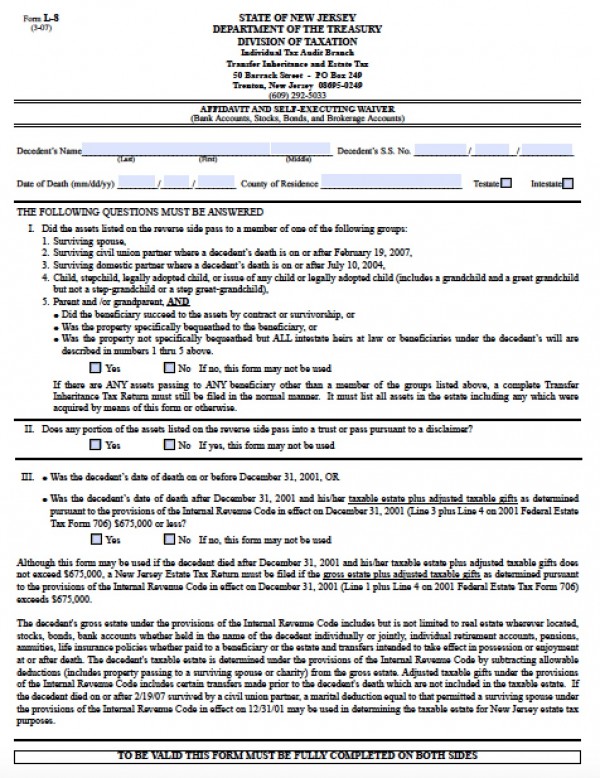

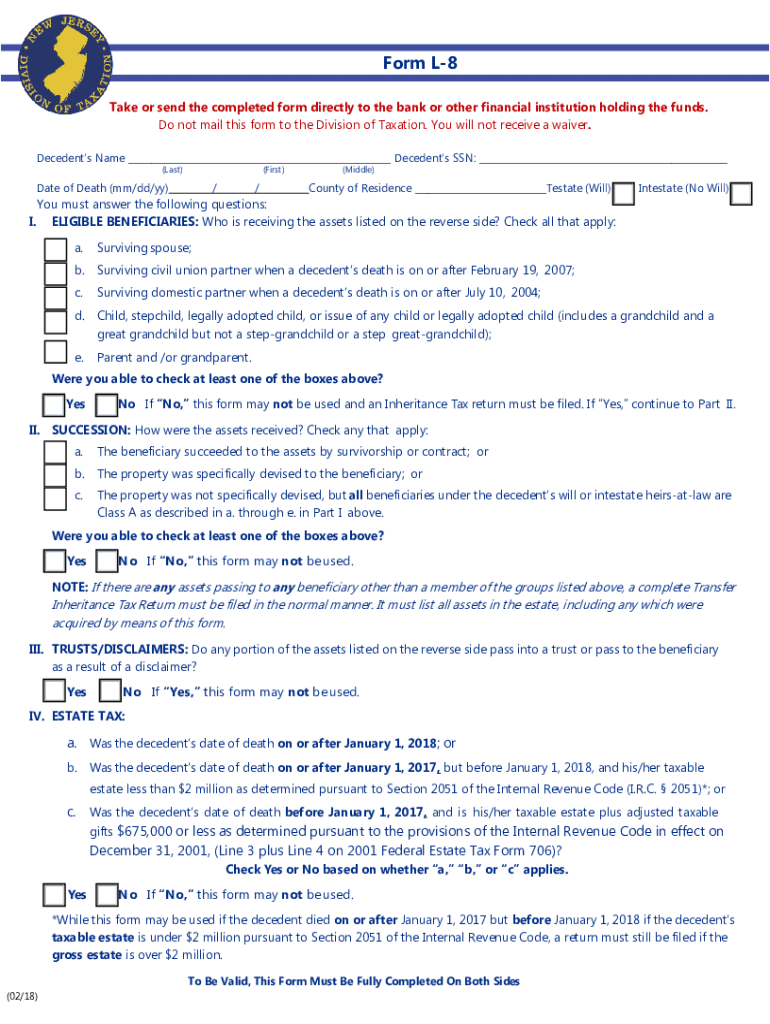

New Jersey L-8 Form

New Jersey L-8 Form - This form can be completed by: However, if other heirs file to claim real estate property, then the value may not exceed $20,000. Stock in new jersey corporations; And new jersey investment bonds. This form cannot be used for real estate. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. Web tax waivers are required for transfers to domestic partners. No estate tax is ever due when there is a surviving spouse. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. Resident (state of new jersey) form is 4 pages long and contains:

Stock in new jersey corporations; This form cannot be used for real estate. And new jersey investment bonds. Resident (state of new jersey) form is 4 pages long and contains: Web tax waivers are required for transfers to domestic partners. Resident decedents use this form for release of: You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. This is new jersey law.

Stock in new jersey corporations; However, if other heirs file to claim real estate property, then the value may not exceed $20,000. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. This is new jersey law. No estate tax is ever due when there is a surviving spouse. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. This form cannot be used for real estate. Resident decedents use this form for release of: And new jersey investment bonds.

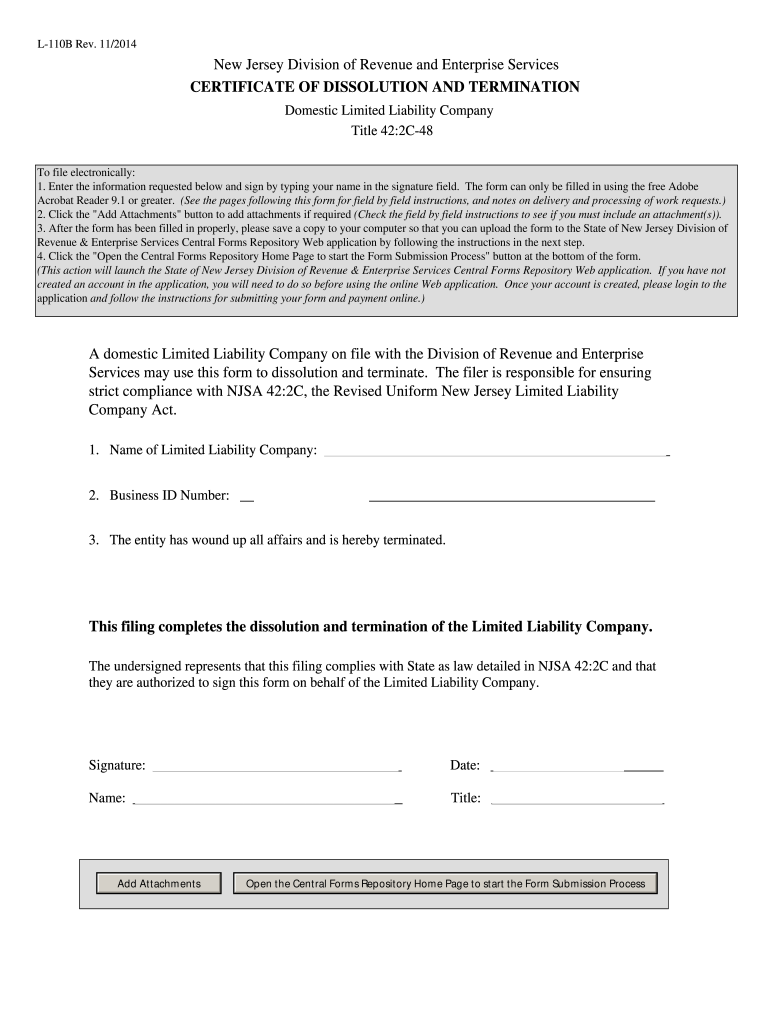

How to Form an LLC in New Jersey With our

However, if other heirs file to claim real estate property, then the value may not exceed $20,000. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. Stock in new jersey corporations; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Web tax waivers are required for.

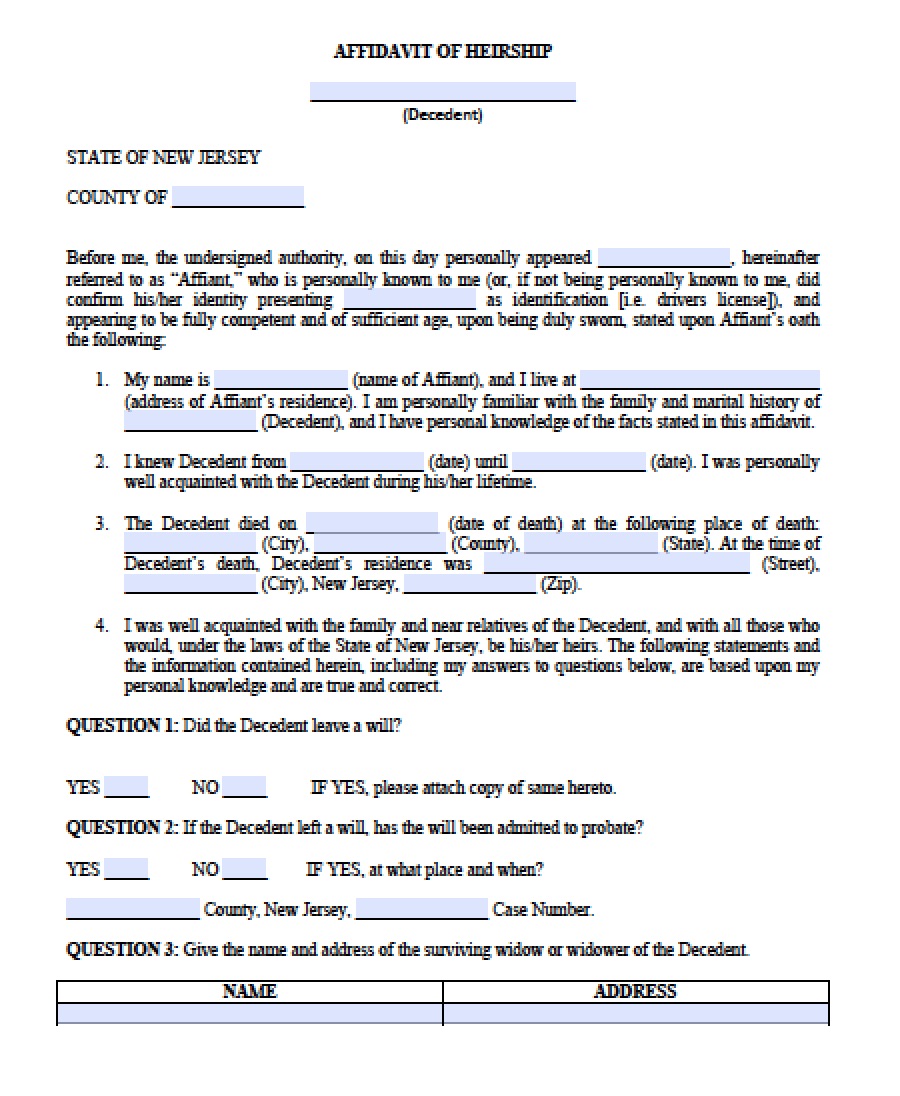

Free New Jersey Small Estate Affidavit L8 Form PDF Word

This is new jersey law. Resident decedents use this form for release of: Web tax waivers are required for transfers to domestic partners. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. And new jersey investment bonds.

Vendor Registration Supplemental Disclosure Form New Jersey Free Download

And new jersey investment bonds. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. No estate tax is ever due when there is a surviving spouse. However, if other heirs file to claim real estate.

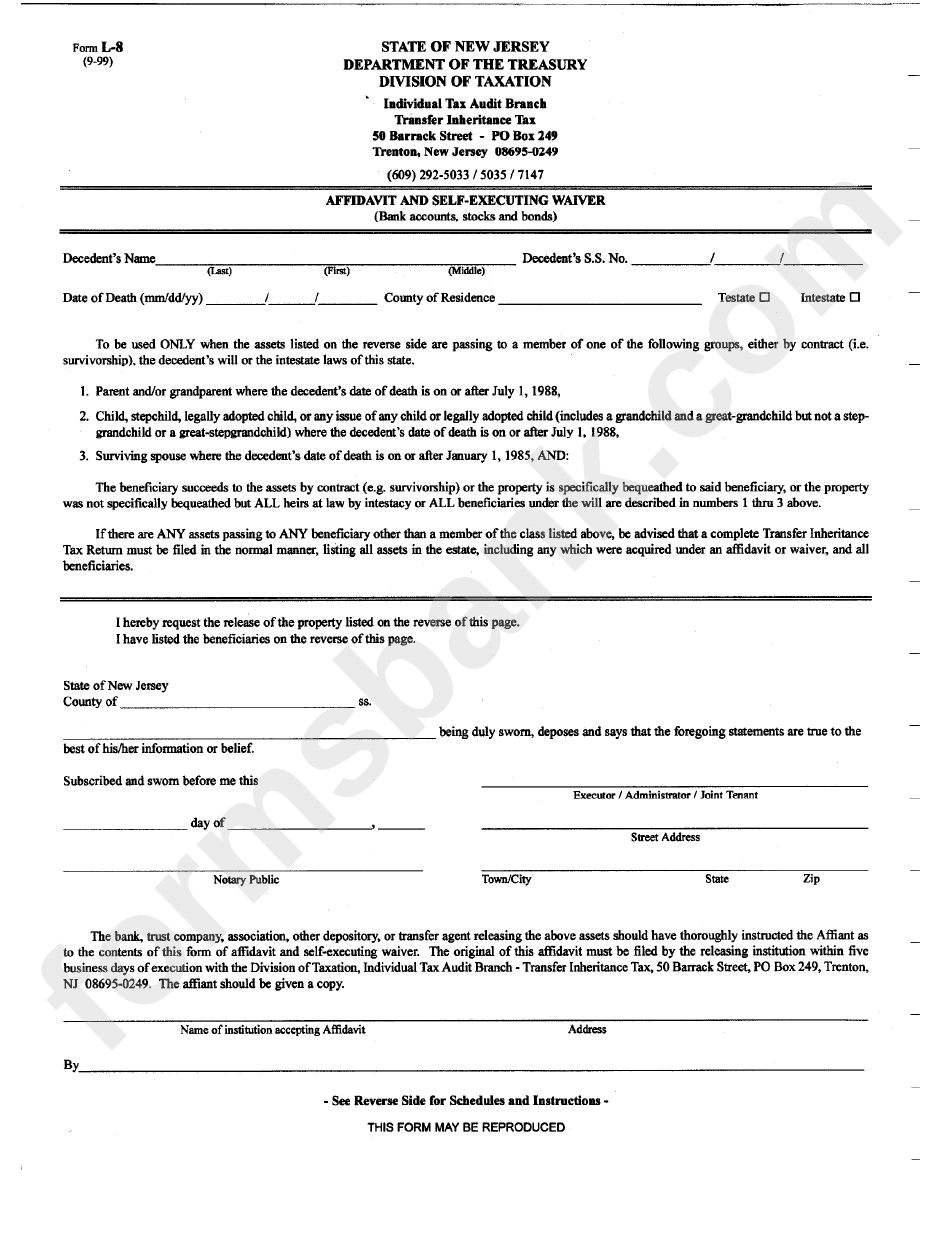

Form L8 Affidavit And SelfExecuting Waiver printable pdf download

Web tax waivers are required for transfers to domestic partners. Resident (state of new jersey) form is 4 pages long and contains: This form can be completed by: No estate tax is ever due when there is a surviving spouse. Stock in new jersey corporations;

Nj Form L 110b Fill Out and Sign Printable PDF Template signNow

Stock in new jersey corporations; However, if other heirs file to claim real estate property, then the value may not exceed $20,000. Web tax waivers are required for transfers to domestic partners. Resident decedents use this form for release of: And new jersey investment bonds.

New Jersey Resident Return New Jersey Free Download

No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Web tax waivers are required for transfers to domestic partners. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. Then.

Free New Jersey Small Estate Affidavit L8 Form PDF Word

Stock in new jersey corporations; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This form cannot be used for real estate. You must file this form directly with each bank, financial institution, broker or.

20182021 Form NJ DoT L8 Fill Online, Printable, Fillable, Blank

No estate tax is ever due when there is a surviving spouse. Resident decedents use this form for release of: You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. This form cannot be used for real estate. And new jersey investment bonds.

Vendor Registration Supplemental Disclosure Form New Jersey Free Download

This form can be completed by: However, if other heirs file to claim real estate property, then the value may not exceed $20,000. And new jersey investment bonds. This is new jersey law. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

New Jersey Power Of Attorney Form Pdf

Web tax waivers are required for transfers to domestic partners. Resident decedents use this form for release of: This form can be completed by: Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. Resident (state of new jersey) form is 4 pages long and contains:

And New Jersey Investment Bonds.

Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. Web tax waivers are required for transfers to domestic partners. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. This form cannot be used for real estate.

Resident (State Of New Jersey) Form Is 4 Pages Long And Contains:

This form can be completed by: Stock in new jersey corporations; This is new jersey law. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

However, If Other Heirs File To Claim Real Estate Property, Then The Value May Not Exceed $20,000.

Resident decedents use this form for release of: No estate tax is ever due when there is a surviving spouse.