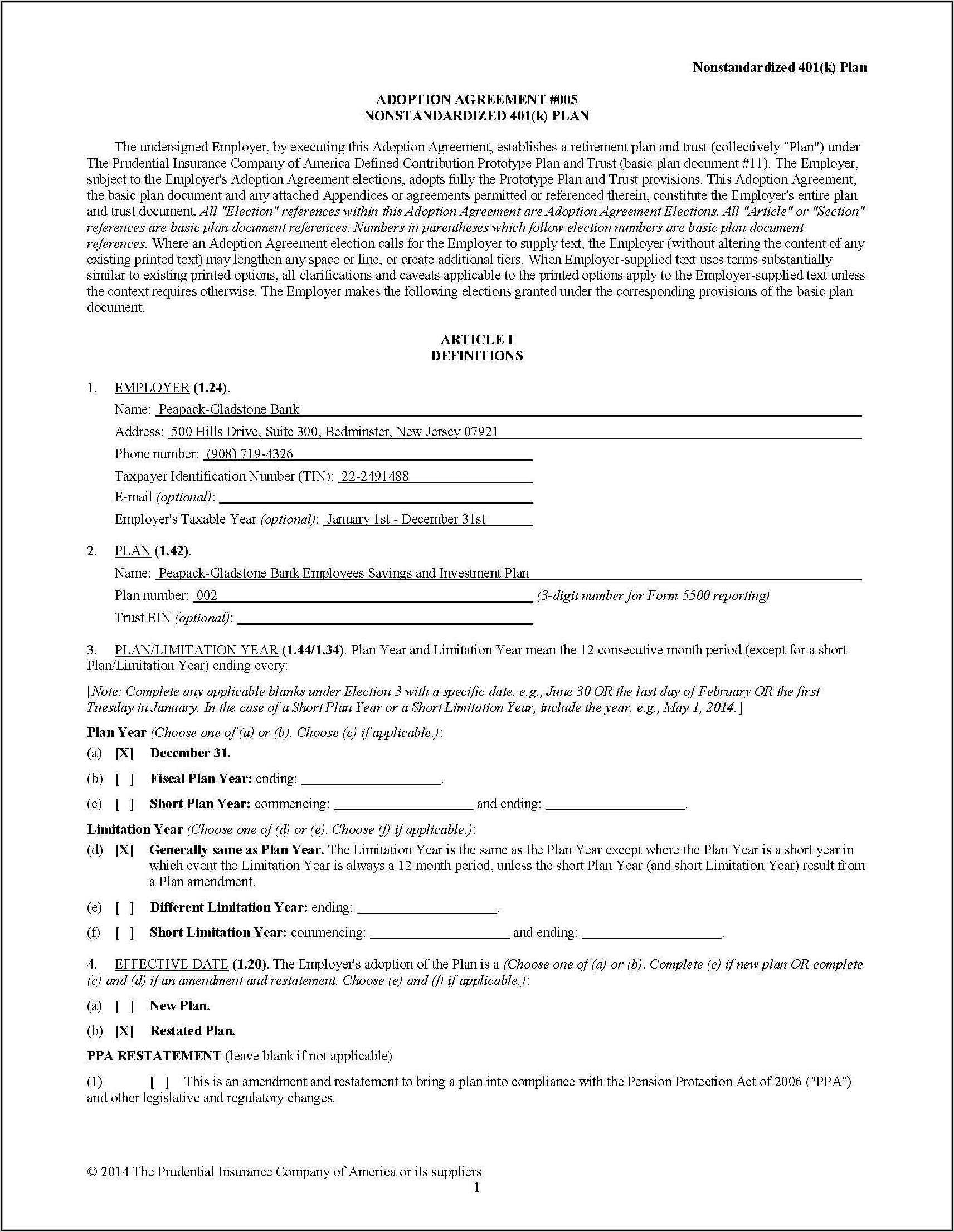

Principal Rollover Form Fill Out and Sign Printable PDF Template

457(b) to 457(b) under the same employer Web distribution request for 457(b) governmental plans page 1 of 4 you may be able to submit and track the status of your distribution request online! Nationwide neither endorses nor recommends the rollover of your existing account. How would you like to be contacted if additional information is required? Log in to your.

AIRBUS A320/A321 NORMAL CHECKLIST flyuk.aero A320/A321 NORMAL

Confirm the information required under the provisions of the patriot act of 2001. Save time and file a claim online. Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) / 401(k) plans unless an exception applicable to 401(a) / 401(k) plans applies..

401k Rollover Form Fidelity Investments Form Resume Examples

Confirm the information required under the provisions of the patriot act of 2001. Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Key person forms mutual fund account forms Nationwide retirement solutions mail check to: C all c 457(b) c 401(a) c 403(b) c 401(k)

401k Rollover Former Employer Universal Network

Nationwide neither endorses nor recommends the rollover of your existing account. C all c 457(b) c 401(a) c 403(b) c 401(k) Web distribution request for 457(b) governmental plans page 1 of 4 you may be able to submit and track the status of your distribution request online! If you haven’t already done so, please complete our automatic rollover application. Rollover.

Incorporate exercise into your day...quick and easy The Healthy Honey's

Web rollover and transfer funds 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. Save time and file a claim online. How would you like to be contacted if additional information is required? C phone c email rollover funds from plan type (select one): Rollover contributions are subject to the

Slavic 401k Rollover Form Universal Network

Rollover contributions are subject to the How would you like to be contacted if additional information is required? Web distribution request for 457(b) governmental plans page 1 of 4 you may be able to submit and track the status of your distribution request online! If you haven’t already done so, please complete our automatic rollover application. Popular nationwide forms key.

2016 Form Nationwide Retirement Solutions DC3653 Fill Online

Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Nationwide retirement solutions fbo (participant name, ssn) p.o. C 457(b) plan c 401(a) plan c 401(k) plan make check payable to: Web distribution request for 457(b) governmental plans page 1 of 4 you may be able to submit and track the status of.

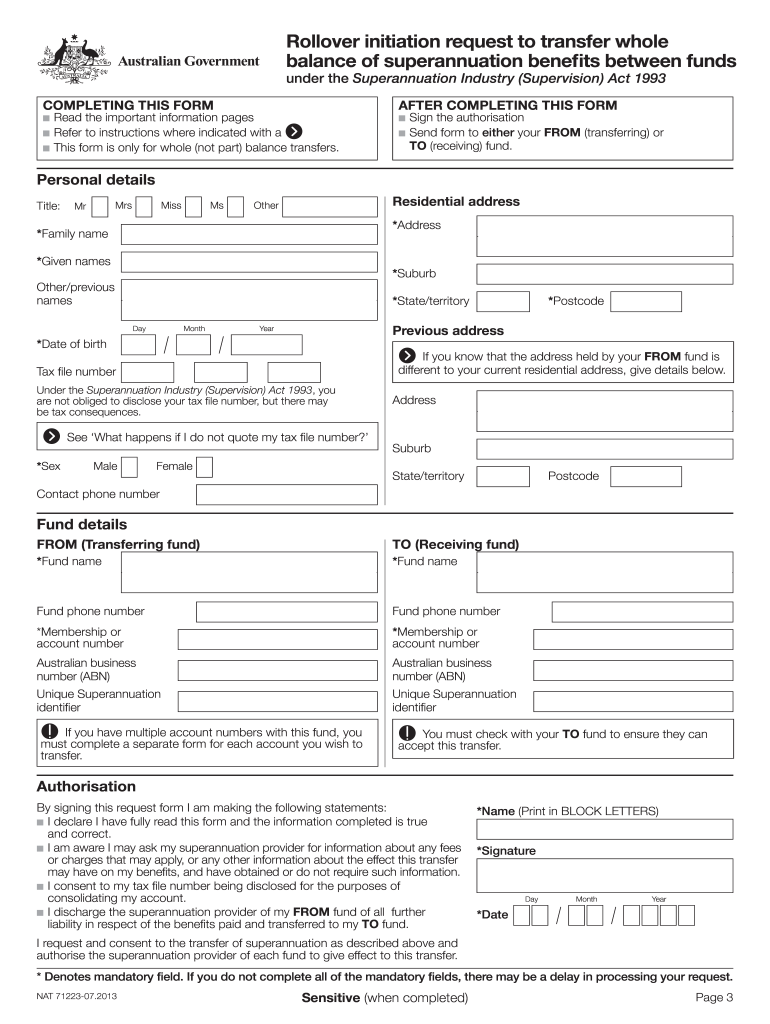

Completing the Form Rollover Initiation Request to Transfer Whole ATO

Nationwide retirement solutions fbo (participant name, ssn) p.o. We need a completed application on file so we can: Box 183150 columbus, oh 43218 amount to rollover/transfer: C phone c email rollover funds from plan type (select one): Key person forms mutual fund account forms

Please Complete A Separate Form For Each Plan You Are Exchanging, Transferring, Or Rolling From.

C partial dollar amount $ c total balance Web distribution request for 457(b) governmental plans page 1 of 4 you may be able to submit and track the status of your distribution request online! Rollover contributions are subject to the C phone c email rollover funds from plan type (select one):

Nationwide Retirement Solutions Mail Check To:

Log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Confirm the information required under the provisions of the patriot act of 2001. If you haven’t already done so, please complete our automatic rollover application. Web download and print the nationwide form you need.

We Need A Completed Application On File So We Can:

403(b) to 403(b) under the same employer c roth 403(b) exchange: Web rollover and transfer funds 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. Nationwide retirement solutions fbo (participant name, ssn) p.o. Need to file an insurance or death benefit claim?

Nationwide Neither Endorses Nor Recommends The Rollover Of Your Existing Account.

Save time and file a claim online. C all c 457(b) c 401(a) c 403(b) c 401(k) rollover funds from (select source)*: Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) / 401(k) plans unless an exception applicable to 401(a) / 401(k) plans applies. How would you like to be contacted if additional information is required?