Renters Insurance Form Ho 4

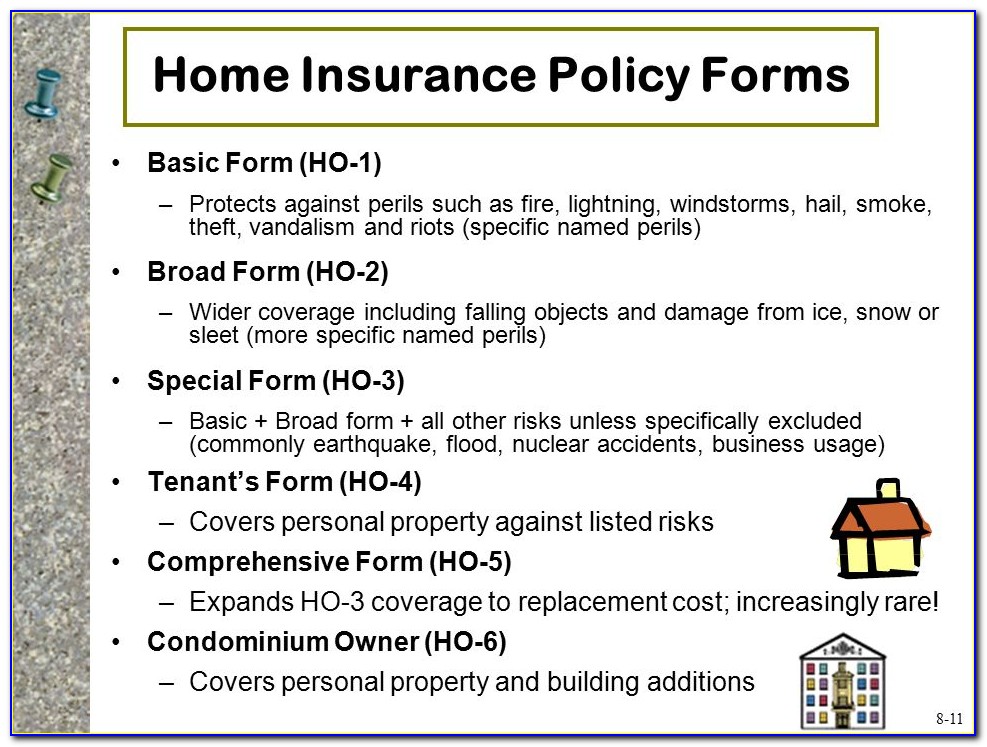

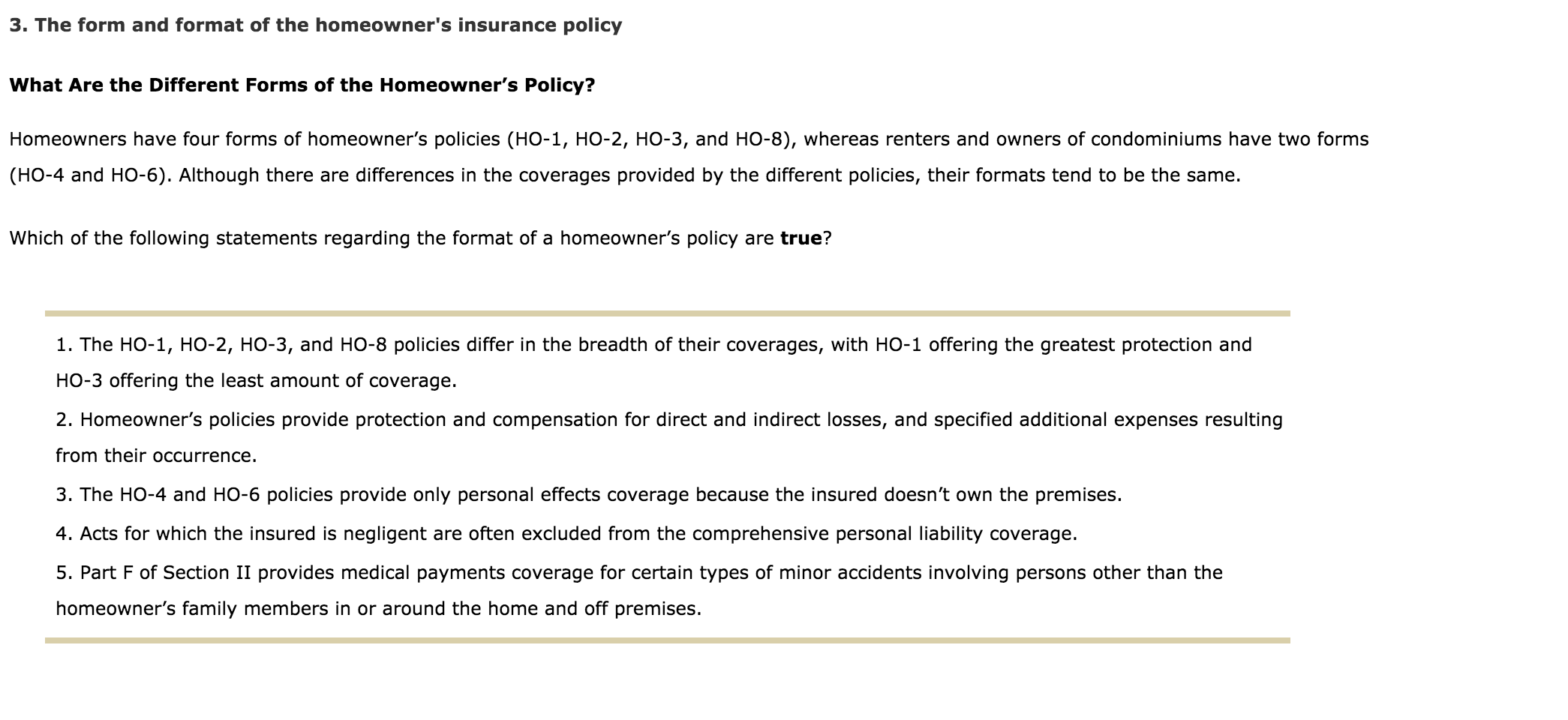

Renters Insurance Form Ho 4 - Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy. In other words, it can help pay for: Web policy forms for renters. Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage that is designed to protect individuals or families who live in a rented house or apartment. Legal expenses when someone is injured in your rented space or you damage their property. Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4. Our content is backed by coverage.com, llc, a licensed entity (npn: This is an ideal policy for someone renting an apartment or house. Web ho4 renters insurance:

Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. You may know that homeowners insurance is highly. Legal expenses when someone is injured in your rented space or you damage their property. Web ho4 renters insurance: An ho4 insurance policy has a list of risks it will cover and a few it won’t. Replacing your property when it’s stolen or damaged by a covered incident. This is an ideal policy for someone renting an apartment or house. In other words, it can help pay for: Web we will adjust all losses with you. Web an ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability.

You may know that homeowners insurance is highly. An ho4 insurance policy has a list of risks it will cover and a few it won’t. It can also cover your personal liability and temporary living expenses if your home becomes uninhabitable. For more information, please see our insurance disclosure. Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage that is designed to protect individuals or families who live in a rented house or apartment. Typically with these policies, your liability and your personal property are covered up to the policy limits. This is an ideal policy for someone renting an apartment or house. Replacing your property when it’s stolen or damaged by a covered incident. Standard renters policies include additional living expenses, personal liability and personal property coverages. In other words, it can help pay for:

Renters Insurance Claim Without Receipts

Replacing your property when it’s stolen or damaged by a covered incident. Standard renters policies include additional living expenses, personal liability and personal property coverages. An ho4 insurance policy has a list of risks it will cover and a few it won’t. Web we will adjust all losses with you. Typically with these policies, your liability and your personal property.

Renters Insurance Form Free INSURANCE DAY

Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy. Replacing your property when it’s stolen or damaged by a covered incident. Web ho4 renters insurance: Web we will adjust all losses with you. Legal expenses when someone is injured in your rented space or you damage their property.

All of your Renters Insurance Questions Answered!

Legal expenses when someone is injured in your rented space or you damage their property. Web policy forms for renters. Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Web ho4 renters insurance: Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage.

Renters Insurance Form Ho 4 INSURANCE DAY

This is an ideal policy for someone renting an apartment or house. Legal expenses when someone is injured in your rented space or you damage their property. In other words, it can help pay for: Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage that is designed to protect individuals or families.

4 Insurance Tips for Renters Cornerstone Insurance

Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4. Web we will adjust all losses with you. This is an ideal policy for someone renting an apartment or house. Web ho4 renters insurance: Typically with these policies, your liability and your personal property are covered up to the policy.

Renters Insurance Terms and Glossary Blog For Insurance Quotes

Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4. Web we will adjust all losses with you. Web an ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. Typically with these policies, your liability and your personal property are covered up to.

Renters Insurance Addendum (form 12.0 Mf) Form Resume Examples

Replacing your property when it’s stolen or damaged by a covered incident. Web ho4 renters insurance: Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy. Web policy forms for renters. Typically with these policies, your liability and your personal property are covered up to the policy limits.

Renters Insurance Form Ho 4 INSURANCE DAY

Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage that is designed to protect individuals or families who live in a rented house or apartment. This is an ideal policy for someone renting an apartment or house. You may know that homeowners insurance is highly. It can also cover your personal liability.

Renters Insurance Addendum (form 12.0 Mf) Form Resume Examples

Our content is backed by coverage.com, llc, a licensed entity (npn: For more information, please see our insurance disclosure. Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4. It can also cover your personal liability and temporary living expenses if your home becomes uninhabitable. Web an ho4 policy, also.

Renters Insurance Form Ho 4 INSURANCE DAY

Typically with these policies, your liability and your personal property are covered up to the policy limits. Web we will adjust all losses with you. Legal expenses when someone is injured in your rented space or you damage their property. Replacing your property when it’s stolen or damaged by a covered incident. In other words, it can help pay for:

Web An Ho4 Policy, Also Called Renters Insurance, Protects A Renter’s Personal Property And Addresses Their Personal Liability.

Web ho4 renters insurance: Our content is backed by coverage.com, llc, a licensed entity (npn: Legal expenses when someone is injured in your rented space or you damage their property. This is an ideal policy for someone renting an apartment or house.

You May Know That Homeowners Insurance Is Highly.

Commonly referred to as renters insurance , this policy form covers personal property in a rented home or apartment. Standard renters policies include additional living expenses, personal liability and personal property coverages. In other words, it can help pay for: It can also cover your personal liability and temporary living expenses if your home becomes uninhabitable.

Replacing Your Property When It’s Stolen Or Damaged By A Covered Incident.

Web we will adjust all losses with you. Web renters insurance, also known as ho4 insurance or tenant insurance, is a type of insurance coverage that is designed to protect individuals or families who live in a rented house or apartment. Web policy forms for renters. Since you know what dangers trigger your ho4 coverage, this insurance plan is considered a “named perils” policy.

Typically With These Policies, Your Liability And Your Personal Property Are Covered Up To The Policy Limits.

An ho4 insurance policy has a list of risks it will cover and a few it won’t. Below is a list of the typical events that cause renters, like yourself, to file a claim under their ho4. For more information, please see our insurance disclosure.