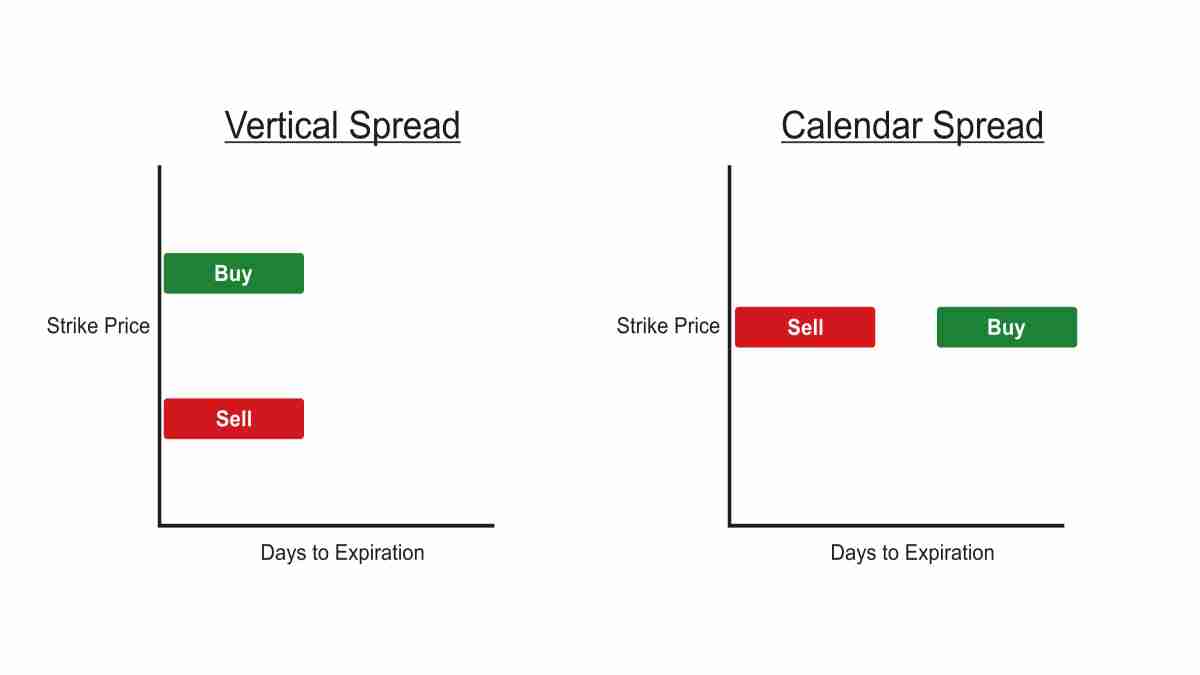

Options Calendar Spread

Options Calendar Spread - Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect.

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility.

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

How Long Calendar Spreads Work (w/ Examples) Options Trading

Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect.

Calendar Spread, stratégie d’options sur deux échéances différentes

Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect.

Calendar Spread Options Strategy VantagePoint

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility.

Calendar Spread Options Trading Strategy In Python

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

Bearish Put Calendar Spread Option Strategy Guide

Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility.

How Calendar Spreads Work (Best Explanation) projectoption

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk.

Web Calendar Spreads Enable Traders To Collect Weekly To Monthly Options Premium Income With Defined Risk.

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)