Oregon State Tax Form 2023

Oregon State Tax Form 2023 - Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. Web 2023 forms and publications. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web instructions oregon state income tax forms for current and previous tax years. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Be sure to verify that the form you are downloading is for the correct year. We don't recommend using your web browser to complete the form, as problems may occur. Form 132 is filed with form oq on a quarterly basis. View all of the current year's forms and publications by popularity or program area. Web current forms and publications.

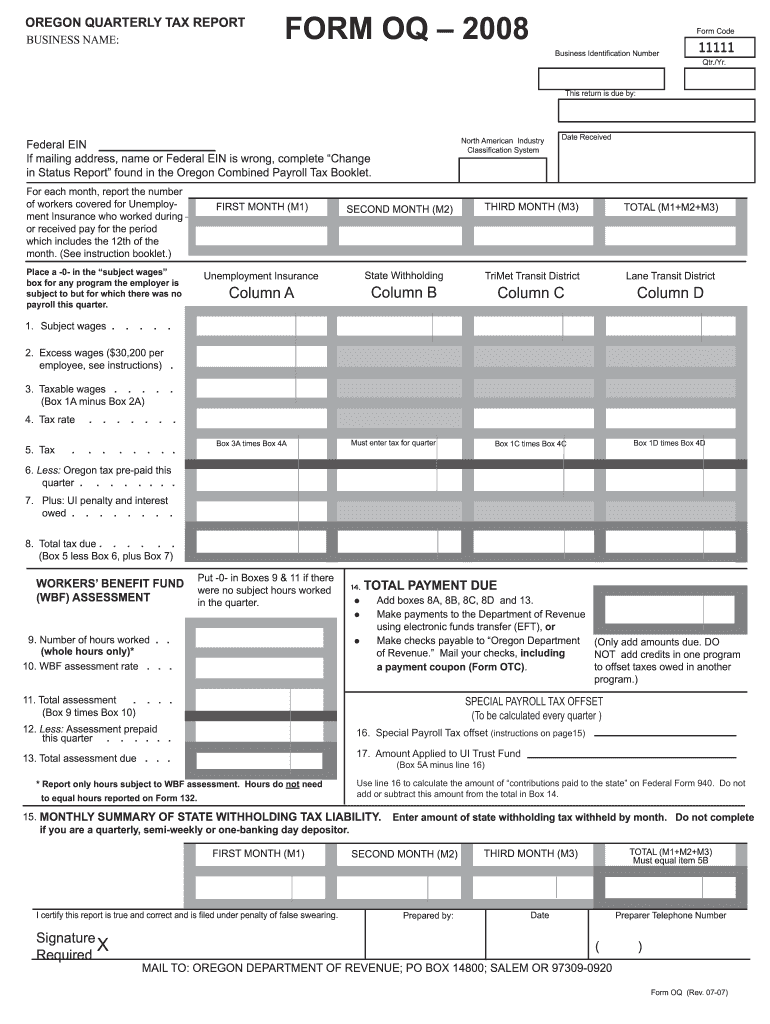

Form 132 is filed with form oq on a quarterly basis. Instructions for employer or other payer. Be sure to verify that the form you are downloading is for the correct year. View all of the current year's forms and publications by popularity or program area. Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Keep in mind that some states will not update their tax forms for 2023 until january 2024. We don't recommend using your web browser to complete the form, as problems may occur. Download and save the form to your computer, then open it in adobe reader to complete and print. Web 2023 forms and publications.

We don't recommend using your web browser to complete the form, as problems may occur. Be sure to verify that the form you are downloading is for the correct year. Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. View all of the current year's forms and publications by popularity or program area. Web 2023 forms and publications. Download and save the form to your computer, then open it in adobe reader to complete and print. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web current forms and publications. Instructions for employer or other payer. All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions.

oregon tax tables

Instructions for employer or other payer. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) View all of the current year's forms and publications by popularity or program area. Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year,.

Or Wr Form For 2019 Fill Online, Printable, Fillable, Blank pdfFiller

Be sure to verify that the form you are downloading is for the correct year. Web 2023 forms and publications. All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. View all of the current year's forms and publications by popularity or program area. Web.

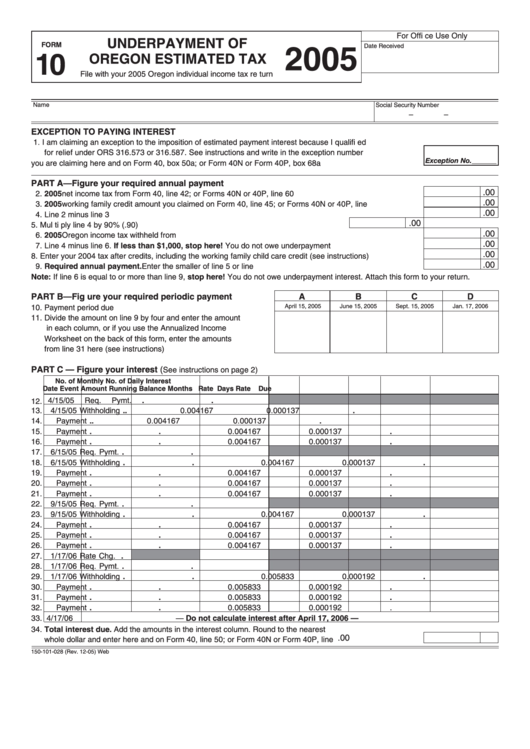

Fillable Form 10 Underpayment Of Oregon Estimated Tax 2005

Download and save the form to your computer, then open it in adobe reader to complete and print. Web 2023 forms and publications. Form 132 is filed with form oq on a quarterly basis. Web current forms and publications. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn)

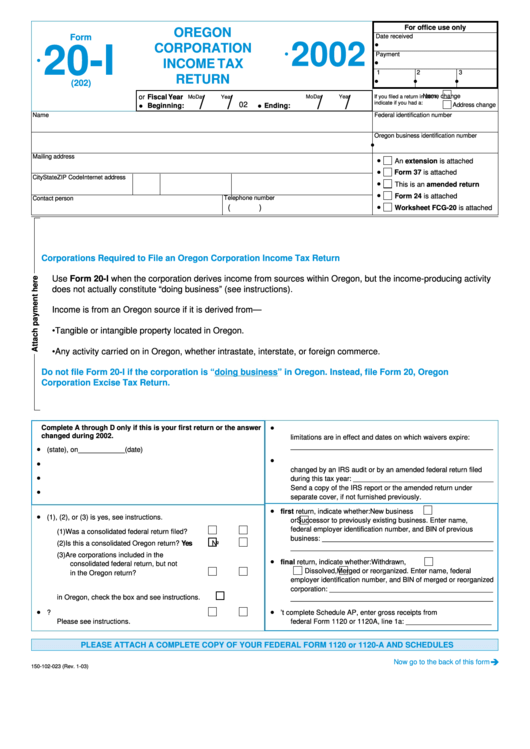

Form 20I Oregon Corporation Tax Return 2002 printable pdf

We don't recommend using your web browser to complete the form, as problems may occur. All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. Select a heading to view its forms, then u se the search feature to locate a form or publication by.

Oregon tax revenue growing 2x other states The Oregon Catalyst

Web instructions oregon state income tax forms for current and previous tax years. Download and save the form to your computer, then open it in adobe reader to complete and print. View all of the current year's forms and publications by popularity or program area. Be sure to verify that the form you are downloading is for the correct year..

Oregon State Tax Forms Printable and Similar Products and Services List

Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. Web instructions oregon state income tax forms for current and previous tax years. Be sure to verify that the form you are downloading is for the correct year. Web 2023 forms and publications..

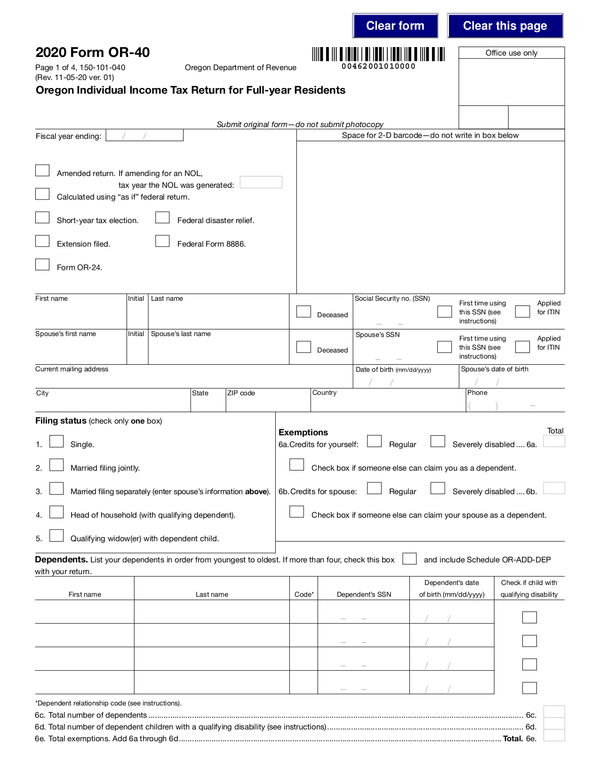

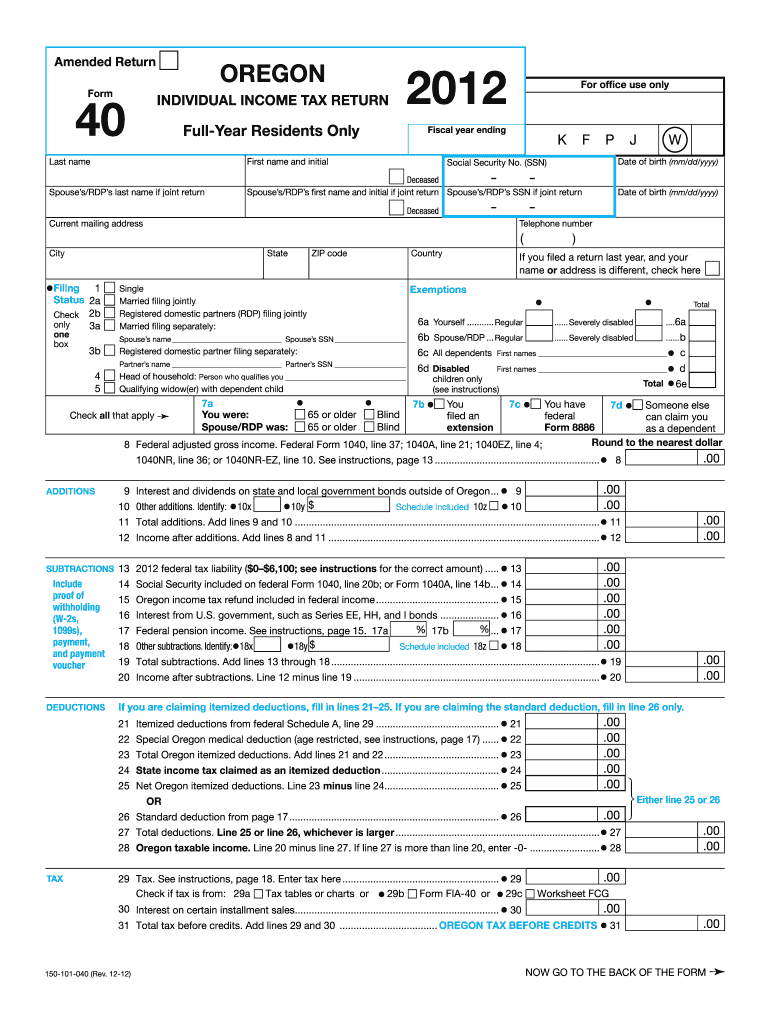

Oregon form 40 v Fill out & sign online DocHub

Web current forms and publications. We don't recommend using your web browser to complete the form, as problems may occur. All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. Web 2023 forms and publications. Be sure to verify that the form you are downloading.

Fill Free fillable forms for the state of Oregon

Web 2023 forms and publications. Web current forms and publications. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. Form 132 is filed with form oq on a quarterly.

Oregon form oq Fill out & sign online DocHub

Web current forms and publications. Keep in mind that some states will not update their tax forms for 2023 until january 2024. All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. Select a heading to view its forms, then u se the search feature.

oregon tax Fill out & sign online DocHub

We don't recommend using your web browser to complete the form, as problems may occur. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Download and save the form to your computer, then open it in adobe reader to complete and print. Keep in mind that some states will not update their tax forms.

Web 2023 Forms And Publications.

Web instructions oregon state income tax forms for current and previous tax years. Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. Download and save the form to your computer, then open it in adobe reader to complete and print. View all of the current year's forms and publications by popularity or program area.

Be Sure To Verify That The Form You Are Downloading Is For The Correct Year.

01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Instructions for employer or other payer. Keep in mind that some states will not update their tax forms for 2023 until january 2024. We don't recommend using your web browser to complete the form, as problems may occur.

Web Current Forms And Publications.

All filers can get their tax using the personal income tax calculator instead of using the tax rate charts or tables in the return instructions. Form 132 is filed with form oq on a quarterly basis.