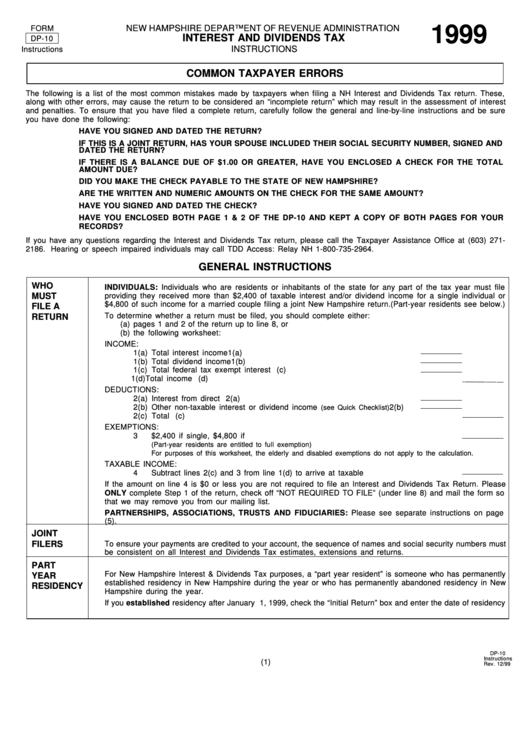

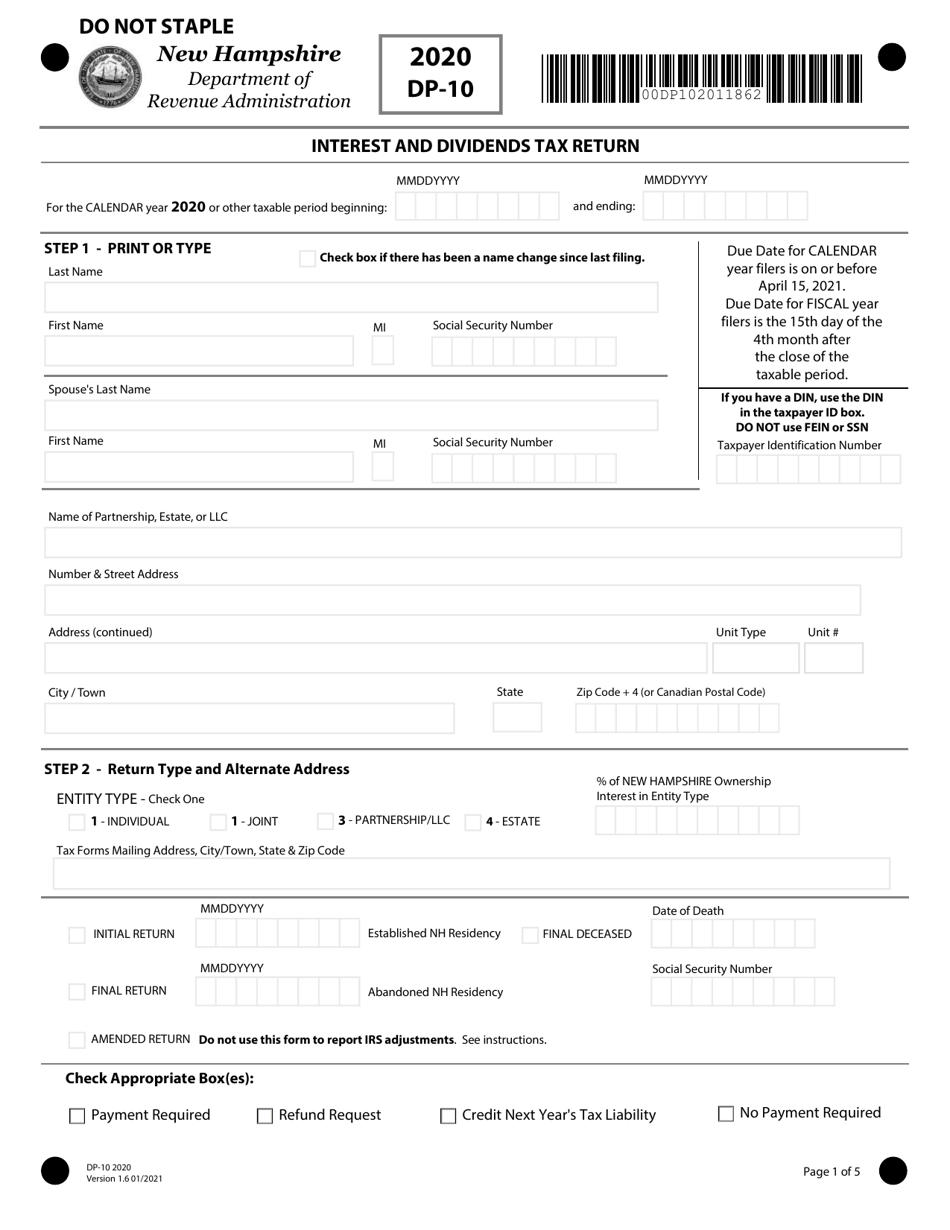

Nh Form Dp 10

Nh Form Dp 10 - There is no filing requirement for nonresidents. Web new hampshire usually releases forms for the current tax year between january and april. Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. Web follow the simple instructions below: If you have a substantive question or need assistance completing a form, please. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. Printable new hampshire state tax. Using our solution submitting nh dp 10 will take a. Experience all the advantages of completing and submitting documents on the internet. This form is for income earned in tax year 2022,.

Web new hampshire usually releases forms for the current tax year between january and april. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. There is no filing requirement for nonresidents. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. Interest and dividends tax return. This form is for income earned in tax year 2022,. Web follow the simple instructions below: New hampshire department of revenue administration. Printable new hampshire state tax. If you have a substantive question or need assistance completing a form, please.

Using our solution submitting nh dp 10 will take a. Web new hampshire usually releases forms for the current tax year between january and april. Web interest and dividends tax instructions. Web follow the simple instructions below: If you have a substantive question or need assistance completing a form, please. Interest and dividends tax return. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Experience all the advantages of completing and submitting documents on the internet. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. New hampshire department of revenue administration.

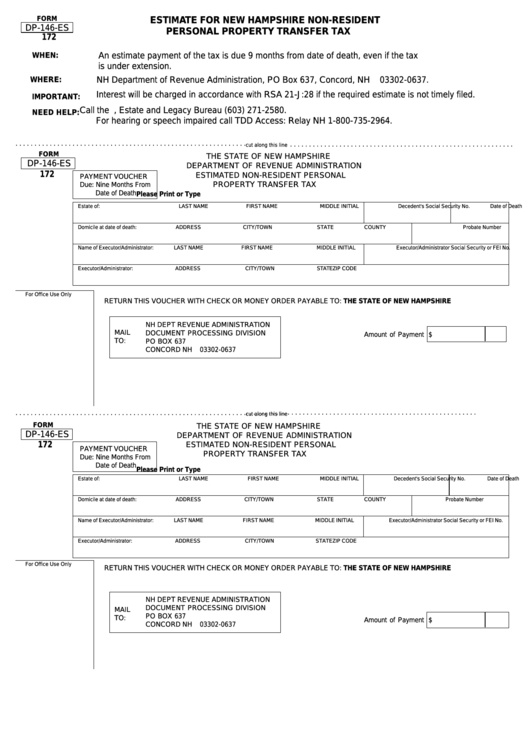

Form Dp146Es Estimate For New Hampshire NonResident Personal

Web interest and dividends tax instructions. Web follow the simple instructions below: This form is for income earned in tax year 2022,. There is no filing requirement for nonresidents. Experience all the advantages of completing and submitting documents on the internet.

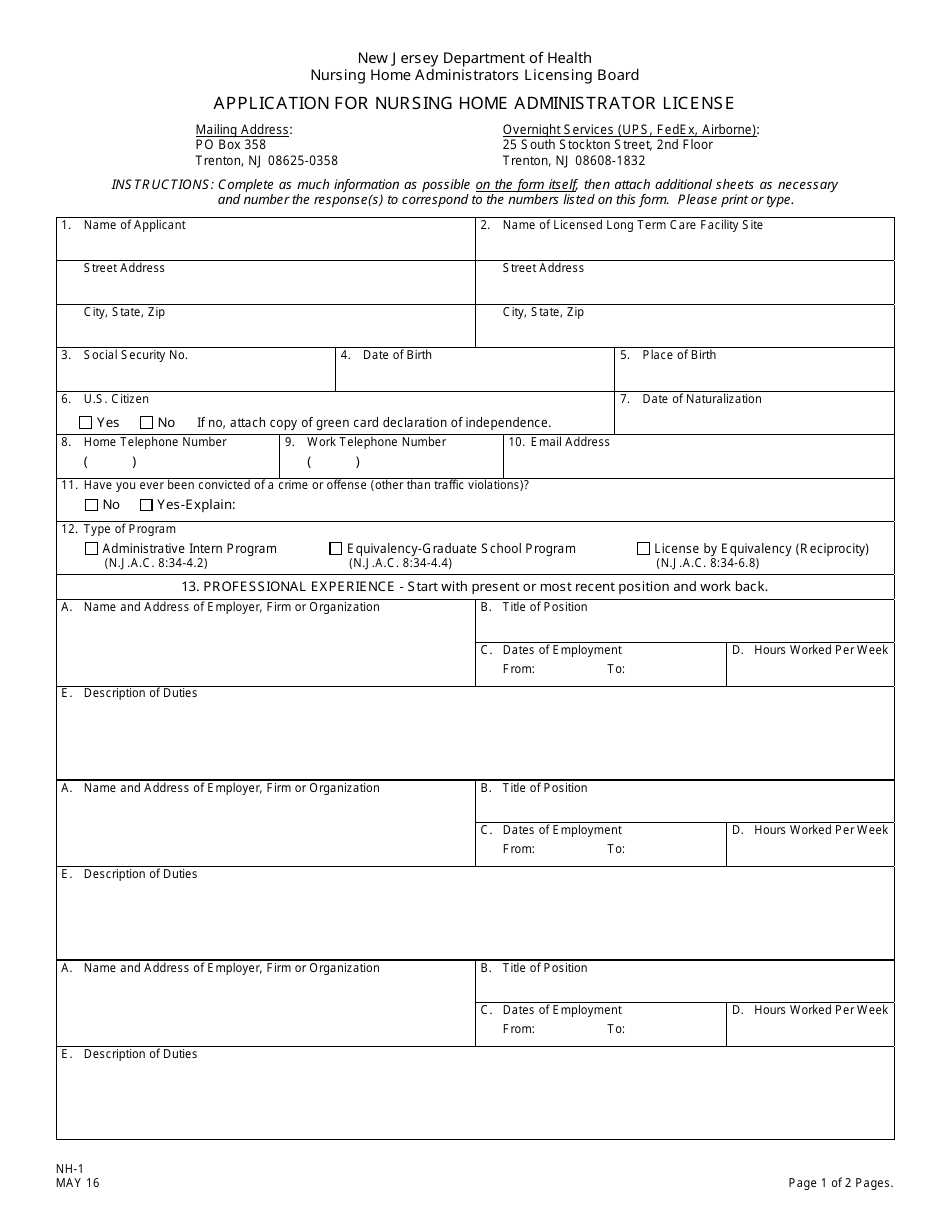

Form NH1 Download Printable PDF or Fill Online Application for Nursing

Interest and dividends tax return. Using our solution submitting nh dp 10 will take a. Experience all the advantages of completing and submitting documents on the internet. Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. There is no requirement for nonresidents.

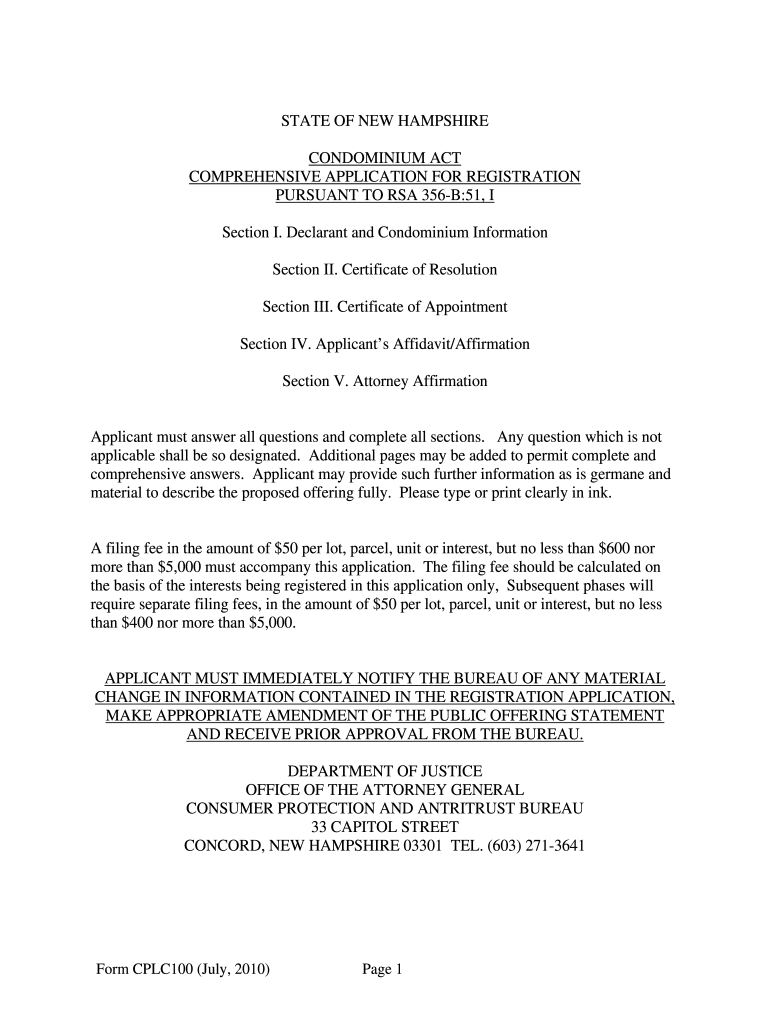

Nh Form Condominium Fill Online, Printable, Fillable, Blank pdfFiller

New hampshire department of revenue administration. Printable new hampshire state tax. Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web interest and dividends tax instructions.

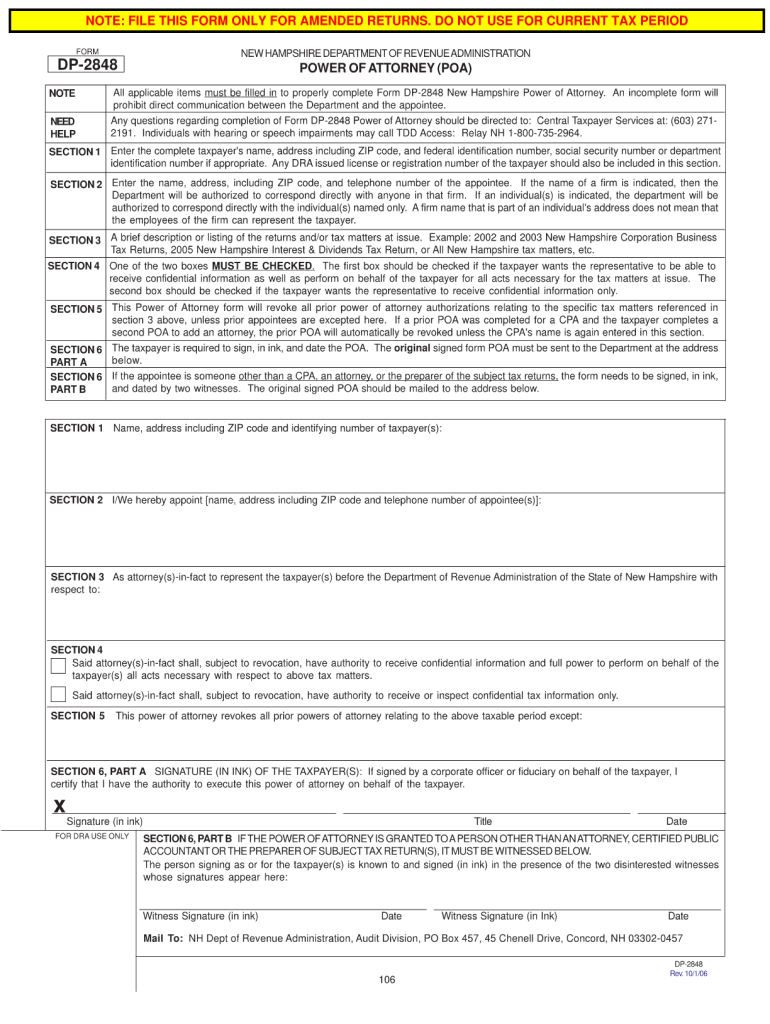

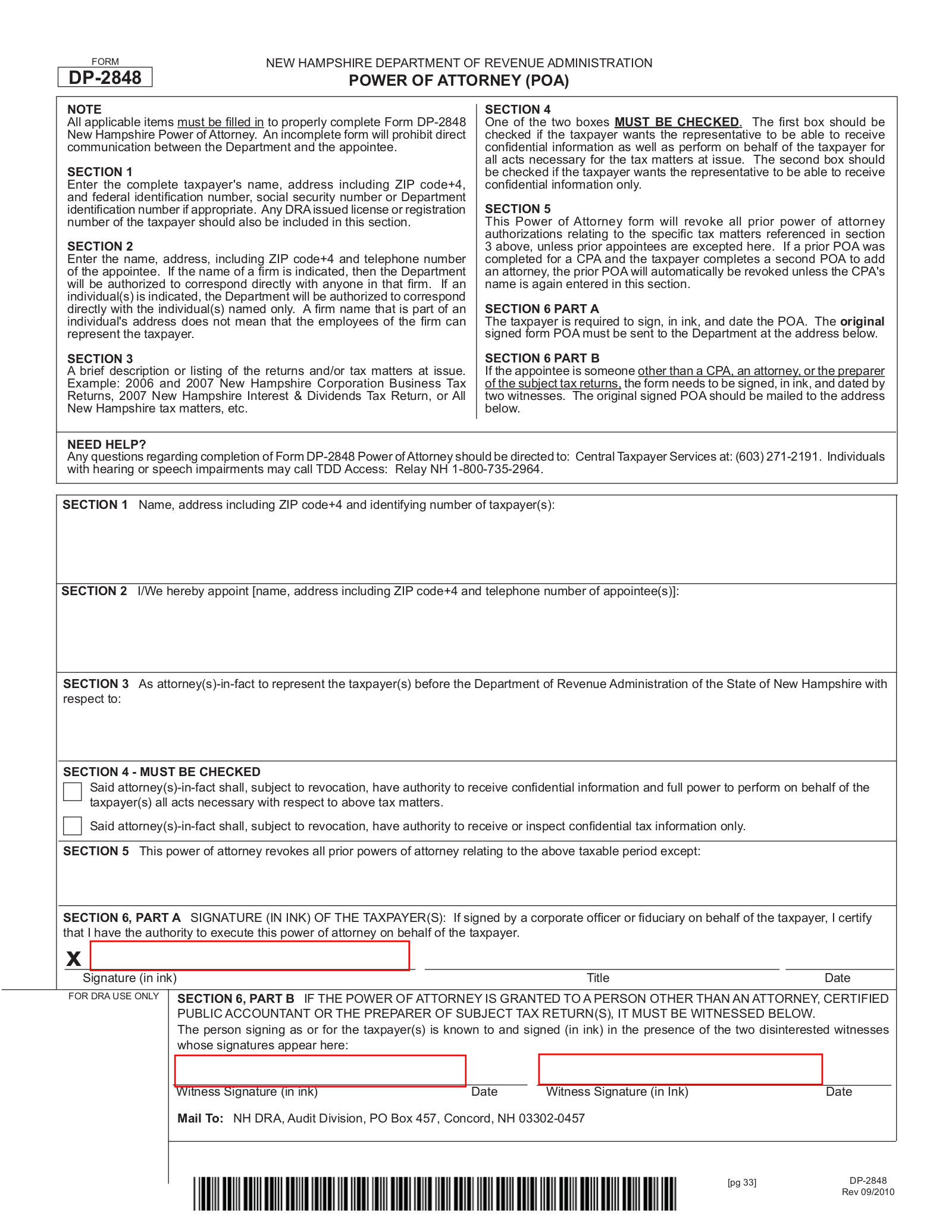

NH DP2848 2006 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web interest and dividends tax instructions. Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. Printable new hampshire state tax.

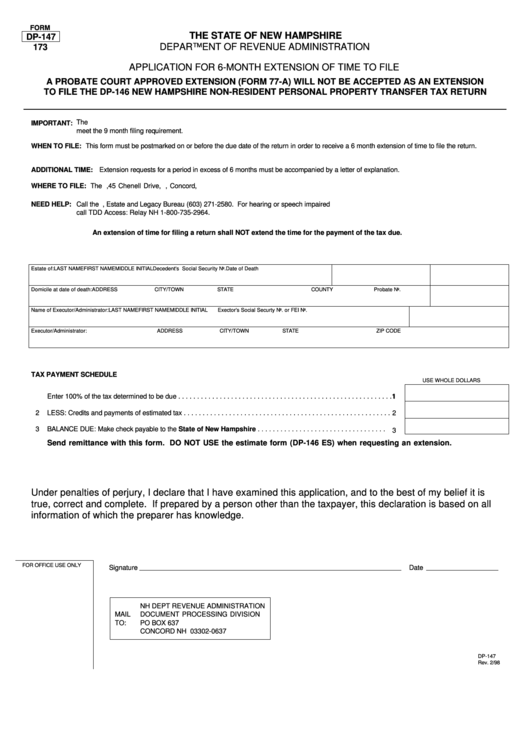

Form Dp147 Application For 6Month Extension Of Time To File New

Interest and dividends tax return. New hampshire department of revenue administration. This form is for income earned in tax year 2022,. Experience all the advantages of completing and submitting documents on the internet. Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more.

Free New Hampshire Tax (Dept. of Revenue) Power of Attorney (Form DP

If you have a substantive question or need assistance completing a form, please. Experience all the advantages of completing and submitting documents on the internet. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web follow the.

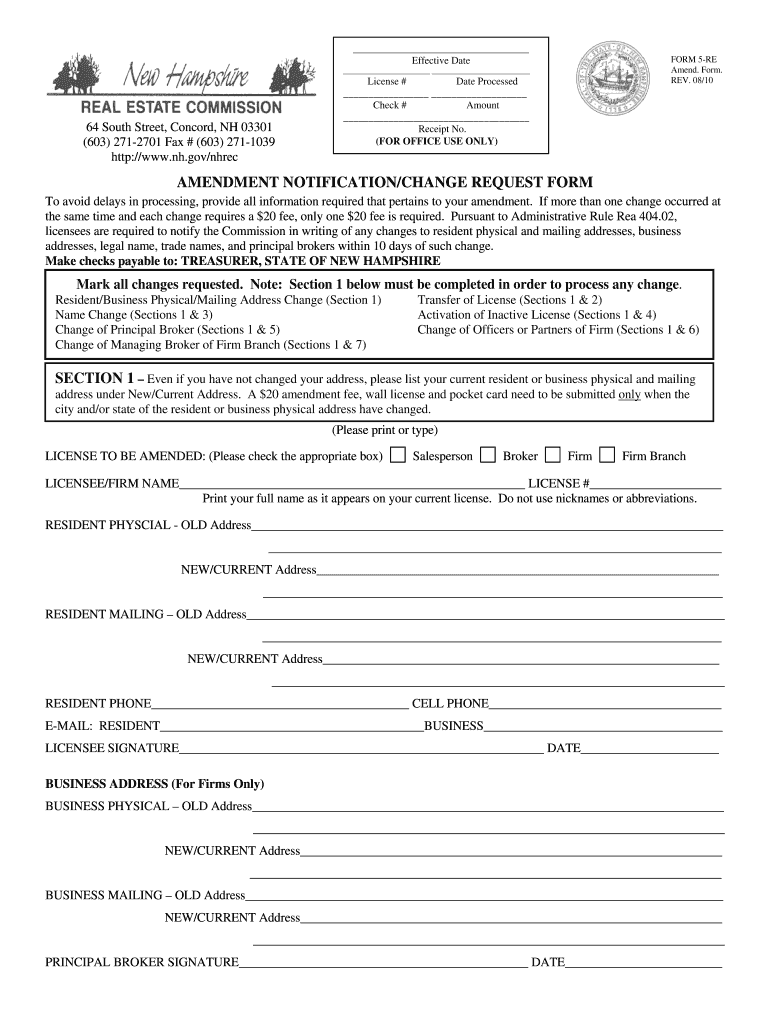

NH Form 5RE 2010 Fill and Sign Printable Template Online US Legal

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web new hampshire usually releases forms for the current tax year between january and april. Web follow the simple instructions below: Printable new hampshire state tax. Experience all the advantages of completing and submitting documents on the internet.

Form Dp10 Interest And Dividends Tax Instructions New Hampshire

Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. There is no filing requirement for nonresidents. Web new hampshire usually releases forms for the current tax year between january and april. Web follow the simple instructions below: While most taxpayers have income taxes automatically withheld every pay.

2019 Form NH DoR DP14 Fill Online, Printable, Fillable, Blank pdfFiller

Experience all the advantages of completing and submitting documents on the internet. Printable new hampshire state tax. This form is for income earned in tax year 2022,. Web new hampshire usually releases forms for the current tax year between january and april. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers.

Form DP10 Download Fillable PDF or Fill Online Interest and Dividends

New hampshire department of revenue administration. Using our solution submitting nh dp 10 will take a. Experience all the advantages of completing and submitting documents on the internet. This form is for income earned in tax year 2022,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers.

New Hampshire Department Of Revenue Administration.

Individuals who are residents or inhabitants of the state for any part of the tax year must file providing they received more. Web new hampshire usually releases forms for the current tax year between january and april. Web follow the simple instructions below: This form is for income earned in tax year 2022,.

While Most Taxpayers Have Income Taxes Automatically Withheld Every Pay Period By Their Employer, Taxpayers.

Web interest and dividends tax instructions. It’s a mandatory tax form to file if you received more than $2,400 in interests and dividends. Interest and dividends tax return. Printable new hampshire state tax.

There Is No Filing Requirement For Nonresidents.

If you have a substantive question or need assistance completing a form, please. Experience all the advantages of completing and submitting documents on the internet. Using our solution submitting nh dp 10 will take a. There is no requirement for nonresidents.