Printable Form 941 For 2023

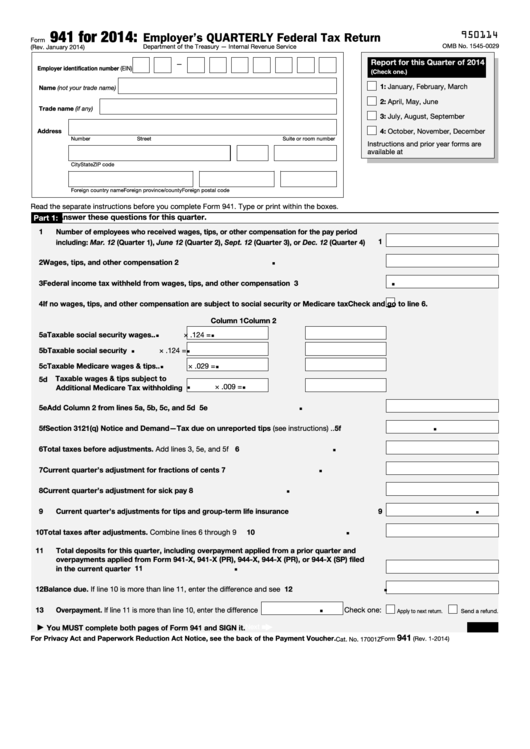

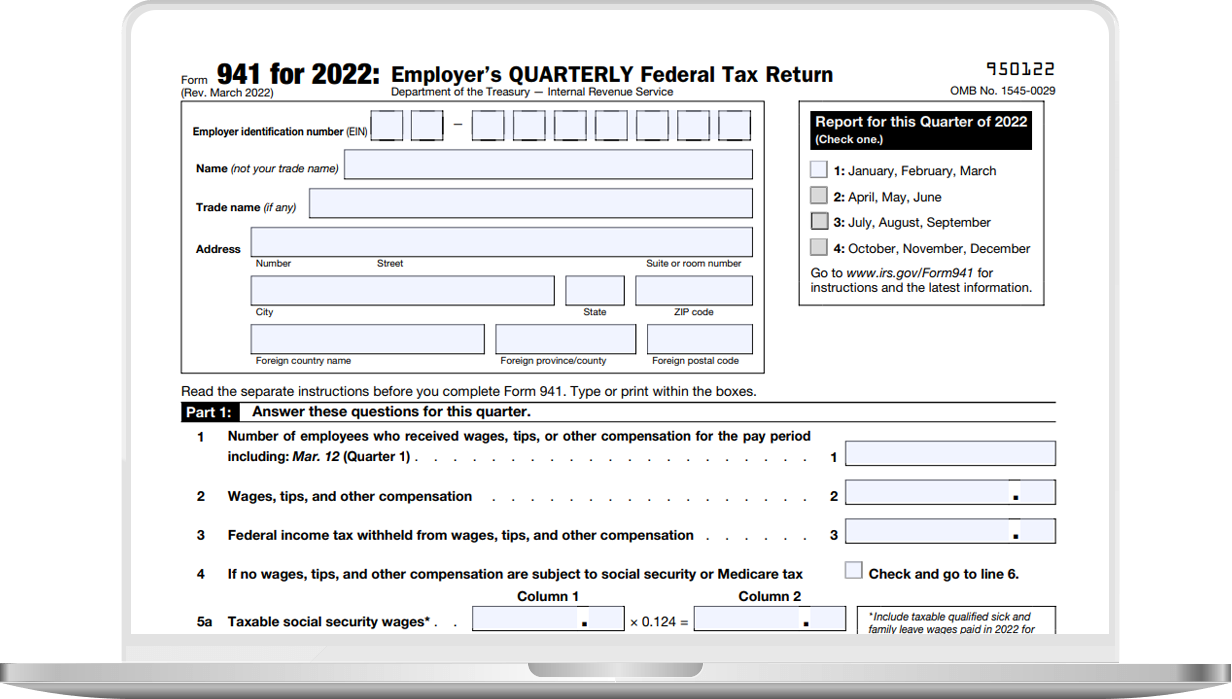

Printable Form 941 For 2023 - Don't use an earlier revision to report taxes for 2023. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Quarterly returns for q4 payroll and income taxes from the prior year (form 941) or annual returns for payroll and income returns from the prior year (form 944). Web january 17, 2023. I'm trying to launch the 2qtr 2023 941 form and it says, you are about to create a tax form for the 2023 tax year, but the. Annual returns for unemployment taxes from the prior year (form 940). The instructions for line 1 have changed slightly to include the pay period (march 12) for the first quarter. What are the new changes to form 941 for 2023? The irs has introduced a second worksheet for form 941. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

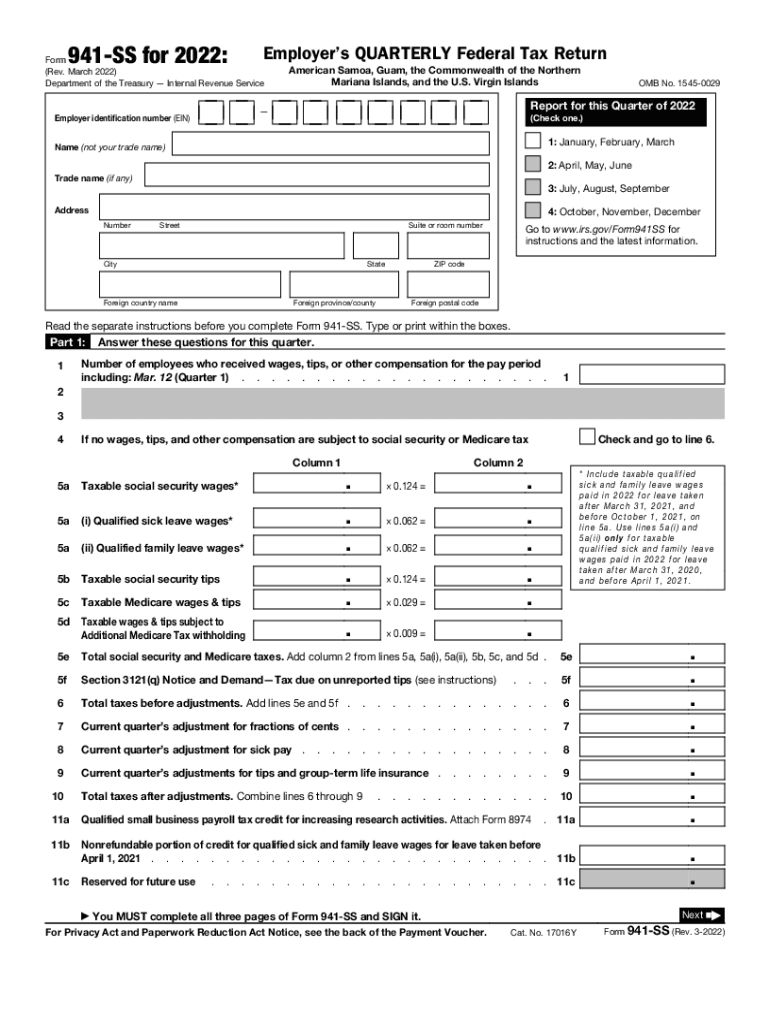

There are a few minor changes to q1 form 941 for 2023. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) 950122 omb no. Web this article will provide an overview of what the 941 form 2023 entails, as well as some tips and strategies for filling it out correctly. Don't use an earlier revision to report taxes for 2023. The instructions for line 1 have changed slightly to include the pay period (march 12) for the first quarter. The irs has introduced a second worksheet for form 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county.

The irs has introduced a second worksheet for form 941. The instructions for line 1 have changed slightly to include the pay period (march 12) for the first quarter. Web this article will provide an overview of what the 941 form 2023 entails, as well as some tips and strategies for filling it out correctly. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. There is also a small update to the instruction box for line 5. Form 941 is a document to report income and employment taxes, such as social security and medicare, to the irs. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Web form 941 for 2023:

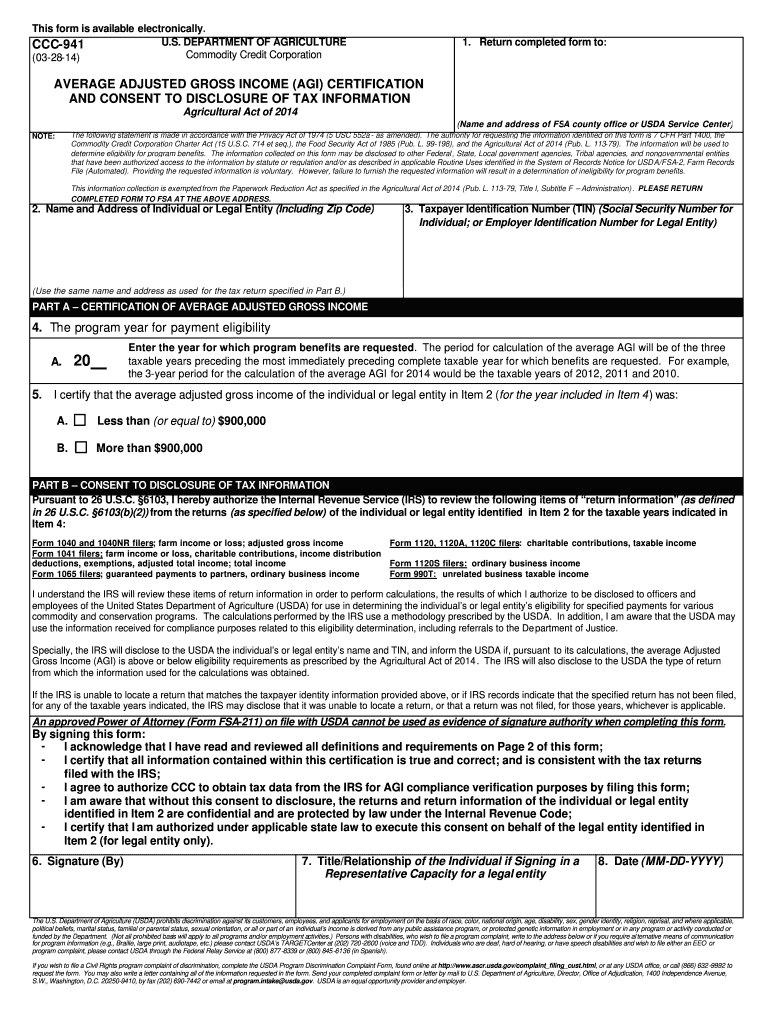

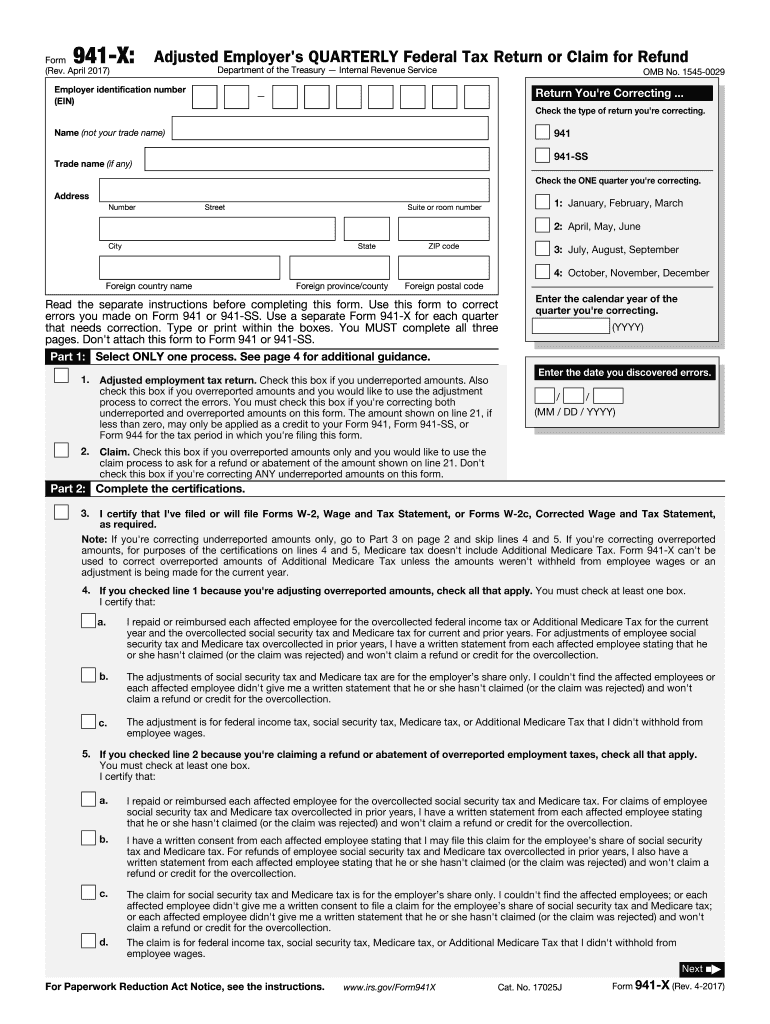

2014 Form USDA CCC941 Fill Online, Printable, Fillable, Blank pdfFiller

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Don't use it to show your deposits. Don't use an earlier revision to report taxes.

Irs form 941 printable Fill out & sign online DocHub

There are a few minor changes to q1 form 941 for 2023. Web form 941 employer's quarterly federal tax return. There is also a small update to the instruction box for line 5. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name.

941 Form Printable Blank PDF Online

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. There are a few minor changes to q1 form 941 for 2023. Web january 17,.

941 Form 2021

Quarterly returns for q4 payroll and income taxes from the prior year (form 941) or annual returns for payroll and income returns from the prior year (form 944). Web january 17, 2023. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; There are a few minor changes to q1 form 941 for 2023. Form.

Missouri Revenue Form Mo 941 20202021 Fill and Sign Printable

October, november, december use this schedule to show your tax liability for the quarter; Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. There are a few minor changes to q1 form 941 for 2023. March 2023) employer’s quarterly federal tax return.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Form 941 is a document to report income and employment taxes, such as social security and medicare, to the irs. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. March 2023) employer’s quarterly federal tax return department of the treasury.

EFile Form 941 for 2023 File 941 Electronically at 5.95

There are a few minor changes to q1 form 941 for 2023. There is also a small update to the instruction box for line 5. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. March 2023) employer’s quarterly federal tax return department.

941 Form Fill Out and Sign Printable PDF Template signNow

Web this article will provide an overview of what the 941 form 2023 entails, as well as some tips and strategies for filling it out correctly. Web form 941 employer's quarterly federal tax return. Web january 17, 2023. Web form 941 for 2023: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must.

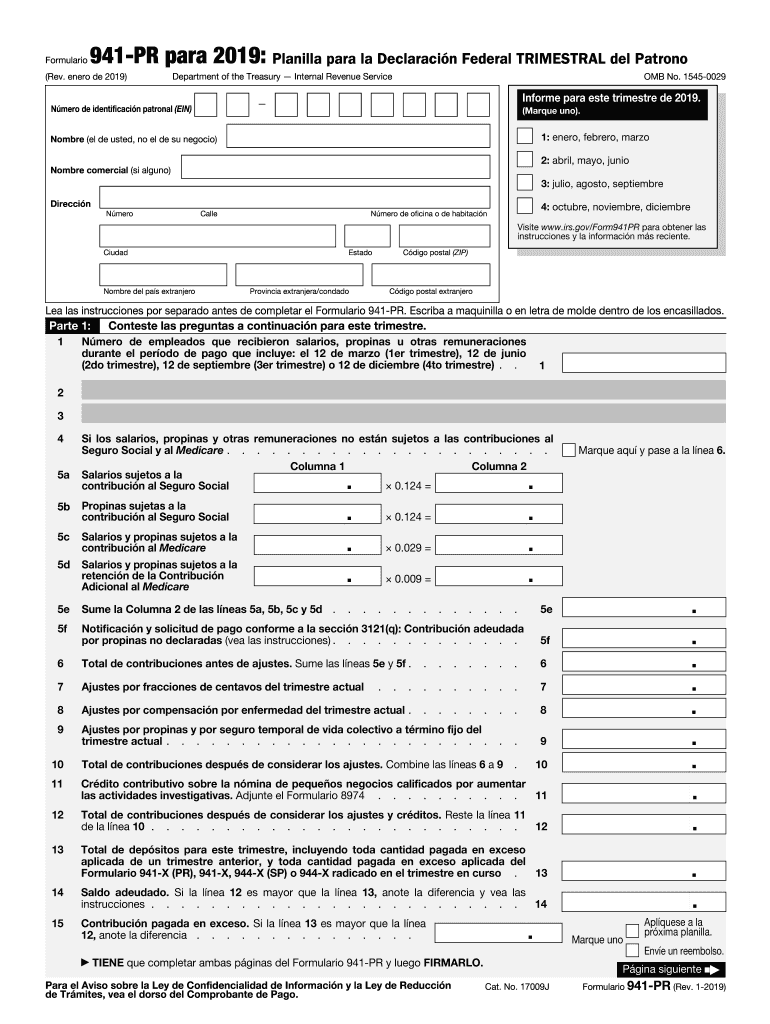

2019 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

Web form 941 for 2023: Form 941 is a document to report income and employment taxes, such as social security and medicare, to the irs. October, november, december use this schedule to show your tax liability for the quarter; The irs has introduced a second worksheet for form 941. Web information about form 941, employer's quarterly federal tax return, including.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) 950122 Omb No.

Quarterly returns for q4 payroll and income taxes from the prior year (form 941) or annual returns for payroll and income returns from the prior year (form 944). Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Monthly deposit of payroll and income taxes. What are the new changes to form 941 for 2023?

Annual Returns For Unemployment Taxes From The Prior Year (Form 940).

Form 941 is a document to report income and employment taxes, such as social security and medicare, to the irs. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

I'm Trying To Launch The 2Qtr 2023 941 Form And It Says, You Are About To Create A Tax Form For The 2023 Tax Year, But The.

There is also a small update to the instruction box for line 5. Web this article will provide an overview of what the 941 form 2023 entails, as well as some tips and strategies for filling it out correctly. Web form 941 employer's quarterly federal tax return. There are a few minor changes to q1 form 941 for 2023.

Don't Use An Earlier Revision To Report Taxes For 2023.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web form 941 for 2023: The irs has introduced a second worksheet for form 941. October, november, december use this schedule to show your tax liability for the quarter;