Nc Farm Tax Exempt Form

Nc Farm Tax Exempt Form - Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. The criteria are set by nc state law, but. Web this is your farm tax id number. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. (2) a copy of the property tax listing showing that the property is eligible for participation in the. A “qualifying farmer” is a person who has an annual gross income for the. The application form is available from the county tax administration office. This application is to be used to apply for a conditional farmer.

Sales tax on purchases of farm. Web this is your farm tax id number. The application form is available from the county tax administration office. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. The criteria are set by nc state law, but. This application is to be used to apply for a conditional farmer. Web for complete details, read this guide.

Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. This application is to be used to apply for a conditional farmer. Web exemption certificate are set out in n.c. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions to north carolina’s agriculture sales. (2) a copy of the property tax listing showing that the property is eligible for participation in the. Web (1) a farm sales tax exemption certificate issued by the department of revenue. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web for complete details, read this guide. Sales tax on purchases of farm.

How To Get A North Carolina Sales Tax Certificate of Exemption (Resale

The application form is available from the county tax administration office. Web (1) a farm sales tax exemption certificate issued by the department of revenue. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Fill out the form with information about. A “qualifying farmer” is a person who has an annual gross.

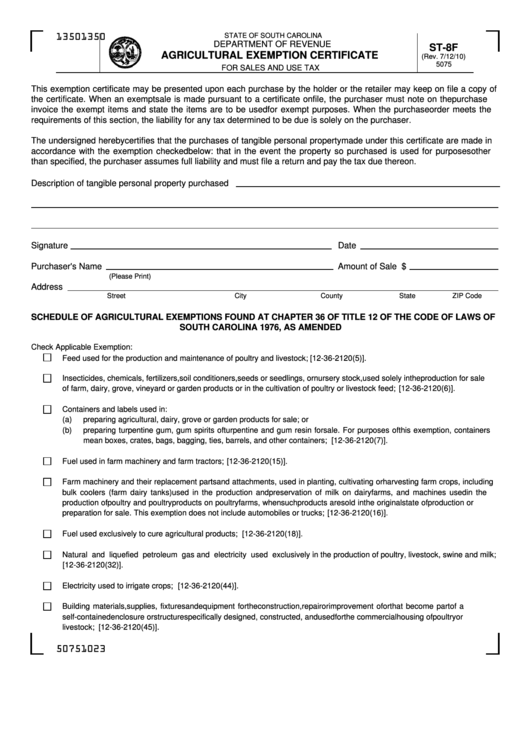

Form St8f Agricultural Exemption Certificate printable pdf download

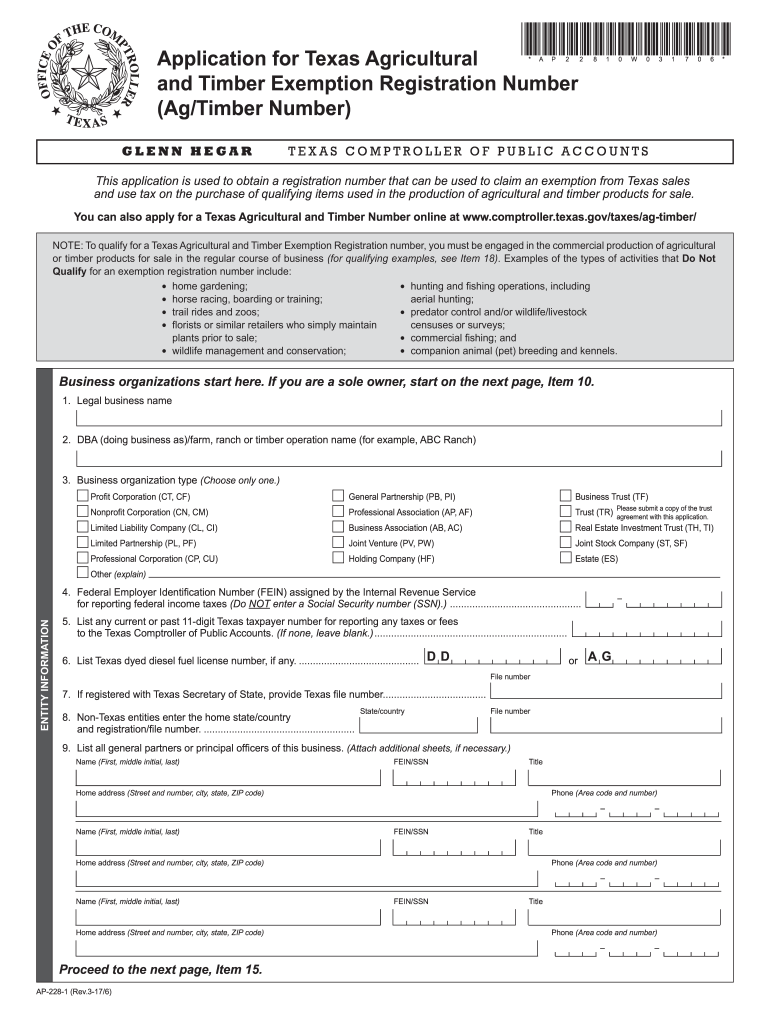

Web this document serves as notice that effective july 1, 2014, n.c. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web for complete details, read this guide. Web this application is to be used by.

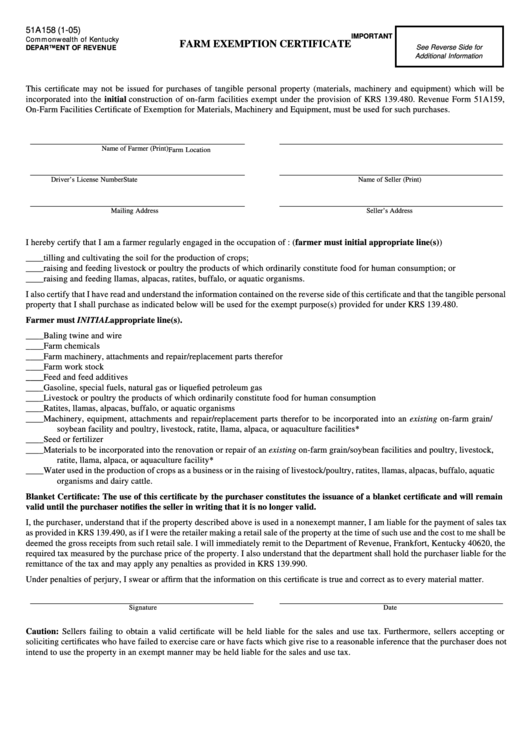

Farm Tax Exempt Form Tn

Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. A “qualifying farmer” is a person who has an annual gross income for the..

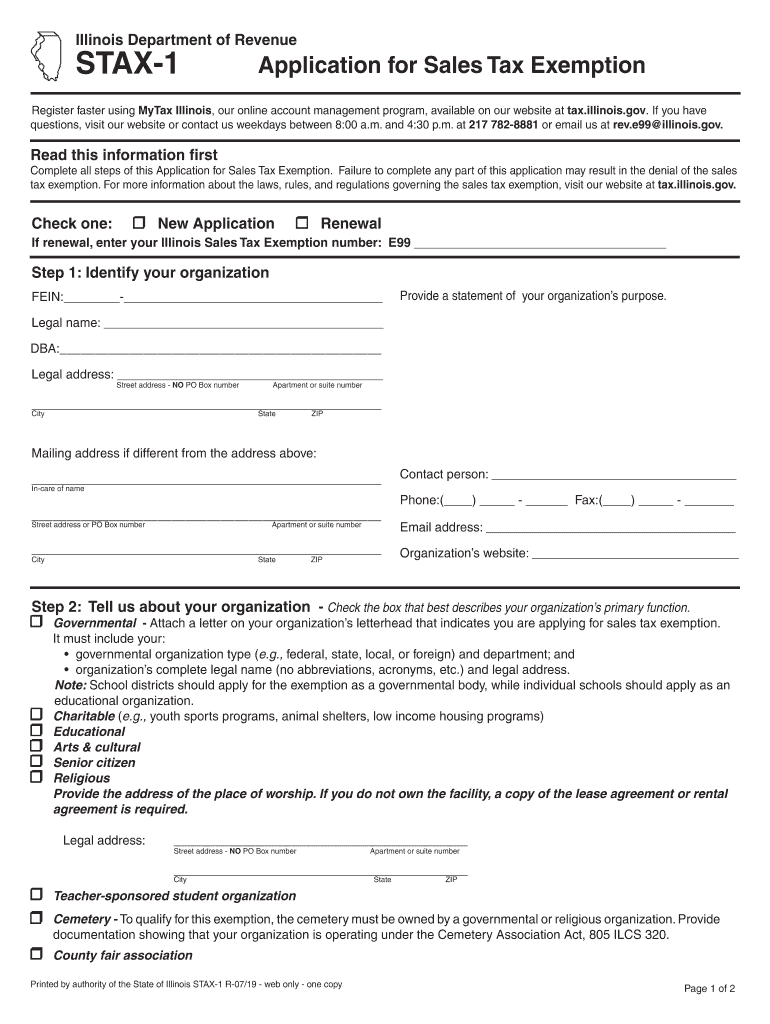

20192022 Form IL STAX1 Fill Online, Printable, Fillable, Blank

Fill out the form with information about. The criteria are set by nc state law, but. The application form is available from the county tax administration office. Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. Web exemption certificate are.

How to get a Sales Tax Exemption Certificate in Missouri

Sales tax on purchases of farm. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web this document serves as notice that effective july 1, 2014, n.c. Web exemption certificate are set out in n.c. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable.

Bupa Tax Exemption Form / We do not accept sales tax permits, articles

Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. Web this.

Bupa Tax Exemption Form Bupa Tax Exemption Form Increased Homestead

(2) a copy of the property tax listing showing that the property is eligible for participation in the. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Sales tax on purchases of farm. The application form.

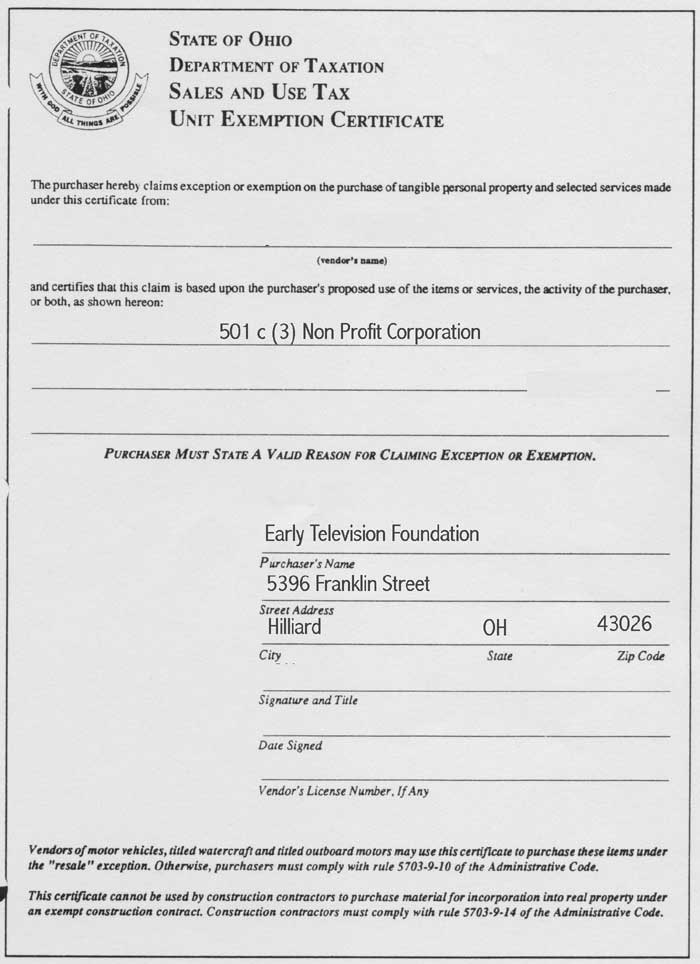

The Early Television Foundation

(2) a copy of the property tax listing showing that the property is eligible for participation in the. The criteria are set by nc state law, but. Fill out the form with information about. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions to north carolina’s agriculture sales. Web sep.

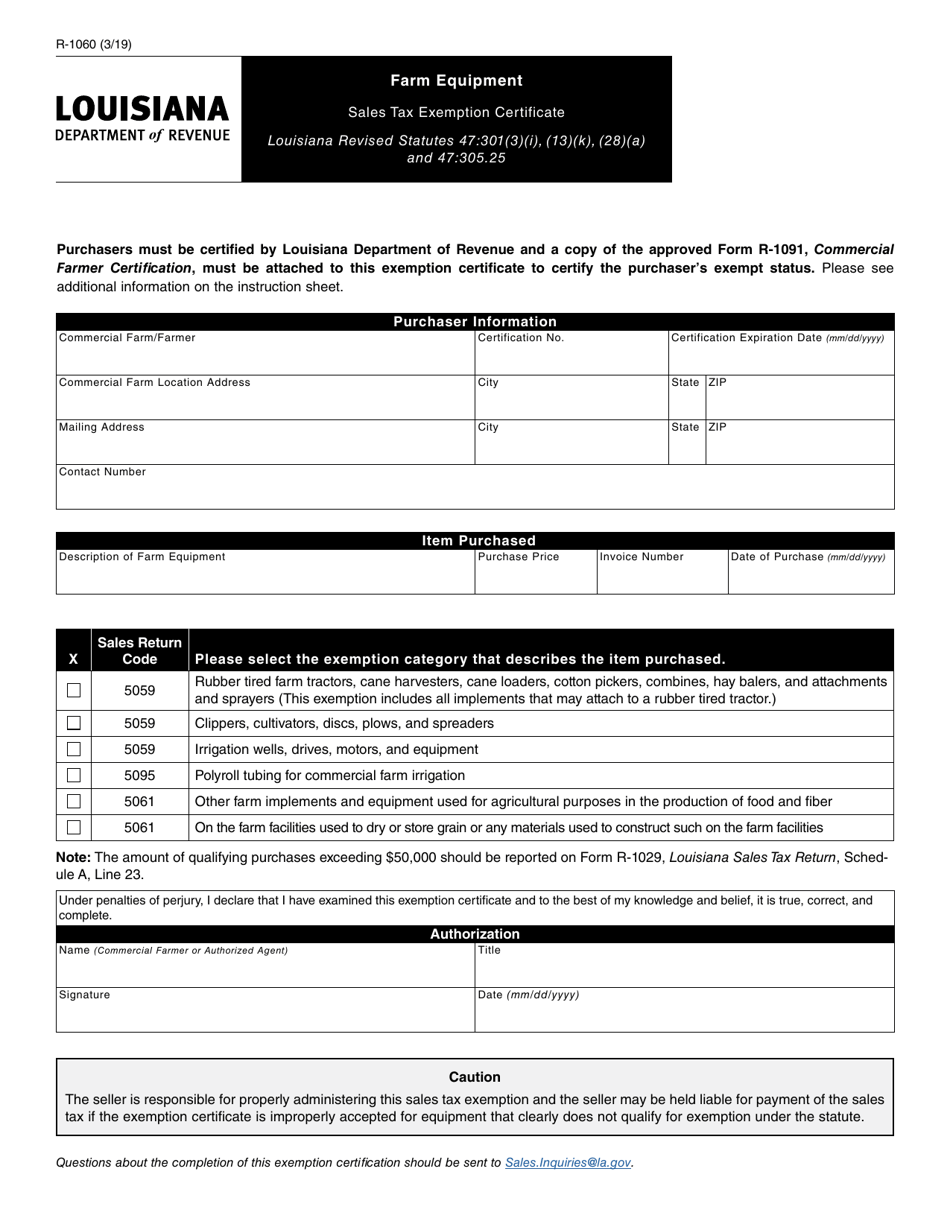

Form R1060 Download Fillable PDF or Fill Online Farm Equipment Sales

This application is to be used to apply for a conditional farmer. Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web a.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. This application is to be used to apply for a conditional farmer. Web sep 5, 2022 4 min read north carolina farm property tax exemption if.

Web The Term Farmer Means Any Person Engaged In The Raising, Growing And Producing Of Farm Products On A Farm Not Less Than 10 Acres In Area And Located In North Carolina And.

The criteria are set by nc state law, but. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. A “qualifying farmer” is a person who has an annual gross income for the.

Web (1) A Farm Sales Tax Exemption Certificate Issued By The Department Of Revenue.

(2) a copy of the property tax listing showing that the property is eligible for participation in the. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. Web this is your farm tax id number. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or.

The Application Form Is Available From The County Tax Administration Office.

Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Sales tax on purchases of farm. Fill out the form with information about. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property.

Web This Document Serves As Notice That Effective July 1, 2014, N.c.

Web exemption certificate are set out in n.c. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions to north carolina’s agriculture sales. This application is to be used to apply for a conditional farmer. Web for complete details, read this guide.