Printable Form 941

Printable Form 941 - Web form 941 for 2022: 28 by the internal revenue service. Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their. Web form 941 employer's quarterly federal tax return. Employer identification number (ein) — name (not. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Type or print within the boxes. See the instructions for line 42. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

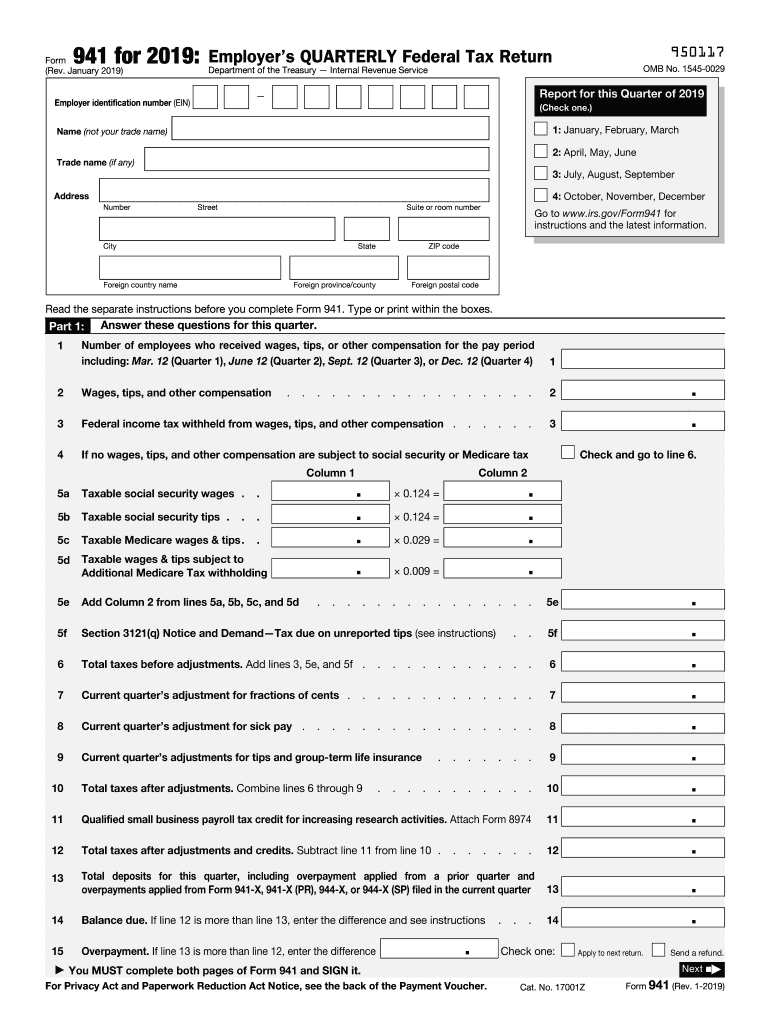

Web read the separate instructions before you complete form 941. Type or print within the boxes. See the instructions for line 42. 12 (quarter 1), june 12 (quarter 2), sept. Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Form 941, employer’s quarterly federal tax return, was revised to take into account the. 1 number of employees who received wages, tips, or other compensation for the pay period including: Web form 941, employer's quarterly federal tax return; Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their. You must complete all five pages.

Web form 941 for 2022: 12 (quarter 1), june 12 (quarter 2), sept. Type or print within the boxes. Form 941, employer’s quarterly federal tax return, was revised to take into account the. Type or print within the boxes. Web form 941, employer's quarterly federal tax return; Web form 941 employer's quarterly federal tax return. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web read the separate instructions before you complete form 941.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Form 941, employer’s quarterly federal tax return, was revised to take into account the. Employer identification number (ein) small businesses. Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms,.

Form 941 Fill Out and Sign Printable PDF Template signNow

Form 941, employer’s quarterly federal tax return, was revised to take into account the. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. March 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or.

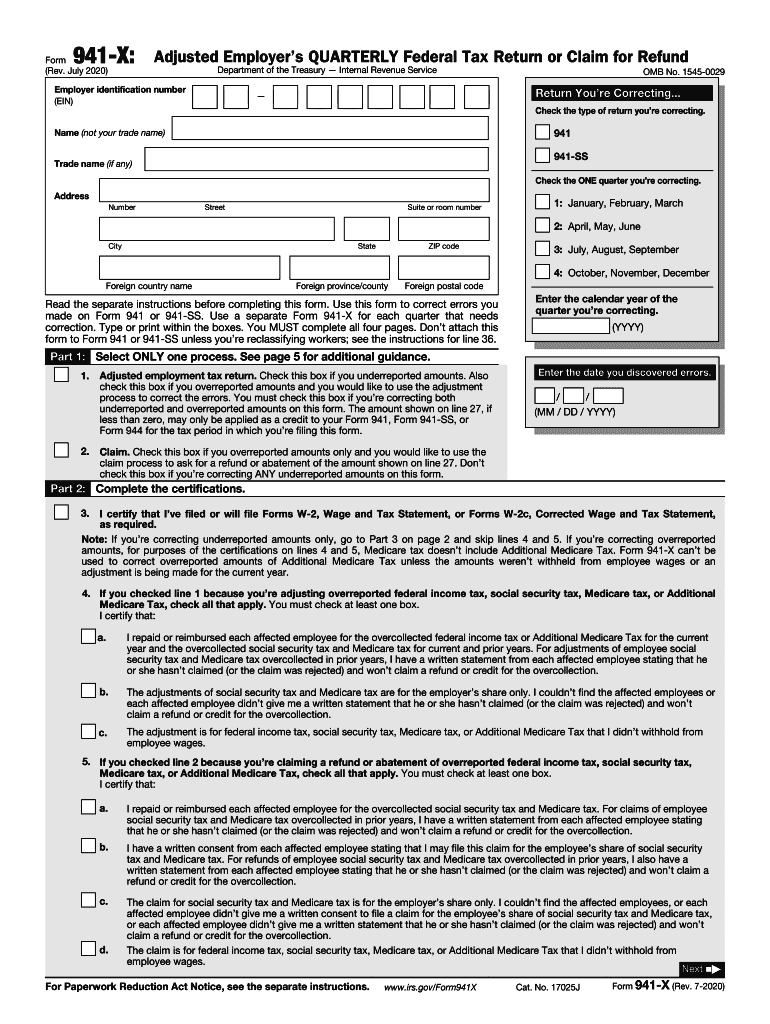

Form 941X Edit, Fill, Sign Online Handypdf

March 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web form 941 employer's.

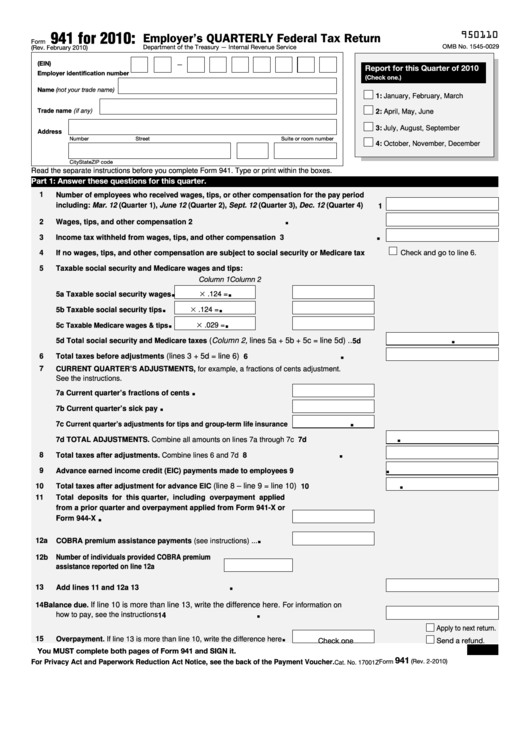

Fillable Form 941 Employer'S Quarterly Federal Tax Return 2010

Form 941, employer’s quarterly federal tax return, was revised to take into account the. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. 12 (quarter 1), june 12 (quarter 2), sept. Form 941 is used by employers who withhold income taxes from.

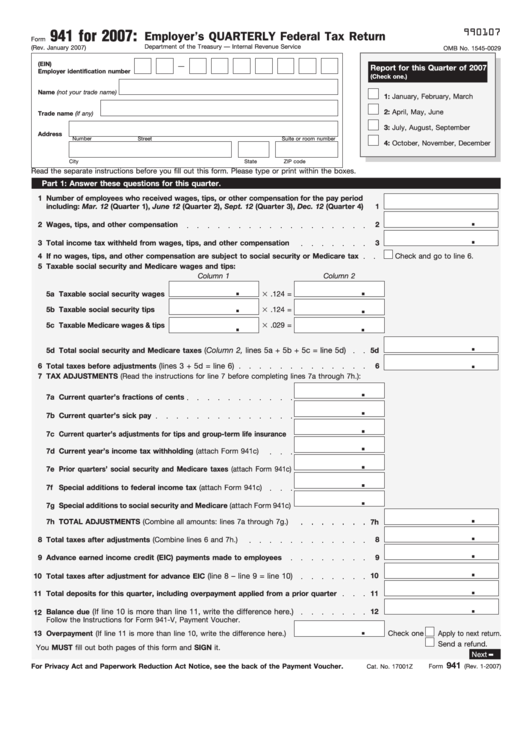

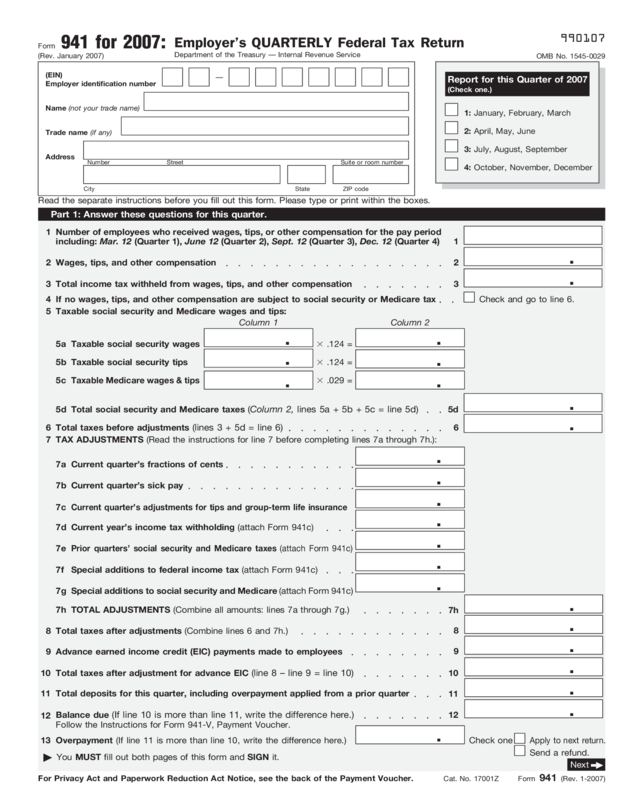

Form 941 (Rev. January 2007) Edit, Fill, Sign Online Handypdf

Web form 941 for 2022: Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their. Web form 941, employer's quarterly federal tax return; 12 (quarter 4) 1 2 Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms,.

941 X Form Fill Out and Sign Printable PDF Template signNow

Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web form 941, employer's quarterly federal tax return; 12 (quarter 4) 1 2 Web form 941 employer's quarterly federal tax return. Web read the separate instructions before you complete form 941.

Printable 941 Form Printable Form 2021

Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their. Web read the separate instructions before you complete form 941. More about the federal form 941 March 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employers.

How to Print Form 941 ezAccounting Payroll

Web what is form 941? Employer identification number (ein) small businesses. Type or print within the boxes. Web federal — employer's quarterly federal tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web form 941 employer's quarterly federal tax return.

941 Schedule B Fill Out and Sign Printable PDF Template signNow

Web form 941 for 2022: 12 (quarter 1), june 12 (quarter 2), sept. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Form 941, employer’s quarterly federal tax return, was revised to take into account the. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on.

Form 941 3Q 2020

12 (quarter 1), june 12 (quarter 2), sept. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 941 for 2022: March 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web federal — employer's quarterly federal tax return download this.

Irs Form 941, Also Known As The Employer’s Quarterly Federal Tax Return, Is Where Businesses Report The Income Taxes And Payroll Taxes That They Withheld From Their.

More about the federal form 941 Answer these questions for this quarter. Type or print within the boxes. Web form 941 for 2022:

Type Or Print Within The Boxes.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. March 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web what is form 941?

Web Read The Separate Instructions Before You Complete Form 941.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. You must complete all five pages. 1 number of employees who received wages, tips, or other compensation for the pay period including: 28 by the internal revenue service.

12 (Quarter 4) 1 2

12 (quarter 1), june 12 (quarter 2), sept. Employer identification number (ein) — name (not. See the instructions for line 42. Web form 941, employer's quarterly federal tax return;