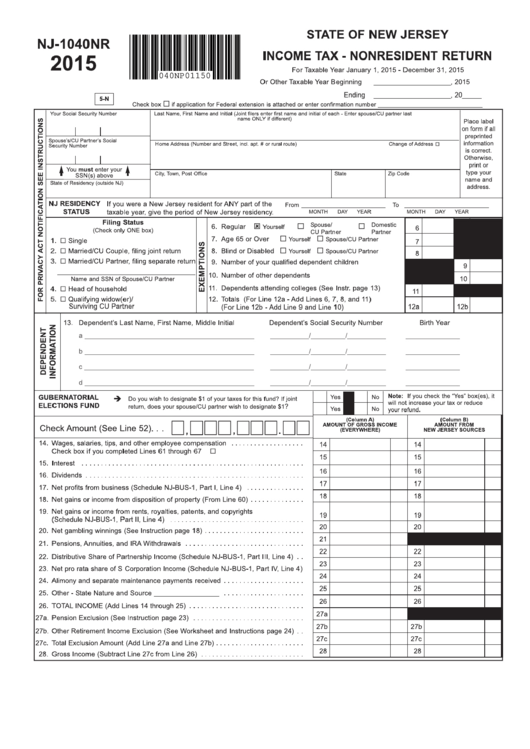

Nj Form 1040Nr

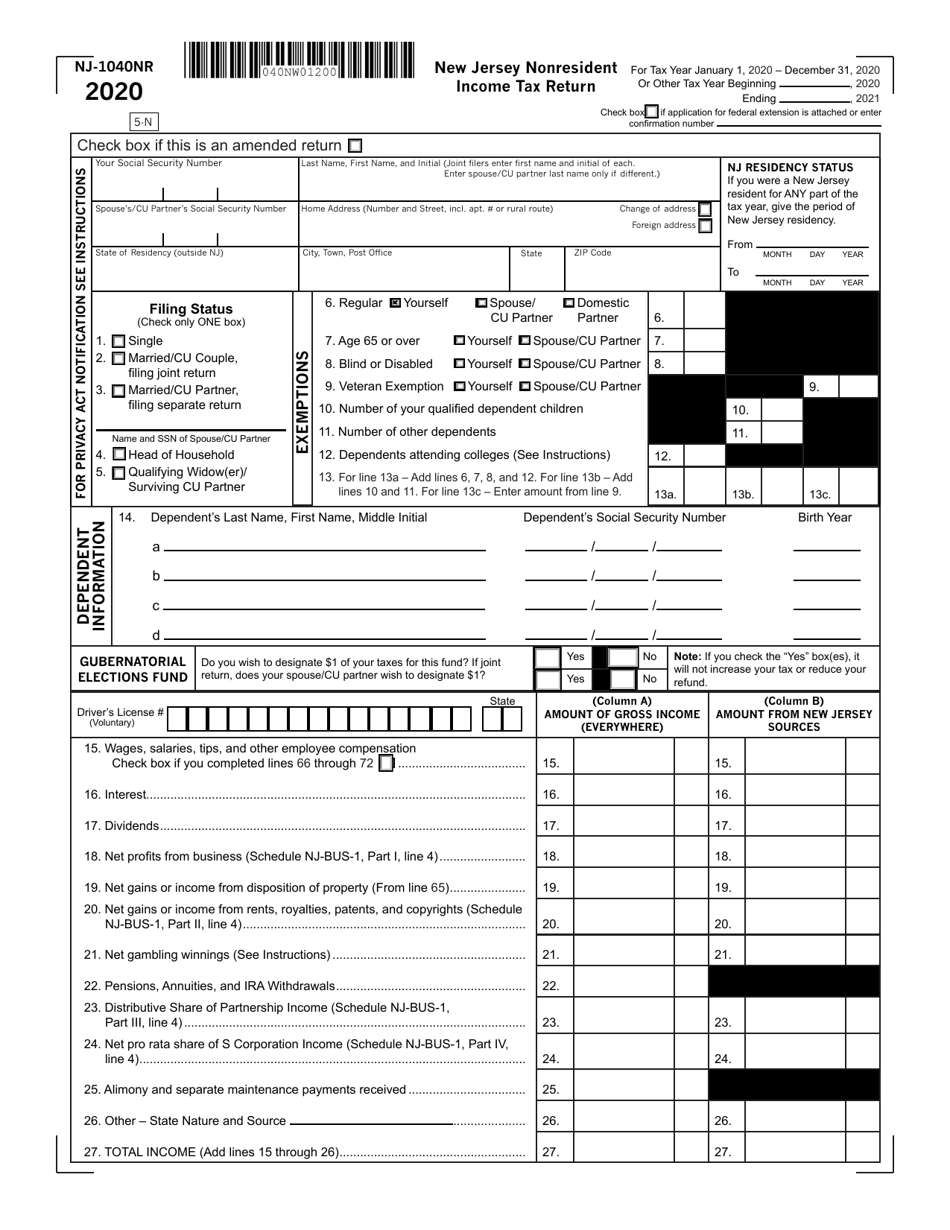

Nj Form 1040Nr - New jersey resident returns state of. Web if you had any income from new jersey sources while you were a nonresident, you may also need to file a new jersey nonresident return (form nj. Ad complete irs tax forms online or print government tax documents. Web 2019 new jersey income tax nonresident return what you need to know: Try it for free now! Filing requirements do you have to file?. Complete, edit or print tax forms instantly. Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the. You can download or print. Last name, first name, and initial (joint filers enter first name and initial of each.

Web 2019 new jersey income tax nonresident return what you need to know: Nonresident alien income tax return department of the treasury internal revenue service contents page Web this form must be filed by all out of state or part time resident taxpayers who earned over $10,000 in new jersey over the last year (or $20,000 if filing as a couple or head of ho. Web if you had any income from new jersey sources while you were a nonresident, you may also need to file a new jersey nonresident return (form nj. Enter spouse/cu partner last name only if. Try it for free now! Department of the treasury—internal revenue service. Complete, edit or print tax forms instantly. • use only blue or black ink. Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the.

Web if you had any income from new jersey sources while you were a nonresident, you may also need to file a new jersey nonresident return (form nj. Try it for free now! Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Irs use only—do not write or staple in. Estimated income tax payment voucher for 2023. Filing requirements do you have to file?. Enter spouse/cu partner last name only if. Upload, modify or create forms. • use only blue or black ink.

Index of /Newsletter/1040NR

Web 2019 new jersey income tax nonresident return what you need to know: Department of the treasury—internal revenue service. Upload, modify or create forms. Filing requirements do you have to file?. Nonresident alien income tax return.

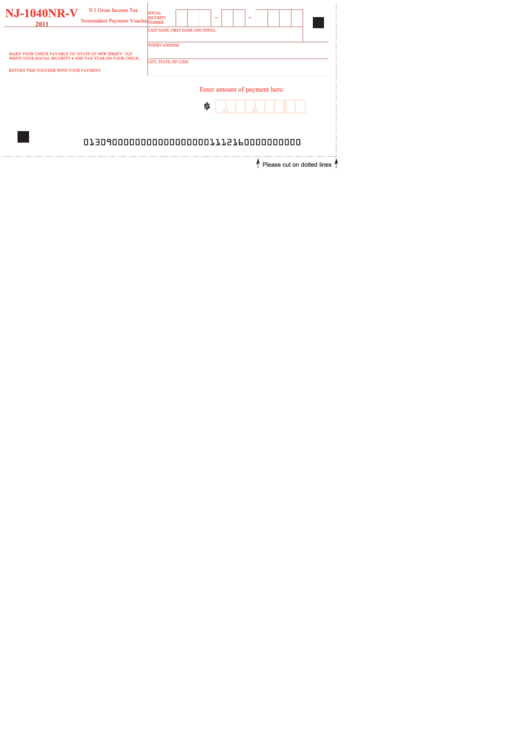

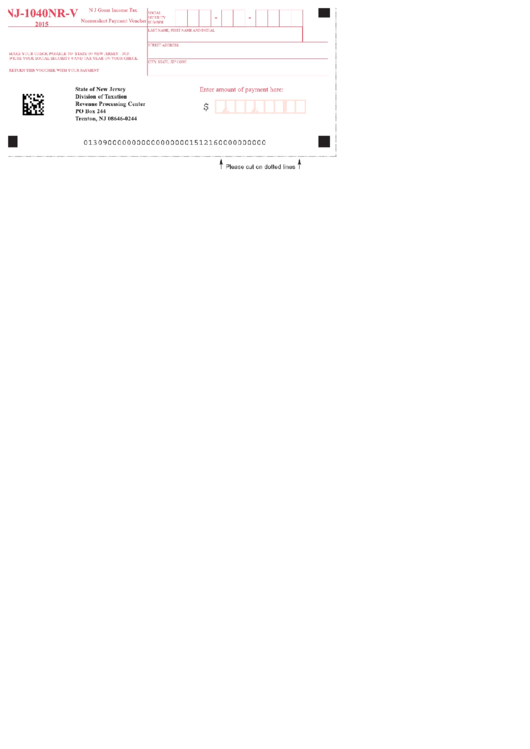

Fillable Form Nj1040nrV Nj Gross Tax Nonresident Payment

Web this form must be filed by all out of state or part time resident taxpayers who earned over $10,000 in new jersey over the last year (or $20,000 if filing as a couple or head of ho. Ad complete irs tax forms online or print government tax documents. Last name, first name, and initial (joint filers enter first name.

Tenant Homestead Rebate Instructions

Estimated income tax payment voucher for 2023. Web application for extension of time to file income tax return. New jersey resident returns state of. • use only blue or black ink. Web if you had any income from new jersey sources while you were a nonresident, you may also need to file a new jersey nonresident return (form nj.

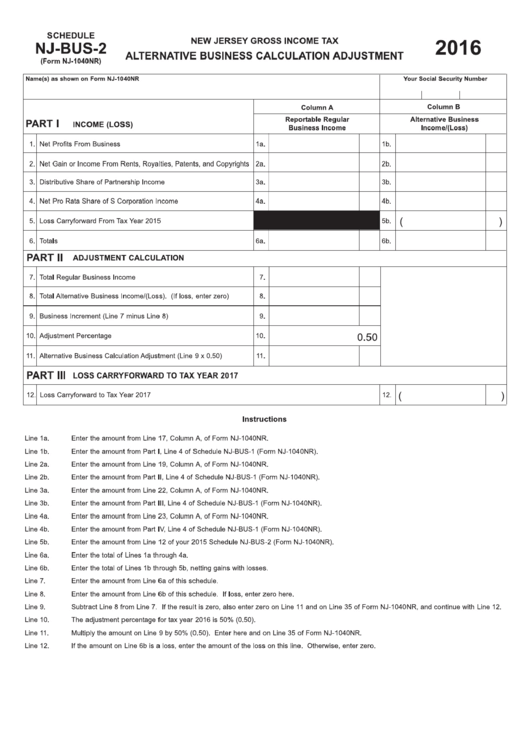

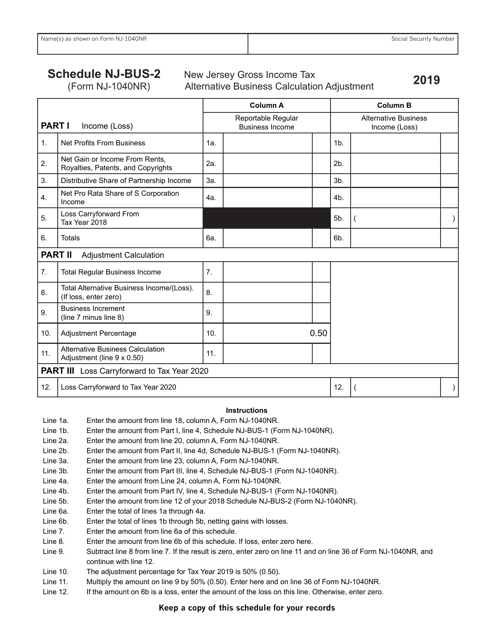

Fillable Form Nj1040nr Alternative Business Calculation Adjustment

Upload, modify or create forms. Enter spouse/cu partner last name only if. Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the. You can download or print. Filing requirements do you have to file?.

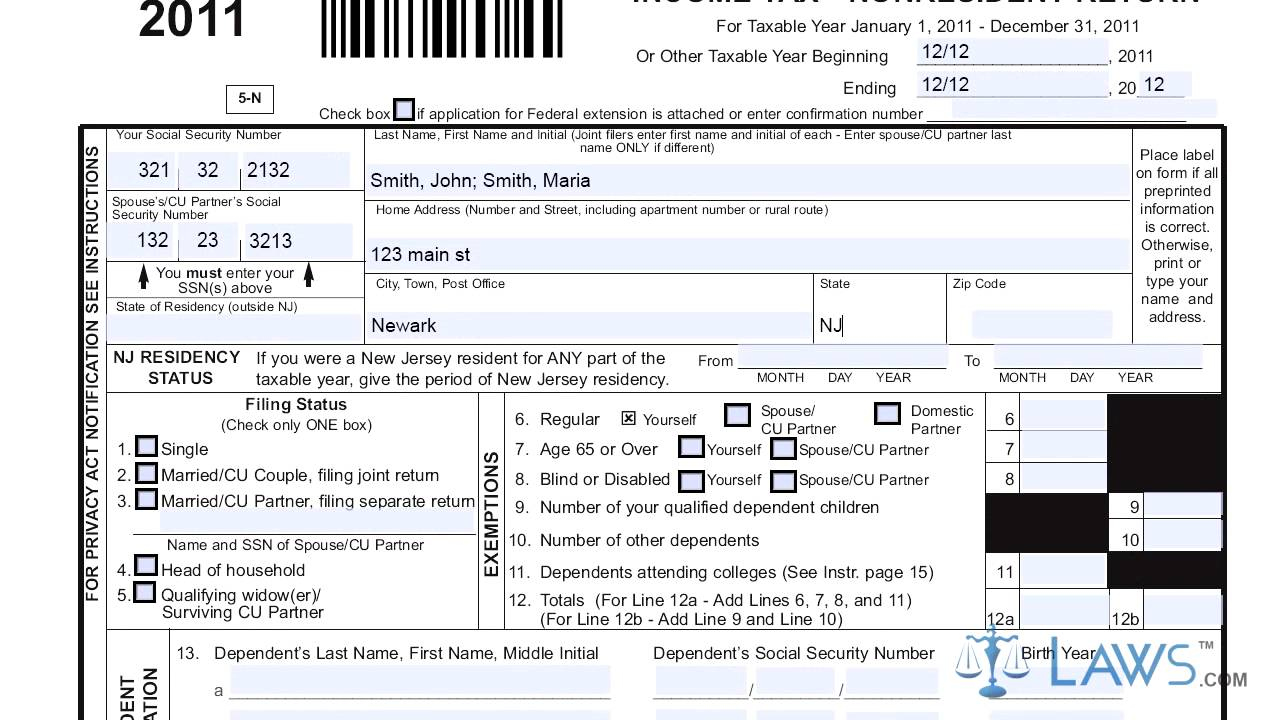

Form NJ 1040NR Tax Nonresident Return YouTube 1040 Form Printable

Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the. Web this form must be filed by all out of state or part time resident taxpayers who earned over $10,000 in new jersey over the last year (or $20,000 if filing.

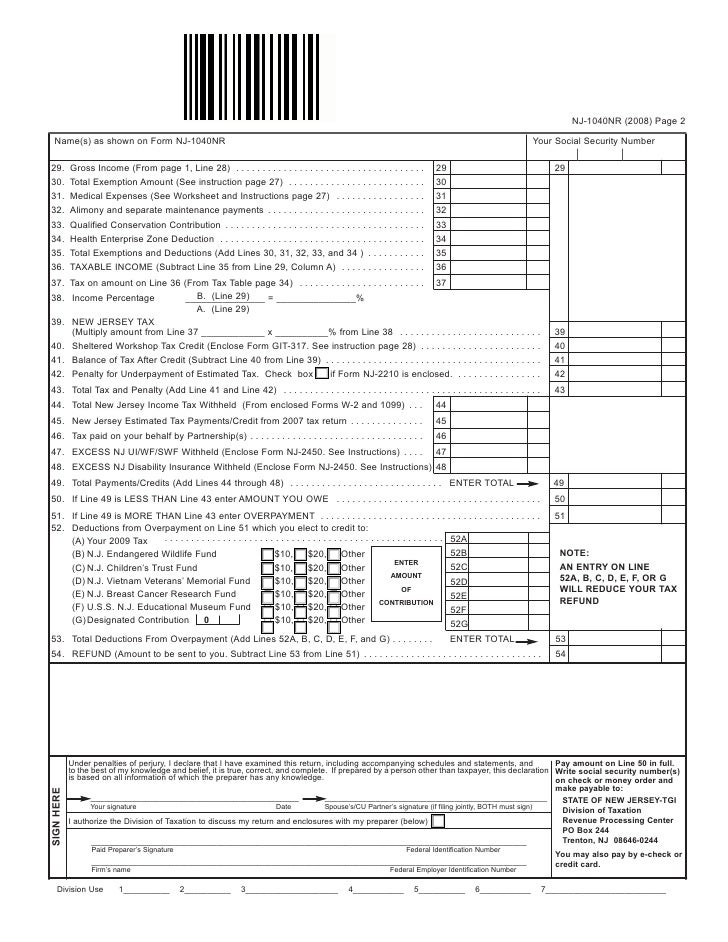

Fillable Form Nj1040nr NonResident Tax Return 2015

Filing requirements do you have to file?. Department of the treasury—internal revenue service. Web application for extension of time to file income tax return. Try it for free now! Complete, edit or print tax forms instantly.

Download Instructions for Form NJ1040NR New Jersey Tax

Estimated income tax payment voucher for 2023. • do not staple, paper clip, tape, or use any other fastening device. You can download or print. Enter spouse/cu partner last name only if. Nonresident alien income tax return.

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Schedule lep (form 1040), request for change in language preference. Web this form must be filed by all out of state or part time resident taxpayers who earned over $10,000 in new jersey over the last year (or $20,000 if filing as a couple or head of ho. Web 2019 new jersey income tax nonresident return what you need to.

Form NJ1040NR Schedule NJBUS2 Download Fillable PDF or Fill Online

• use only blue or black ink. Web 2019 new jersey income tax nonresident return what you need to know: Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the. Ad complete irs tax forms online or print government tax documents..

Enter Spouse/Cu Partner Last Name Only If.

You can download or print. • do not staple, paper clip, tape, or use any other fastening device. • use only blue or black ink. New jersey resident returns state of.

Web If You Had Any Income From New Jersey Sources While You Were A Nonresident, You May Also Need To File A New Jersey Nonresident Return (Form Nj.

Upload, modify or create forms. Last name, first name, and initial (joint filers enter first name and initial of each. Estimated income tax payment voucher for 2023. Web this form must be filed by all out of state or part time resident taxpayers who earned over $10,000 in new jersey over the last year (or $20,000 if filing as a couple or head of ho.

Department Of The Treasury—Internal Revenue Service.

Nonresident alien income tax return. Nonresident alien income tax return department of the treasury internal revenue service contents page Web 2019 new jersey income tax nonresident return what you need to know: Web be sure that form nj‐nr‐a is enclosed with form nj‐1040nr, nj‐1041, or nj‐1065, and that the name and address on the business allocation schedule agree exactly with the.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Try it for free now! Complete, edit or print tax forms instantly. Filing requirements do you have to file?. Web application for extension of time to file income tax return.