Ny 529 Tax Form

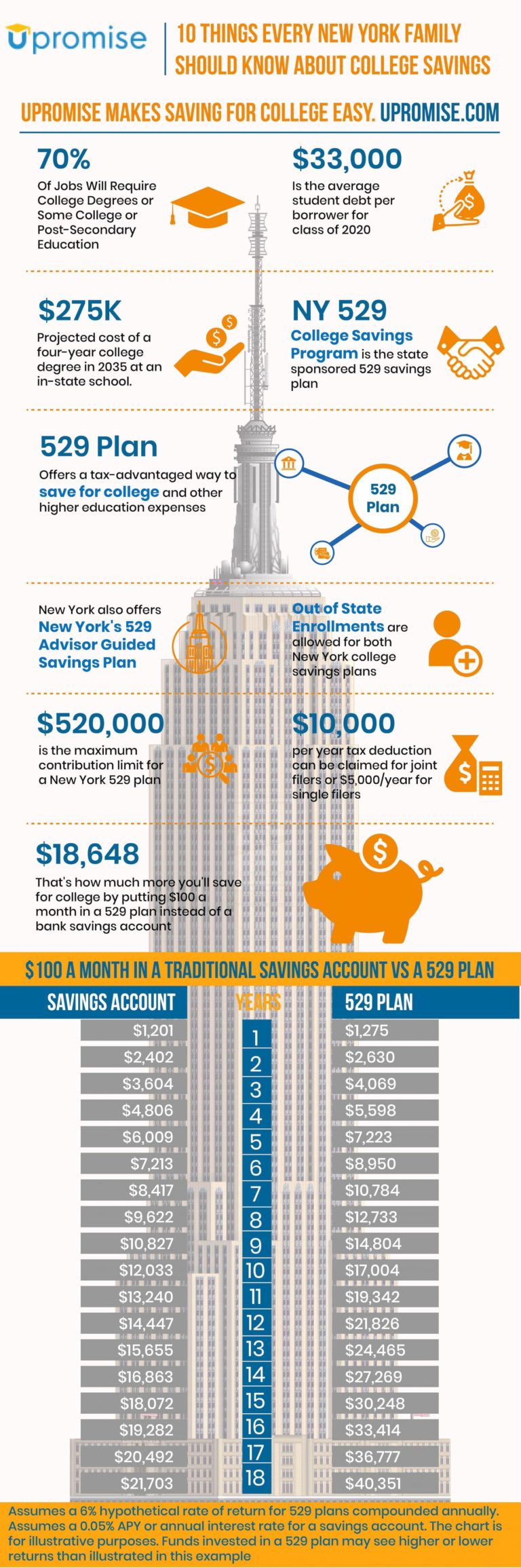

Ny 529 Tax Form - New york's 529 college savings program direct plan p.o. However, they are deductible on your ny return. Web forms can be downloaded from our website at. Ad your ny 529 account can pay for more than tuition, like room/board & books. We will show you just how much money you can save. Enter the contributions that were made to an. When you are in your ny return,. There are no federal or state tax forms reporting 529 contributions. Learn more though the program’s frequently asked questions. Web if a taxpayer contributes to a new york 529 college savings 529 plan, a portion of the contribution can be subtracted from income on the new york return.

Web through ny’s 529 college savings program, you can save on taxes while you save for college. Web contributions to state 529 plans are not deductible on the federal return. Web will i get a tax form regarding my annual contribution totals? New york's 529 college savings program direct plan p.o. Learn more though the program’s frequently asked questions. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web today, we’re going over everything you need to know about the new york 529 tax deduction program. Web forms can be downloaded from our website at. Web if a taxpayer contributes to a new york 529 college savings 529 plan, a portion of the contribution can be subtracted from income on the new york return. Web new york state taxes.

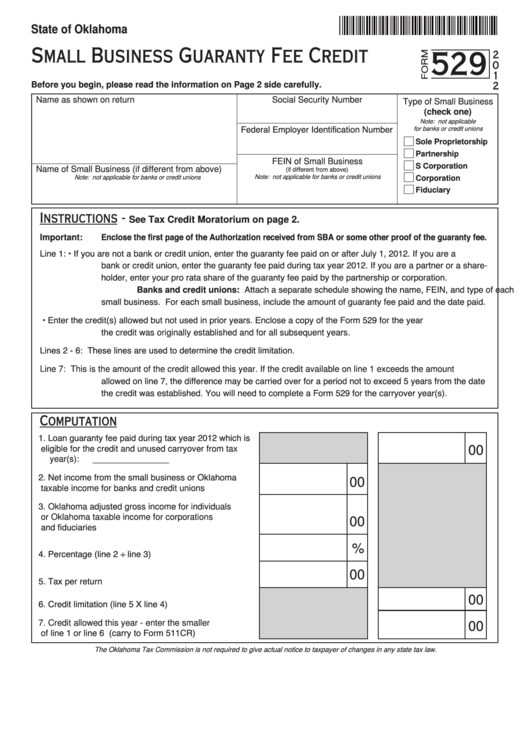

Web will i get a tax form regarding my annual contribution totals? Web contributions to state 529 plans are not deductible on the federal return. Web to enter your 529 information within the program, please go to: Web forms can be downloaded from our website at. Ad your ny 529 account can pay for more than tuition, like room/board & books. When you are in your ny return,. Web to enter a 529 plan contribution: Web today, we’re going over everything you need to know about the new york 529 tax deduction program. Web mail your completed form to: There are no federal or state tax forms reporting 529 contributions.

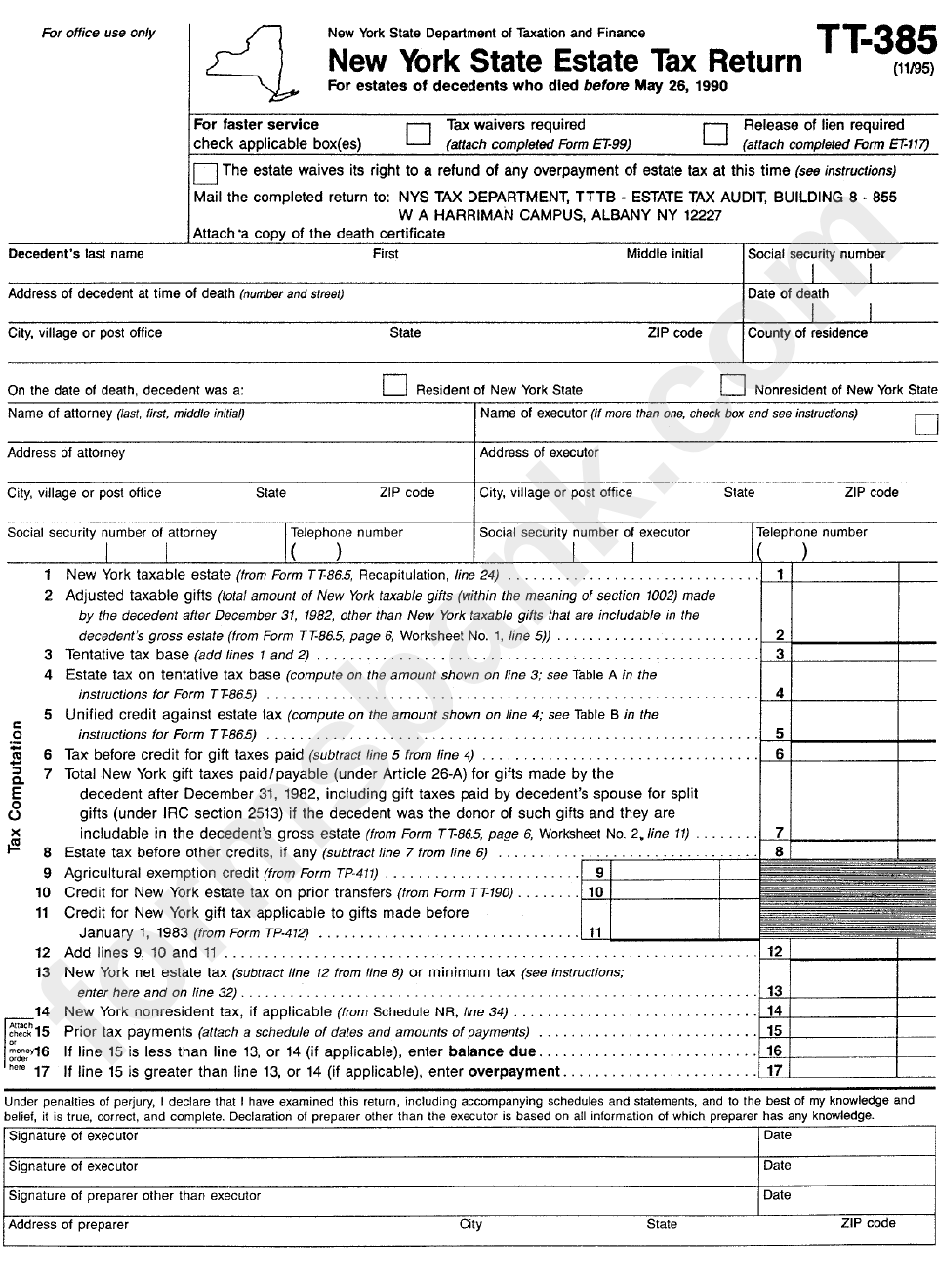

Form Tt385 New York State Estate Tax Return printable pdf download

However, they are deductible on your ny return. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web new york state taxes. Web employer guide an overall guide to the direct plan for your employees, detailing the benefits of saving for college, the added benefits of the direct plan, and an overview. Web through.

529 Plan New York Infographic 10 Facts About NY's 529 to Know

When you are in your ny return,. New york's 529 college savings program direct plan p.o. Web to enter your 529 information within the program, please go to: Web updated on november 11, 2021 reviewed by cierra murry photo: Web for more information about new york's 529 college savings program direct plan, download a disclosure booklet and tuition savings agreement.

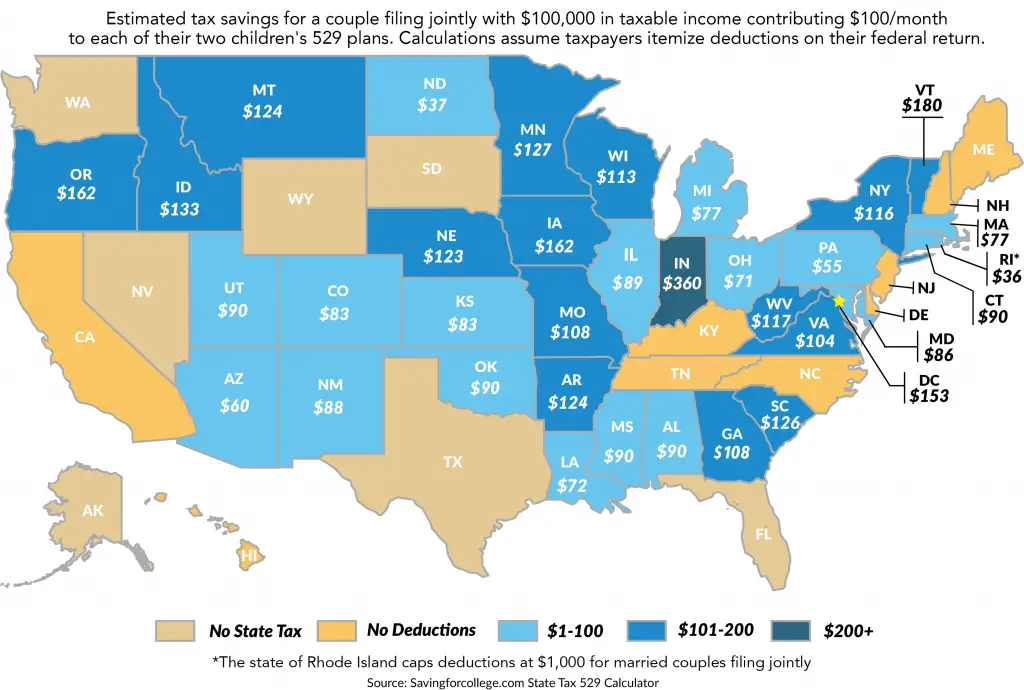

Capturing a 529 tax break in just 24 hours The College Solution

Web forms can be downloaded from our website at. Enter the contributions that were made to an. Learn more though the program’s frequently asked questions. Web will i get a tax form regarding my annual contribution totals? Web today, we’re going over everything you need to know about the new york 529 tax deduction program.

Fill Free fillable New York's 529 College Savings

Learn more though the program’s frequently asked questions. When you are in your ny return,. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web to enter your 529 information within the program, please go to: Enter the contributions that were made to an.

More Saving, Less Borrowing with NY 529 Direct College Savings Plan!

Web if a taxpayer contributes to a new york 529 college savings 529 plan, a portion of the contribution can be subtracted from income on the new york return. There are no federal or state tax forms reporting 529 contributions. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web employer guide an overall.

New York’s 529 Advisor Guided College Savings Program Deardorff

Web to enter your 529 information within the program, please go to: Learn more though the program’s frequently asked questions. Web employer guide an overall guide to the direct plan for your employees, detailing the benefits of saving for college, the added benefits of the direct plan, and an overview. Scroll down to the section new york subtractions. We will.

Stanley 529 Withdrawal Form 20202022 Fill and Sign Printable

Go to screen 51.091, new york modifications. Web if a taxpayer contributes to a new york 529 college savings 529 plan, a portion of the contribution can be subtracted from income on the new york return. Web new york state taxes. Web to enter your 529 information within the program, please go to: Web for more information about new york's.

Fillable Form 529 Small Business Guaranty Fee Credit 2012 printable

Web to enter a 529 plan contribution: Web through ny’s 529 college savings program, you can save on taxes while you save for college. Learn more though the program’s frequently asked questions. Contributions of up to $10,000 are deductible annually from new york state taxable income for married couples filing jointly; Web for more information about new york's 529 college.

Is Ny 529 Tax Deductible

Ad your ny 529 account can pay for more than tuition, like room/board & books. Dean mitchell / getty images if you live in new york and are planning to put a child through. Web contributions to state 529 plans are not deductible on the federal return. Contributions of up to $10,000 are deductible annually from new york state taxable.

how to report 529 distributions on tax return Fill Online, Printable

Web mail your completed form to: New york's 529 college savings program direct plan p.o. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web to enter a 529 plan contribution: Ad your ny 529 account can pay for more than tuition, like room/board & books.

Web To Enter A 529 Plan Contribution:

Ad your ny 529 account can pay for more than tuition, like room/board & books. Web today, we’re going over everything you need to know about the new york 529 tax deduction program. There are no federal or state tax forms reporting 529 contributions. Web updated on november 11, 2021 reviewed by cierra murry photo:

Web If A Taxpayer Contributes To A New York 529 College Savings 529 Plan, A Portion Of The Contribution Can Be Subtracted From Income On The New York Return.

Scroll down to the section new york subtractions. Web will i get a tax form regarding my annual contribution totals? Web mail your completed form to: When you are in your ny return,.

We Will Show You Just How Much Money You Can Save.

Enter the contributions that were made to an. Web contributions to state 529 plans are not deductible on the federal return. New york's 529 college savings program direct plan p.o. Contributions of up to $10,000 are deductible annually from new york state taxable income for married couples filing jointly;

However, They Are Deductible On Your Ny Return.

Web forms can be downloaded from our website at. Dean mitchell / getty images if you live in new york and are planning to put a child through. Ad your ny 529 account can pay for more than tuition, like room/board & books. Web new york state taxes.