Oklahoma Form 511 Instructions 2021

Oklahoma Form 511 Instructions 2021 - Taxformfinder has an additional 54 oklahoma income tax forms that you may need, plus all federal. If your taxable income is $100,000 or more, use the tax computation on the lower portion of. Form 511 can be efiled, or a paper copy can be filed via mail. Use this table if your taxable income is less than $100,000. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. • generally, your return must be postmarked by april 15, 2021. Try it for free now! Form 511 is the general income tax return for oklahoma residents. Web revised 2021 for loss years 2016 and subsequent, use this form. Web other credits form state of oklahoma name as shown on return:

Name as shown on return: Form 511 is the general income tax return for oklahoma residents. • generally, your return must be postmarked by april 15, 2021. For additional information, see the “due date” section on page 4. • this form is also used to le an. Use this table if your taxable income is less than $100,000. Sign, mail form 511 or 511nr to. Web of the oklahoma itemized deductions is computed as follows. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Try it for free now!

Form 511 is the general income tax return for oklahoma residents. Web form 511 oklahoma — individual resident income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Form 511 can be efiled, or a paper copy can be filed via mail. Web imdividual income tax return. If you have already filed your return, either electronically or by paper, send this voucher with your check or money. Web the 2021 form 511 oklahoma resident individual income tax forms packet & instructions (state of oklahoma) form is 80 pages long and contains: If your taxable income is $100,000 or more, use the tax computation on the lower portion of. For additional information, see the “due date” section on page 4. Web revised 2021 for loss years 2016 and subsequent, use this form. Web other credits form state of oklahoma name as shown on return:

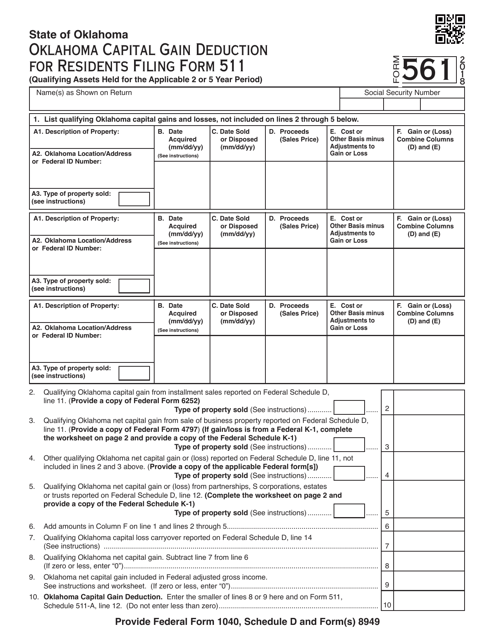

OTC Form 561 Download Fillable PDF or Fill Online Oklahoma Capital Gain

Complete, edit or print tax forms instantly. Web other credits form state of oklahoma name as shown on return: For additional information, see the “due date” section on page 4. Taxformfinder has an additional 54 oklahoma income tax forms that you may need, plus all federal. Web file now with turbotax related oklahoma individual income tax forms:

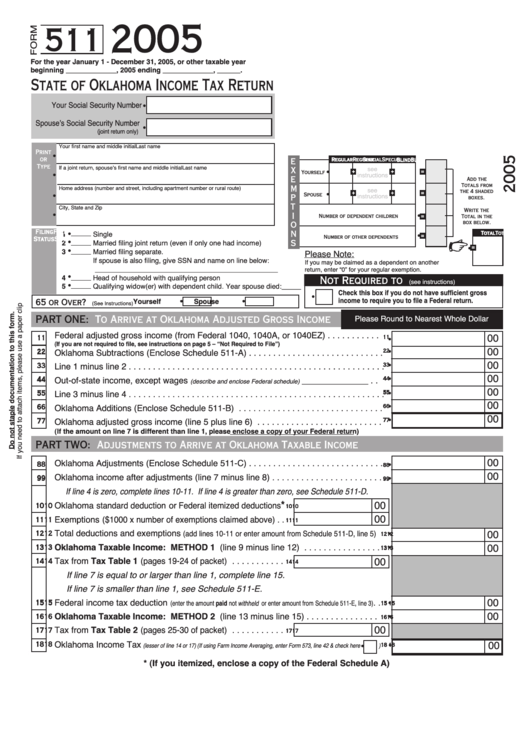

Form 511 State Of Oklahoma Tax Return 2005 printable pdf

Web imdividual income tax return. • this form is also used to le an. Taxformfinder has an additional 54 oklahoma income tax forms that you may need, plus all federal. If your taxable income is $100,000 or more, use the tax computation on the lower portion of. Use this table if your taxable income is less than $100,000.

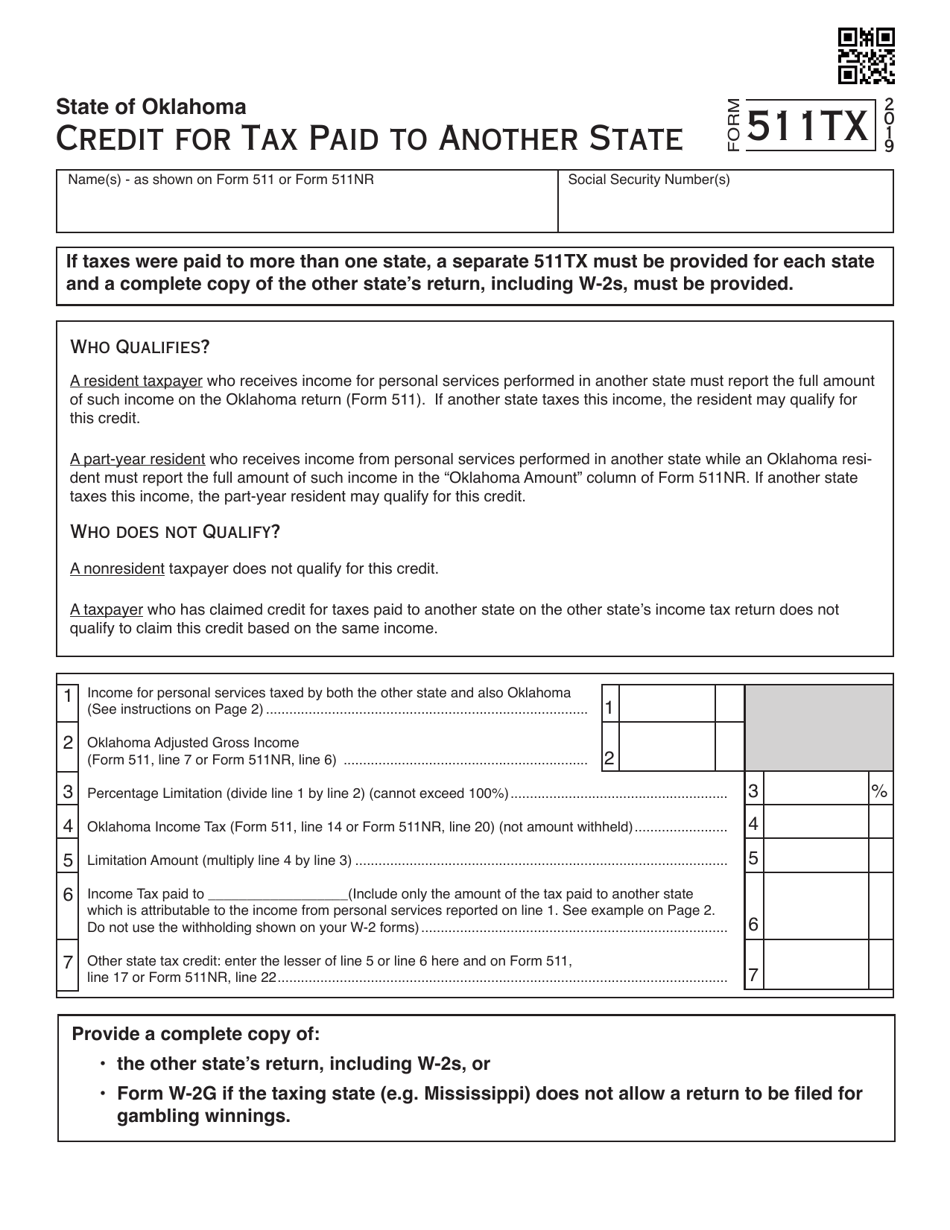

Form 511TX Download Fillable PDF or Fill Online Oklahoma Credit for Tax

If your taxable income is $100,000 or more, use the tax computation on the lower portion of. • this form is also used to le an. Web other credits form state of oklahoma name as shown on return: Web imdividual income tax return. Use this table if your taxable income is less than $100,000.

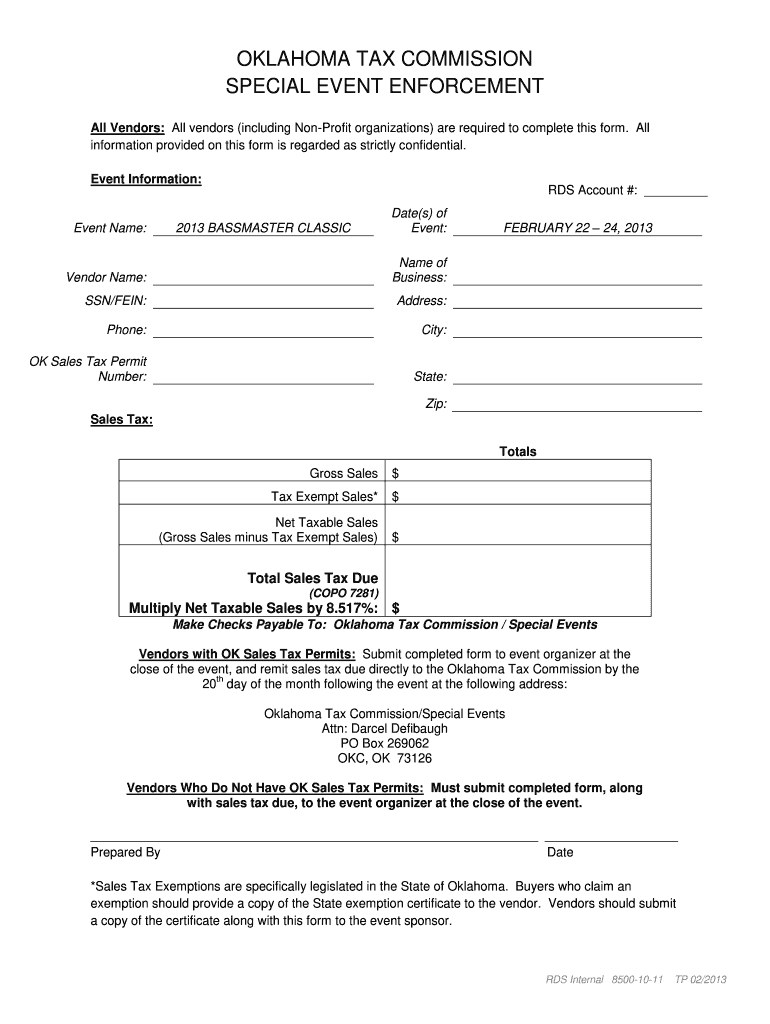

Oklahoma Tax Commission Forms Fill Out and Sign Printable PDF

Complete, edit or print tax forms instantly. If your taxable income is $100,000 or more, use the tax computation on the lower portion of. Web file now with turbotax related oklahoma individual income tax forms: Provide this form and supporting documents with your oklahoma tax return. Web other credits form state of oklahoma name as shown on return:

Form 511 Oklahoma Resident Tax Return and Sales Tax Relief

Try it for free now! Web imdividual income tax return. Sign, mail form 511 or 511nr to. Past years income tax forms” page. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return.

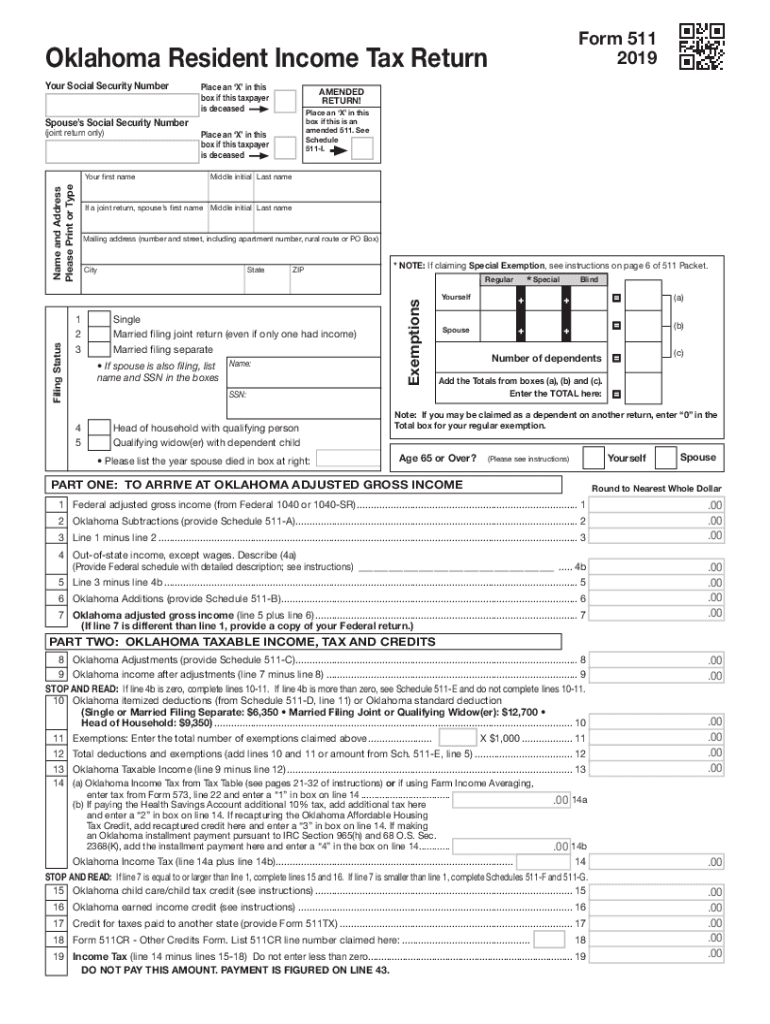

Oklahoma resident tax return 2019 Fill out & sign online DocHub

Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Web • instructions for completing the form 511: Web of the oklahoma itemized deductions is computed as follows. For additional information, see the “due date” section on page 4. Web file now with turbotax related oklahoma individual income tax forms:

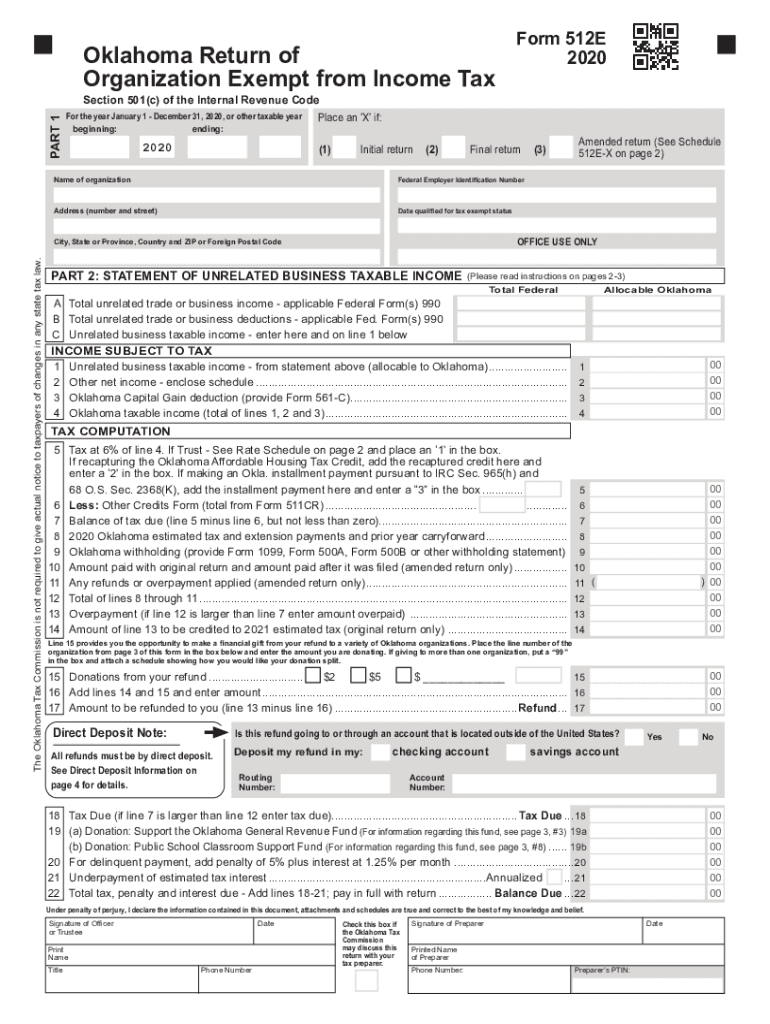

Oklahoma Form 512 Instructions 2020 Fill Out and Sign Printable PDF

Use this table if your taxable income is less than $100,000. For additional information, see the “due date” section on page 4. If you have already filed your return, either electronically or by paper, send this voucher with your check or money. Sign, mail form 511 or 511nr to. Web the 2021 form 511 oklahoma resident individual income tax forms.

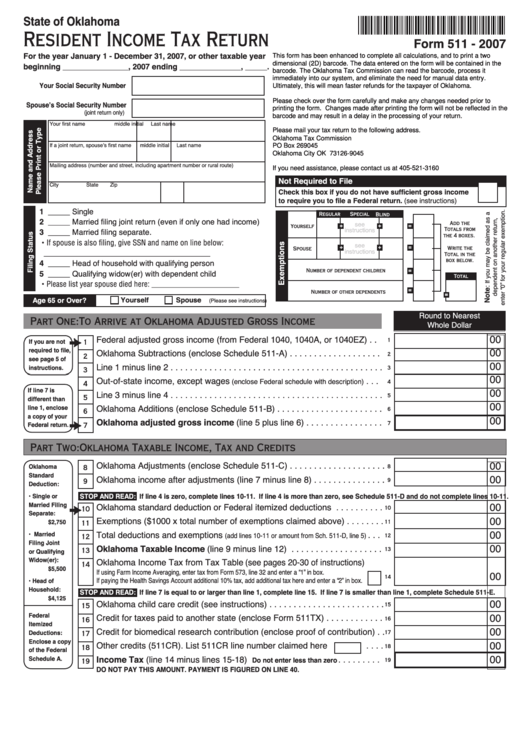

Fillable Form 511 Oklahoma Resident Tax Return 2007

Form 511 is the general income tax return for oklahoma residents. Past years income tax forms” page. Web follow the simple instructions below: Web of the oklahoma itemized deductions is computed as follows. Upload, modify or create forms.

2022 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

If your taxable income is $100,000 or more, use the tax computation on the lower portion of. Try it for free now! Web revised 2021 for loss years 2016 and subsequent, use this form. Upload, modify or create forms. If you have already filed your return, either electronically or by paper, send this voucher with your check or money.

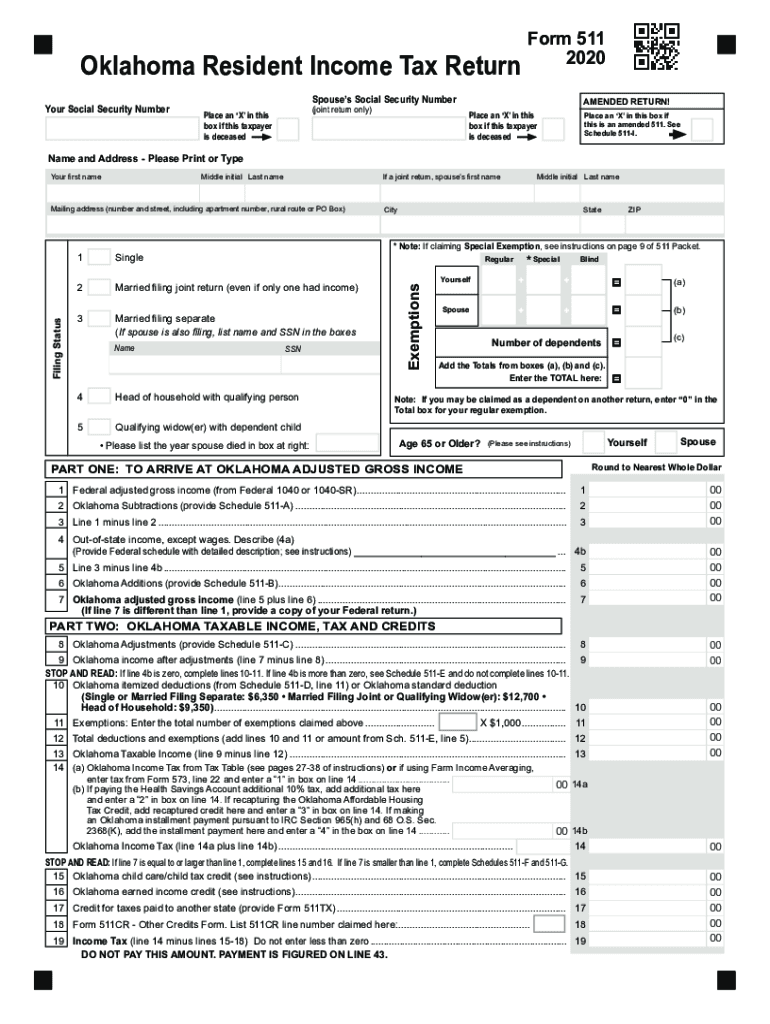

2020 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Web file now with turbotax related oklahoma individual income tax forms: Form 511 can be efiled, or a paper copy can be filed via mail. Web follow the simple instructions below: Past years income tax forms” page. Form 511 is the general income tax return for oklahoma residents.

Upload, Modify Or Create Forms.

Web form 511 oklahoma — individual resident income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web revised 2021 for loss years 2016 and subsequent, use this form. Form 511 can be efiled, or a paper copy can be filed via mail. Web the 2021 form 511 oklahoma resident individual income tax forms packet & instructions (state of oklahoma) form is 80 pages long and contains:

Web Of The Oklahoma Itemized Deductions Is Computed As Follows.

Taxformfinder has an additional 54 oklahoma income tax forms that you may need, plus all federal. If your taxable income is $100,000 or more, use the tax computation on the lower portion of. Past years income tax forms” page. Sign, mail form 511 or 511nr to.

• This Form Is Also Used To Le An.

Complete, edit or print tax forms instantly. Web other credits form state of oklahoma name as shown on return: If you have already filed your return, either electronically or by paper, send this voucher with your check or money. Provide this form and supporting documents with your oklahoma tax return.

Web State Of Oklahoma Other Credits Form Provide This Form And Supporting Documents With Your Oklahoma Tax Return.

Web follow the simple instructions below: For additional information, see the “due date” section on page 4. Name as shown on return: • generally, your return must be postmarked by april 15, 2021.