Schedule C Form 8829

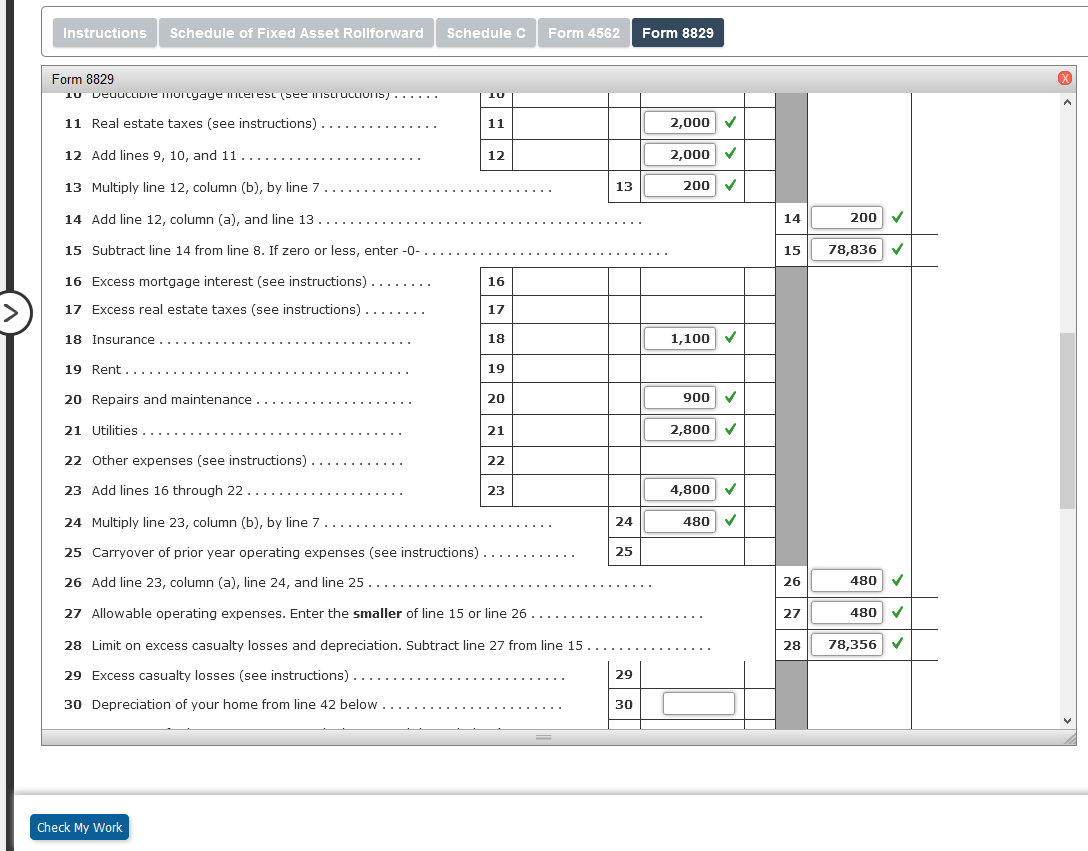

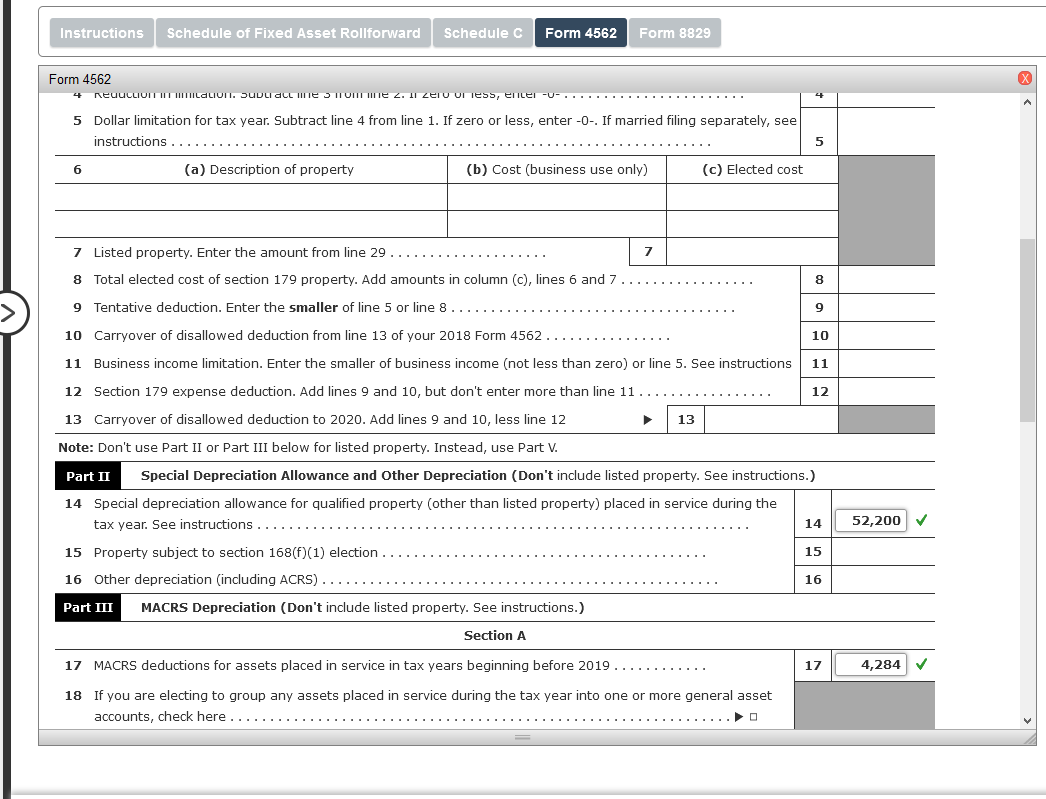

Schedule C Form 8829 - Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces wks 8829 rather than form 8829. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. How to take a home office write off. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Home office deduction video lo. Partnerships must generally file form 1065. Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. 176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829.

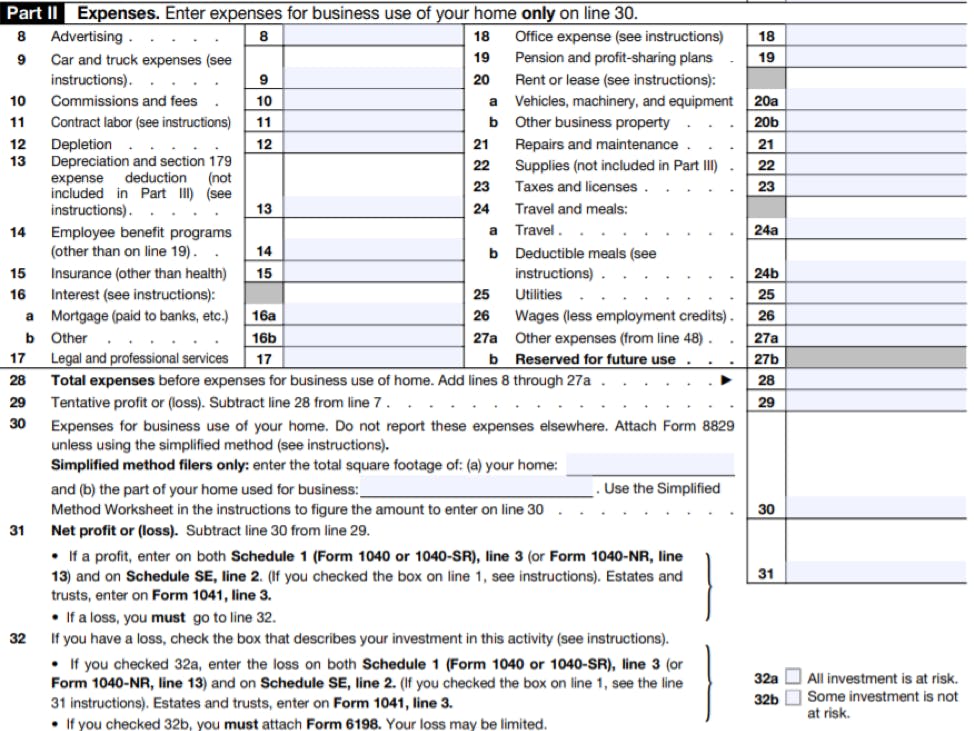

But that is not correct. Go to www.irs.gov/form8829 for instructions and the latest information. Which turbotax cd/download product is right for you? How to take a home office write off. If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Use a separate form 8829 for each home you used for the business during the year. Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download. Web go to www.irs.gov/schedulec for instructions and the latest information. Web check schedule c, line 29, tentative profit or (loss).

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces wks 8829 rather than form 8829. Web check schedule c, line 29, tentative profit or (loss). Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. But that is not correct. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Go to www.irs.gov/form8829 for instructions and the latest information. Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914).

Solved Required Complete Trish's Schedule C, Form 8829, and

When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download. Web use screen.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. Form 8829 is produced only.

Schedule C Profit or Loss From Business Definition

Web home office deduction and your taxes.form 1040, schedule c, form 8829home office expense. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it.

Working for Yourself? What to Know about IRS Schedule C Credit Karma

Partnerships must generally file form 1065. Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. Web check schedule c, line 29, tentative profit or (loss). Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces.

Solved Required Complete Trish's Schedule C, Form 8829, and

If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Go to www.irs.gov/form8829 for instructions and the latest information. Use a separate form 8829 for each home you used for the business during the year. Partnerships must generally file form 1065. If line 29 is zero or if it shows a loss,.

I NEED HELP WITH THE BLANKS PLEASE. """ALL

If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. 176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Use a separate form 8829 for each home you used for the business during.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web check schedule c, line 29, tentative profit or (loss). Web file only with schedule c (form 1040). Different programs may use different entry lines. Please see the following turbotax website for a list of forms available in each version of turbotax: Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which.

The New York Times > Business > Image > Form 8829

Go to www.irs.gov/form8829 for instructions and the latest information. Web check schedule c, line 29, tentative profit or (loss). If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it.

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Use a separate form 8829 for each home you used for business during the year. Home office deduction video lo. Web home office deduction and your taxes.form 1040, schedule c, form 8829home office expense. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Different programs may use different entry lines.

Web Home Office Deduction And Your Taxes.form 1040, Schedule C, Form 8829Home Office Expense.

Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces wks 8829 rather than form 8829. If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Which turbotax cd/download product is right for you?

Web Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts.

Web Information About Form 8829, Expenses For Business Use Of Your Home, Including Recent Updates, Related Forms And Instructions On How To File.

But that is not correct. Partnerships must generally file form 1065. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download.

Different Programs May Use Different Entry Lines.

If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. Please see the following turbotax website for a list of forms available in each version of turbotax: Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. Web check schedule c, line 29, tentative profit or (loss).

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)