Paychex 401K Withdrawal Form

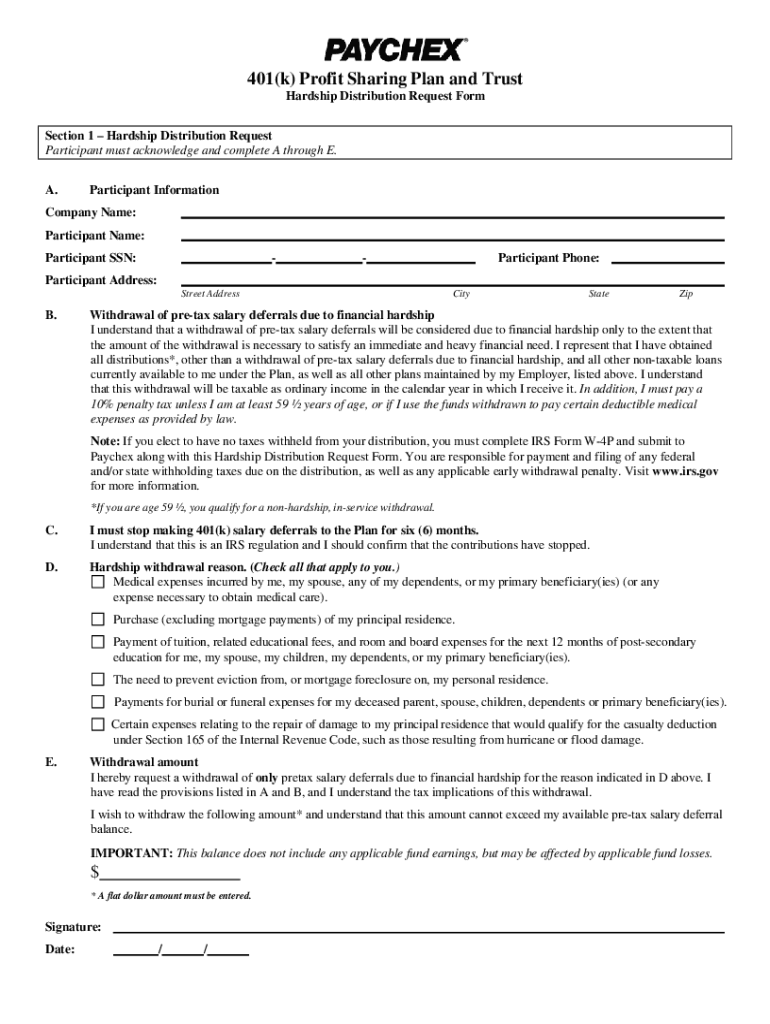

Paychex 401K Withdrawal Form - Like the cares act, the consolidated appropriations act allows you to withdraw funds from both a 401(k) and. Log into the paychex retirement services website at paychexflex.com and select my retirement. Web all eligible employees must receive a copy of the document regardless of whether they have elected to make a salary deferral to the 401(k) plan; Web contributions to your 401(k) are withdrawn from the bank account you have on file with paychex retirement services. Web • select the distribution type and review the qualified retirement plan withdrawal notice. Assuming you're under 59½ years old, you can now withdraw as much as $100,000 from your company retirement or. Web individual 401 (k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401 (k). When finished, check the box to indicate “i have read and understand the qualified. If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. To access your plan on your mobile device, download the paychex flex.

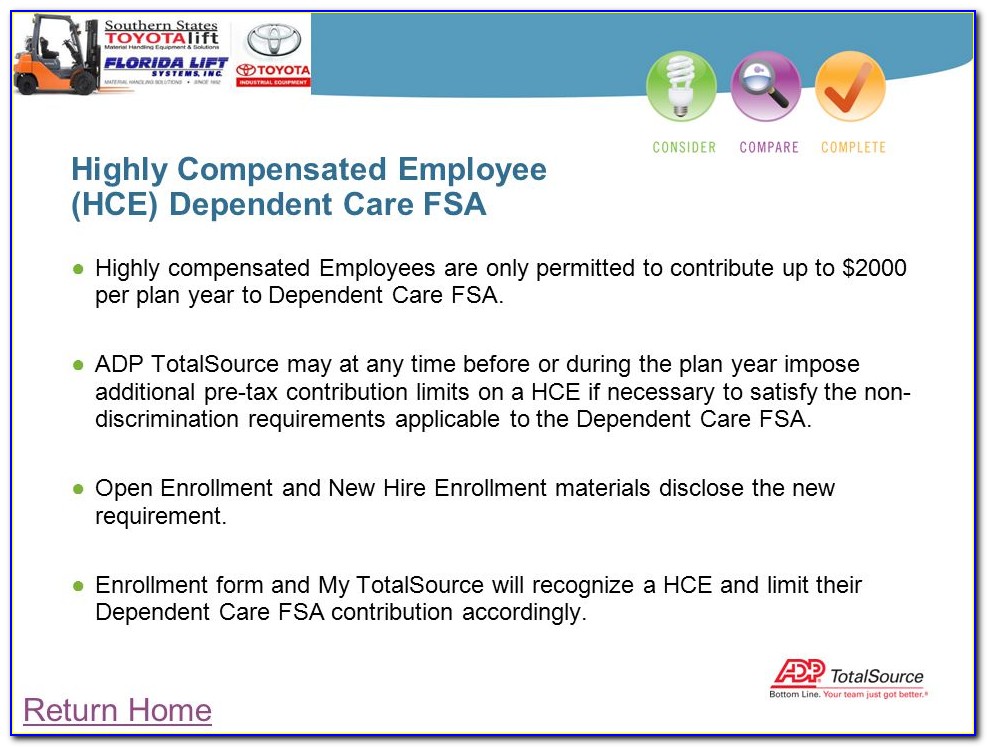

Get form check to the ira company named below if the employee. Web contributions to your 401(k) are withdrawn from the bank account you have on file with paychex retirement services. Web a 401(k) account could be a significant asset and a tempting source of funds to pay for something you need. Web 401(k) plans that report corrective distributions typically fail nondiscrimination testing. Web retirement calculator partner with the #1 401 (k) recordkeeper paychex can help you determine attainable retirement savings goals for each stage of your career. If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. To access your plan on your mobile device, download the paychex flex. Most 401(k) plans today allow participants to borrow from. Web you’re on your way to potential savings! Web can i withdraw my 401k from paychex?

When finished, check the box to indicate “i have read and understand the qualified. To access your plan on your mobile device, download the paychex flex. Assuming you're under 59½ years old, you can now withdraw as much as $100,000 from your company retirement or. Web all eligible employees must receive a copy of the document regardless of whether they have elected to make a salary deferral to the 401(k) plan; If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. Web if you are a participant in a 401(k) plan and you are automatically enrolled under the terms of the plan, the value of your automatic salary deferral account may be distributed to you if. Refer to the top of the general information sheet to determine whether your plan is a 401(k) (including simplified 401(k)), profit sharing, or money purchase pension plan. Web 401(k) plans that report corrective distributions typically fail nondiscrimination testing. Web retirement calculator partner with the #1 401 (k) recordkeeper paychex can help you determine attainable retirement savings goals for each stage of your career. Most 401(k) plans today allow participants to borrow from.

401k Enrollment Form Template HQ Printable Documents

Like the cares act, the consolidated appropriations act allows you to withdraw funds from both a 401(k) and. Web individual 401 (k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401 (k). To access your plan on your mobile device, download the paychex flex. Learn how paychex can.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

Web can i withdraw my 401k from paychex? Web understand that upon approval of this initial hardship request form, i will receive an additional hardship withdrawal request form that will need to be completed and. Refer to the top of the general information sheet to determine whether your plan is a 401(k) (including simplified 401(k)), profit sharing, or money purchase.

Paychex request distribution form Fill out & sign online DocHub

Like the cares act, the consolidated appropriations act allows you to withdraw funds from both a 401(k) and. Web a 401(k) account could be a significant asset and a tempting source of funds to pay for something you need. Web you’re on your way to potential savings! Web • select the distribution type and review the qualified retirement plan withdrawal.

Paychex 401k beneficiary designation form Fill out & sign online DocHub

Web can i withdraw my 401k from paychex? Web should you take a distribution from your 401(k) or ira? Web • select the distribution type and review the qualified retirement plan withdrawal notice. Web if you are a participant in a 401(k) plan and you are automatically enrolled under the terms of the plan, the value of your automatic salary.

Filing A Hardship Form Fill Online, Printable, Fillable, Blank

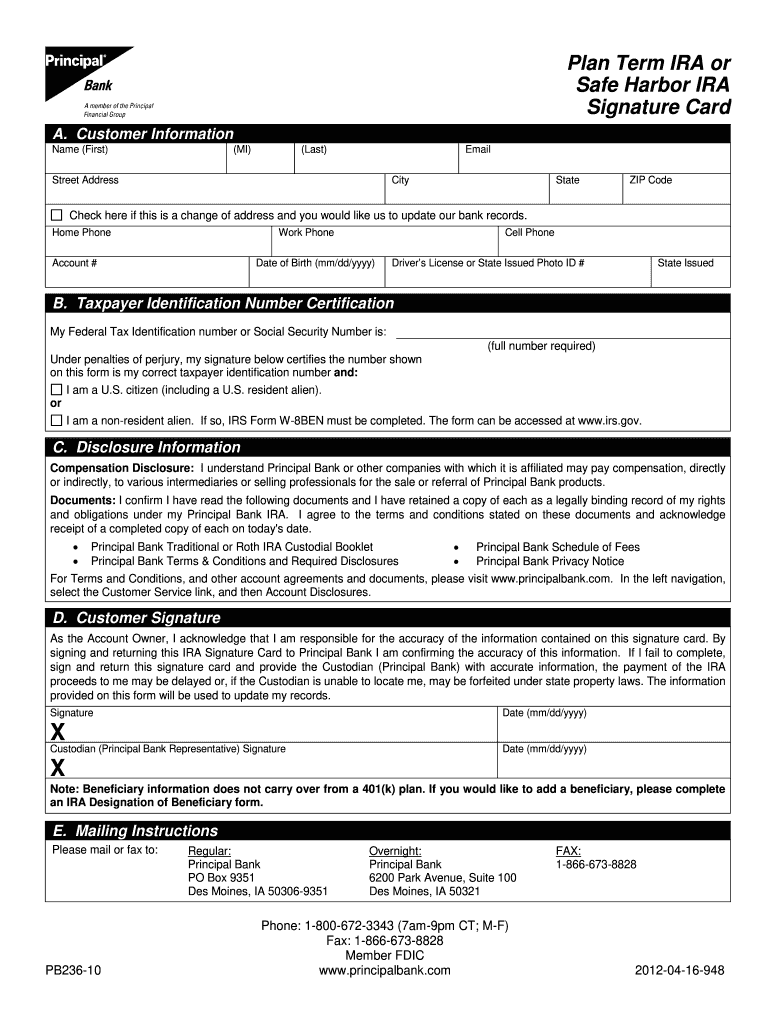

Monthly service fees can be paid from your bank. Get form check to the ira company named below if the employee. To access your plan on your mobile device, download the paychex flex. Log into the paychex retirement services website at paychexflex.com and select my retirement. Web should you take a distribution from your 401(k) or ira?

Principal 401k Withdrawal Fill Online, Printable, Fillable, Blank

If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. Get form check to the ira company named below if the employee. Web use a paychex 401k withdrawal form 2019 template to make your document workflow more streamlined. Web contributions to your 401(k) are withdrawn from the.

Paychex 401k Withdrawal Form Universal Network

When finished, check the box to indicate “i have read and understand the qualified. Web contributions to your 401(k) are withdrawn from the bank account you have on file with paychex retirement services. If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. Web use a paychex.

Paychex 401K Enrollment Form DocHub

Web if you have made investments selections in your company’s 401(k) retirement plan with paychex, your rollover funds will be invested according to your current fund allocations. Refer to the top of the general information sheet to determine whether your plan is a 401(k) (including simplified 401(k)), profit sharing, or money purchase pension plan. Web individual 401 (k) distribution request.

Paychex 401k Hardship Withdrawal Form Universal Network

When finished, check the box to indicate “i have read and understand the qualified. Web should you take a distribution from your 401(k) or ira? Web you’re on your way to potential savings! Web how does the cares act impact 401k? Monthly service fees can be paid from your bank.

John Hancock 401k Rollover Request Form Form Resume Examples

Web retirement calculator partner with the #1 401 (k) recordkeeper paychex can help you determine attainable retirement savings goals for each stage of your career. Web can i withdraw my 401k from paychex? Here's what to know about the careers act 401k rules before taking a loan or distribution. Web all eligible employees must receive a copy of the document.

Assuming You're Under 59½ Years Old, You Can Now Withdraw As Much As $100,000 From Your Company Retirement Or.

Web a 401(k) account could be a significant asset and a tempting source of funds to pay for something you need. Web how does the cares act impact 401k? Web contributions to your 401(k) are withdrawn from the bank account you have on file with paychex retirement services. Web can i withdraw my 401k from paychex?

Web You’re On Your Way To Potential Savings!

To access your plan on your mobile device, download the paychex flex. Monthly service fees can be paid from your bank. Log into the paychex retirement services website at paychexflex.com and select my retirement. Like the cares act, the consolidated appropriations act allows you to withdraw funds from both a 401(k) and.

Web If You Are A Participant In A 401(K) Plan And You Are Automatically Enrolled Under The Terms Of The Plan, The Value Of Your Automatic Salary Deferral Account May Be Distributed To You If.

If a 401(k) plan participant withdraws funds from their plan before age 59½, they would be subject to a 10 percent early withdrawal. Web if you have made investments selections in your company’s 401(k) retirement plan with paychex, your rollover funds will be invested according to your current fund allocations. Refer to the top of the general information sheet to determine whether your plan is a 401(k) (including simplified 401(k)), profit sharing, or money purchase pension plan. Learn how paychex can help with retirement plan changes.

When Finished, Check The Box To Indicate “I Have Read And Understand The Qualified.

Web retirement calculator partner with the #1 401 (k) recordkeeper paychex can help you determine attainable retirement savings goals for each stage of your career. Web 401(k) plans that report corrective distributions typically fail nondiscrimination testing. Get form check to the ira company named below if the employee. Web individual 401 (k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401 (k).