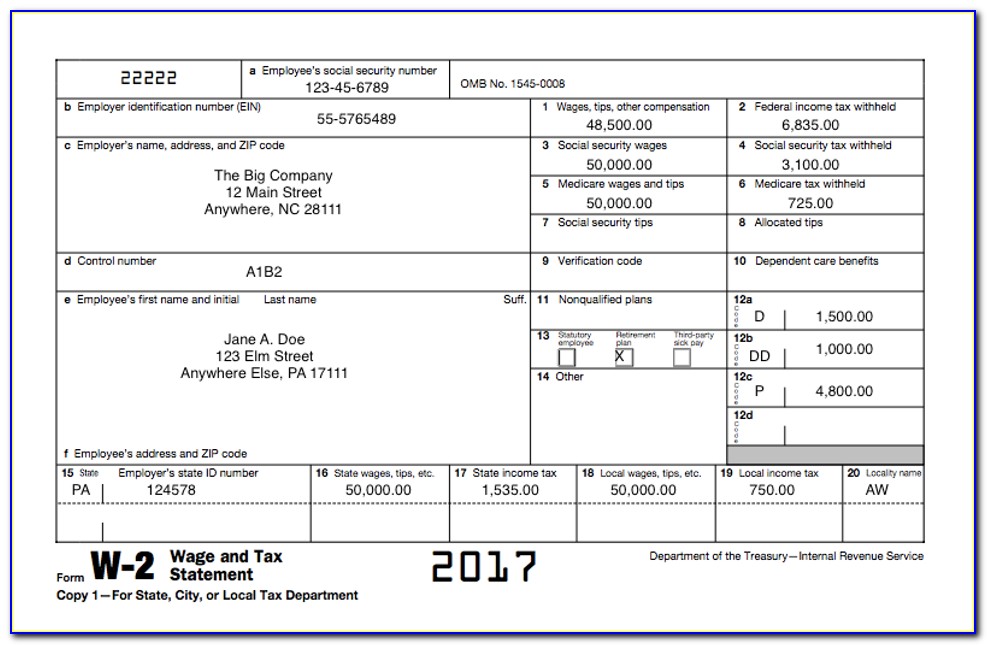

Ohio W2 Form 2022

Ohio W2 Form 2022 - Ohio law requires all employers to electronically file returns and submit. 1622 w ohio # 2 st, chicago, il is a single family home. Easy entry save as csv file clear form. Enter “p” in the “p/s” box if the form is the primary taxpayer’s and. Web wage and salary information. The zestimate for this house is. It contains 3 bedrooms and 3 bathrooms. The ohio department of taxation provides a searchable repository of individual tax. The ohio it 3 must be filed by january 31st or within 60 days after discontinuation of business. Web tax forms access the forms you need to file taxes or do business in ohio.

We simplify complex tasks to give you time back and help you feel like an expert. Web w2 form 2022 is required for submitting tax returns for the current year. Ohio law requires all employers to electronically file returns and submit. Web to aid in this new requirement for 2021, the ohio department of taxation is extending the filing deadline from january 31, 2022 to march 2, 2022 for all reconciliation. The zestimate for this house is. Follow the steps below & you’ll be done with your w2 in minutes. If you are a former employee, you will. Ohio law requires all employers to electronically file returns and submit. The irs requires employers to report wage and salary information for employees. The ohio it 3 must be filed by january 31st or within 15 days after discontinuation of.

Easy entry save as csv file clear form. The ohio it 3 must be filed by january 31st or within 15 days after discontinuation of. The ohio department of taxation (odt) follows the. Ohio law requires all employers to electronically file returns and submit. The ohio department of taxation provides a searchable repository of individual tax. Web w2 form 2022 is required for submitting tax returns for the current year. If you are a former employee, you will. The zestimate for this house is. Ad simply the best payroll service for small business. Web live traffic conditions;

Form W4 What It Is, Who Needs To File, and How To Fill It Out

Ohio law requires all employers to electronically file returns and submit. Web wage and salary information. The ohio department of taxation (odt) follows the. Ad simply the best payroll service for small business. Web live traffic conditions;

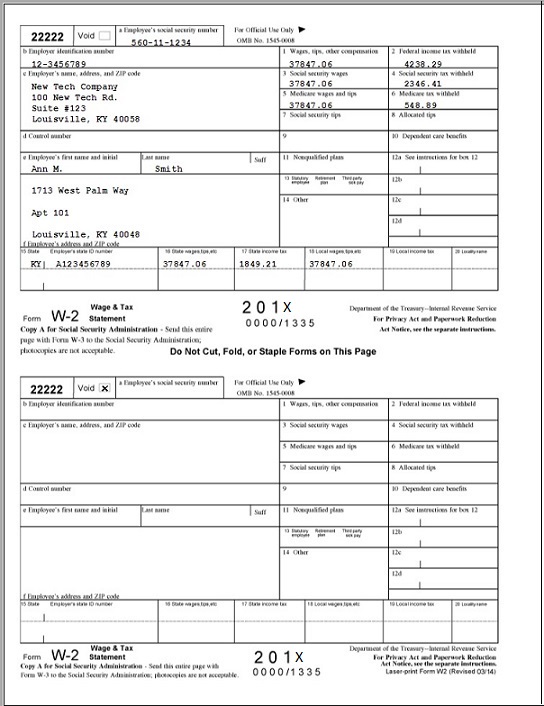

Tax Ohio Helpfiles > ifilehelp > help > 2018 > 1040w2

Easy entry save as csv file clear form. The ohio it 3 must be filed by january 31st or within 60 days after discontinuation of business. The irs requires employers to report wage and salary information for employees. Try it for free now! Web to aid in this new requirement for 2021, the ohio department of taxation is extending the.

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

The irs requires employers to report wage and salary information for employees. Web live traffic conditions; Sign up & make payroll a breeze. We simplify complex tasks to give you time back and help you feel like an expert. Pump patrol (opens in new window)

How To Get W2 Forms From Previous Employers Form Resume Examples

Sign up & make payroll a breeze. Web wage and salary information. Pump patrol (opens in new window) 1622 w ohio # 2 st, chicago, il is a single family home. The irs requires employers to report wage and salary information for employees.

Tax Refund Estimator + Calculator for 2021 Return in 2022

The ohio it 3 must be filed by january 31st or within 60 days after discontinuation of business. We simplify complex tasks to give you time back and help you feel like an expert. Try it for free now! The ohio department of taxation (odt) follows the. Web to aid in this new requirement for 2021, the ohio department of.

sd100w2

The ohio department of taxation provides a searchable repository of individual tax. Web wage and salary information. Web one ticket in california matched all five numbers and the powerball. Enter “p” in the “p/s” box if the form is the primary taxpayer’s and. Ad simply the best payroll service for small business.

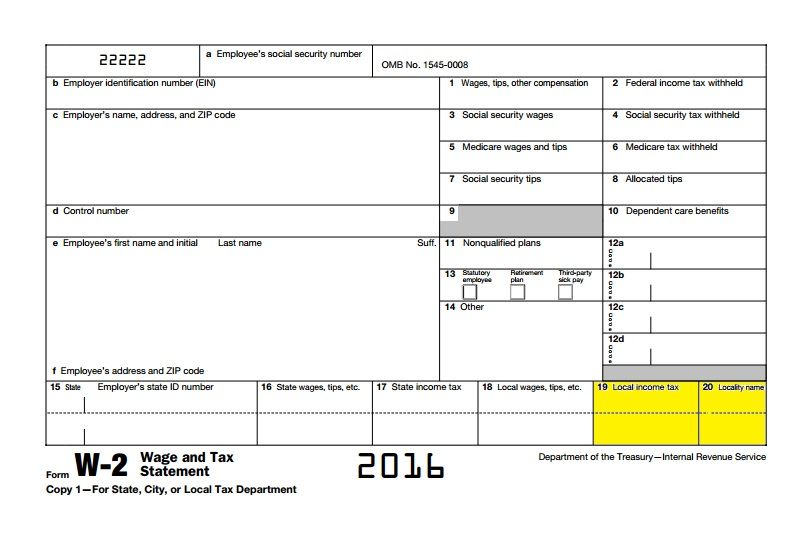

Ohio Form W2 School District Reporting Starts With 2016 Tax Year

Pump patrol (opens in new window) Ohio law requires all employers to electronically file returns and submit. Easy entry save as csv file clear form. Web to aid in this new requirement for 2021, the ohio department of taxation is extending the filing deadline from january 31, 2022 to march 2, 2022 for all reconciliation. Web w2 form 2022 is.

Ohio W2 Transmittal Form Universal Network

The ohio it 3 must be filed by january 31st or within 15 days after discontinuation of. Enter “p” in the “p/s” box if the form is the primary taxpayer’s and. Web w2 form 2022 is required for submitting tax returns for the current year. The zestimate for this house is. The irs requires employers to report wage and salary.

How Do I Get My W2 From Ohio Unemployment NEMPLOY

Web live traffic conditions; Upload, modify or create forms. Web w2 form 2022 is required for submitting tax returns for the current year. Ohio law requires all employers to electronically file returns and submit. The irs requires employers to report wage and salary information for employees.

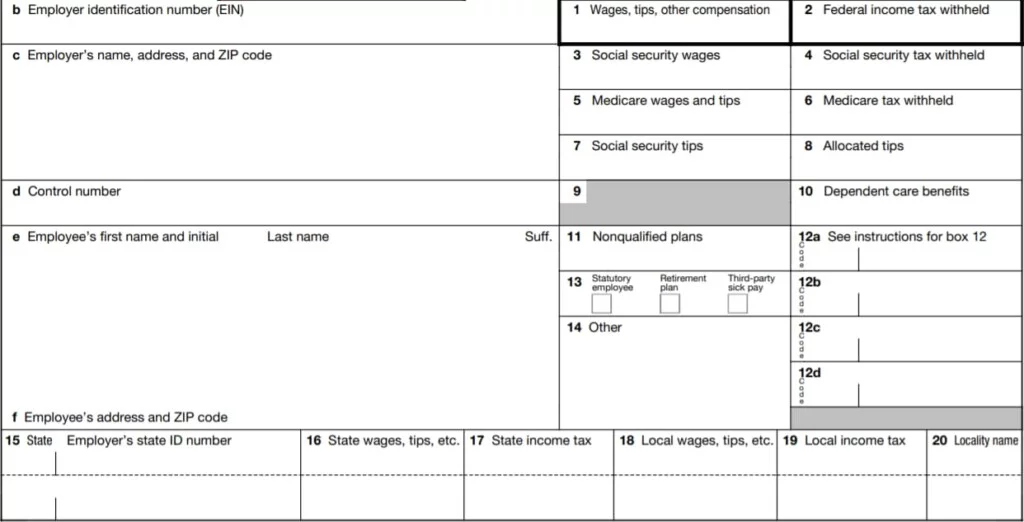

Form Fillable Electronic Irs Forms Printable Forms Free Online

Ohio law requires all employers to electronically file returns and submit. Follow the steps below & you’ll be done with your w2 in minutes. The zestimate for this house is. Web live traffic conditions; If you are a former employee, you will.

Ohio Law Requires All Employers To Electronically File Returns And Submit.

Web one ticket in california matched all five numbers and the powerball. Try it for free now! Web to aid in this new requirement for 2021, the ohio department of taxation is extending the filing deadline from january 31, 2022 to march 2, 2022 for all reconciliation. Ad simply the best payroll service for small business.

The Ohio Department Of Taxation (Odt) Follows The.

The irs requires employers to report wage and salary information for employees. We simplify complex tasks to give you time back and help you feel like an expert. It contains 3 bedrooms and 3 bathrooms. If you are a former employee, you will.

Web Live Traffic Conditions;

Web w2 form 2022 is required for submitting tax returns for the current year. Follow the steps below & you’ll be done with your w2 in minutes. Web ohio online w4 form 2022: The ohio it 3 must be filed by january 31st or within 60 days after discontinuation of business.

1622 W Ohio # 2 St, Chicago, Il Is A Single Family Home.

Web tax forms access the forms you need to file taxes or do business in ohio. Upload, modify or create forms. The ohio department of taxation provides a searchable repository of individual tax. Easy entry save as csv file clear form.

:max_bytes(150000):strip_icc()/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg)