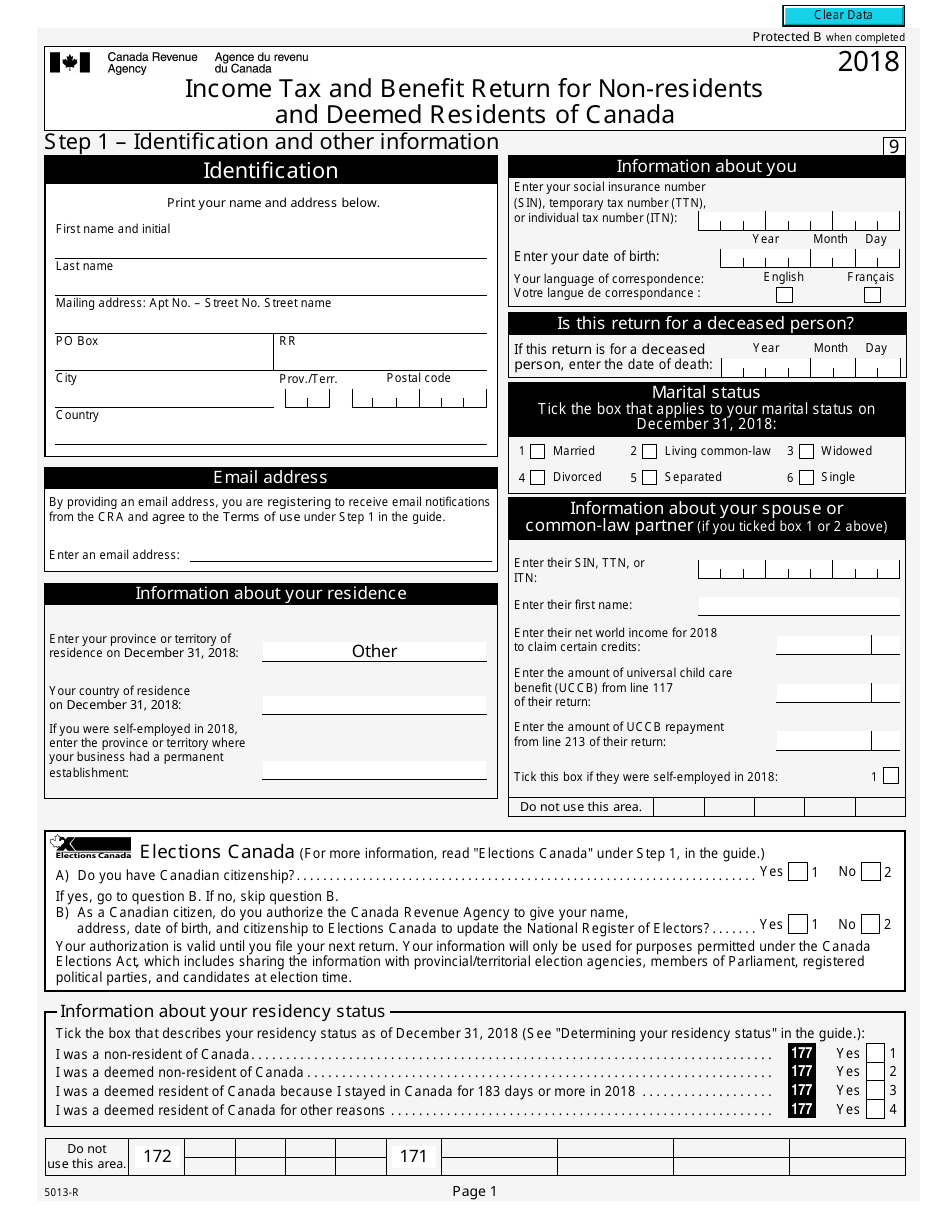

Non Resident Tax Form Canada

Non Resident Tax Form Canada - Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) According to the cra, individuals who normally,. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. The cra publishes the form and. This is the amount to be. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Tax you withheld from the nonresident partners or shareholders. This guide will walk you through the rules and. There are many tax implications to be considered for those who earned income in canada and who may call. Web shareholders are missouri residents.

The cra publishes the form and. According to the cra, individuals who normally,. Tax you withheld from the nonresident partners or shareholders. There are many tax implications to be considered for those who earned income in canada and who may call. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This guide will walk you through the rules and. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Web shareholders are missouri residents.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. For best results, download and open this form in adobe reader. This is the amount to be. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. According to the cra, individuals who normally,. The cra publishes the form and. Web shareholders are missouri residents. Tax you withheld from the nonresident partners or shareholders. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship.

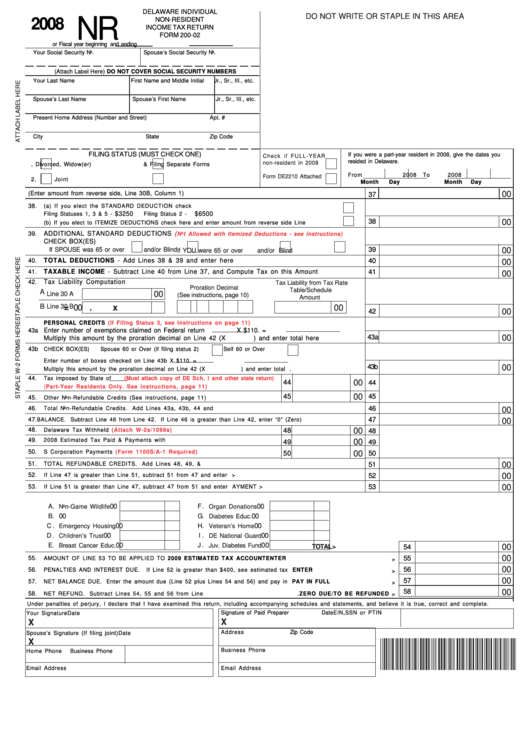

Fillable Form 20002 Delaware Individual NonResident Tax

This is the amount to be. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. According to the cra, individuals who normally,. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Tax you.

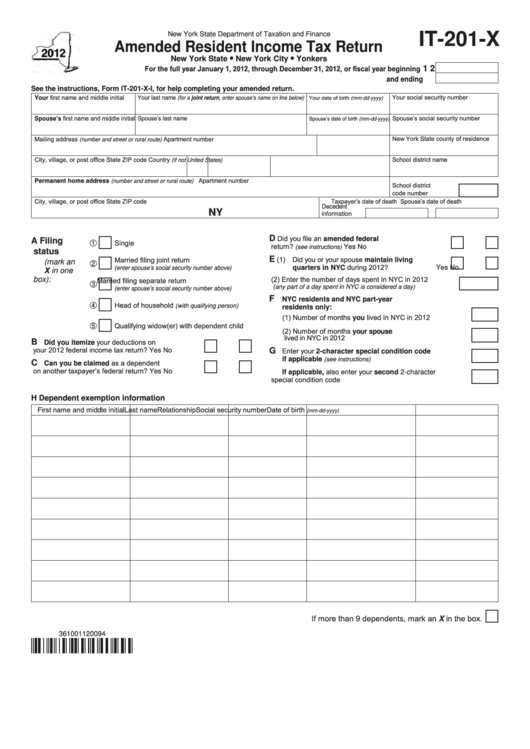

Fillable Form It201X Amended Resident Tax Return 2012

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. This guide will walk you through the rules and. The cra publishes the form and. For best results, download and open this form in adobe reader. There are many tax implications to be considered for those who earned.

NonResident tax services for Canada Tax Doctors Canada

This guide will walk you through the rules and. The cra publishes the form and. This is the amount to be. Tax you withheld from the nonresident partners or shareholders. Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states.

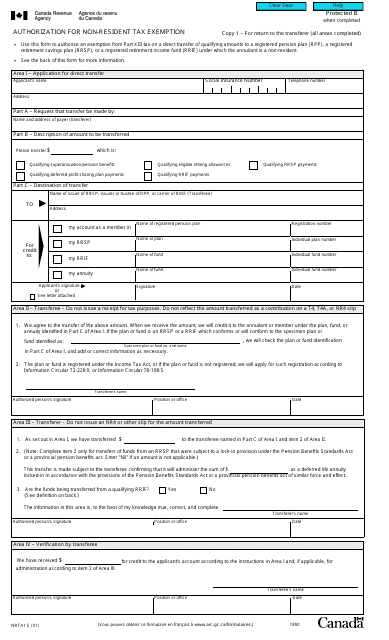

Form NRTA1 Download Fillable PDF or Fill Online Authorization for Non

This is the amount to be. Tax you withheld from the nonresident partners or shareholders. According to the cra, individuals who normally,. The cra publishes the form and. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship.

How much tax does a nonresident Canadian citizen have to pay annually

The cra publishes the form and. According to the cra, individuals who normally,. This guide will walk you through the rules and. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

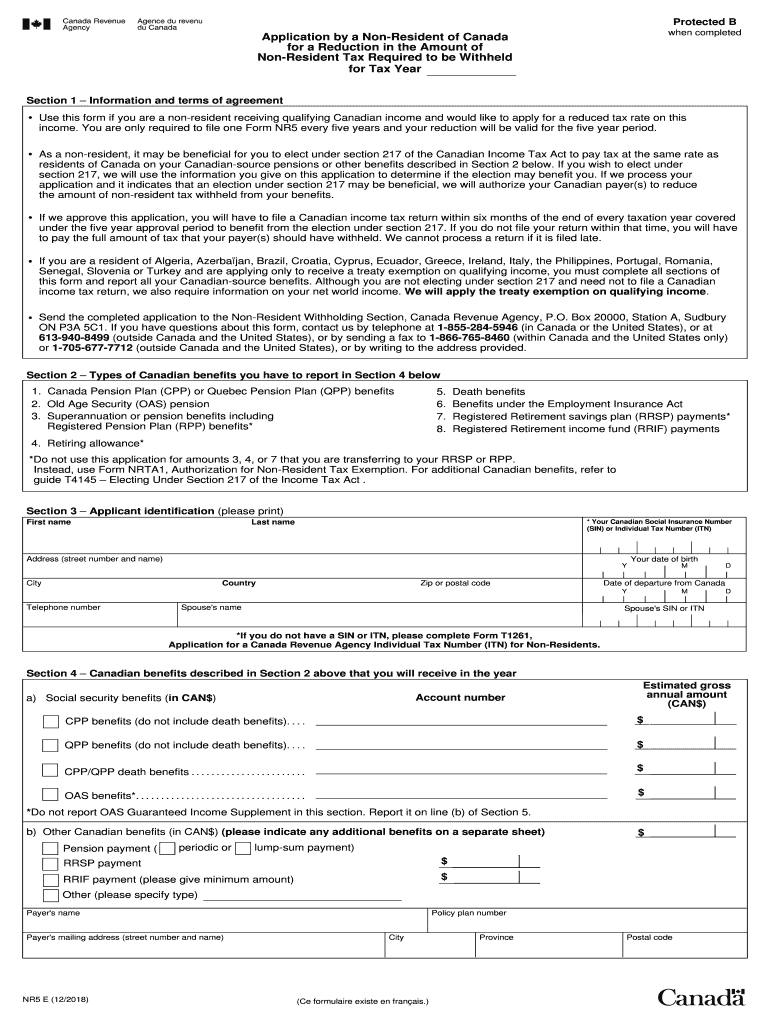

Nr5 Fill Out and Sign Printable PDF Template signNow

The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Tax you withheld from the nonresident partners or shareholders. The cra publishes the form and. According to the cra, individuals who normally,.

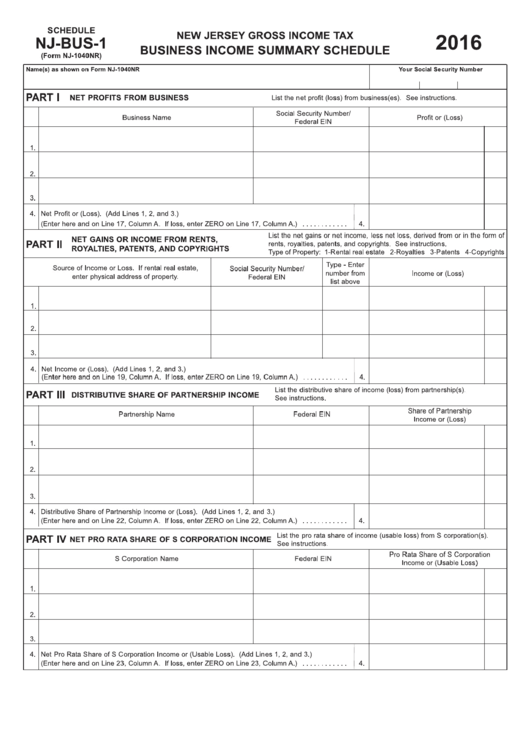

Fillable Form Nj1040nr NonResident Tax Return 2016

For best results, download and open this form in adobe reader. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. The cra publishes the form and. There are many tax implications to be considered for those who earned income in canada and who may call. The nonresident.

Tax from nonresidents in Spain, what is it and how to do it properly

According to the cra, individuals who normally,. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Web shareholders are missouri residents. The cra publishes the form.

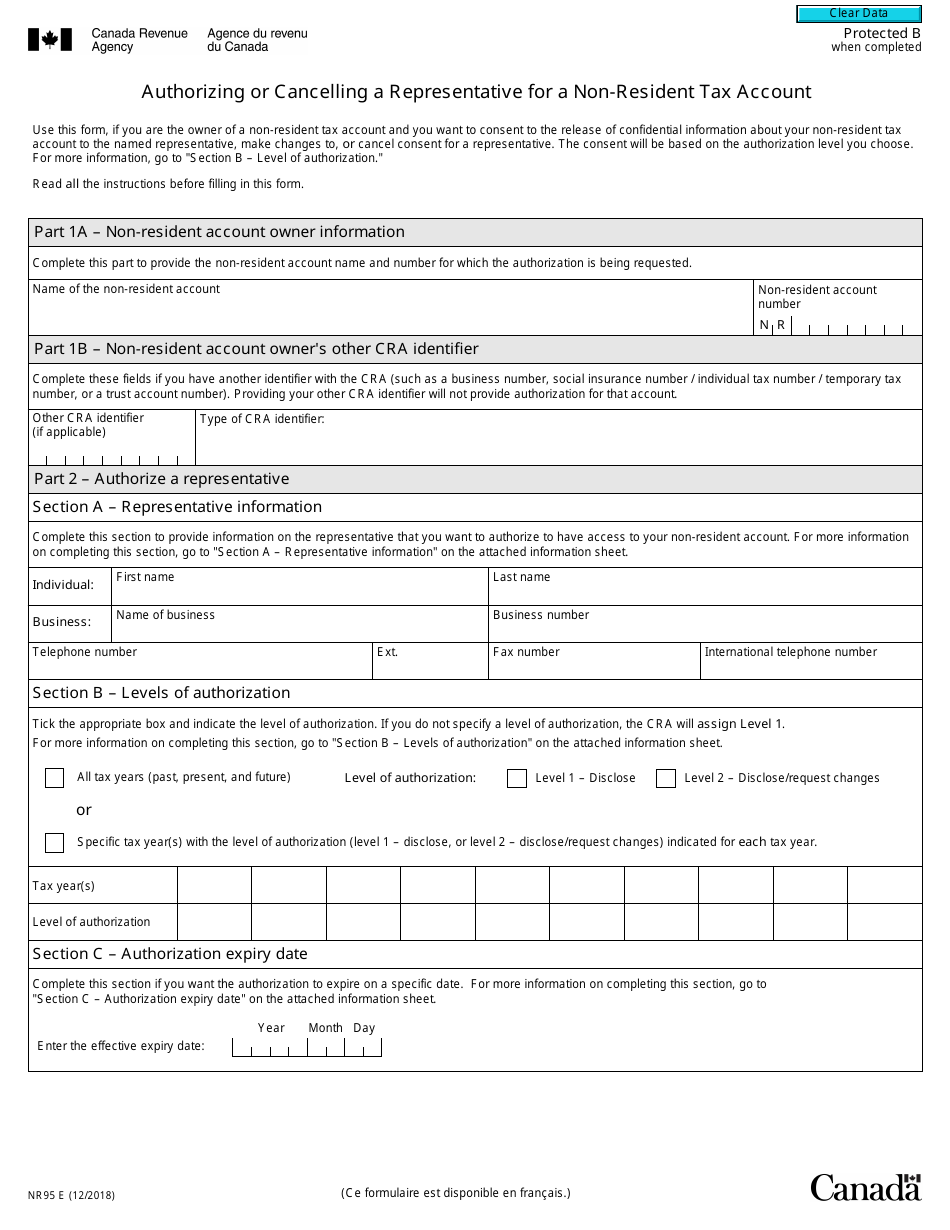

Form NR95 Download Fillable PDF or Fill Online Authorizing or

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. This guide will walk you through the rules and. According to the cra, individuals who normally,. This is the amount to be. Web shareholders are missouri residents.

Revenue Canada 2012 Tax Return Forms designedbycarl

According to the cra, individuals who normally,. For best results, download and open this form in adobe reader. Tax you withheld from the nonresident partners or shareholders. There are many tax implications to be considered for those who earned income in canada and who may call. The cra publishes the form and.

This Guide Will Walk You Through The Rules And.

Web per missouri code section 143.121, if a nonresident taxpayer reported property taxes paid to another state on federal schedule a, the amount of property taxes paid to certain states. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This is the amount to be. The cra publishes the form and.

Web Shareholders Are Missouri Residents.

The nonresident shareholder must report his or her share of the missouri income and missouri source modifications indicated on form mo. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship. Tax you withheld from the nonresident partners or shareholders. According to the cra, individuals who normally,.

There Are Many Tax Implications To Be Considered For Those Who Earned Income In Canada And Who May Call.

For best results, download and open this form in adobe reader.