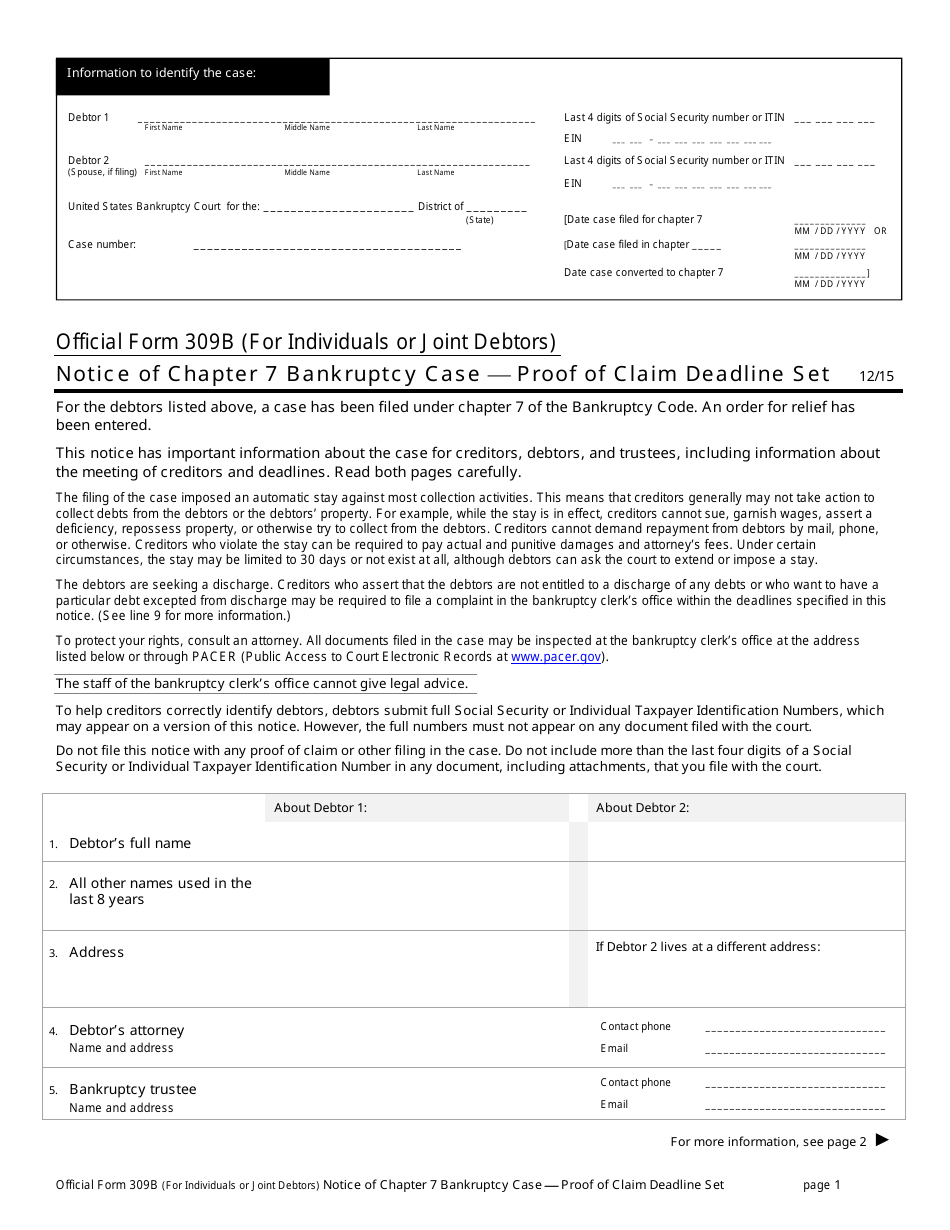

Payment Plan Bankruptcy Chapter 7

Payment Plan Bankruptcy Chapter 7 - Everyone seeking debt relief in the form of. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Businesses choosing to terminate their. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. There is a little bit more to it than that, however. For individuals, the most common type of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web liquidation under chapter 7 is a common form of bankruptcy. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option.

Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. For individuals, the most common type of. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web liquidation under chapter 7 is a common form of bankruptcy. Everyone seeking debt relief in the form of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Businesses choosing to terminate their. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Other options include an irs payment plan or an offer in compromise. There is a little bit more to it than that, however.

For individuals, the most common type of. Web liquidation under chapter 7 is a common form of bankruptcy. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. There is a little bit more to it than that, however. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Businesses choosing to terminate their. Everyone seeking debt relief in the form of. Other options include an irs payment plan or an offer in compromise.

Fighting Legal Complexity How Sen. Warren’s Bankruptcy Plan Defends

There is a little bit more to it than that, however. Everyone seeking debt relief in the form of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web liquidation under chapter 7 is a common form of bankruptcy. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment.

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. For individuals, the most common type.

The Bankruptcy Payment Plan

It is available to individuals who cannot make regular, monthly, payments toward their debts. Other options include an irs payment plan or an offer in compromise. There is a little bit more to it than that, however. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web if you.

NEW Payment Plan Available for Chapter 7 Bankruptcy YouTube

Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web liquidation under chapter 7 is a common form of bankruptcy. Businesses choosing to terminate their. Web a chapter 7 bankruptcy case does not involve the.

Bradley’s Bankruptcy Basics Chapter 13 Bankruptcy — Consumer

Other options include an irs payment plan or an offer in compromise. Web liquidation under chapter 7 is a common form of bankruptcy. For individuals, the most common type of. There is a little bit more to it than that, however. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter.

Chapter 13 Bankruptcy Payments How To Calculate Yours

Businesses choosing to terminate their. Everyone seeking debt relief in the form of. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web individuals, spouses, and business entities can qualify for relief.

Filing for bankruptcy Chapter 13 2022 guide by NY lawyer Ortiz&Ortiz

Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Everyone seeking debt.

Proof Of Claim Chapter 13 eformsdesigner

Everyone seeking debt relief in the form of. Web liquidation under chapter 7 is a common form of bankruptcy. There is a little bit more to it than that, however. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web individuals, spouses, and business entities can qualify for relief.

What You Need to Know About Bankruptcy

It is available to individuals who cannot make regular, monthly, payments toward their debts. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Everyone seeking debt relief in the form of. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. There.

What Is Chapter 7 Bankruptcy? Bankruptcy, Filing bankruptcy, Personal

Businesses choosing to terminate their. Everyone seeking debt relief in the form of. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web liquidation under chapter 7 is a common form of bankruptcy. For individuals, the most common type of.

Web Individuals, Spouses, And Business Entities Can Qualify For Relief Under Chapter 7 Of The Bankruptcy Code.

Businesses choosing to terminate their. For individuals, the most common type of. Web liquidation under chapter 7 is a common form of bankruptcy. There is a little bit more to it than that, however.

It Is Available To Individuals Who Cannot Make Regular, Monthly, Payments Toward Their Debts.

Other options include an irs payment plan or an offer in compromise. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)