Savers Credit Form 8880

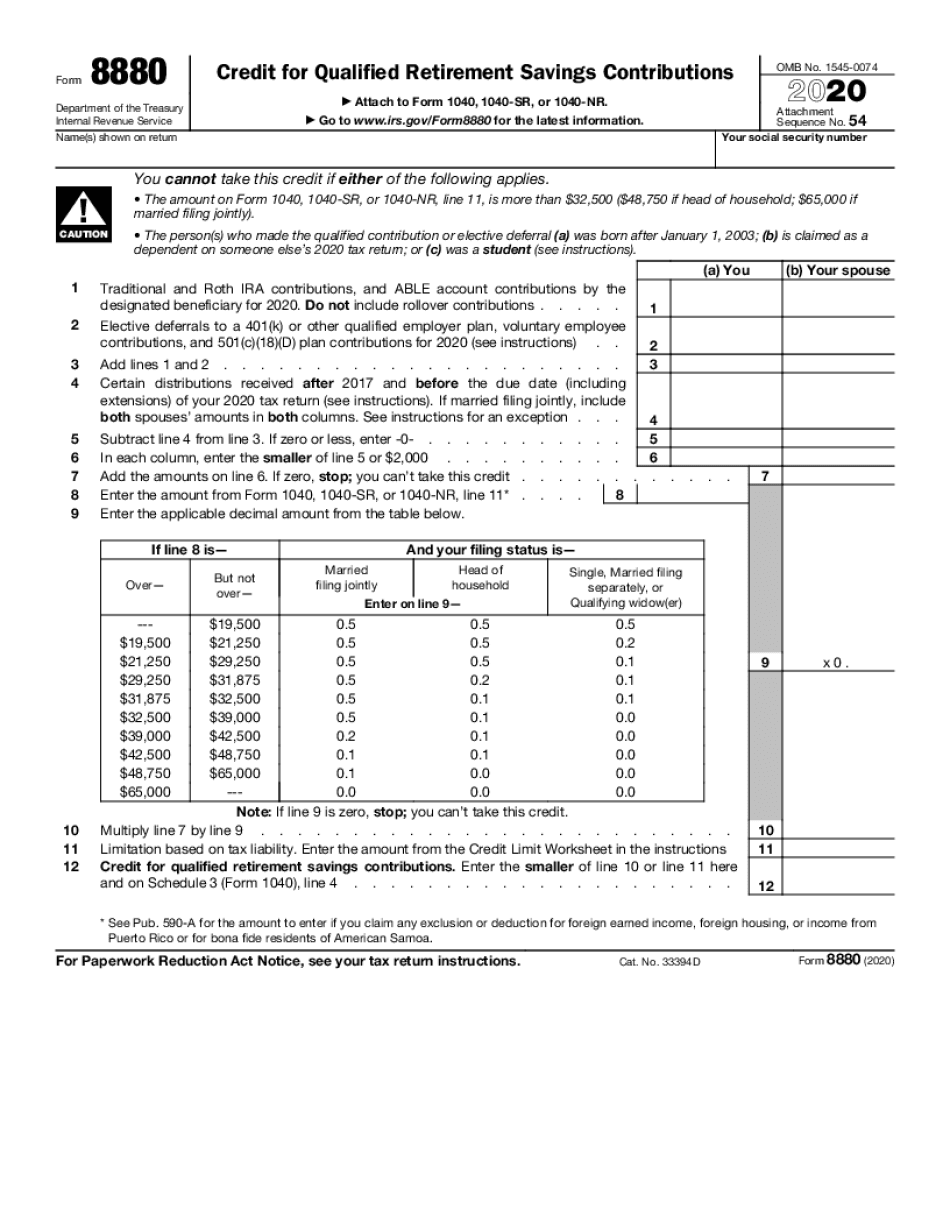

Savers Credit Form 8880 - Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). That specific form deals with 401k contributions and a deduction for the. Download infographic pdf learn more about the saver's credit. For tax years prior to 2018, you can only claim the savers. You are not a full. Edit, sign and save irs 8880 form. Ad access irs tax forms. In tax year 2020, the most recent year for which. Get ready for tax season deadlines by completing any required tax forms today. Web 4 rows irs form 8880 reports contributions made to qualified retirement savings accounts.

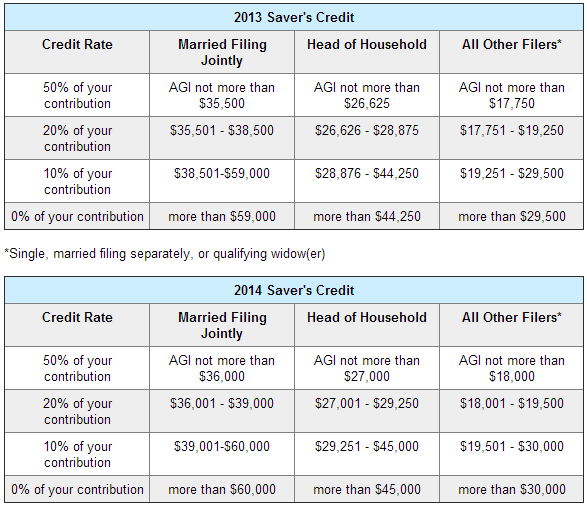

Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Store opening today at 9 a.m. Web the irs is fairly explicit on how retirement savers can claim the saver's credit. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web my specific complaint deals with how their system treats the 8880 filing in their filing program. In tax year 2020, the most recent year for which. That specific form deals with 401k contributions and a deduction for the. Edit, sign and save irs 8880 form. Web 4 rows irs form 8880 reports contributions made to qualified retirement savings accounts.

For tax years prior to 2018, you can only claim the savers. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web saver's credit to encourage people with lower incomes to contribute to their retirement savings accounts, the internal revenue service offers a tax credit for. Web saver's credit fact sheet. You are age 18 or over; Web my specific complaint deals with how their system treats the 8880 filing in their filing program. Get ready for tax season deadlines by completing any required tax forms today. That specific form deals with 401k contributions and a deduction for the. You are not a full. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return.

9+ Easy Tips How To Remove Late Payments From Credit Report Sample

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Get ready for tax season deadlines by completing any required tax forms today. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). You are age.

Get to Know The Savers Tax Credit

Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web saver's credit fact sheet. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web 4 rows irs.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web you may be eligible to claim the retirement savings contributions credit, also known as the savers credit, if all of the following apply: Tip this credit can be claimed in addition to any ira. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form.

Credit Limit Worksheet Form 8880

Web saver's credit fact sheet. In tax year 2020, the most recent year for which. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web 5441 w 95th st. Web saver's credit to encourage people with lower incomes to contribute to their retirement savings accounts, the internal.

Saver's Credit Fact Sheet English

Store opening today at 9 a.m. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web with over 300 thrift stores in the u.s., canada and australia you're sure to find great deals on clothing, accessories, hard goods, electronics, books, home goods, and more. Web form 8880.

What Is the Savers Credit? TurboTax Tax Tips & Videos

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr.

How States Can Utilize the Saver’s Tax Credit to Boost Retirement

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Ad access irs tax forms. Web my specific complaint deals with how their system treats the 8880 filing in their filing program. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit.

What is the Saver’s Credit? The TurboTax Blog

For tax years prior to 2018, you can only claim the savers. Here's the rundown—follow it, and if you're eligible, you should get your tax. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. Store opening today at 9 a.m. That specific form deals with 401k contributions and a.

Credits and Deductions Getting more from your pay check Saverocity

Web 5441 w 95th st. You are not a full. Web retirement savings contributions credit (savers credit form 8880) you may be eligible to claim the retirement savings contributions credit, also known as the savers credit,. In tax year 2020, the most recent year for which. That specific form deals with 401k contributions and a deduction for the.

savers credit irs form Fill Online, Printable, Fillable Blank form

Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Uslegalforms allows users to edit, sign, fill.

Web 4 Rows Irs Form 8880 Reports Contributions Made To Qualified Retirement Savings Accounts.

Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web saver's credit fact sheet. You are age 18 or over; Ad access irs tax forms.

Web My Specific Complaint Deals With How Their System Treats The 8880 Filing In Their Filing Program.

Here's the rundown—follow it, and if you're eligible, you should get your tax. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. For tax years prior to 2018, you can only claim the savers.

Web Based On Form 8880, The Credit Percentage Is 50%, 20%, Or 10% Of The Eligible Contributions, Depending On Your Adjusted Gross Income.

Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). You are not a full. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Web The Irs Is Fairly Explicit On How Retirement Savers Can Claim The Saver's Credit.

That specific form deals with 401k contributions and a deduction for the. Download infographic pdf learn more about the saver's credit. In tax year 2020, the most recent year for which. Tip this credit can be claimed in addition to any ira.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)