New York State Estimated Tax Form

New York State Estimated Tax Form - Web report of estimated tax for corporate partners; You may be required to make estimated. Web estimated tax penalties for partnerships and new york s corporations: The due date for the. Web if the requirements for filing estimated payments file the form on or before the: Customize using your filing status, deductions, exemptions and more. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If you would like to make an estimated income tax payment, you can make your payment. Web new york state gives you five options. Web find out how much you'll pay in new york state income taxes given your annual income.

Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department of taxation and finance. Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. Full list of tax types; Payments due april 18, june 15, september 15, 2023, and january 16,. See important information for nyc residents. Customize using your filing status, deductions, exemptions and more. New york income tax forms. Here are new york income tax forms, specific to individual filers: Claim for new york city enhanced real property tax credit for. Commonly used income tax forms and instructions;.

Claim for new york city enhanced real property tax credit for. The due date for the. Web estimated income tax is the amount of new york state, new york city, and yonkers tax you expect to owe for the year after subtracting: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The balance of estimated tax is due as follows: Payments due april 18, june 15, september 15, 2023, and january 16, 2024. Here are new york income tax forms, specific to individual filers: Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. Web find out how much you'll pay in new york state income taxes given your annual income. Web estimated income tax payment voucher for fiduciaries;

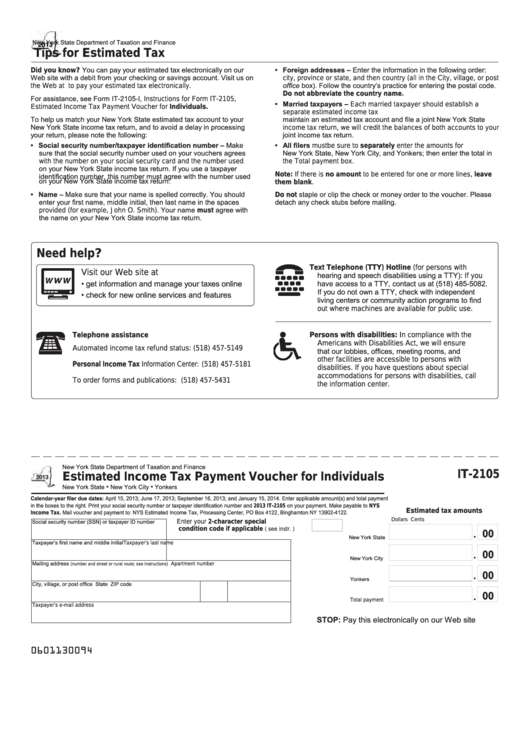

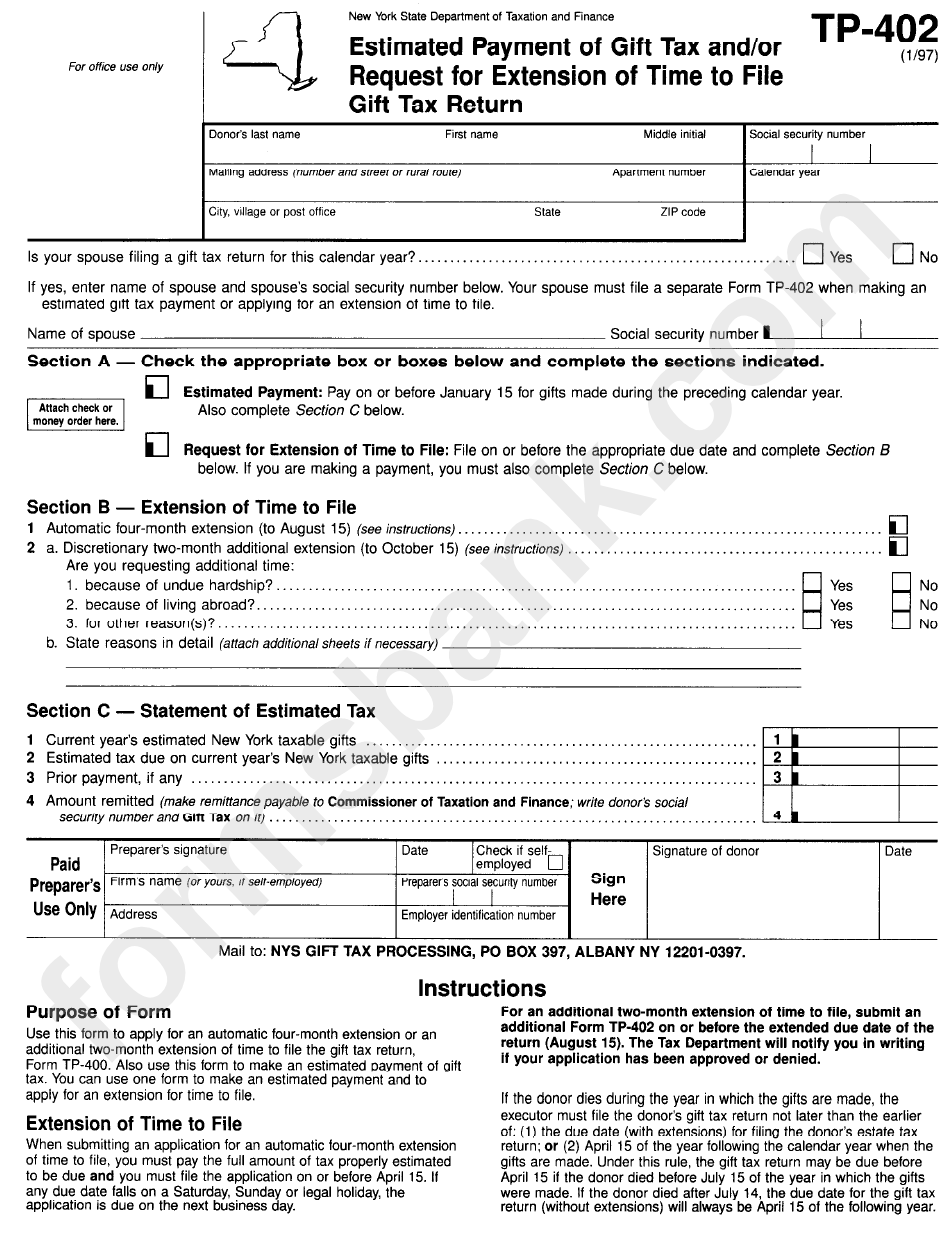

Fillable Form It2105 Estimated Tax Payment Voucher For

Web new york state gives you five options. See important information for nyc residents. Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department of taxation and finance. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Here are.

Tax Withholding Estimator New Job QATAX

Four of these options are based on a percentage of tax from both the prior year and the current year. Full list of tax types; Payments due april 18, june 15, september 15, 2022, and january 17, 2023. Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department.

Nys Estimated Tax Forms Fill Out and Sign Printable PDF Template

Four of these options are based on a percentage of tax from both the prior year and the current year. Web find out how much you'll pay in new york state income taxes given your annual income. The due date for the. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook..

IRS 2220 2020 Fill out Tax Template Online US Legal Forms

Here are new york income tax forms, specific to individual filers: If you would like to make an estimated income tax payment, you can make your payment. Web find out how much you'll pay in new york state income taxes given your annual income. Web watch newsmax live for the latest news and analysis on today's top stories, right here.

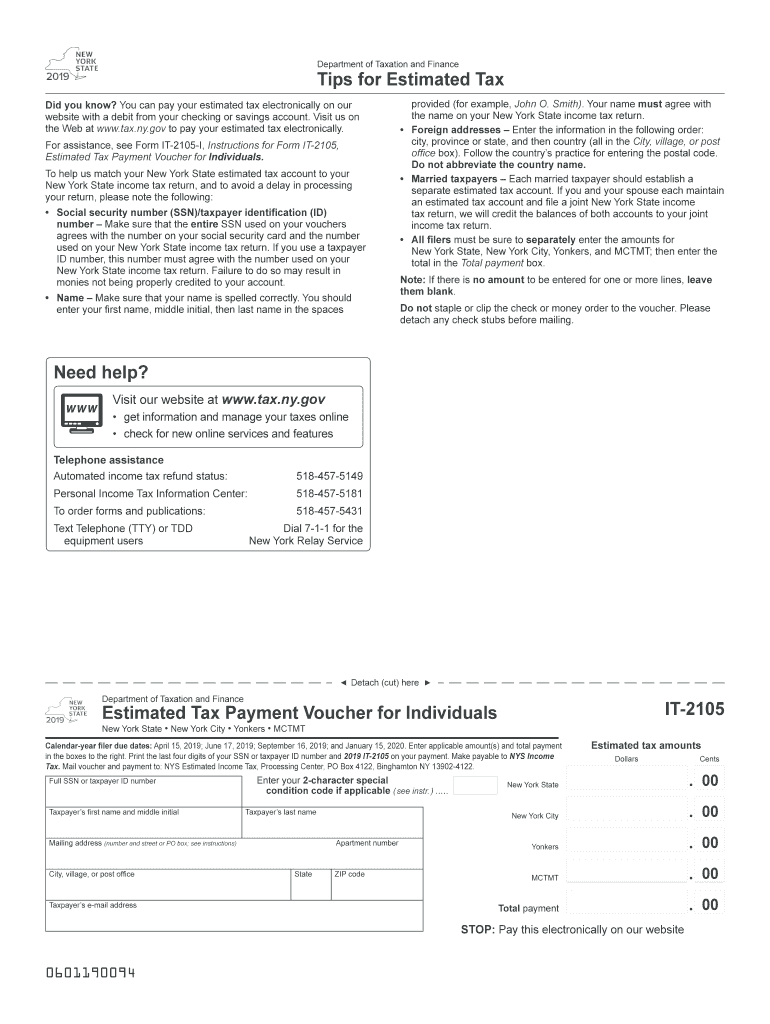

2020 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Here are new york income tax forms, specific to individual filers: Payments due april 18, june 15, september 15, 2023, and january 16, 2024. Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Four of these options are based on.

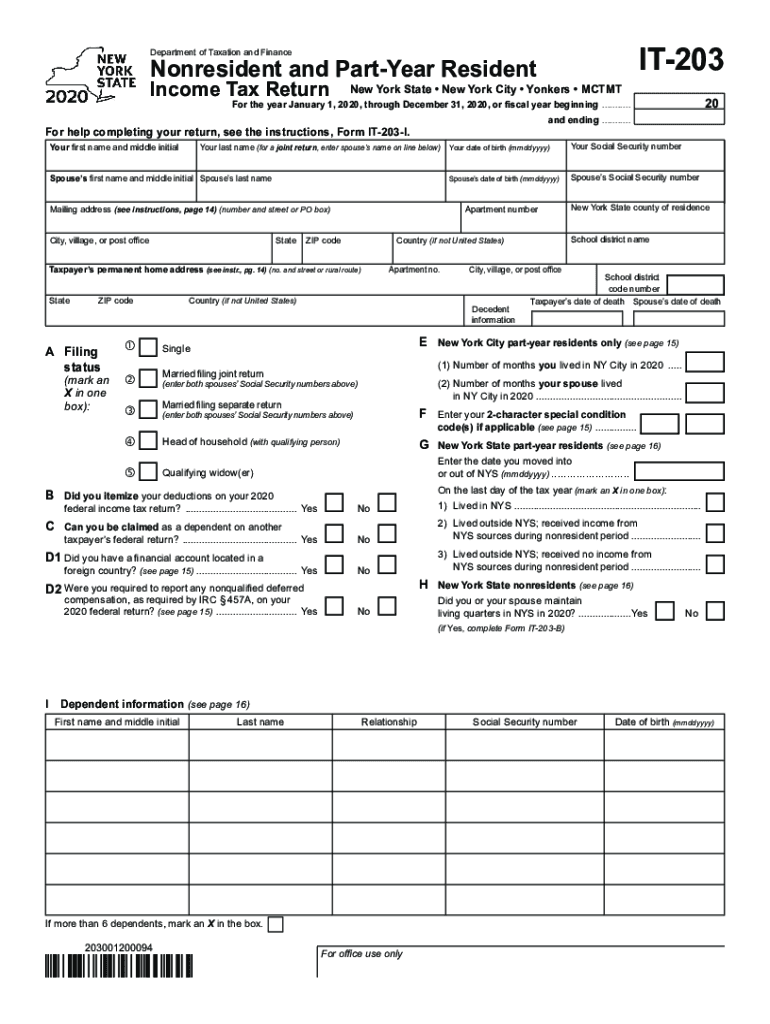

Form Tp402 Estimated Payment Of Gift Tax And/or Request For

Web if you would like to make an estimated income tax payment, you can make your payment directly on our website or use approved tax preparation software. Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department of taxation and finance. See important information for nyc residents. Customize.

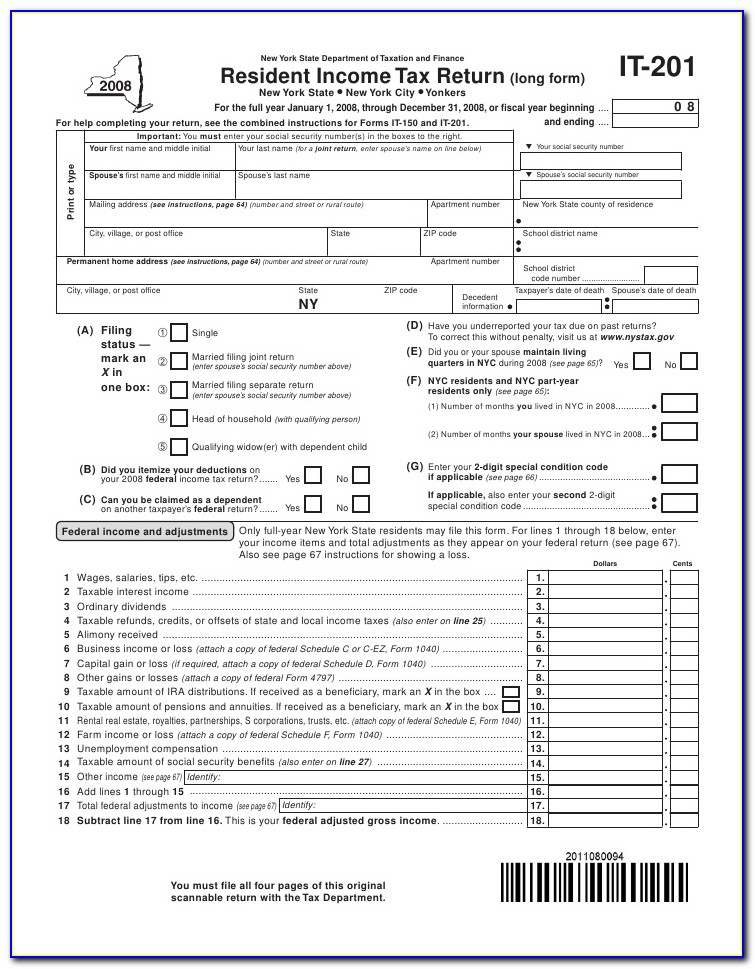

Printable Ny State Tax Form It 201 Form Resume Examples VEk19Rmk8p

Web new york state gives you five options. • the amount of tax you expect to have. Commonly used income tax forms and instructions;. Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Payments due april 18, june 15, september.

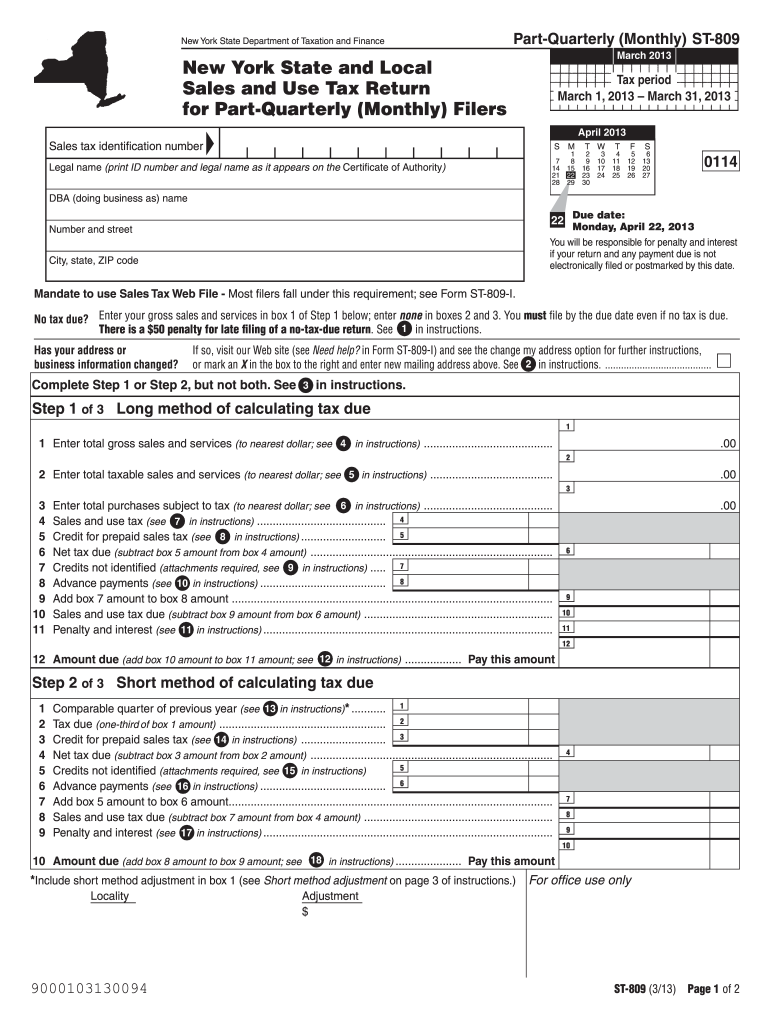

NY ST809 20202022 Fill out Tax Template Online US Legal Forms

Customize using your filing status, deductions, exemptions and more. Web new york state gives you five options. Be sure to verify that the form you are downloading is for the correct year. • the amount of tax you expect to have. Claim for new york city enhanced real property tax credit for.

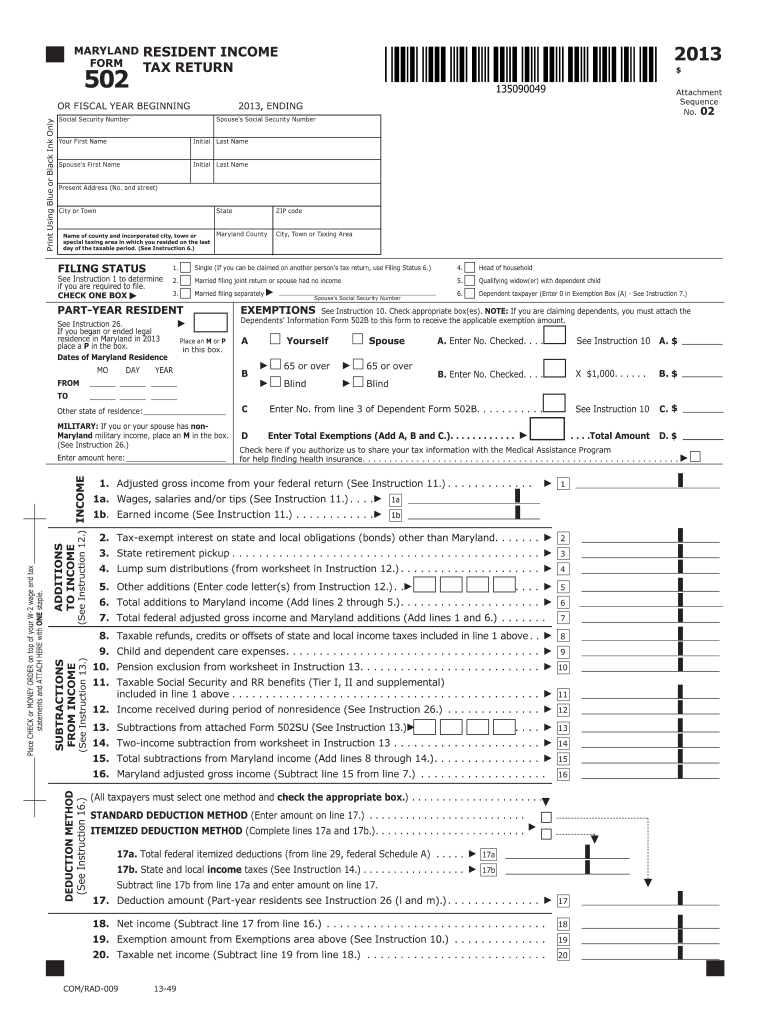

Fillable Md 502 Form Fill Out and Sign Printable PDF Template signNow

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web estimated tax penalties for partnerships and new york s corporations: Customize using your filing status, deductions, exemptions and more. Be sure to verify that the form you are downloading is for the correct year. Here are new york income tax forms,.

2020 Form IRS 1040ES Fill Online, Printable, Fillable, Blank pdfFiller

Full list of tax types; New york income tax forms. Web if the requirements for filing estimated payments file the form on or before the: Four of these options are based on a percentage of tax from both the prior year and the current year. Web porated business or profession in new york city if its estimated tax (line 6.

Web Estimated Income Tax Payment Voucher For Fiduciaries;

Claim for new york city enhanced real property tax credit for. Here are new york income tax forms, specific to individual filers: • the amount of tax you expect to have. New york income tax forms.

See Important Information For Nyc Residents.

Are first met during the taxable year: Payments due april 18, june 15, september 15, 2023, and january 16, 2024. What is this form for? Web estimated tax penalties for partnerships and new york s corporations:

The Due Date For The.

Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Web estimated income tax is the amount of new york state, new york city, and yonkers tax you expect to owe for the year after subtracting: The balance of estimated tax is due as follows: Web report of estimated tax for corporate partners;

Payments Due April 18, June 15, September 15, 2022, And January 17, 2023.

Web find out how much you'll pay in new york state income taxes given your annual income. Payments due april 18, june 15, september 15, 2023, and january 16,. These options are to pay:. Full list of tax types;