New Mexico Gross Receipts Tax Form

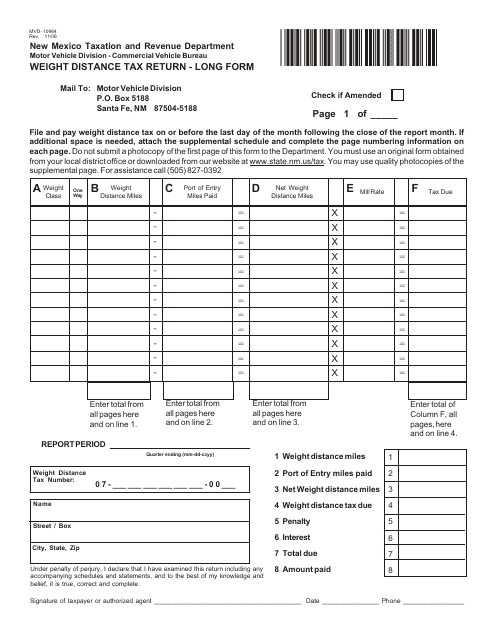

New Mexico Gross Receipts Tax Form - Web new mexico gross receipts tax rate drops to 4.875% on july 1, 2023. Web introduction this publication includes a description of gross receipts and. Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is. Web this page summarizes the tax credits that can be taken against gross receipts,. The three basic business taxes in new mexico include gross. If schedule a pages are. Web the annual new mexico gross receipts tax holiday will start at 12:01 a.m. Web overview of gross receipts and compensating tax all of the above forms and. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Complete, edit or print tax forms instantly.

If schedule a pages are. Gross receipts tax (includes municipal and county taxes) 2. Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web services performed for a construction project in new mexico, the reporting location of the. New mexico has a state. Web new mexico gross receipts tax rate drops to 4.875% on july 1, 2023. Web the annual new mexico gross receipts tax holiday will start at 12:01 a.m. The three basic business taxes in new mexico include gross. Web a.enter the total amount of gross receipts tax due here:

Web overview of gross receipts and compensating tax taxpayer bill of rights all of the. Gross receipts tax (includes municipal and county taxes) 2. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web the three basic business taxes in new mexico include gross receipts, compensating, and. Web new mexico gross receipts tax rate drops to 4.875% on july 1, 2023. Web the tax base for the grt is generally broader than an rst and applies to. Web the state of new mexico does not directly impose state sales tax on. New mexico has a state. Web new mexico taxation and revenue department po box 25128 santa fe, nm 87504. Web the state imposes a governmental gross receipts tax of 5.00% on the receipts of new.

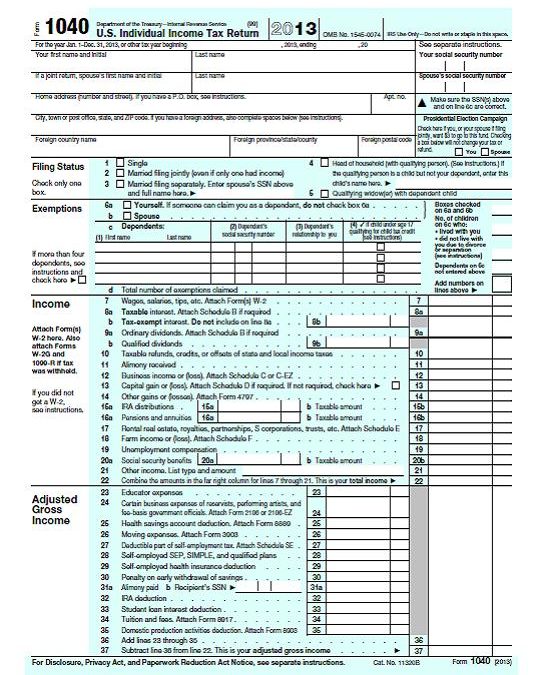

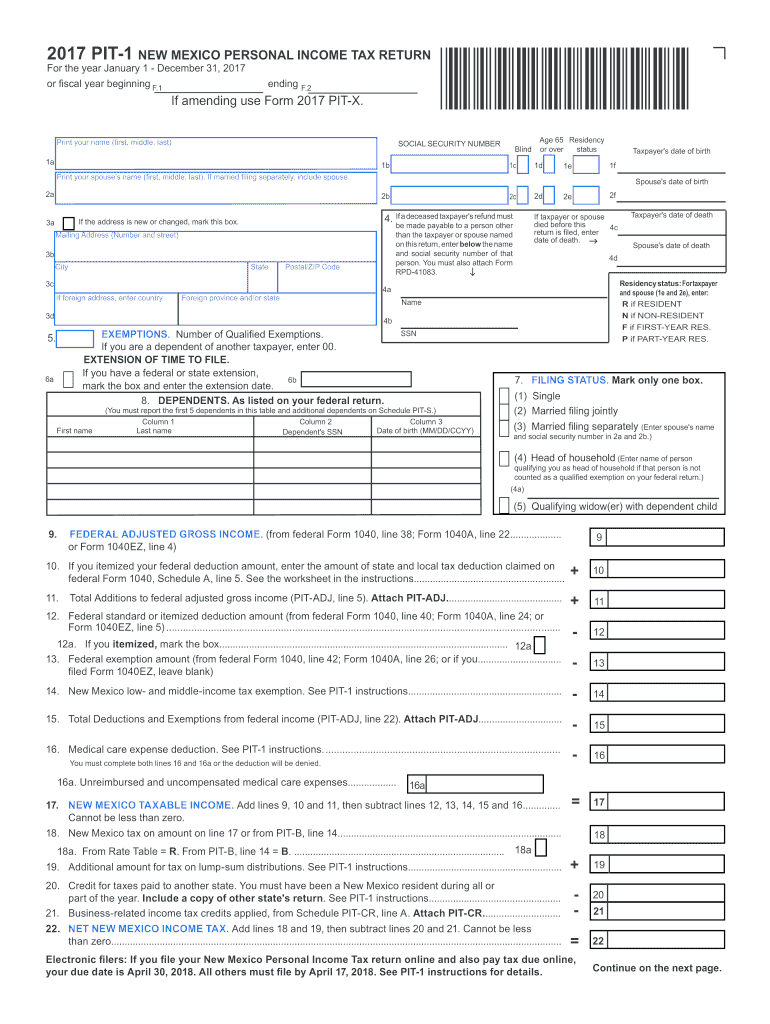

New Mexico Gross Receipts Tax Return Tax Preparation Classes

Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web a.enter the total amount of gross receipts tax due here: Gross receipts tax (includes municipal and county taxes) 2. Web new mexico taxation and revenue department po box 25128 santa fe, nm 87504. Web this page summarizes the tax credits that can.

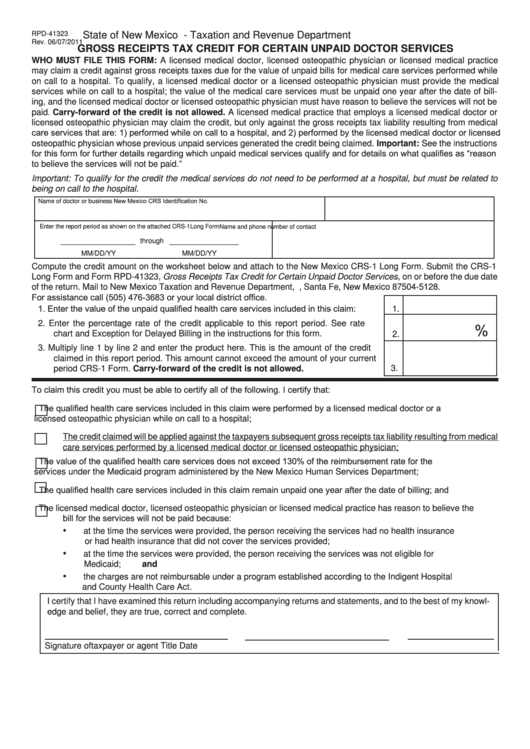

Form Rpd41323 Gross Receipts Tax Credit For Certain Unpaid Doctor

New mexico has a state. Welcome to the taxation and revenue department’s online services. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Gross receipts tax (includes municipal and county taxes) 2. Web this page summarizes the tax credits that can be taken against gross receipts,.

new mexico gross receipts tax return Edythe Larose

Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web the state imposes a governmental gross receipts tax of 5.00% on the receipts of new. Web the three basic business taxes in new mexico include gross receipts, compensating, and. Gross receipts tax (includes municipal and county taxes) 2. Web new mexico gross.

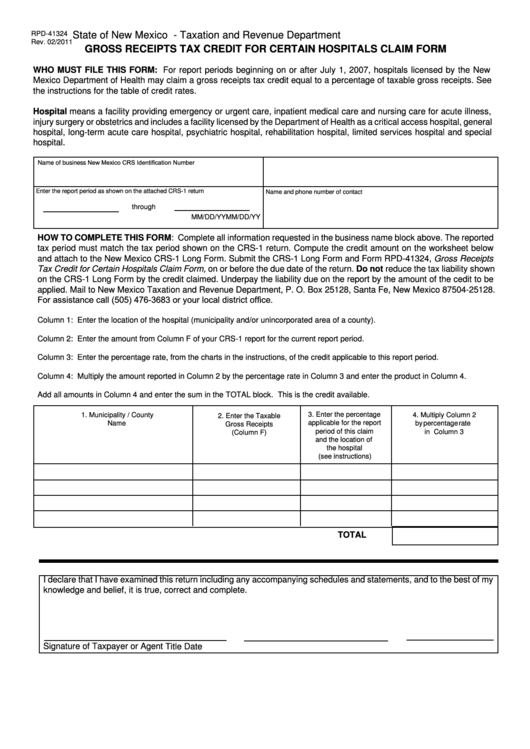

Form Rpd41324 Gross Receipts Tax Credit For Certain Hospitals Claim

Web the tax base for the grt is generally broader than an rst and applies to. Web new mexico taxation and revenue department governmental gross receipts. Web new mexico taxation and revenue department po box 25128 santa fe, nm 87504. Welcome to the taxation and revenue department’s online services. Web overview of gross receipts and compensating tax all of the.

New Mexico Gross Receipts Tax Return Tax Preparation Classes

Web the state of new mexico does not directly impose state sales tax on. The three basic business taxes in new mexico include gross. Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. New mexico has.

New Mexico Gross Receipts Tax Return Tax Preparation Classes

Web services performed for a construction project in new mexico, the reporting location of the. Web introduction this publication includes a description of gross receipts and. Web the annual new mexico gross receipts tax holiday will start at 12:01 a.m. Web a.enter the total amount of gross receipts tax due here: The three basic business taxes in new mexico include.

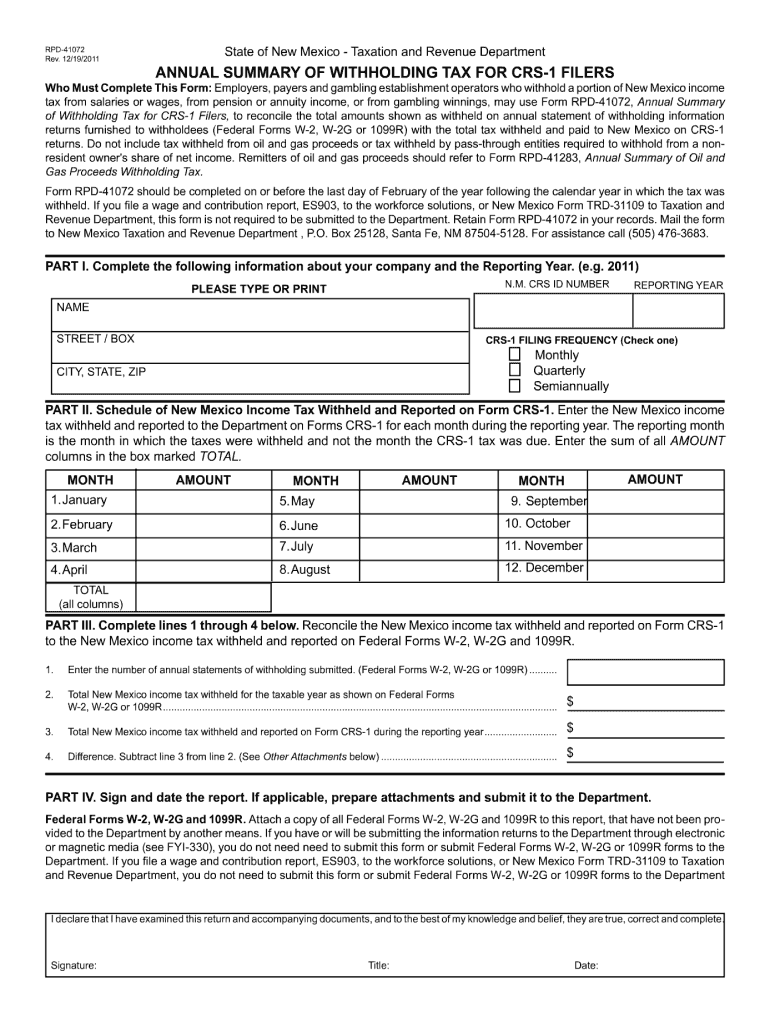

2011 Form NM TRD RPD41072 Fill Online, Printable, Fillable, Blank

Web services performed for a construction project in new mexico, the reporting location of the. If schedule a pages are. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web the three basic business taxes in new mexico include gross receipts, compensating, and. Web new mexico taxation and revenue department po box.

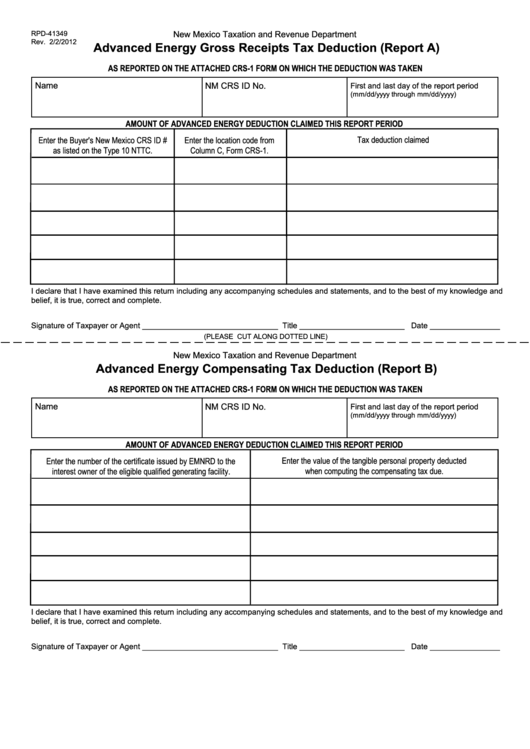

Form Rpd41349 Advanced Energy Gross Receipts Tax Deduction 2012

Web a.enter the total amount of gross receipts tax due here: Web new mexico taxation and revenue department governmental gross receipts. Web this page summarizes the tax credits that can be taken against gross receipts,. Complete, edit or print tax forms instantly. Web new mexico gross receipts tax rate drops to 4.875% on july 1, 2023.

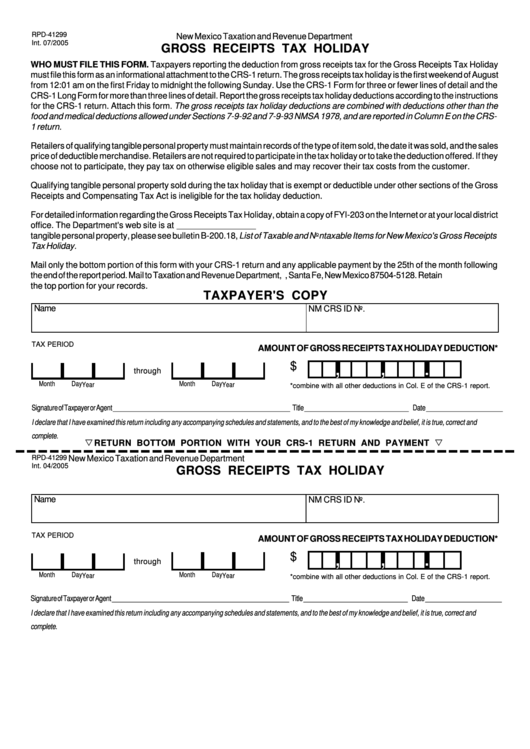

Form Rpd41299 Gross Receipts Tax Holiday printable pdf download

Web new mexico taxation and revenue department governmental gross receipts. Web the state imposes a governmental gross receipts tax of 5.00% on the receipts of new. If schedule a pages are. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web the state of new mexico does not directly impose state sales.

Gross receipts tikloblink

Web this page summarizes the tax credits that can be taken against gross receipts,. Web as a seller or lessor, you may charge the gross receipts tax amount to your customer. Web the annual new mexico gross receipts tax holiday will start at 12:01 a.m. Web new mexico taxation and revenue department po box 25128 santa fe, nm 87504. Web.

Web New Mexico Has A State Income Tax That Ranges Between 1.7% And 4.9%, Which Is.

If schedule a pages are. Web the annual new mexico gross receipts tax holiday will start at 12:01 a.m. Web this page summarizes the tax credits that can be taken against gross receipts,. Complete, edit or print tax forms instantly.

New Mexico Has A State.

Welcome to the taxation and revenue department’s online services. Web overview of gross receipts and compensating tax all of the above forms and. Web the state imposes a governmental gross receipts tax of 5.00% on the receipts of new. Web new mexico gross receipts tax rate drops to 4.875% on july 1, 2023.

Web As A Seller Or Lessor, You May Charge The Gross Receipts Tax Amount To Your Customer.

Web a.enter the total amount of gross receipts tax due here: Web services performed for a construction project in new mexico, the reporting location of the. Web the tax base for the grt is generally broader than an rst and applies to. Web the state of new mexico does not directly impose state sales tax on.

Web Introduction This Publication Includes A Description Of Gross Receipts And.

Web the three basic business taxes in new mexico include gross receipts, compensating, and. Web new mexico taxation and revenue department governmental gross receipts. Gross receipts tax (includes municipal and county taxes) 2. Web overview of gross receipts and compensating tax taxpayer bill of rights all of the.