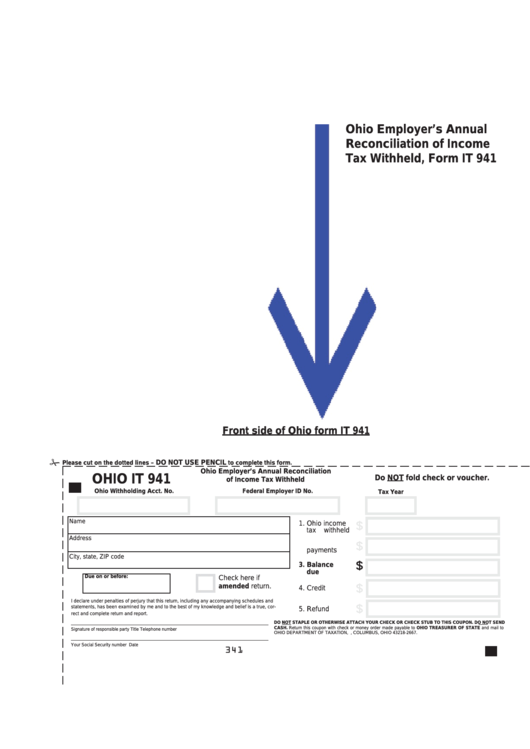

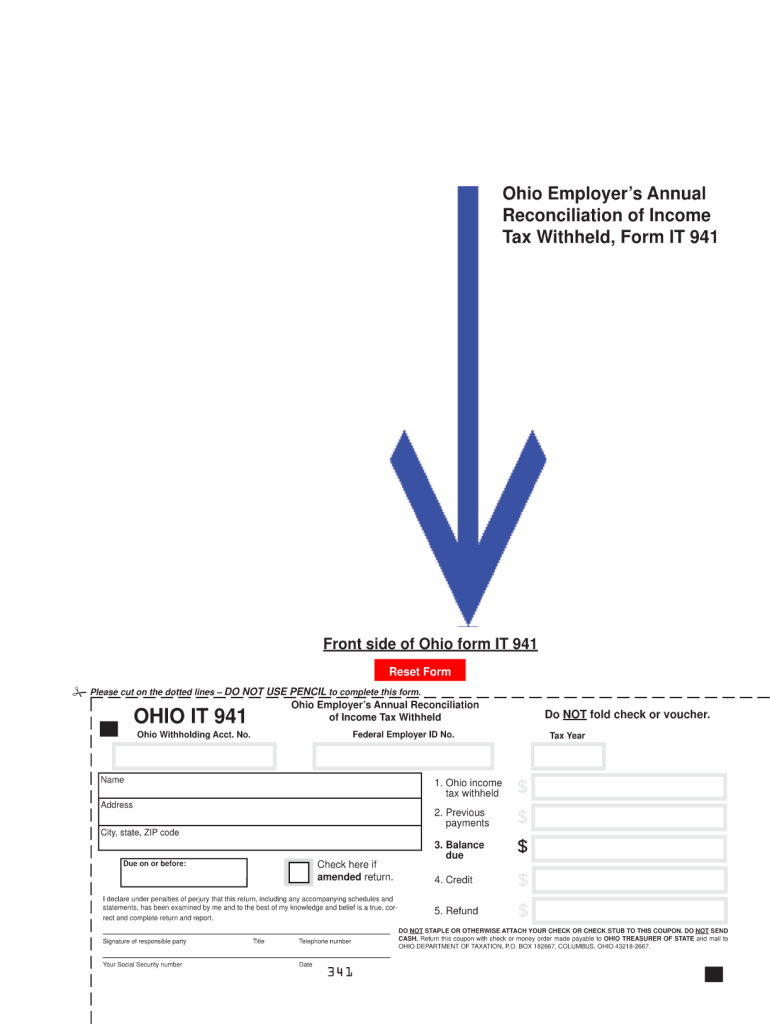

Ohio Form It 941

Ohio Form It 941 - Save or instantly send your ready documents. Web bulk filing enables companies to submit large numbers of filings in a single file. Web return this form with check or money order made payable to ohio treasurer of state and mail torect and complete return and report. 2 of 8 city state zip code name of trust or estate fein ssn of decedent (estates only). Please visit the following links Web about form 941, employer's quarterly federal tax return. Ohio it 941 ohio employer’s annual. Instructions for this form are on our. The ohio treasurer of state vendor has a payment. Web 2021 ohio it 1041 rev.

Easily fill out pdf blank, edit, and sign them. Instead, you should have your employer withhold income tax for your resident state. There are open liabilities on the print checks screen (or manage impound payments). Web you work in ohio, you do not owe ohio income tax on your compensation. Ohio it 941 ohio employer’s annual. The ohio treasurer of state vendor has a payment. 2 of 8 city state zip code name of trust or estate fein ssn of decedent (estates only). Please visit the following links Now it takes at most half an hour, and you can accomplish it from any location. The ohio department of taxation provides a searchable repository of individual tax.

Web up to 10% cash back employers in ohio must conform with these state rules relating to filing income tax withholding returns. Save or instantly send your ready documents. Access the forms you need to file taxes or do business in ohio. The gateway is capable of receiving bulk filings for the following employer withholding services. Name address city, state, zip code ohio employer's annual reconciliation of income tax withheld federal employer id no. Ohio it 941 ohio employer’s annual. The ohio treasurer of state vendor has a payment. Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. Easily fill out pdf blank, edit, and sign them. The ohio department of taxation provides a searchable repository of individual tax.

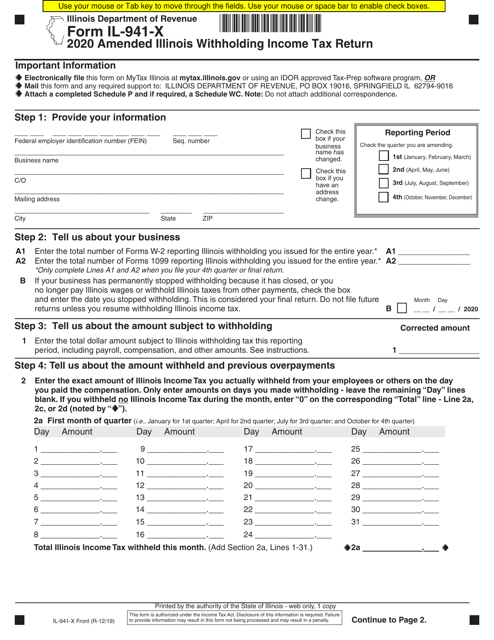

Form IL941X Download Fillable PDF or Fill Online Amended Illinois

Easily fill out pdf blank, edit, and sign them. The ohio department of taxation provides a searchable repository of individual tax. Web you work in ohio, you do not owe ohio income tax on your compensation. Name address city, state, zip code ohio employer's annual reconciliation of income tax withheld federal employer id no. Save or instantly send your ready.

2019 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

The ohio treasurer of state vendor has a payment. Web about form 941, employer's quarterly federal tax return. Web bulk filing enables companies to submit large numbers of filings in a single file. Web complete state of ohio form 941 online with us legal forms. Now it takes at most half an hour, and you can accomplish it from any.

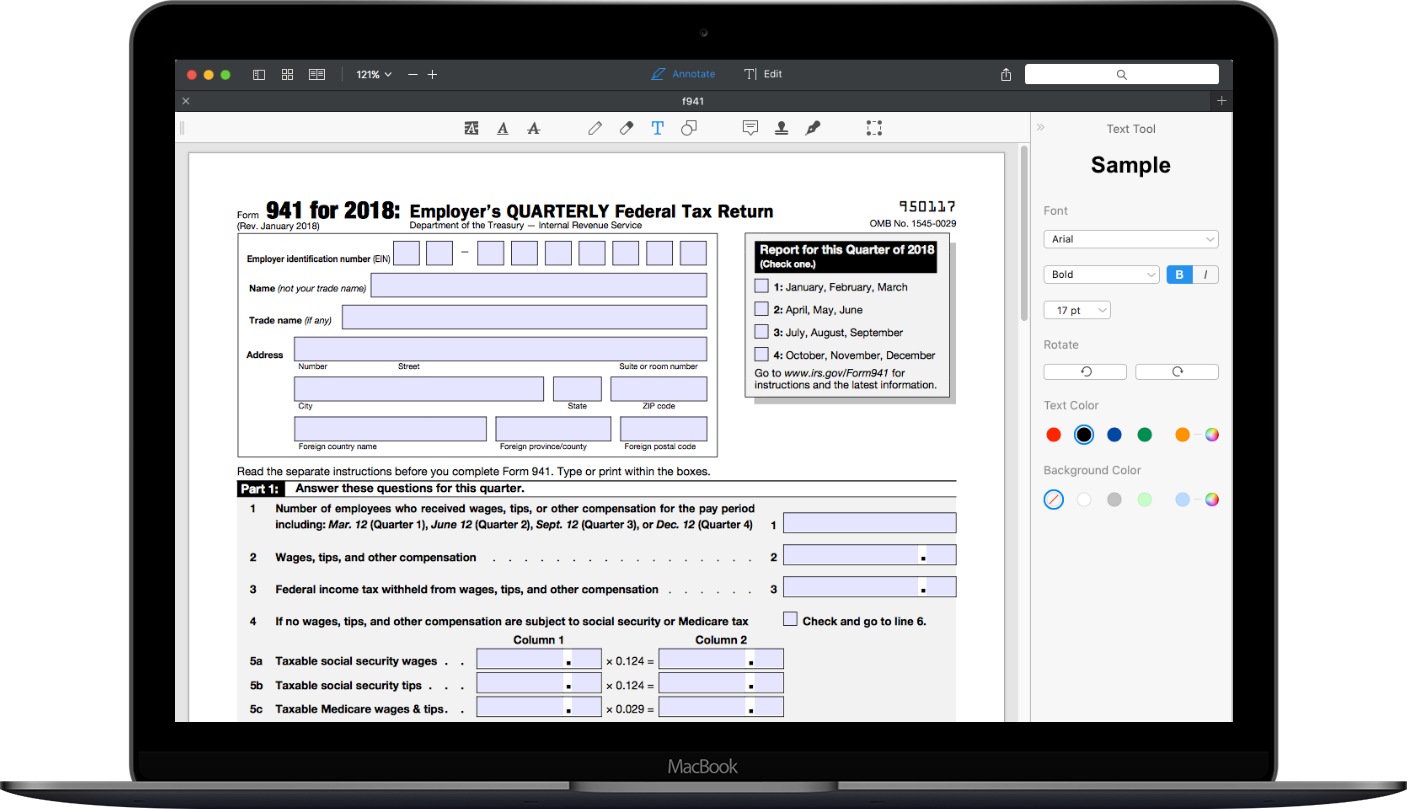

How to fill out IRS Form 941 2019 PDF Expert

Access the forms you need to file taxes or do business in ohio. Ohio it 941 ohio employer’s annual. Web return this form with check or money order made payable to ohio treasurer of state and mail torect and complete return and report. Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. Report income.

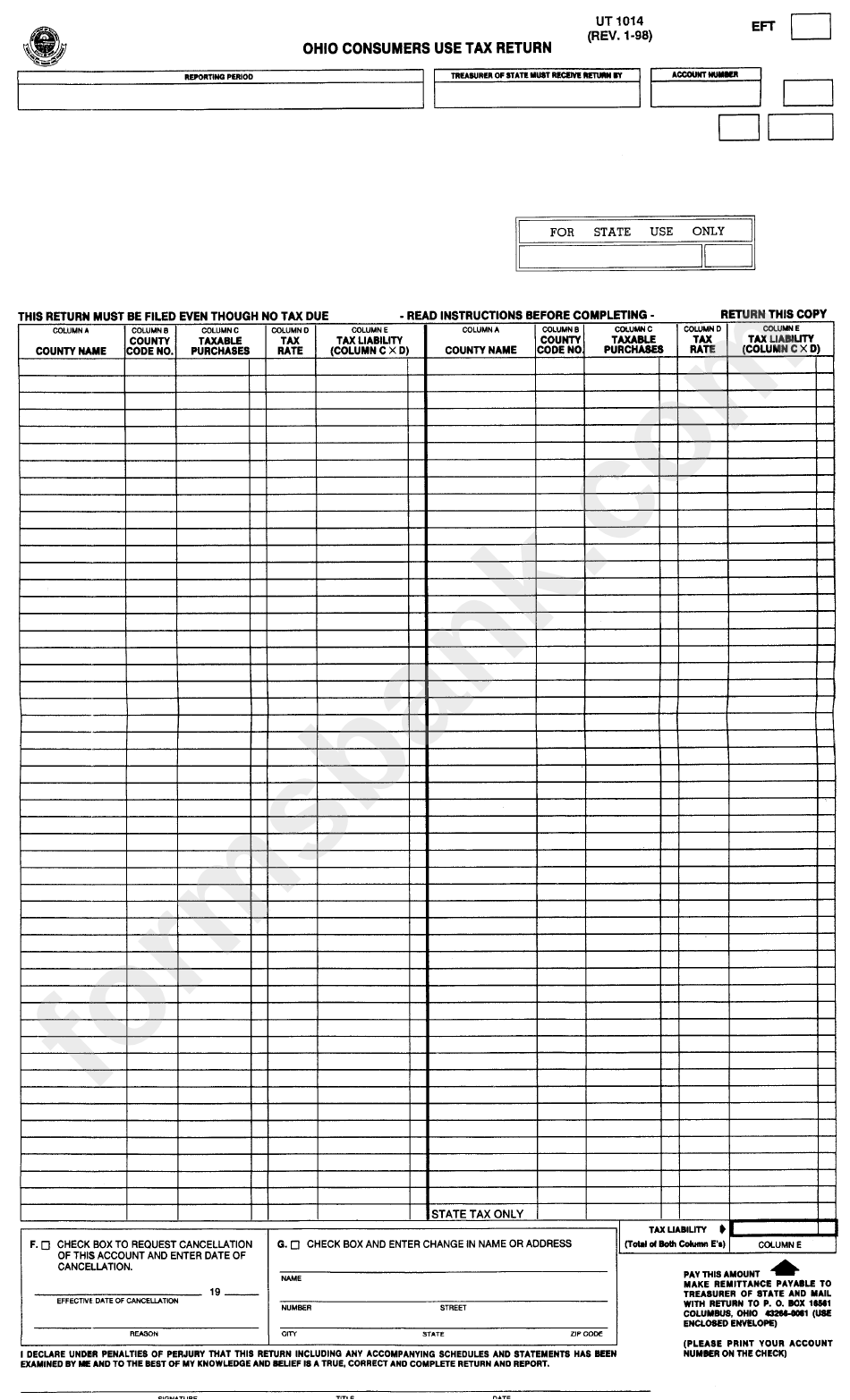

Form Ut 1014 Ohio Consumer'S Use Tax Return Form Ohio printable pdf

Now it takes at most half an hour, and you can accomplish it from any location. Web 2021 ohio it 1041 rev. The gateway is capable of receiving bulk filings for the following employer withholding services. Easily fill out pdf blank, edit, and sign them. Web 2 where do i find paper employer withholding and school district withholding tax forms?

Sage Releases 2011 941 Form Update Aries Technology Group LLCAries

Web up to 10% cash back employers in ohio must conform with these state rules relating to filing income tax withholding returns. Web bulk filing enables companies to submit large numbers of filings in a single file. Web you work in ohio, you do not owe ohio income tax on your compensation. Now it takes at most half an hour,.

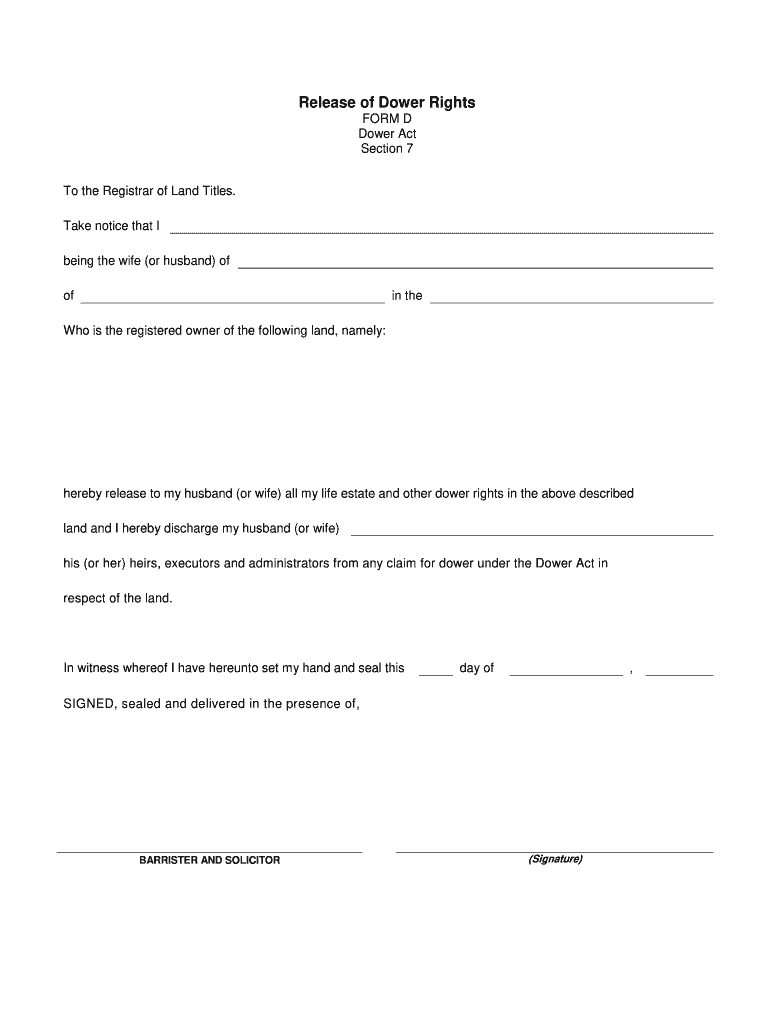

Ohio Dower Release Fill Online, Printable, Fillable, Blank pdfFiller

Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: Report income taxes, social security tax, or medicare tax withheld from employee's. Ohio it 941 ohio employer’s annual. Easily fill out pdf blank, edit, and sign them.

IRS 941 2010 Fill out Tax Template Online US Legal Forms

There are open liabilities on the print checks screen (or manage impound payments). Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. 2 of 8 city state zip code name of trust or estate fein ssn of decedent (estates only). Web you work in ohio, you do not owe ohio income tax on your.

Fillable Ohio Form It 941 Ohio Employer'S Annual Reconciliation Of

Report income taxes, social security tax, or medicare tax withheld from employee's. Instructions for this form are on our. Web about form 941, employer's quarterly federal tax return. Web about form 941, employer's quarterly federal tax return. Web return this form with check or money order made payable to ohio treasurer of state and mail torect and complete return and.

OH IT 941 Fill out Tax Template Online US Legal Forms

Report income taxes, social security tax, or medicare tax withheld from employee's. Please visit the following links Name address city, state, zip code ohio employer's annual reconciliation of income tax withheld federal employer id no. Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. Ohio it 941 ohio employer’s annual.

8 Form Amended I Will Tell You The Truth About 8 Form Amended In The

Name address city, state, zip code ohio employer's annual reconciliation of income tax withheld federal employer id no. Web about form 941, employer's quarterly federal tax return. Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. Web about form 941, employer's quarterly federal tax return. Web return this form with check or money order.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web you work in ohio, you do not owe ohio income tax on your compensation. Report income taxes, social security tax, or medicare tax withheld from employee's. Web electronic filing is mandatory for employer withholding and employer withholding school district tax accounts. Web bulk filing enables companies to submit large numbers of filings in a single file.

Instructions For This Form Are On Our.

2 of 8 city state zip code name of trust or estate fein ssn of decedent (estates only). Web up to 10% cash back employers in ohio must conform with these state rules relating to filing income tax withholding returns. Web 2021 ohio it 1041 rev. Ohio it 941 ohio employer’s annual.

There Are Open Liabilities On The Print Checks Screen (Or Manage Impound Payments).

Now it takes at most half an hour, and you can accomplish it from any location. Please visit the following links Web about form 941, employer's quarterly federal tax return. The gateway is capable of receiving bulk filings for the following employer withholding services.

Web 2 Where Do I Find Paper Employer Withholding And School District Withholding Tax Forms?

Web ohio it 941 ohio withholding acct. Web about form 941, employer's quarterly federal tax return. Instead, you should have your employer withhold income tax for your resident state. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.