Penalty For Not Filing Form 8938

Penalty For Not Filing Form 8938 - Person may have to report specified foreign financial assets on form 8938 or any other. If tax is not paid by the due date, multiply line 5 by the annual percentage rate and then. As provided by the irs: Line 6 — interest for late payment: Fines of up to $50,000 can be applied if you ignore irs requests to file. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web the form 8938 is due to be filed with a tax return — which for most people is april 15th. Web under internal revenue code section 7203, the intentional (willful) failure to file a required form 8938 can, if successfully prosecuted, result in a prison sentence of up to one year. Web filing an amended or delinquent form 893 8 outside one of the irs’s penalty relief programs provides no penalty protection and therefore requires careful consideration. Web line 5 — follow instructions shown on front of form.

Web failure to properly report foreign financial assets can result in a penalty of $10,000 with additional penalties of up to $50,000 for continued failure to disclose after receiving a. If tax is not paid by the due date, multiply line 5 by the annual percentage rate and then. Web under internal revenue code section 7203, the intentional (willful) failure to file a required form 8938 can, if successfully prosecuted, result in a prison sentence of up to one year. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). If for any reason the taxpayer applies for an extension to file their tax return — then the. Web line 5 — follow instructions shown on front of form. Web the penalty for failing to file each one of these information returns is $10,000, with an additional $10,000 added for each month the failure continues beginning 90 days after. How to avoid late fines form 8938 penalties under 6038d (fatca). Web penalties for failing to file form 8938, or incomplete or inaccurate filing, start at $10,000.

Web failure to properly report foreign financial assets can result in a penalty of $10,000 with additional penalties of up to $50,000 for continued failure to disclose after receiving a. These exceptions do not affect any reporting obligations that a u.s. Web filing an amended or delinquent form 893 8 outside one of the irs’s penalty relief programs provides no penalty protection and therefore requires careful consideration. Fines of up to $50,000 can be applied if you ignore irs requests to file. Line 6 — interest for late payment: Web under internal revenue code section 7203, the intentional (willful) failure to file a required form 8938 can, if successfully prosecuted, result in a prison sentence of up to one year. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: If tax is not paid by the due date, multiply line 5 by the annual percentage rate and then. Payer (such as a u.s. It can go up to $50,000 if the failure continues after receiving formal notification from the irs.

Estate FBAR Filing IRS Offshore Account & Asset Reporting

Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. How to avoid late fines form 8938 penalties under 6038d (fatca). Web failure to properly report foreign financial assets can result in.

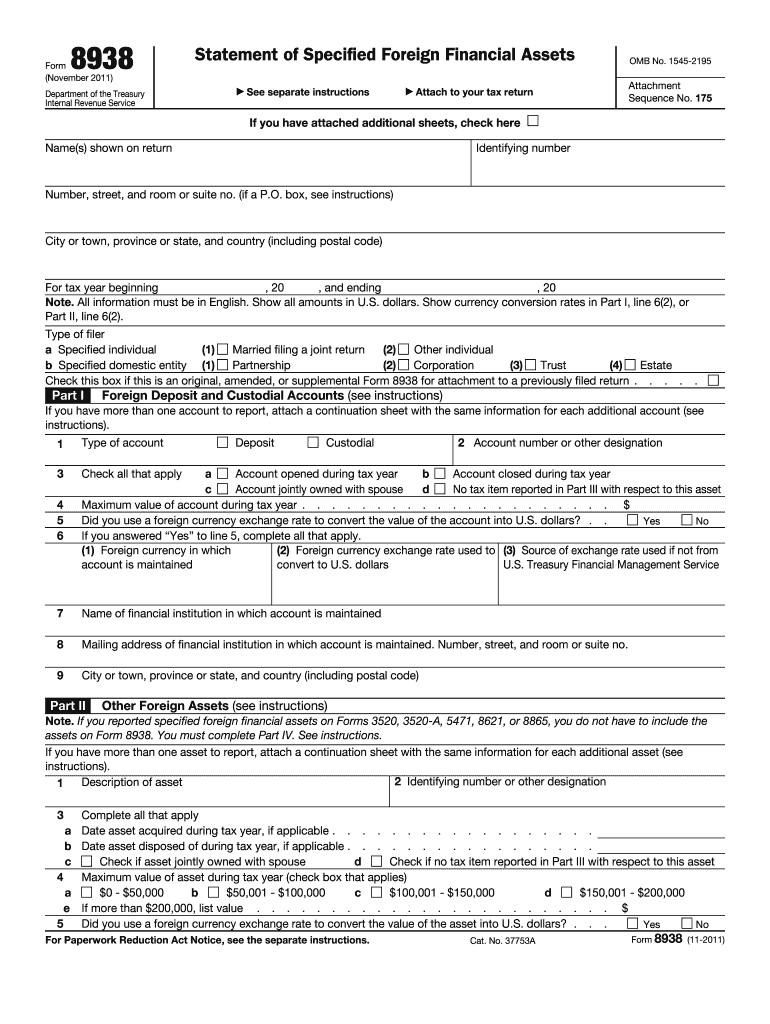

The FORM 8938 Here is what you need to know if you are filing it

“you may be subject to. Person may have to report specified foreign financial assets on form 8938 or any other. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. These exceptions.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Line 6 — interest for late payment: Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). (1) pleadings in criminal proceedings shall be the complaint, information or indictment, the bill of particulars when ordered, and the pleas of. If for any reason.

Penalty on Late Filing of Tax Return Section 234F GST Guntur

Web penalties for failing to file form 8938, or incomplete or inaccurate filing, start at $10,000. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Form 8938 is one of the newest additions to the internal revenue service’s. It can go up.

What is the Penalty for Not Filing an FBAR Form? Ayar Law

How to avoid late fines form 8938 penalties under 6038d (fatca). Web filing an amended or delinquent form 893 8 outside one of the irs’s penalty relief programs provides no penalty protection and therefore requires careful consideration. As provided by the irs: Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

If for any reason the taxpayer applies for an extension to file their tax return — then the. Web penalties for failing to file form 8938, or incomplete or inaccurate filing, start at $10,000. Person may have to report specified foreign financial assets on form 8938 or any other. Web if you are required to file form 8938, you do.

Late Filing Penalty Malaysia Avoid Penalties

Payer (such as a u.s. It can go up to $50,000 if the failure continues after receiving formal notification from the irs. Domestic financial institution), the foreign. Web penalties for failing to file form 8938, or incomplete or inaccurate filing, start at $10,000. Web if you do not file a correct and complete form 8938 within 90 days after the.

Form 8938 Who Has to Report Foreign Assets & How to File

Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). These exceptions do not affect any reporting obligations that a u.s. If tax is not paid by the due date, multiply line 5 by the annual percentage rate and then. Person may have.

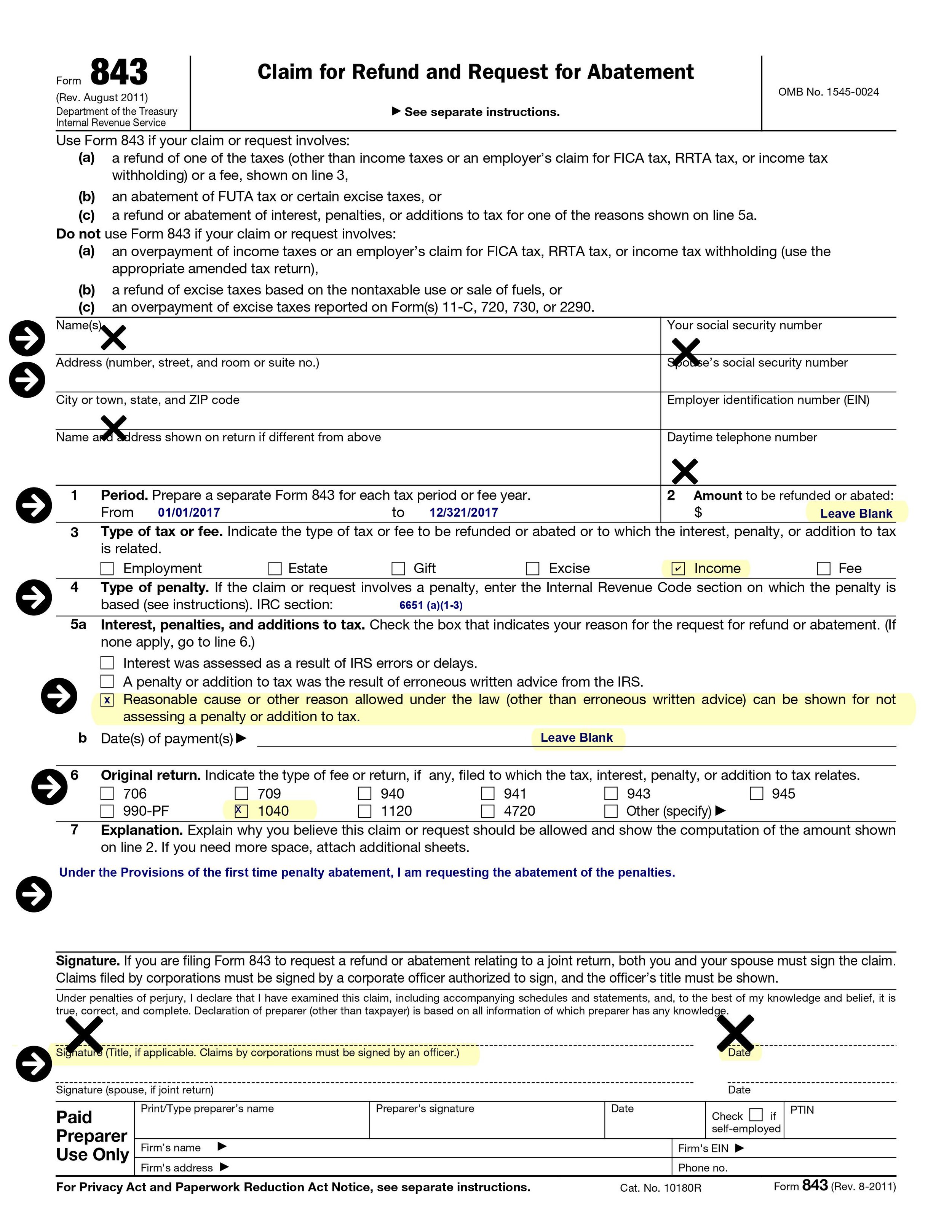

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Line 6 — interest for late payment: “you may be subject to. Web the penalty for failing to file each one of.

HVUT Tax Form 2290 Due Dates & Penalties For Form 2290

Domestic financial institution), the foreign. Web filing an amended or delinquent form 893 8 outside one of the irs’s penalty relief programs provides no penalty protection and therefore requires careful consideration. As provided by the irs: Web the form 8938 is due to be filed with a tax return — which for most people is april 15th. Web failure to.

Line 6 — Interest For Late Payment:

How to avoid late fines form 8938 penalties under 6038d (fatca). Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Domestic financial institution), the foreign. Fines of up to $50,000 can be applied if you ignore irs requests to file.

If Tax Is Not Paid By The Due Date, Multiply Line 5 By The Annual Percentage Rate And Then.

Web if a person did not file form 8938, the irs may be able to penalize them upwards of $50,000 for not filing the form. Web filing an amended or delinquent form 893 8 outside one of the irs’s penalty relief programs provides no penalty protection and therefore requires careful consideration. Web failure to properly report foreign financial assets can result in a penalty of $10,000 with additional penalties of up to $50,000 for continued failure to disclose after receiving a. Web the penalty for failing to file each one of these information returns is $10,000, with an additional $10,000 added for each month the failure continues beginning 90 days after.

Payer (Such As A U.s.

Form 8938 is one of the newest additions to the internal revenue service’s. These exceptions do not affect any reporting obligations that a u.s. If for any reason the taxpayer applies for an extension to file their tax return — then the. Person may have to report specified foreign financial assets on form 8938 or any other.

Web The Form 8938 Filing Requirement Does Not Replace Or Otherwise Affect A Taxpayer’s Obligation To File Fincen Form 114 (Report Of Foreign Bank And Financial Accounts).

Web under internal revenue code section 7203, the intentional (willful) failure to file a required form 8938 can, if successfully prosecuted, result in a prison sentence of up to one year. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. It can go up to $50,000 if the failure continues after receiving formal notification from the irs. “you may be subject to.