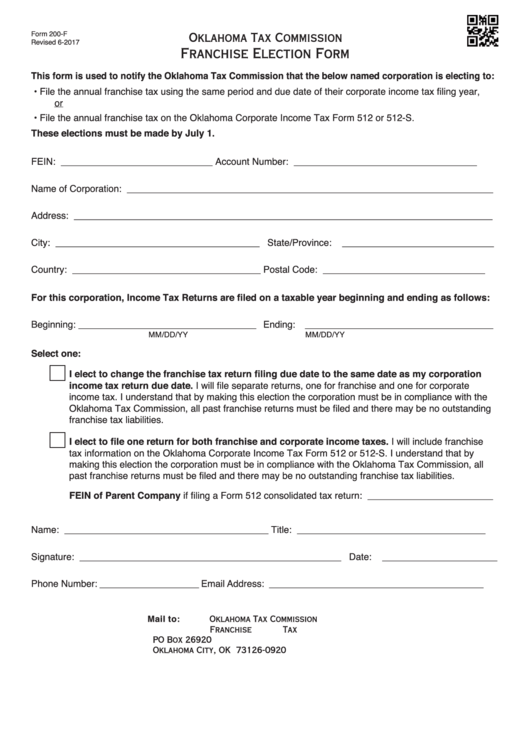

Oklahoma Form 200-F

Oklahoma Form 200-F - This government document is issued by tax commission for use in oklahoma. Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. Use the cross or check marks in the top toolbar to select your answers in the list boxes. I elect to file one return for both franchise and corporate income taxes. These elections must be made by july 1. You may file this form online or download it at www.tax.ok.gov. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. Fill in the blank areas; Web oklahoma form 200 f use a ok form 200 f template to make your document workflow more streamlined.

Corporations that remitted the maximum amount of franchise tax for the preceding tax Web oklahoma form 200 f use a ok form 200 f template to make your document workflow more streamlined. Involved parties names, addresses and phone numbers etc. You may file this form online or download it at www.tax.ok.gov. After you have filed the request to change your filing. This page contains schedules b, c, and d for the completion of form 200: Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Web fill online, printable, fillable, blank form 200: Once completed you can sign your fillable form or send for signing. I elect to file one return for both franchise and corporate income taxes.

All forms are printable and downloadable. Corporations that remitted the maximum amount of franchise tax for the preceding tax Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. You may file this form online or download it at www.tax.ok.gov. Start completing the fillable fields and carefully type in required information. I elect to file one return for both franchise and corporate income taxes. Web fill online, printable, fillable, blank form 200: These elections must be made by july 1. You may file this form online or download it at www.tax.ok.gov. Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link.

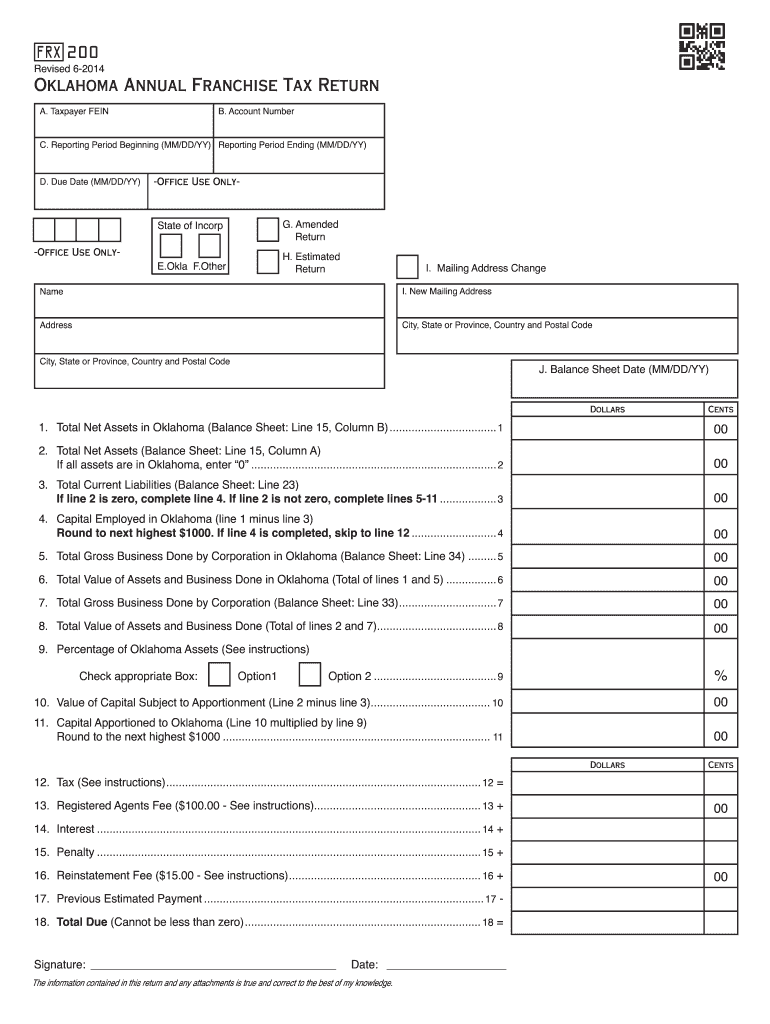

Oklahoma form franchise tax 2014 Fill out & sign online DocHub

After you have filed the request to change your filing. Change the template with smart fillable fields. This page contains schedules b, c, and d for the completion of form 200: Web oklahoma form 200 f use a ok form 200 f template to make your document workflow more streamlined. Request to change franchise tax filing period.

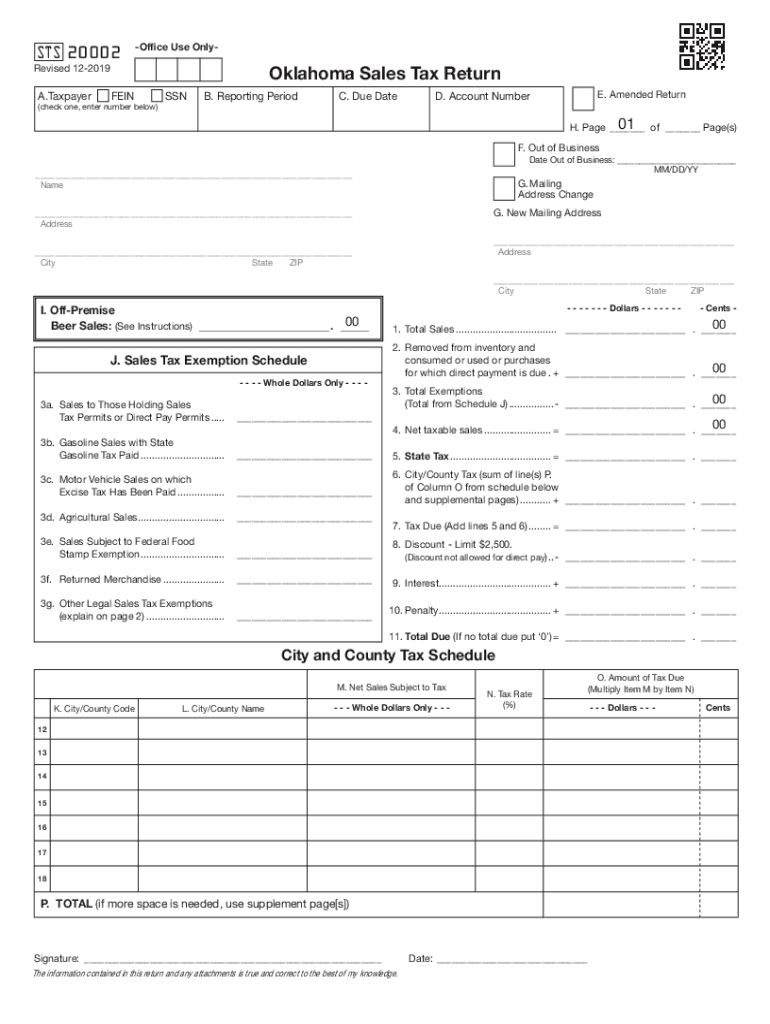

20192022 Form OK OTC STS20002 Fill Online, Printable, Fillable, Blank

Once completed you can sign your fillable form or send for signing. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Share your form with others send oklahoma form 200 f via email, link, or fax. Edit your form 200 f online type text, add images, blackout confidential.

Oklahoma Limited Liability Company / Form an Oklahoma LLC

You may file this form online or download it at www.tax.ok.gov. All forms are printable and downloadable. These elections must be made by july 1. • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding Use the cross or check marks.

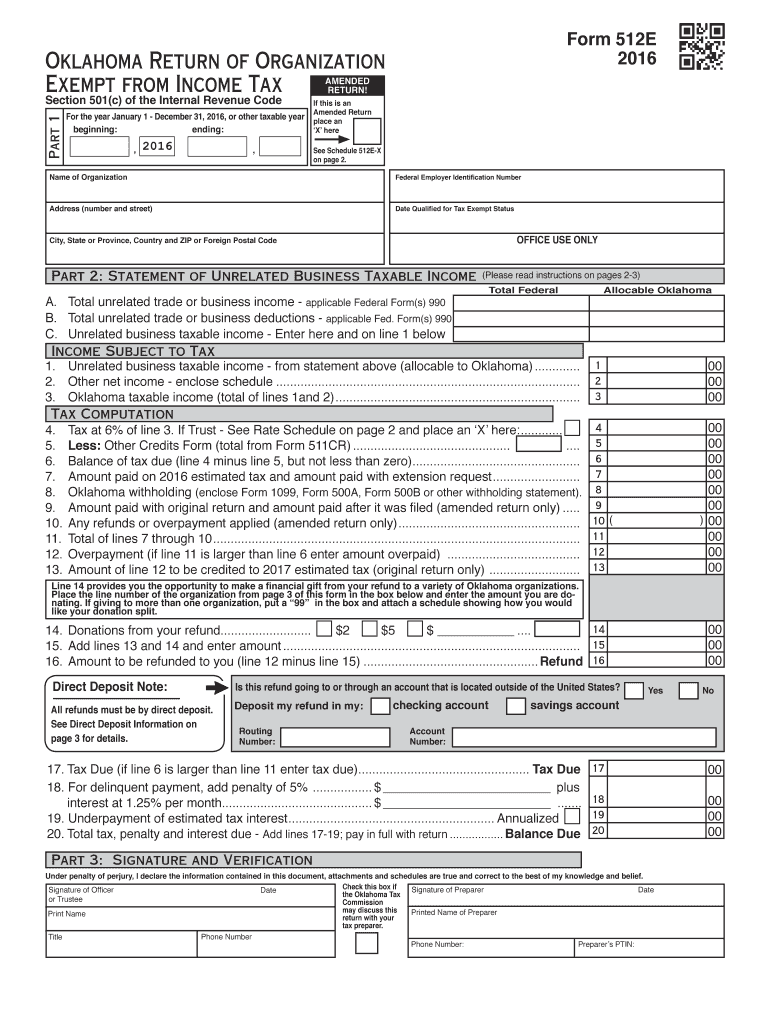

Oklahoma Form 512E Fill Out and Sign Printable PDF Template signNow

Web this form is used to notify the oklahoma tax commission that the below named corporation is electing to: Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link. Corporations that remitted the.

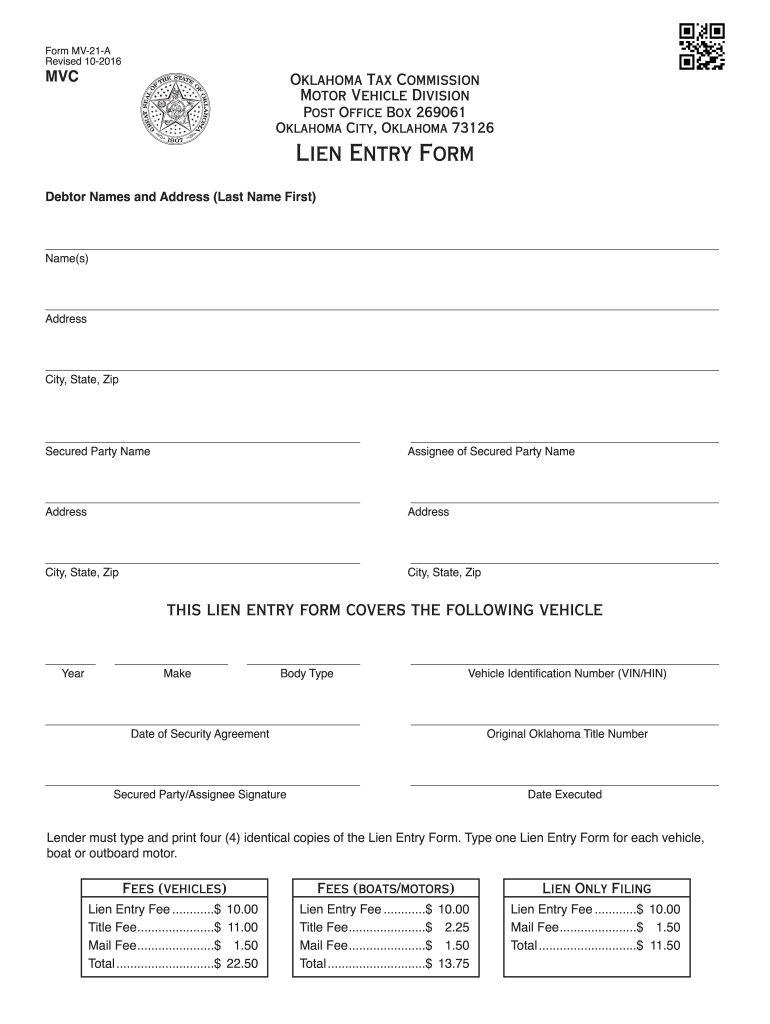

Oklahoma Form Mv 21 A Fill Out and Sign Printable PDF Template signNow

Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. This page contains schedules b, c, and d for the completion of form 200: Web fill online, printable, fillable, blank.

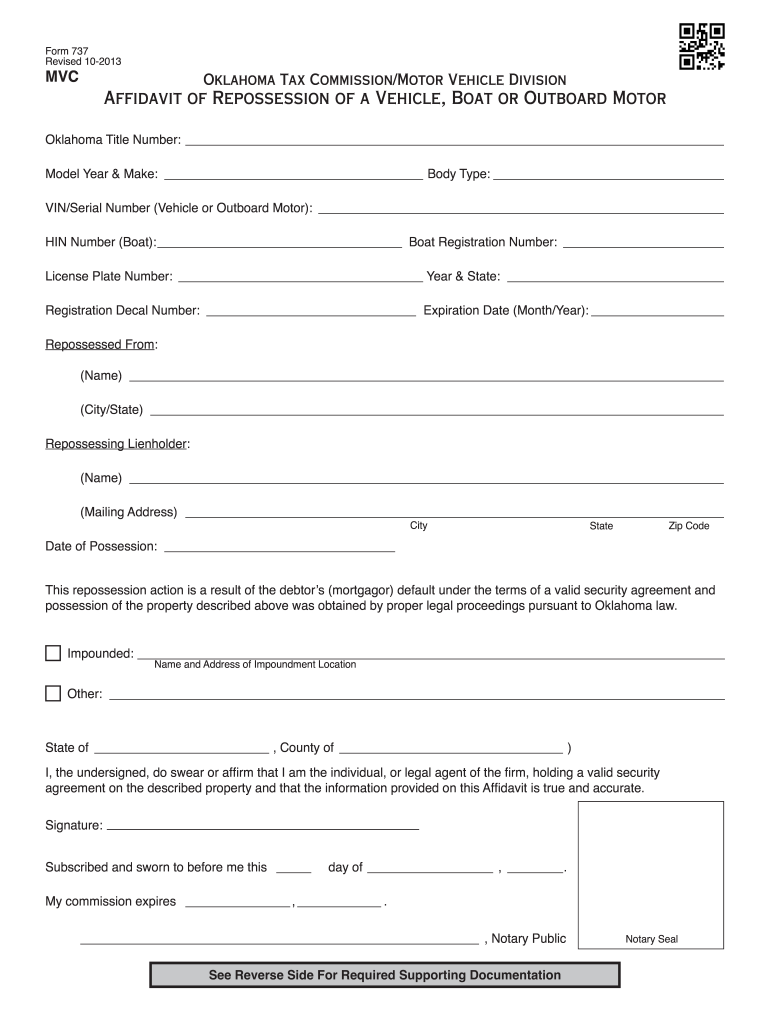

2013 Form OK OTC 737 Fill Online, Printable, Fillable, Blank pdfFiller

This page contains schedules b, c, and d for the completion of form 200: I elect to file one return for both franchise and corporate income taxes. Change the template with smart fillable fields. Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link. Web this form is used to notify the oklahoma tax commission.

915 Oklahoma Tax Forms And Templates free to download in PDF

Web get the form 200 f you need. After you have filed the request to change your filing. Corporations that remitted the maximum amount of franchise tax for the preceding tax Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. All forms are printable and downloadable.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

I elect to file one return for both franchise and corporate income taxes. Insert and customize text, images, and fillable areas, whiteout unnecessary details. You may file this form online or download it at www.tax.ok.gov. All forms are printable and downloadable. Web click on new document and select the file importing option:

Fill Free fillable forms for the state of Oklahoma

You may file this form online or download it at www.tax.ok.gov. You may ile this form online or download it at tax.ok.gov. Insert and customize text, images, and fillable areas, whiteout unnecessary details. Web this form is used to notify the oklahoma tax commission that the below named corporation is electing to: You can download this form from the oklahoma.

936 Form Oklahoma Fill Online, Printable, Fillable, Blank pdfFiller

You may file this form online or download it at www.tax.ok.gov. These elections must be made by july 1. Change the template with smart fillable fields. Corporations that remitted the maximum amount of franchise tax for the preceding tax Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

Open It Up With Online Editor And Begin Adjusting.

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Change the template with smart fillable fields. Fill in the blank areas; Start completing the fillable fields and carefully type in required information.

After You Have Filed The Request To Change Your Filing.

I elect to file one return for both franchise and corporate income taxes. This government document is issued by tax commission for use in oklahoma. Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link. You may file this form online or download it at www.tax.ok.gov.

Web Oklahoma Form 200 F Use A Ok Form 200 F Template To Make Your Document Workflow More Streamlined.

I elect to file one return for both franchise and corporate income taxes. Use the cross or check marks in the top toolbar to select your answers in the list boxes. You may ile this form online or download it at tax.ok.gov. Web fill online, printable, fillable, blank form 200:

Oklahoma Annual Franchise Tax Return (State Of Oklahoma) Form.

Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding Share your form with others send oklahoma form 200 f via email, link, or fax. Show details how it works browse for the form 200 f customize and esign ok 200 f form send out signed oklahoma form 200 f or print it rate the form 200f 4.6 satisfied 86 votes what makes the form 200 f legally binding?