Nyc Form 1127

Nyc Form 1127 - Go into screen 54, taxes. This will take you to screen 54.097. Save or instantly send your ready documents. Any new must file the 1127 tax return? Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Web how to edit nyc 1127 form online for free. To begin the process, press the. Web the amount deducted from your pay for the section 1127 waiver shows up under city waiver on your pay statement. Complete, edit or print tax forms instantly. Employee's social security number spouse's social security number.

Web if either the federal return or the new york state tax return has been extended, documentation evidencing the granting of the extension must be submitted to the new york city section 1127 unit. Web the amount deducted from your pay for the section 1127 waiver shows up under city waiver on your pay statement. Shouldn't it be reported on line 5 as a local income tax? Web find and fill out the correct nyc form 1127 instructions. Choose the correct version of the editable pdf form from the list and get started filling it out. This pdf editor was built to be as clear as it can be. To begin the process, press the. Any new must file the 1127 tax return? You are considered a new city employee? This will take you to screen 54.097.

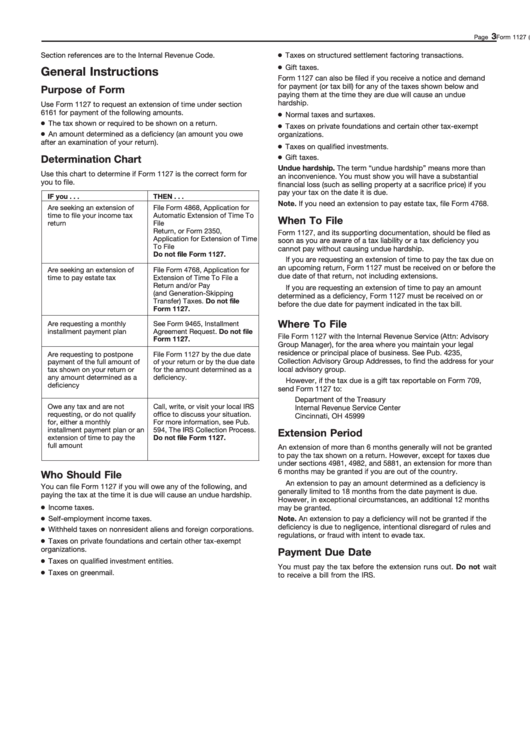

Purpose of form use form 1127 to request an extension of time under section 6161 for payment of the following amounts. City and state zip code. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city. Go into screen 54, taxes. Web apply to new york state or new york city personal income tax. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must An 1127 in most return. This pdf editor was built to be as clear as it can be. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return.

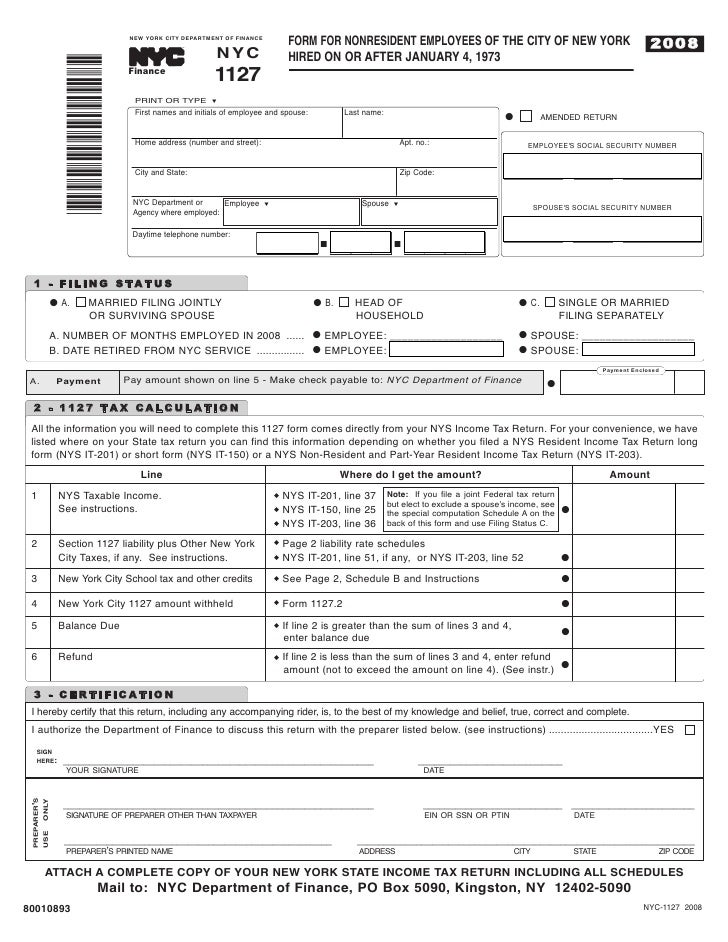

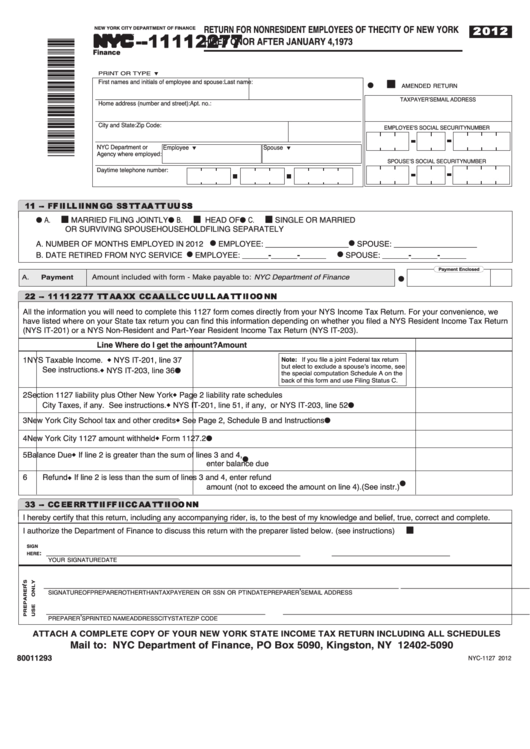

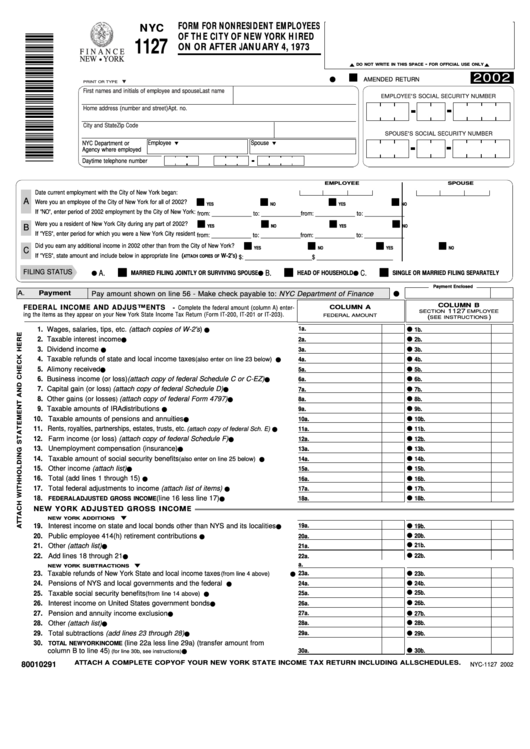

NYC1127 Form for Nonresident Employees of the City of New York Hired…

You are considered a new city employee? Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: Web find and fill out the correct nyc form 1127 instructions. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of.

Form 1127 General Instructions printable pdf download

To begin the process, press the. First names and initials of employee and spouse last name home address (number and street) apt. Complete, edit or print tax forms instantly. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. City.

Form 1127 Application for Extension of Time for Payment of Tax Due To

Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Complete, edit or print tax forms instantly. You are considered a new city employee? Go into screen 54, taxes. Employee's social security number spouse's social security number.

Nyc 1127 Form ≡ Fill Out Printable PDF Forms Online

In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Easily fill out pdf blank, edit, and sign them. City and state zip code. Under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a.

Fillable Online nyc nyc 1127 instructions for 2013 form Fax Email Print

Go into screen 54, taxes. Web apply to new york state or new york city personal income tax. First names and initials of employee and spouse last name home address (number and street) apt. Save or instantly send your ready documents. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any.

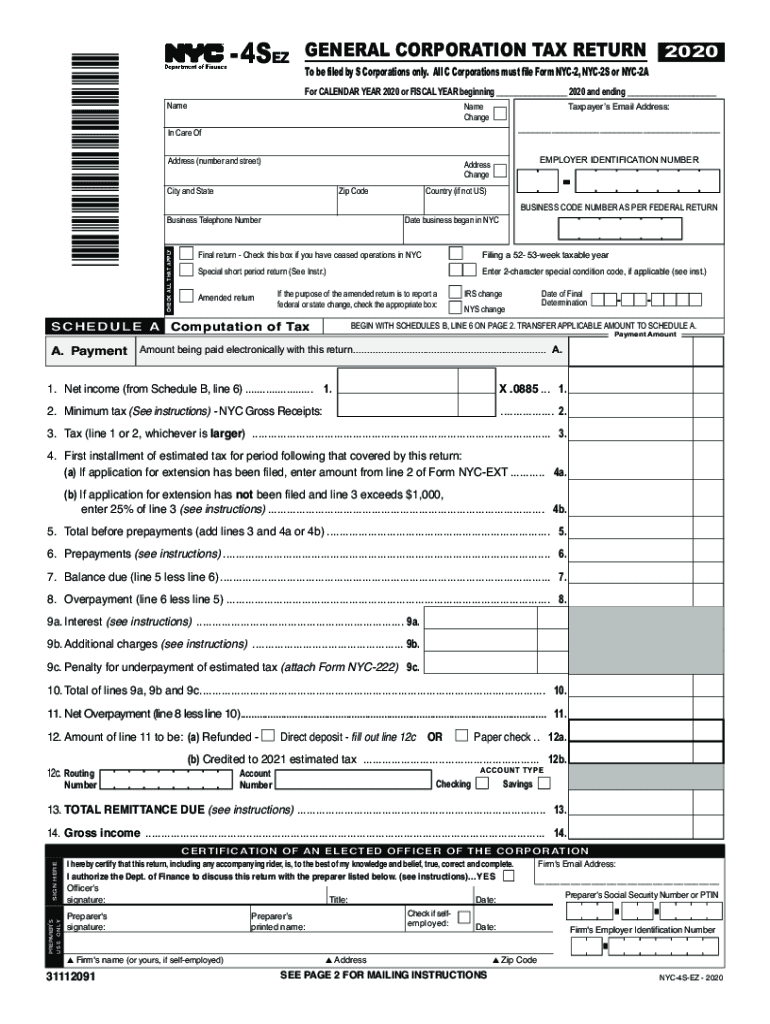

2020 Form NYC DoF NYC4SEZ Fill Online, Printable, Fillable, Blank

To begin the process, press the. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. Web how to edit nyc 1127 form online for free. City and state zip code. An 1127 in most return.

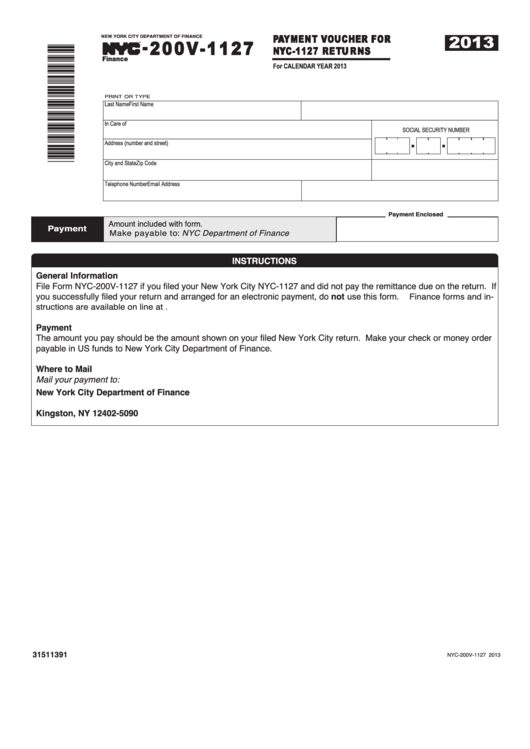

Form Nyc200v1127 Payment Voucher For Nyc1127 Returns 2013

Complete, edit or print tax forms instantly. To begin the process, press the. Web find and fill out the correct nyc form 1127 instructions. This will take you to screen 54.097. Save or instantly send your ready documents.

Nyc 1127 Form ≡ Fill Out Printable PDF Forms Online

Save or instantly send your ready documents. Web find and fill out the correct nyc form 1127 instructions. Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: City and state zip code. Under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january.

Fillable Form Nyc1127 Return For Nonresident Employees Of The City

You are considered a new city employee? City and state zip code. Purpose of form use form 1127 to request an extension of time under section 6161 for payment of the following amounts. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file.

Form Nyc 1127 Form For Nonresident Employees Of The City Of New York

Easily fill out pdf blank, edit, and sign them. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return. This pdf editor was built to be as clear as it can be. Web the amount deducted from your pay for the section 1127 waiver shows up under city waiver on your pay.

Change Of Residence If You Were A Resident Of The City Of New York During Part Of 2022 And A Nonresident Subject To The Provisions Of Section 1127 Of The New York City Charter During All Or Part Of The Remainder Of 2022, You Must

This pdf editor was built to be as clear as it can be. First names and initials of employee and spouse last name home address (number and street) apt. Employee's social security number spouse's social security number. An 1127 in most return.

Under Section 1127 Of The City Charter, If You Are A City Employee Who Lives Outside The City And You Were Hired After January 4, 1973, As A Condition Of Employment You Agreed To Pay To The City An Amount Equal To A City.

Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Web the amount deducted from your pay for the section 1127 waiver shows up under city waiver on your pay statement. Go into screen 54, taxes. Amendedreturn taxpayer’s email address home address (number and.

Complete, Edit Or Print Tax Forms Instantly.

Web if either the federal return or the new york state tax return has been extended, documentation evidencing the granting of the extension must be submitted to the new york city section 1127 unit. Web apply to new york state or new york city personal income tax. Complete, edit or print tax forms instantly. Web how to edit nyc 1127 form online for free.

City And State Zip Code.

Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. You are considered a new city employee? Taxes box in the left navigation pane. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.