One America 401K Withdrawal Form

One America 401K Withdrawal Form - Consider these factors before taking a loan from your retirement plan Click on the “file a claim” button above. Before doing so, consider exploring all options to ensure these withdrawals are appropriate for your situation. Distribution information (continued) unforeseeable emergency withdrawal (457(b) plan only) check this box to request an unforeseeable emergency withdrawal. Web which money sources will you withdraw the loan from? Web products april 9, 2020 oneamerica forgives hardship withdrawal fees the recordkeeper is making the move in response to the cares act. Get started today on the road to planning yourretirement. If you die, your beneficiary can take a distribution from your account. Web 309 votes quick guide on how to complete form for 401k withdrawal forget about scanning and printing out forms. Web there are different types of retirement plans —the retirement plan offered by your employer might be called a 401 (k), a 403 (b), a 457 deferred compensation plan or a 408 (ira) plan.

Web send completed form to oneamerica, p.o. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web the approximate amount you will clear on a $10,000 withdrawal from a 401(k) if you are under age 59½ and subject to a 10% penalty and taxes. If you die, your beneficiary can take a distribution from your account. Get started today on the road to planning yourretirement. Web if you are under age 59½, you may have to pay a 10% penalty on your distribution amount, in addition to federal and possibly state and local taxes. Consider these factors before taking a loan from your retirement plan Start participating as soon as possible — the sooner you begin. Participant information for foreign addresses, visit www.irs.govto determine if an additional tax form is required to receive your distribution. Plan features can vary —talk to your employer to get information specific to your plan.

Plan features can vary —talk to your employer to get information specific to your plan. You can roll over your 401(k) into an individual retirement account (ira) of your liking. Web the approximate amount you will clear on a $10,000 withdrawal from a 401(k) if you are under age 59½ and subject to a 10% penalty and taxes. Plan information complete this section with your information. Distribution information (continued) unforeseeable emergency withdrawal (457(b) plan only) check this box to request an unforeseeable emergency withdrawal. Before doing so, consider exploring all options to ensure these withdrawals are appropriate for your situation. If an insured person passes away, you can simplify the claims process by filing online. Web in a financial crisis, you may decide to take a loan or hardship withdrawal, if they are available in your plan. Use our detailed instructions to fill out and esign your documents online. Web there are different types of retirement plans —the retirement plan offered by your employer might be called a 401 (k), a 403 (b), a 457 deferred compensation plan or a 408 (ira) plan.

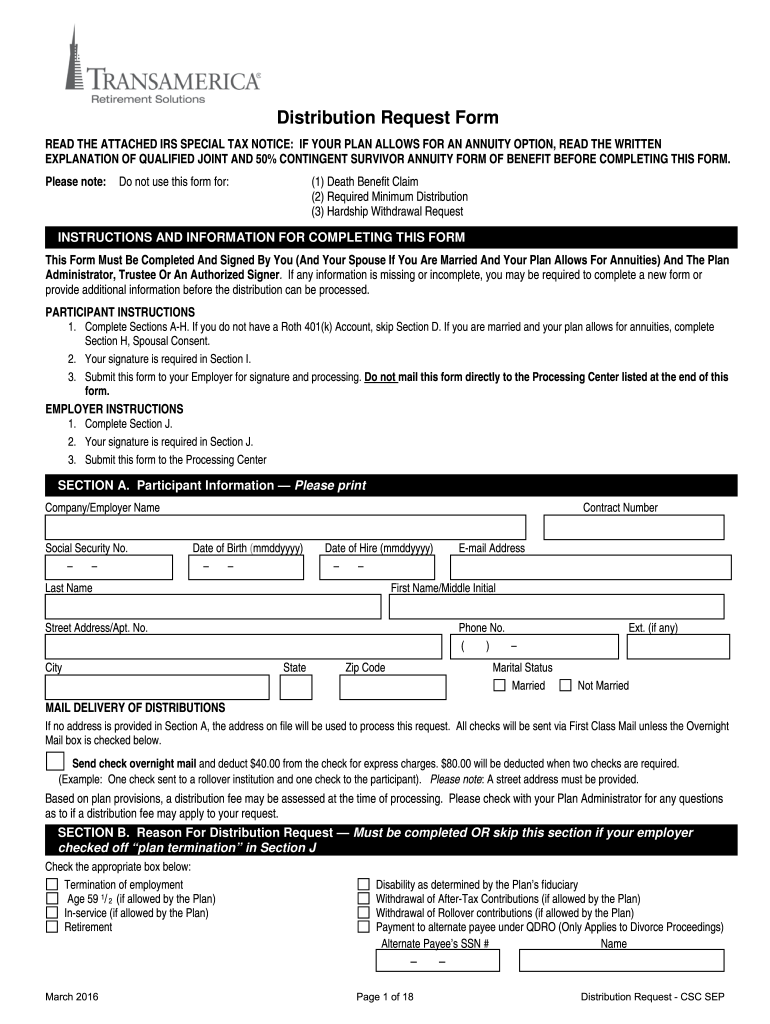

QP/401(k) Separation From Service Distribution Request Form 20072022

If you die, your beneficiary can take a distribution from your account. If an insured person passes away, you can simplify the claims process by filing online. You can roll over your 401(k) into an individual retirement account (ira) of your liking. Plan information complete this section with your information. Start participating as soon as possible — the sooner you.

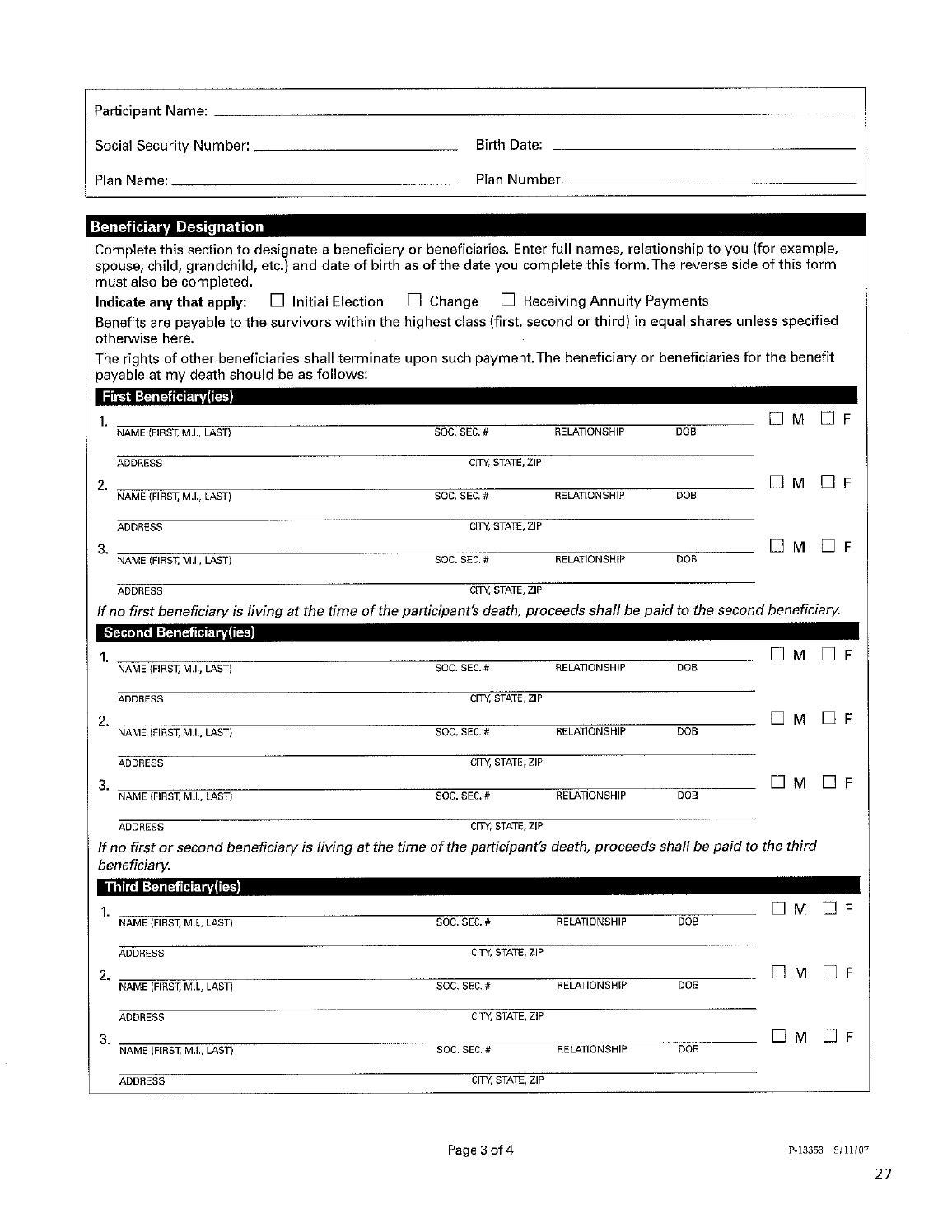

401koneamericabeneficiarydesignationform by Mattress Firm Benefits

Get started today on the road to planning yourretirement. Living off the interest and dividends once you’ve determined where your 401(k) will be housed, you have 4. Start participating as soon as possible — the sooner you begin. The appropriate form is to be completed by the participant before a distribution from the plan occurs. Then just sign the forms.

Pentegra 401k Withdrawal Form Universal Network

Web there are different types of retirement plans —the retirement plan offered by your employer might be called a 401 (k), a 403 (b), a 457 deferred compensation plan or a 408 (ira) plan. You can roll over your 401(k) into an individual retirement account (ira) of your liking. Web oneamerica retirement services llc (including former bmo and cnb retirement.

Empower 401k Withdrawal Form Universal Network

Web oneamerica retirement services llc (including former bmo and cnb retirement services) mccready and keene, inc. 50% qualified joint and survivor annuity (qjsa) notice. Living off the interest and dividends once you’ve determined where your 401(k) will be housed, you have 4. Our representatives can help you complete the enclosed enrollmentforms. Get started today on the road to planning yourretirement.

Pentegra 401k Withdrawal Form Universal Network

Web there are different types of retirement plans —the retirement plan offered by your employer might be called a 401 (k), a 403 (b), a 457 deferred compensation plan or a 408 (ira) plan. Plan features can vary —talk to your employer to get information specific to your plan. Click on the “file a claim” button above. The appropriate form.

Fillable Online transamerica 401k withdrawal form Fax Email Print

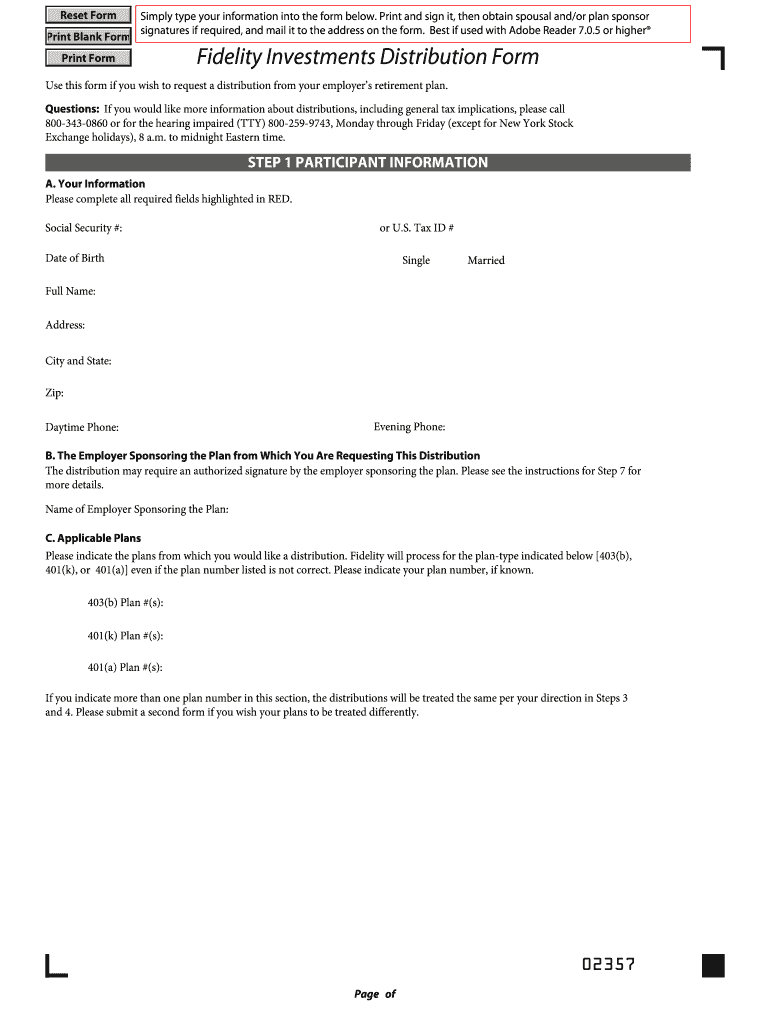

The appropriate form is to be completed by the participant before a distribution from the plan occurs. Web the following forms are available for your convenience. Participant information for foreign addresses, visit www.irs.govto determine if an additional tax form is required to receive your distribution. Sign it in a few clicks draw your signature, type it, upload its image, or.

What to do if you have to take an early withdrawal from your Solo 401k

Consider these factors before taking a loan from your retirement plan Get started today on the road to planning yourretirement. You can roll over your 401(k) into an individual retirement account (ira) of your liking. Distribution information (continued) unforeseeable emergency withdrawal (457(b) plan only) check this box to request an unforeseeable emergency withdrawal. Web the approximate amount you will clear.

First Time Home Buyer 401K Withdrawal 2020 Irs Goimages Ninja

And since a rollover isn’t a withdrawal, it generally isn’t a taxable event. Understand the facts about hardship withdrawals; Take a distribution of your entire account balance. Our representatives can help you complete the enclosed enrollmentforms. Web 309 votes quick guide on how to complete form for 401k withdrawal forget about scanning and printing out forms.

InService Withdrawals from 401(k) Plans The Basics Retirement

Understand the facts about hardship withdrawals; Web a plan distribution before you turn 65 (or the plan’s normal retirement age, if earlier) may result in an additional income tax of 10% of the amount of the withdrawal. Web spousal consent and qualified joint & survivor annuity (qjsa) waiver. Web the approximate amount you will clear on a $10,000 withdrawal from.

401k Withdrawal Form Fill Out and Sign Printable PDF Template signNow

Web which money sources will you withdraw the loan from? Start participating as soon as possible — the sooner you begin. Web five ways to prepare for retirement including reviewing your financial situation and determining your withdrawal strategy. Web if you are under age 59½, you may have to pay a 10% penalty on your distribution amount, in addition to.

Web Five Ways To Prepare For Retirement Including Reviewing Your Financial Situation And Determining Your Withdrawal Strategy.

Before doing so, consider exploring all options to ensure these withdrawals are appropriate for your situation. Calculate estate tax to calculate your federal estate tax, you must know the worth of your estate, both gross and taxable. Web there are different types of retirement plans —the retirement plan offered by your employer might be called a 401 (k), a 403 (b), a 457 deferred compensation plan or a 408 (ira) plan. Web the following forms are available for your convenience.

Web A Plan Distribution Before You Turn 65 (Or The Plan’s Normal Retirement Age, If Earlier) May Result In An Additional Income Tax Of 10% Of The Amount Of The Withdrawal.

These forms can be printed, completed (including appropriate authorizations) and, unless otherwise noted, submitted to aul through fax or regular mail. Web products april 9, 2020 oneamerica forgives hardship withdrawal fees the recordkeeper is making the move in response to the cares act. Distribution information (continued) unforeseeable emergency withdrawal (457(b) plan only) check this box to request an unforeseeable emergency withdrawal. And since a rollover isn’t a withdrawal, it generally isn’t a taxable event.

Plan Features Can Vary —Talk To Your Employer To Get Information Specific To Your Plan.

Start participating as soon as possible — the sooner you begin. Web send completed form to oneamerica, p.o. Plan features can vary —talk to your employer to get information specific to your plan. Employee benefits forms prospectuses contact us oneamerica financial partners, inc.

Web Which Money Sources Will You Withdraw The Loan From?

You can roll over your 401(k) into an individual retirement account (ira) of your liking. Understand the facts about hardship withdrawals; Web 309 votes quick guide on how to complete form for 401k withdrawal forget about scanning and printing out forms. Start participating as soon as possible — the sooner you begin.