Otc Form 511

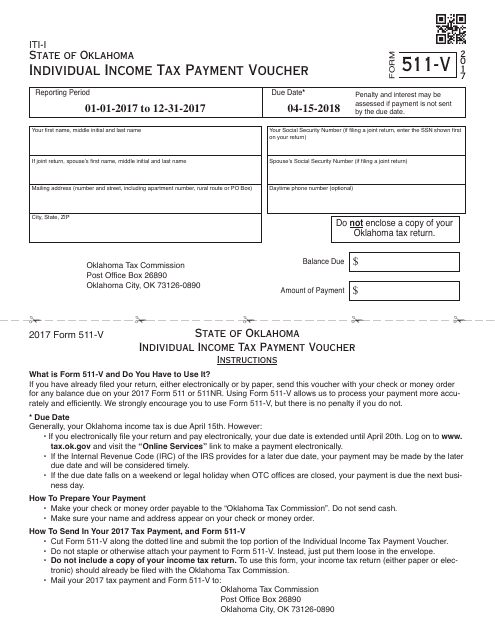

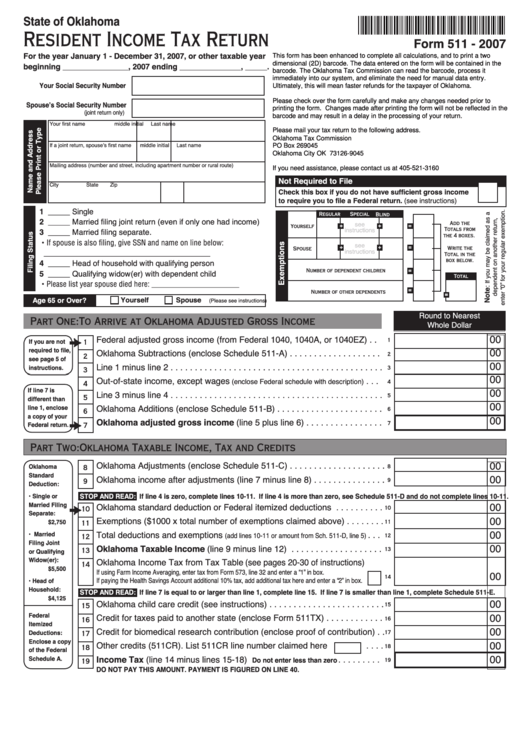

Otc Form 511 - Name as shown on return: Web regular spouse special blind yourself name add the totals from boxes (a), (b) and (c). Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. Oklahoma resident income tax return form • form. Form 511 can be efiled, or a paper copy can be filed via mail. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. The due date for an electronic. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Oklahoma resident income tax return • form 511: This form is for income earned in tax year 2022, with tax returns due in.

• instructions for completing the form 511: Sign, mail form 511 or 511nr to. Web to use this form, your income tax return (either paper or electronic) should already be filed with the otc. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. The due date for an electronic. Name as shown on return: For more information about the oklahoma income. Oklahoma resident income tax return form • form. • instructions for completing the form 511: Web provide this form and supporting documents with your oklahoma tax return.

Web to use this form, your income tax return (either paper or electronic) should already be filed with the otc. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. The due date for an electronic. • instructions for completing the form 511: Name(s) shown on form 511: Web regular spouse special blind yourself name add the totals from boxes (a), (b) and (c). Oklahoma resident income tax return • form 511: Web if you are required to file an oklahoma income tax return, claim the sales tax refund as a credit on your tax return, form 511, and provide this signed form. Form 511 can be efiled, or a paper copy can be filed via mail. Name as shown on return:

OTC Form 511V Download Fillable PDF or Fill Online Individual

Web to use this form, your income tax return (either paper or electronic) should already be filed with the otc. • instructions for completing the form 511: Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Oklahoma resident income tax return • form 511: Web 2021 oklahoma resident.

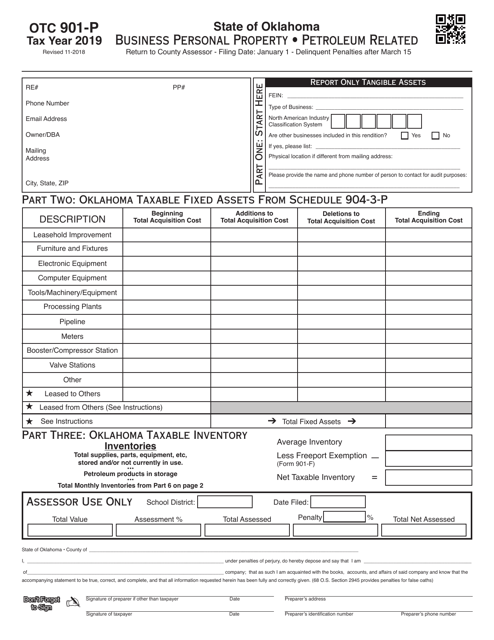

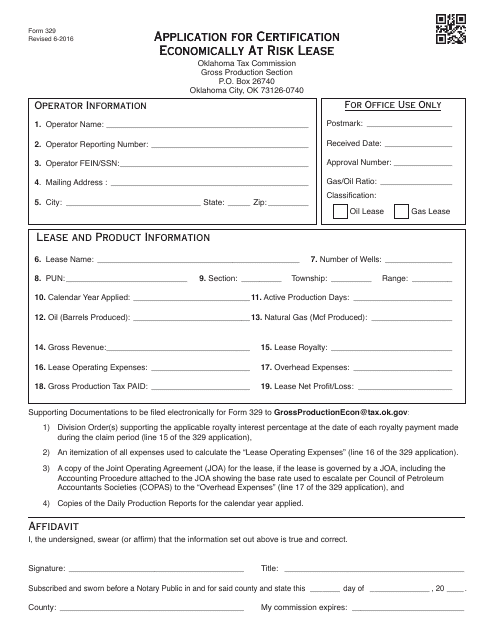

OTC Form OTC9043P Download Fillable PDF or Fill Online Petroleum

Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Ssn number of dependents age 65 or older? Web form 511 is the general.

OTC Form 901P Download Fillable PDF or Fill Online Business Personal

Ssn number of dependents age 65 or older? This form is for income earned in tax year 2022, with tax returns due in. Name(s) shown on form 511: Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. For more information about the oklahoma income.

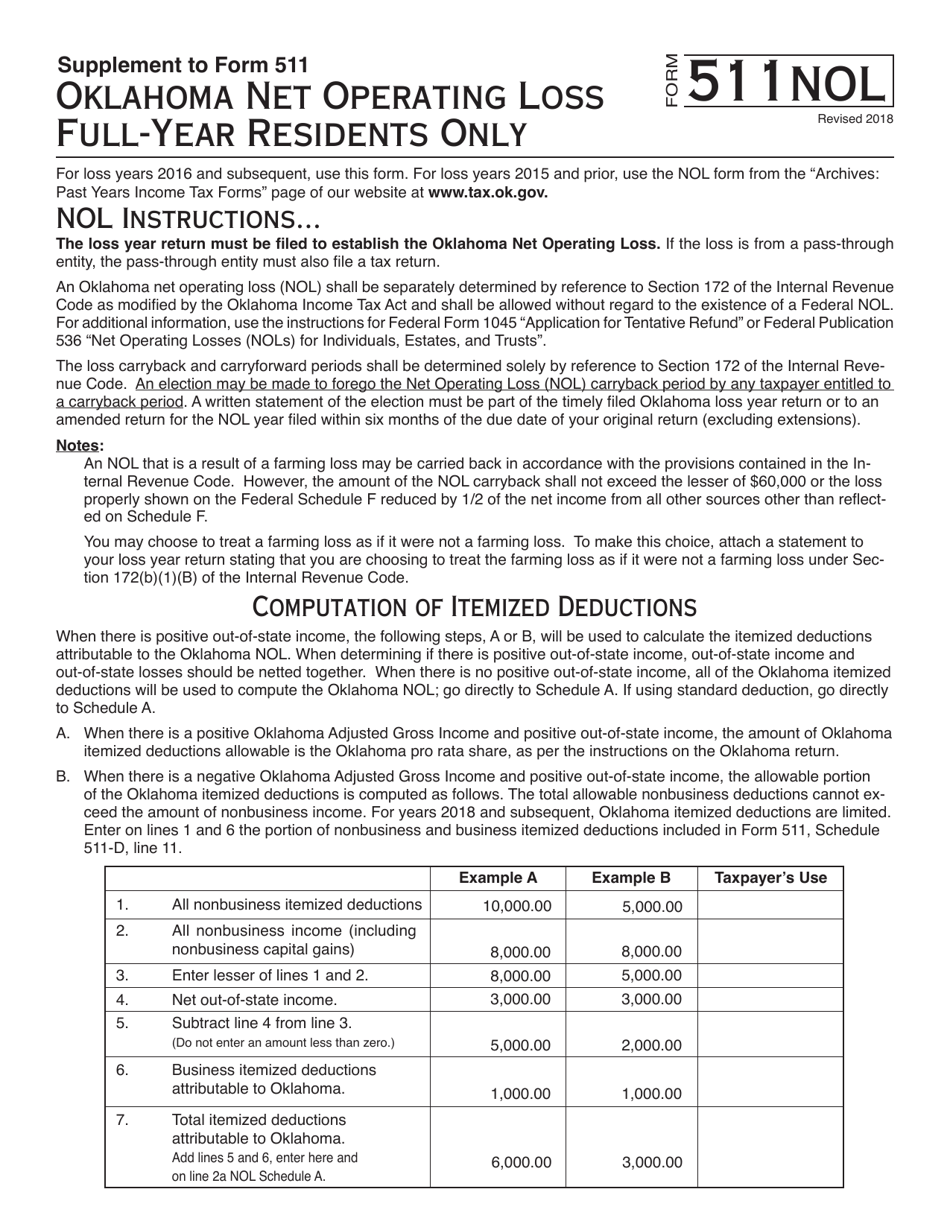

OTC Form 511NOL Download Fillable PDF or Fill Online Oklahoma Net

Oklahoma resident income tax return form • form. Sign, mail form 511 or 511nr to. Web if you are required to file an oklahoma income tax return, claim the sales tax refund as a credit on your tax return, form 511, and provide this signed form. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax.

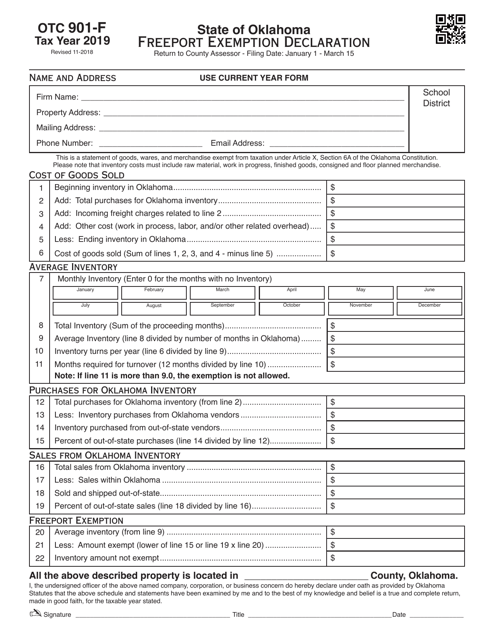

OTC Form 901F Download Fillable PDF or Fill Online Freeport Exemption

Form 511 can be efiled, or a paper copy can be filed via mail. Web form 511 is the general income tax return for oklahoma residents. Oklahoma resident income tax return form • form. • instructions for completing the form 511: Sign, mail form 511 or 511nr to.

Fillable Form 511 Oklahoma Resident Tax Return 2007

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. The due date for an electronic. Web provide this form and supporting documents with your oklahoma tax return. Oklahoma resident income tax return • form 511: Name as shown on return:

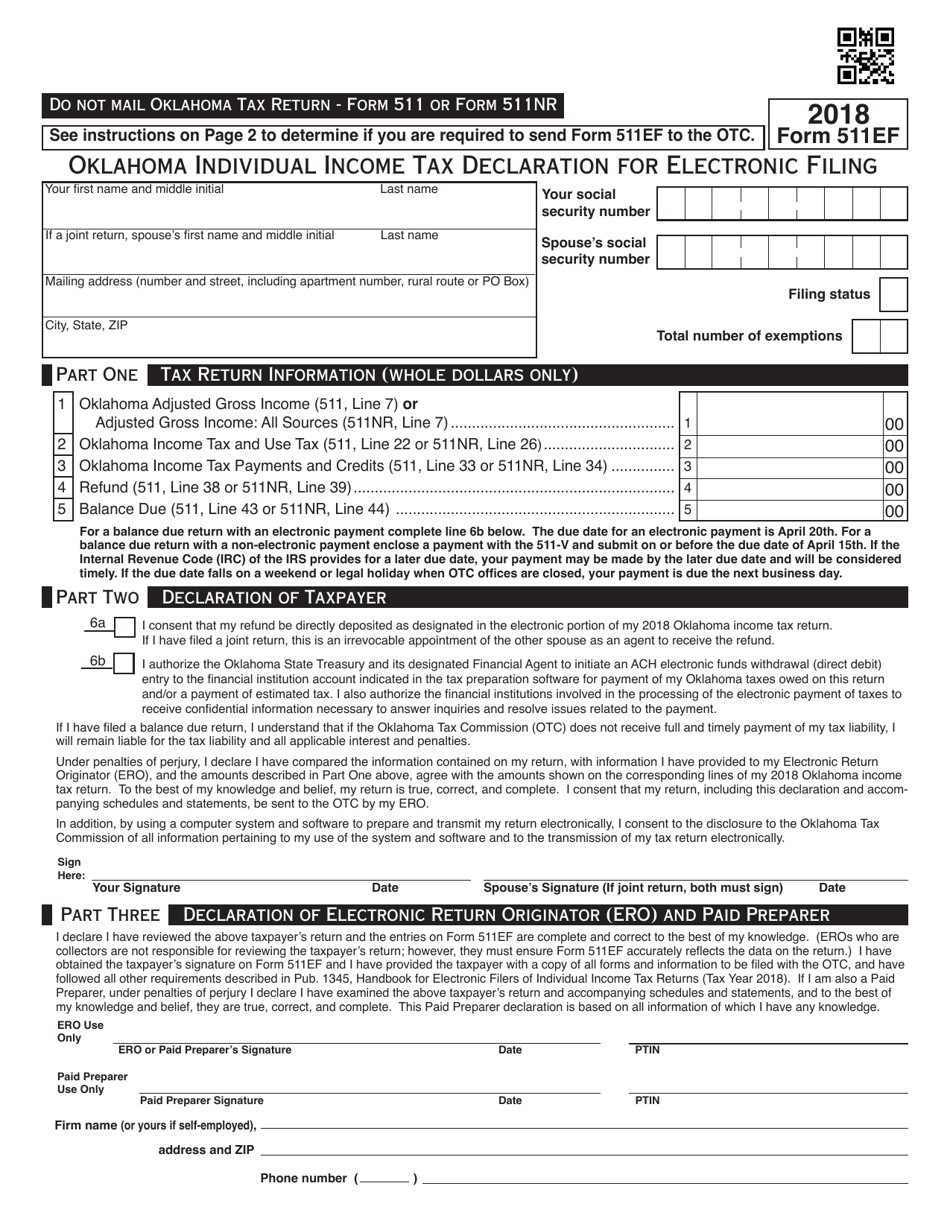

OTC Form 511EF Download Fillable PDF or Fill Online Oklahoma Individual

Ssn number of dependents age 65 or older? Oklahoma resident income tax return form • form. You can download or print current or. Web provide this form and supporting documents with your oklahoma tax return. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

OTC Form 329 Download Fillable PDF or Fill Online Application for

Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Oklahoma resident income tax return form • form. Web to use this form, your income tax return (either paper or electronic) should already be filed with the otc. Web provide this form and supporting documents with your oklahoma tax return. • instructions for completing the.

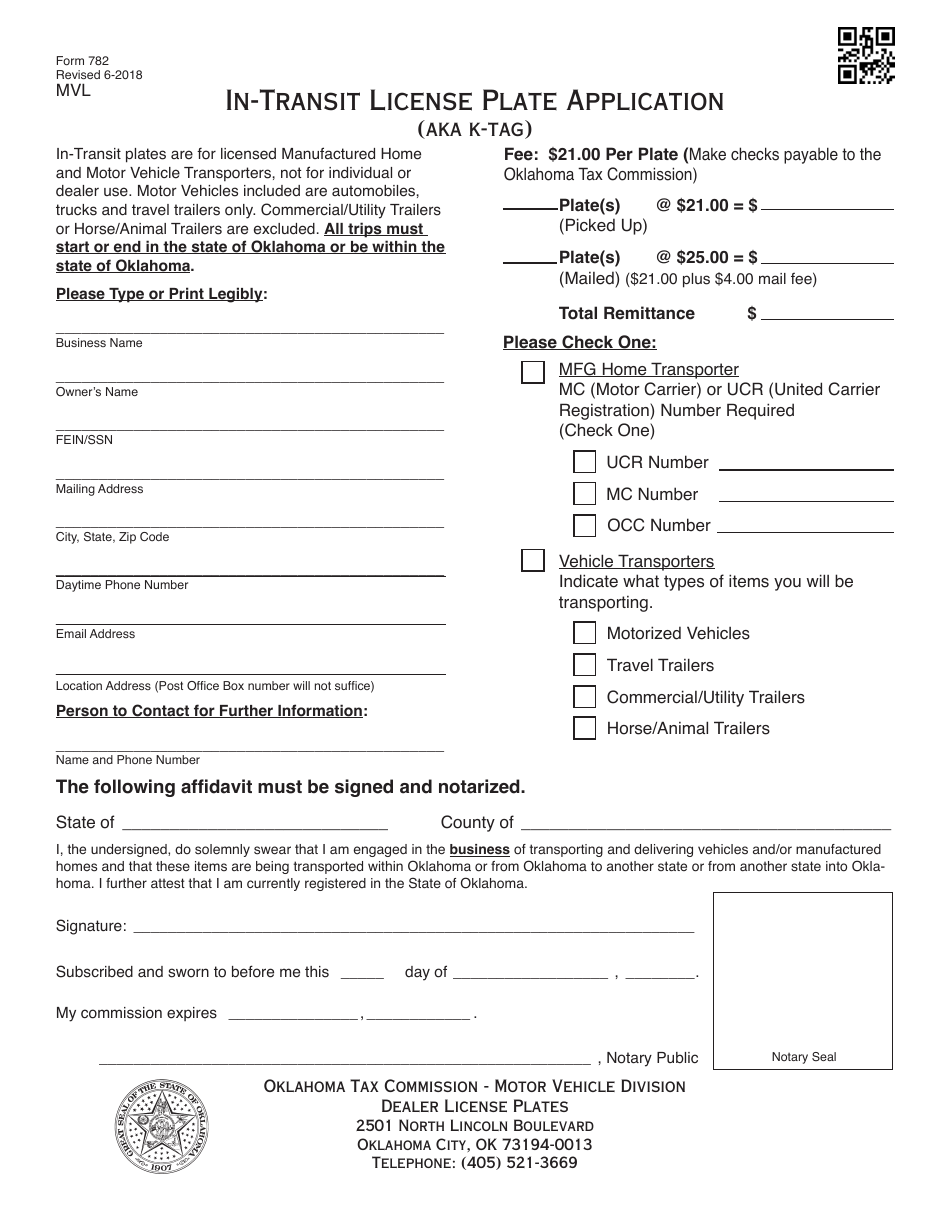

OTC Form 782 Download Fillable PDF or Fill Online Intransit License

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web form 511 is the general income tax return for oklahoma residents. For more information about the oklahoma income. • instructions for completing the form 511:

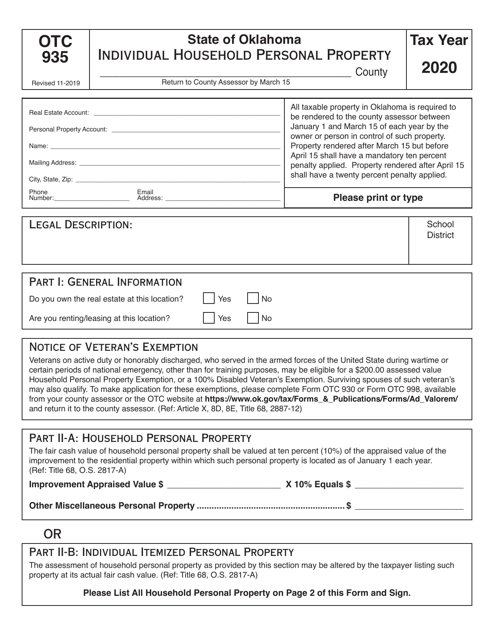

OTC Form 935 Download Fillable PDF or Fill Online Individual Household

The due date for an electronic. • instructions for completing the form 511: Name as shown on return: Sign, mail form 511 or 511nr to. Web if you are required to file an oklahoma income tax return, claim the sales tax refund as a credit on your tax return, form 511, and provide this signed form.

Oklahoma Resident Income Tax Return Form • Form.

Form 511 can be efiled, or a paper copy can be filed via mail. Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. You can download or print current or. Name(s) shown on form 511:

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In.

For more information about the oklahoma income. Sign, mail form 511 or 511nr to. Web form 511 is the general income tax return for oklahoma residents. Web 2021 oklahoma resident individual income tax forms and instructions.

Web If You Are Required To File An Oklahoma Income Tax Return, Claim The Sales Tax Refund As A Credit On Your Tax Return, Form 511, And Provide This Signed Form.

Web regular spouse special blind yourself name add the totals from boxes (a), (b) and (c). Ssn number of dependents age 65 or older? Oklahoma resident income tax return • form 511: • instructions for completing the form 511:

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The Revenue.

The due date for an electronic. Name as shown on return: Web to use this form, your income tax return (either paper or electronic) should already be filed with the otc. Web provide this form and supporting documents with your oklahoma tax return.