Puerto Rico Tax Return Form 482 In English

Puerto Rico Tax Return Form 482 In English - The individual income tax return (form 482.0) for tax year 2020 must be filed electronically. Web 1 best answer carolynb new member hi. Ad we file puerto rican (hacienda), us and canadian returns For additional details, please refer to internal revenue. Get your online template and fill it in using progressive features. Web send puerto rico tax form 482 english 2018 via email, link, or fax. You can also download it, export it or print it out. Irs forms, publications, and instructions are available on the forms and publications. A puerto rico tax return reporting (form 482) only your income from puerto rico. For more details, please refer to the internal revenue circular.

Turbotax does not support state tax returns from puerto rico. Wages for services performed in puerto rico, whether for a. Web forms and publications for residents of the commonwealth of puerto rico. • income tax return for exempt businesses under. Complete, edit or print tax forms instantly. The individual income tax return (form 482.0) for tax year 2020 must be filed electronically. Web what is a form 482 puerto rico? Web form 482 use a puerto rico form 482 english template to make your document workflow more streamlined. Location of principal industry or business (number, street, city) postal address name of the. You can also download it, export it or print it out.

Web what is a form 482 puerto rico? Web if you're a bona fide resident of puerto rico during the entire tax year, you generally aren't required to file a u.s. Complete, edit or print tax forms instantly. Web forma corta is the general income tax form for puerto rico residents. Start federal tax return here. For additional details, please refer to internal revenue. Irs forms, publications, and instructions are available on the forms and publications. Wages for services performed in puerto rico, whether for a. Federal income tax return if your only income is from sources. Turbotax does not support state tax returns from puerto rico.

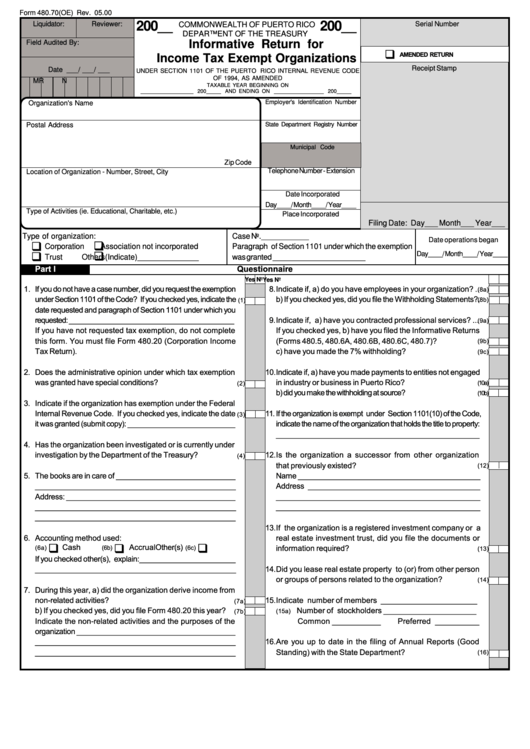

Form 480.70(Oe) Informative Return For Tax Exempt

Edit your puerto rico tax return form 482 online. Location of principal industry or business (number, street, city) postal address name of the. Web form 482 use a puerto rico form 482 english template to make your document workflow more streamlined. Ad we file puerto rican (hacienda), us and canadian returns Get ready for tax season deadlines by completing any.

Puerto Rico Corporation Tax Return Fill Out and Sign Printable

For more details, please refer to the internal revenue circular. Web 1 best answer carolynb new member hi. Web forms and publications for residents of the commonwealth of puerto rico. A puerto rico tax return reporting (form 482) only your income from puerto rico. The individual income tax return (form 482.0) for tax year 2020 must be filed electronically.

Tax Policy Helped Create Puerto Rico’s Fiscal Crisis Tax Foundation

Web form 482 use a puerto rico form 482 english template to make your document workflow more streamlined. Show details we are not affiliated with any brand. Web how to fill out and sign puerto rico tax return form 482 online? Get ready for tax season deadlines by completing any required tax forms today. Web send puerto rico tax form.

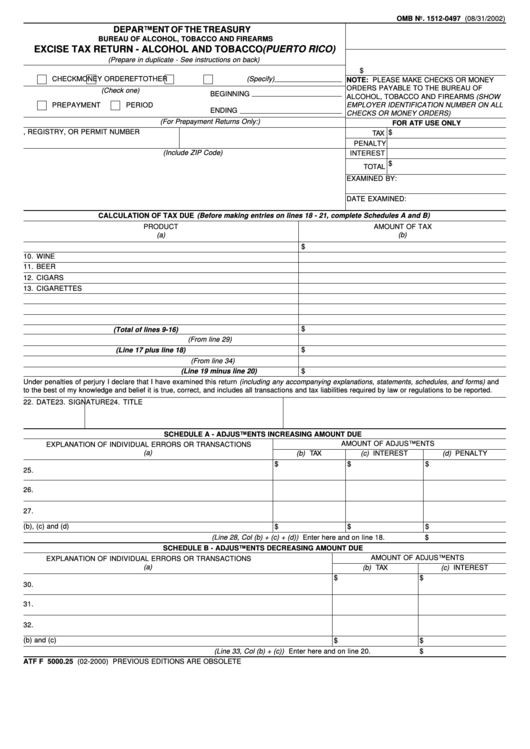

Form Atf F 5000.25 Excise Tax Return Alcohol And Tobacco (Puerto

Web if you want to know basic puerto rico tax information, read on. For more details, please refer to the internal revenue circular. You can still file your federal tax return however, you would. The individual income tax return (form 482.0) for tax year 2020 must be filed electronically. Ad we file puerto rican (hacienda), us and canadian returns

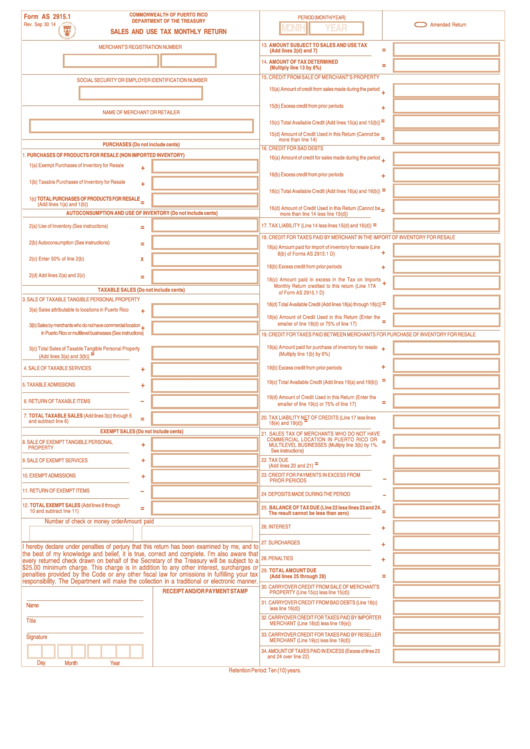

Fillable Form As 2915.1 Sales And Use Tax Monthly Return Puerto

The individual income tax return (form 482.0) for tax year 2022 must be submitted electronically. You can also download it, export it or print it out. The individual income tax return (form 482.0) for tax year 2020 must be filed electronically. Edit your puerto rico tax return form 482 online. Start federal tax return here.

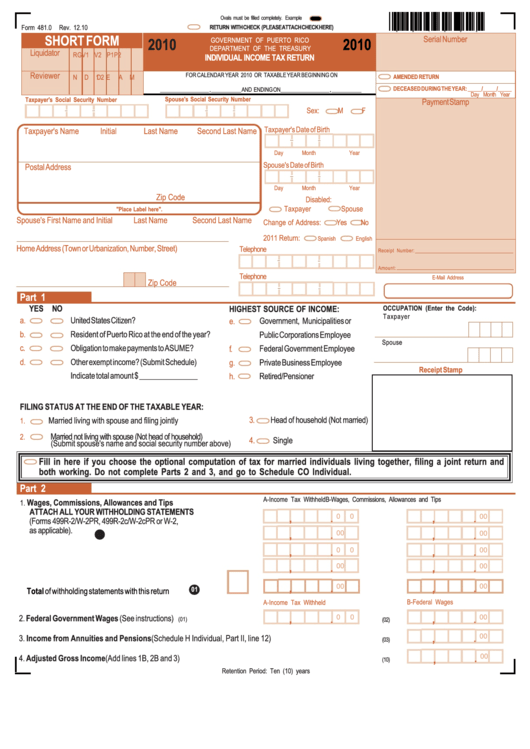

Form 481.0 Individual Tax Return Department Of Treasury Of

Web 1 best answer carolynb new member hi. Web 2019 home address (town or urbanization, number, street) postal address 2019 liquidatorreviewer taxpayer's first name initial last name second last. Irs forms, publications, and instructions are available on the forms and publications. Web if you're a bona fide resident of puerto rico during the entire tax year, you generally aren't required.

20182023 Form PR 482.0 Fill Online, Printable, Fillable, Blank pdfFiller

Federal income tax return if your only income is from sources. For more details, please refer to the internal revenue circular. Start federal tax return here. Turbotax does not support state tax returns from puerto rico. Web forma corta is the general income tax form for puerto rico residents.

Form 482 puerto rico 2018 english Fill out & sign online DocHub

For additional details, please refer to internal revenue. Complete, edit or print tax forms instantly. You can still file your federal tax return however, you would. Web how to fill out and sign puerto rico tax return form 482 online? Web income tax return 2020 information for puerto rico file your return before may 17, 2021 department of the treasury.

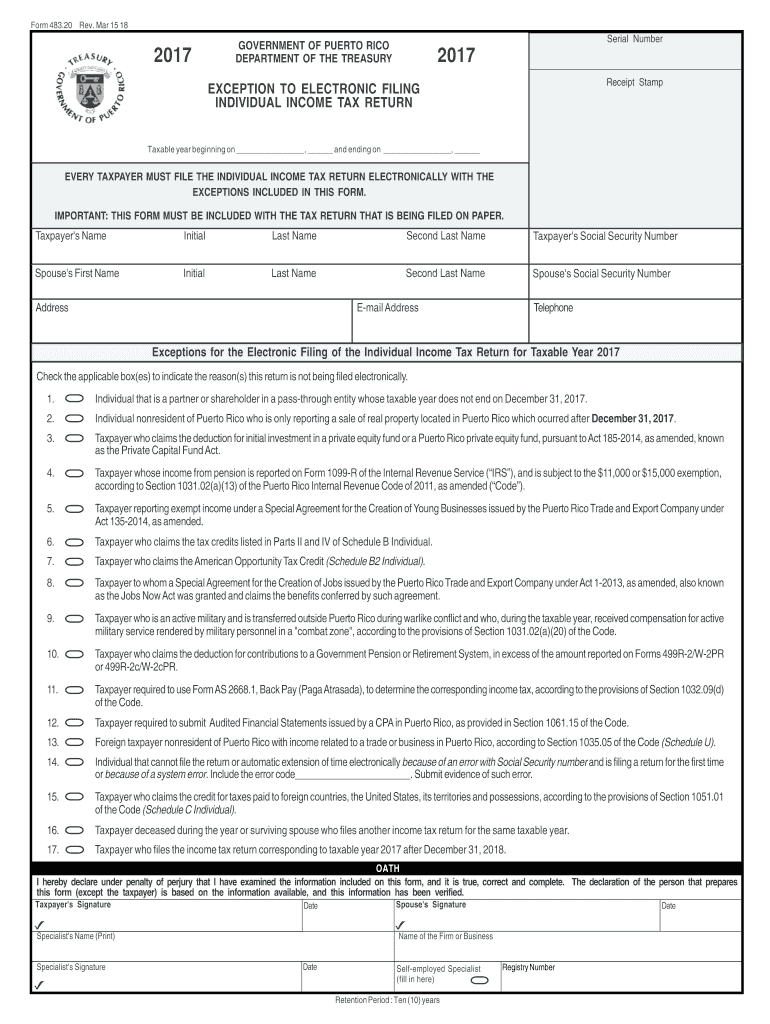

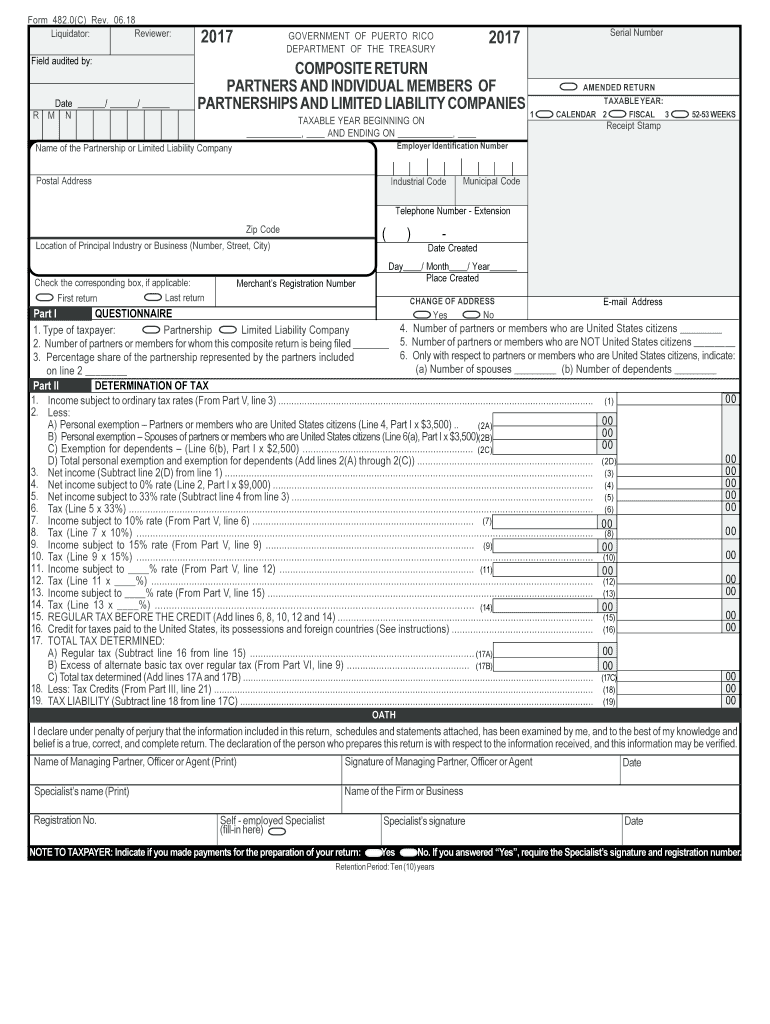

PR 482.0(C) 2017 Fill out Tax Template Online US Legal Forms

Web if you're a bona fide resident of puerto rico during the entire tax year, you generally aren't required to file a u.s. Get ready for tax season deadlines by completing any required tax forms today. Location of principal industry or business (number, street, city) postal address name of the. Web forms and publications for residents of the commonwealth of.

Puerto rico form 480 2 Fill out & sign online DocHub

Turbotax does not support state tax returns from puerto rico. Location of principal industry or business (number, street, city) postal address name of the. Irs forms, publications, and instructions are available on the forms and publications. For more details, please refer to the internal revenue circular. Web income tax return 2020 information for puerto rico file your return before may.

Web Forma Corta Is The General Income Tax Form For Puerto Rico Residents.

Complete, edit or print tax forms instantly. The individual income tax return (form 482.0) for tax year 2022 must be submitted electronically. Web send puerto rico tax form 482 english 2018 via email, link, or fax. The individual income tax return (form 482.0) for tax year 2020 must be filed electronically.

Turbotax Does Not Support State Tax Returns From Puerto Rico.

Get ready for tax season deadlines by completing any required tax forms today. Web forms and publications for residents of the commonwealth of puerto rico. You can still file your federal tax return however, you would. Location of principal industry or business (number, street, city) postal address name of the.

Web How To Fill Out And Sign Puerto Rico Tax Return Form 482 Online?

Web income tax return 2020 information for puerto rico file your return before may 17, 2021 department of the treasury government of. • income tax return for exempt businesses under. For additional details, please refer to internal revenue. Federal income tax return if your only income is from sources.

Ad We File Puerto Rican (Hacienda), Us And Canadian Returns

A puerto rico tax return reporting (form 482) only your income from puerto rico. You can also download it, export it or print it out. Enjoy smart fillable fields and interactivity. Web 1 best answer carolynb new member hi.