Schedule B Form 990 Instructions

Schedule B Form 990 Instructions - Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: (column (b) must equal form 990, part x, col. States that do not require. If the return is not required to file schedule b, one of the following lines will be marked no on the return. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Under section 3101 of p. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web see the schedule b instructions to determine the requirements for filing. Web effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure requirements on form 990,. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community.

Under section 3101 of p. Baa for paperwork reduction act notice, see the instructions for. Web the instructions to schedule b states that contributors include: If the return is not required to file schedule b, one of the following lines will be marked no on the return. For other organizations that file. Web see the schedule b instructions to determine the requirements for filing. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear. As such, up until recently, the state of california. If you checked 12d of part i, complete sections a and d, and complete part v.).

For other organizations that file. (column (b) must equal form 990, part x, col. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Baa for paperwork reduction act notice, see the instructions for. For other organizations that file. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. As such, up until recently, the state of california. Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear.

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

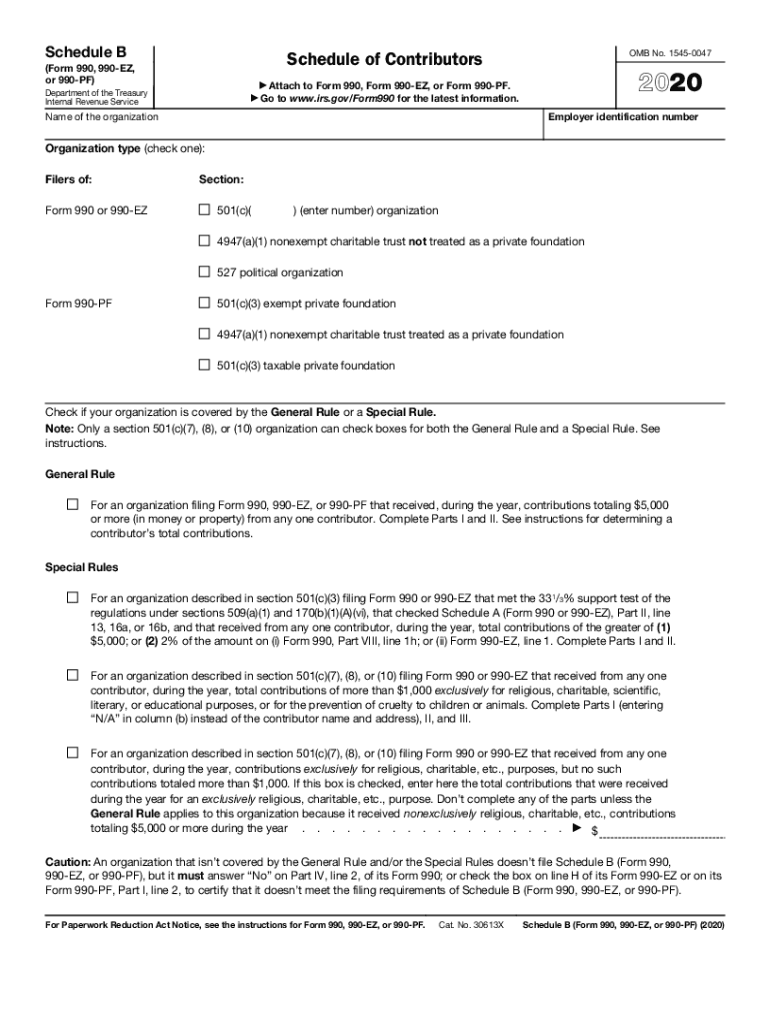

Under section 3101 of p. For other organizations that file. Web the instructions to schedule b states that contributors include: Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

If you checked 12d of part i, complete sections a and d, and complete part v.). (column (b) must equal form 990, part x, col. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. In general, first complete the core form, and then complete alphabetically. Under section 3101 of p.

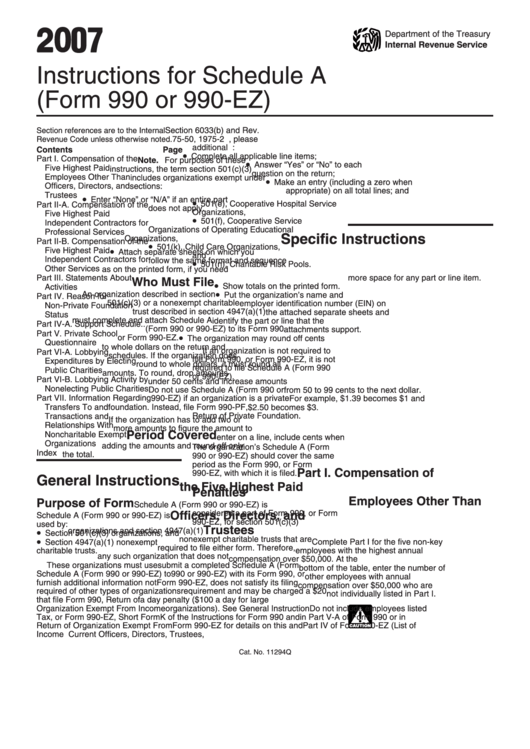

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Web effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure requirements on form 990,. States that do not require. (column (b) must equal form 990, part x, col. Web see the schedule b instructions to determine the requirements for filing. Web the instructions to schedule b states that contributors include:

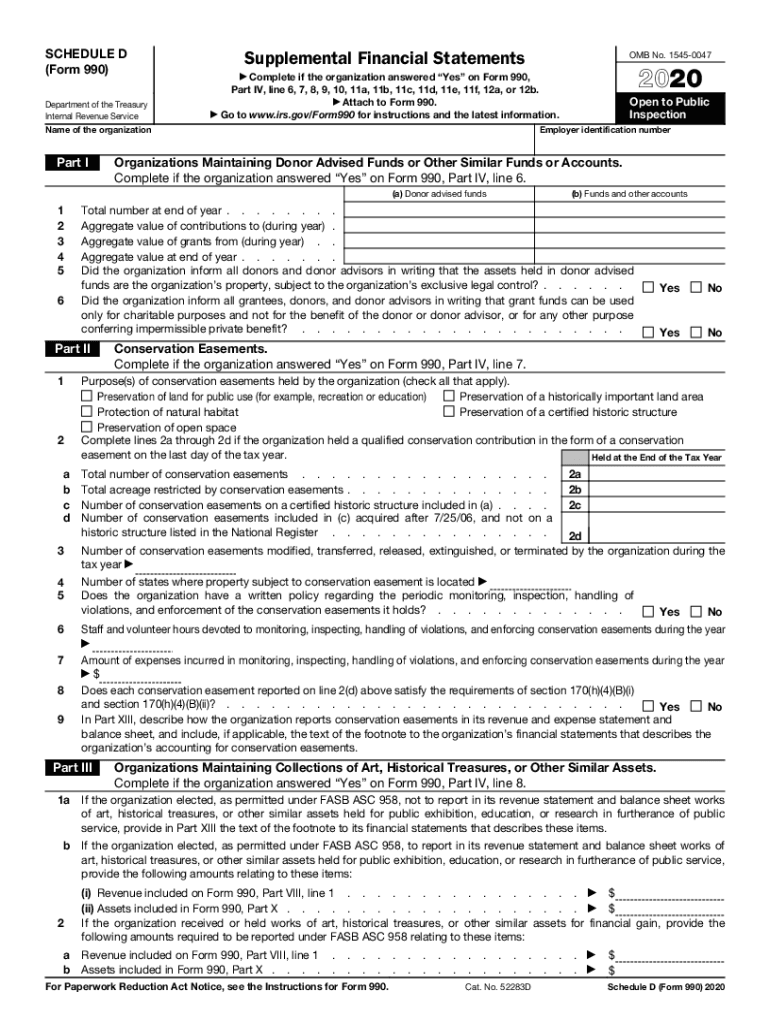

Schedule D Form 990 Supplemental Financial Statements Fill Out and

(column (b) must equal form 990, part x, col. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: If the return is not required to file schedule b, one of the following lines will be marked no on the return. Web schedule b requires you to disclose donors who contributed more than.

Form 990 (Schedule H) Hospitals (2014) Free Download

For other organizations that file. Web schedule b (form 990) department of the treasury internal revenue service schedule of. If the return is not required to file schedule b, one of the following lines will be marked no on the return. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule b.

2010 Form 990 Schedule A Instructions

Individuals fiduciaries partnerships corporations associations trusts exempt organizations most. Web effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure requirements on form 990,. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. In general, first complete the core form, and then.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. In general, first complete the core form, and then complete alphabetically. Schedule.

form 990 schedule m instructions 2017 Fill Online, Printable

Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Baa for paperwork reduction act notice, see the instructions for. Web per irs instructions for form 990 return of organization exempt from income tax, on page 4: Under section 3101 of p.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

If you checked 12d of part i, complete sections a and d, and complete part v.). States that do not require. Web effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure requirements on form 990,. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than.

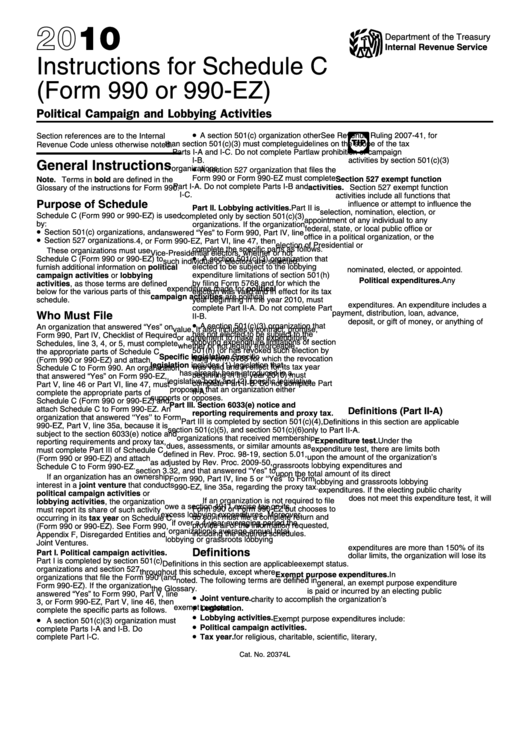

Instructions For Schedule C (Form 990 Or 990Ez) Political Campaign

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. (column (b) must equal form 990, part x, col. States that do not require. As such, up until recently, the state of california. In general, first complete the core form, and then complete alphabetically.

Web Schedule B Is Used By Nonprofit Organizations To Report Details Regarding The Contributions They Received During The Corresponding Tax Year.

Web schedule b (form 990) department of the treasury internal revenue service schedule of. For other organizations that file. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web see the schedule b instructions to determine the requirements for filing.

Baa For Paperwork Reduction Act Notice, See The Instructions For.

For other organizations that file. States that do not require. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; If the return is not required to file schedule b, one of the following lines will be marked no on the return.

Web Effective May 28, 2020, The Internal Revenue Service (Irs) Issued Final Treasury Regulations Addressing Donor Disclosure Requirements On Form 990,.

Under section 3101 of p. (column (b) must equal form 990, part x, col. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Web the instructions to schedule b states that contributors include:

Web Per Irs Instructions For Form 990 Return Of Organization Exempt From Income Tax, On Page 4:

If you checked 12d of part i, complete sections a and d, and complete part v.). Web while the federal filing requirements are clear for schedule b, the states’ instructions still vary or are unclear. As such, up until recently, the state of california. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to.