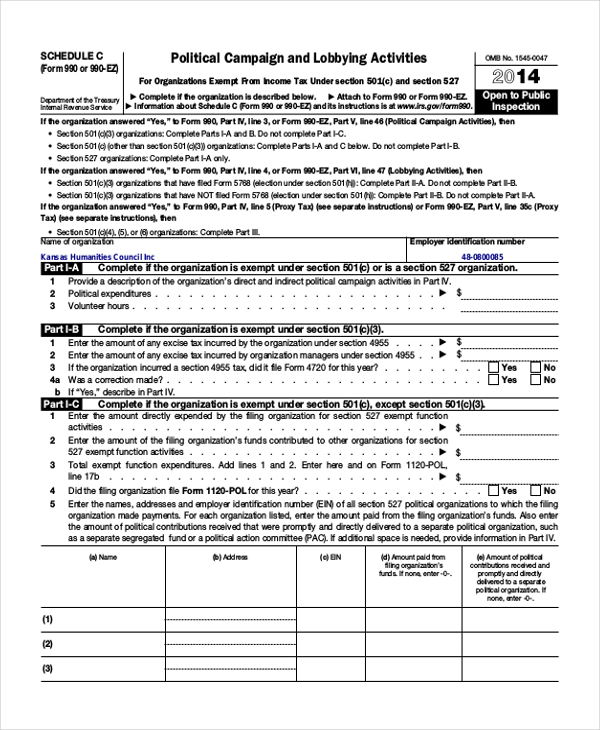

Schedule C Form 990

Schedule C Form 990 - Section 501(c) organizations, and section 527 organizations. (column (b) must equal form 990, part x, col. Purpose of schedule schedule c (form 990) is used by: Schedule d (form 990) 2022 (continued) (column (d) must equal form 990, part x, column (b), line 10c.) two years back three years back four years back. Web tax filings by year. Web learn more about form 990 schedule c 4. Web filling out form irs 990 ez the form must be submitted by the end of the fiscal year if the gross income of the organization is less than $200,000 and its total assets are less than. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. (i) revenue included in form 990, part viii, line 1 $ .

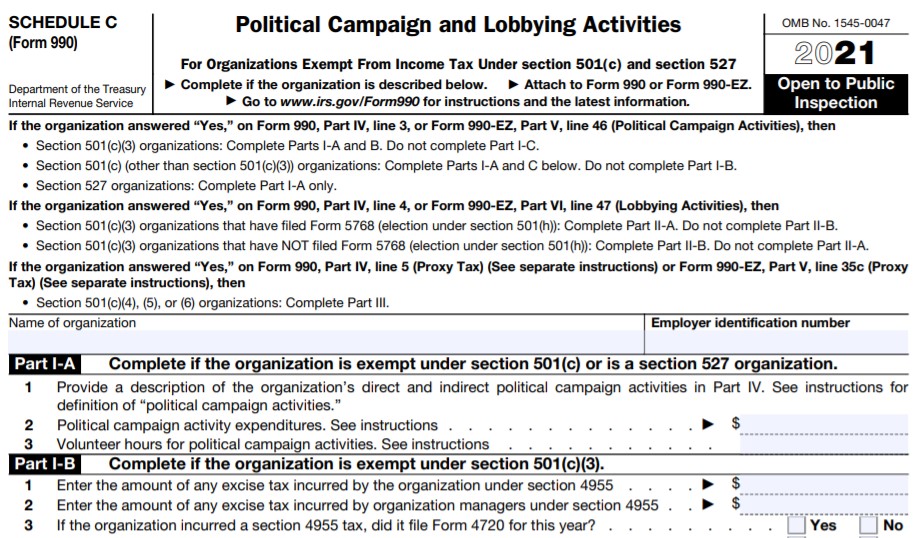

Web learn more about form 990 schedule c 4. Section 501(c) organizations, and section 527 organizations. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Complete, edit or print tax forms instantly. Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web c d e total. Web filling out form irs 990 ez the form must be submitted by the end of the fiscal year if the gross income of the organization is less than $200,000 and its total assets are less than.

Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Web schedule c (form 990) is used by: Web tax filings by year. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web filling out form irs 990 ez the form must be submitted by the end of the fiscal year if the gross income of the organization is less than $200,000 and its total assets are less than. (ii)assets included in form 990,. Get ready for tax season deadlines by completing any required tax forms today. Web service, provide the following amounts relating to these items . (i) revenue included in form 990, part viii, line 1 $ . • section 501(c) organizations, and • section 527 organizations.

Form 990 (Schedule R) Related Organizations and Unrelated

Complete, edit or print tax forms instantly. Web schedule c (form 990) is used by: Schedule a (form 990) 2022 page 6 part v type. Section 501(c) organizations, and section 527 organizations. Web if yes, complete schedule i, parts i and ii form 990 (2021) page is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)?

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web • section 501(c) (other than section 501(c)(3)) organizations: (i) revenue included in form 990, part viii, line 1 $ . Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Web what is the purpose of form 990 schedule c?

Form 990 or 990EZ Schedule E 2019 2020 Blank Sample to Fill out

Web • section 501(c) (other than section 501(c)(3)) organizations: Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Purpose of schedule schedule c (form 990) is used by: Web schedule a (form 990).

Form 990 (Schedule J) Compensation Information Form (2015) Free Download

Schedule a (form 990) 2022 page 6 part v type. Web what is the purpose of form 990 schedule c? (i) revenue included in form 990, part viii, line 1 $ . Instructions for these schedules are. Web schedule c (form 990) is used by:

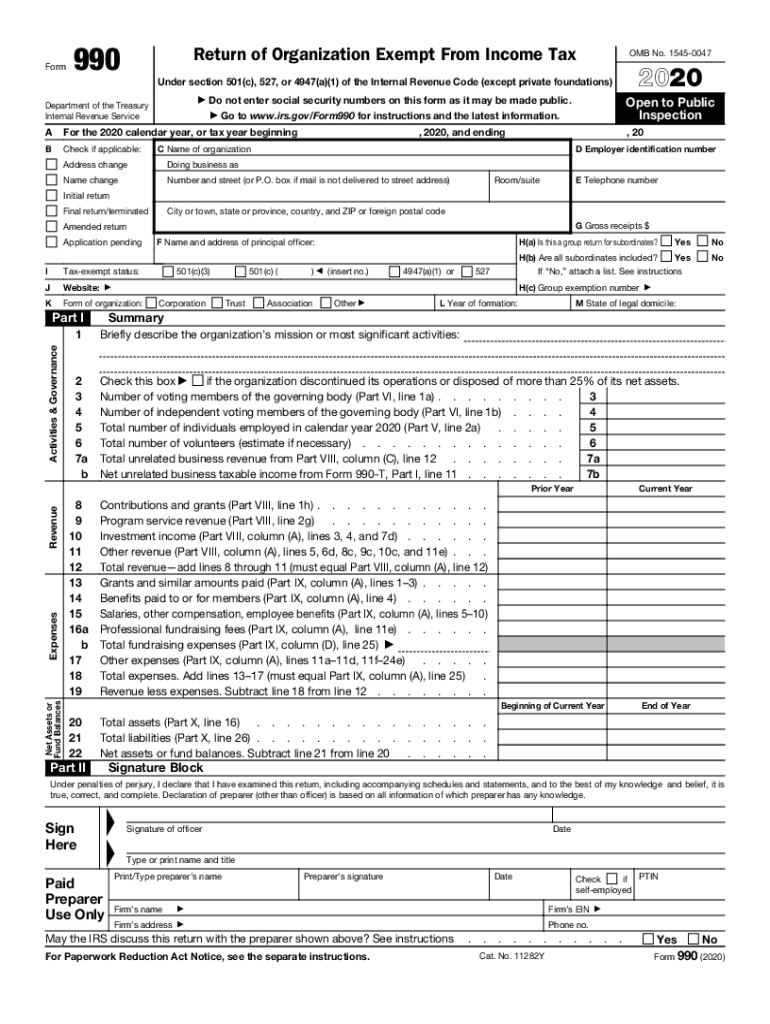

Form 990

Web tax filings by year. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Get ready for tax season deadlines by.

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Purpose of schedule schedule c (form 990) is used by: Web schedule c (form 990) is used by: Web tax filings by year. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign activities or. Web c d e total.

Form 990 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. (ii)assets included in form 990,. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web c d e total. Web schedule c (form 990) 2022 page check if the filing organization belongs.

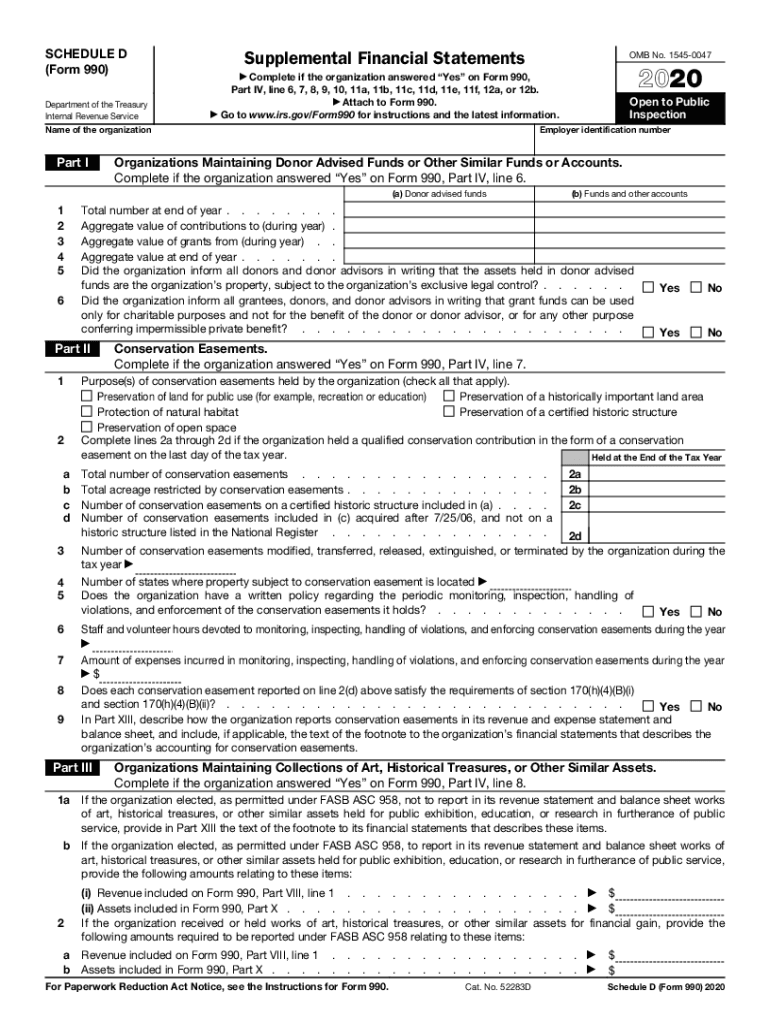

Schedule D Form 990 Supplemental Financial Statements Fill Out and

Web if yes, complete schedule i, parts i and ii form 990 (2021) page is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? Instructions for these schedules are. These organizations use schedule c (form 990 or 990. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information.

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

These organizations must use schedule c (form 990) to furnish. Web • section 501(c) (other than section 501(c)(3)) organizations: Purpose of schedule schedule c (form 990) is used by: Ad get ready for tax season deadlines by completing any required tax forms today. (column (b) must equal form 990, part x, col.

Download Instructions for IRS Form 990, 990EZ Schedule C Political

Web filling out form irs 990 ez the form must be submitted by the end of the fiscal year if the gross income of the organization is less than $200,000 and its total assets are less than. • section 501(c) organizations, and • section 527 organizations. Web instructions for form 990. Complete, edit or print tax forms instantly. Web •.

Web Schedule C (Form 990) Department Of The Treasury Internal Revenue Service Political Campaign And Lobbying Activities For Organizations Exempt From Income Tax Under.

Web the irs form 990 series are informational tax forms that most nonprofits must file annually. These organizations use schedule c (form 990 or 990. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Web filling out form irs 990 ez the form must be submitted by the end of the fiscal year if the gross income of the organization is less than $200,000 and its total assets are less than.

Web If Yes, Complete Schedule I, Parts I And Ii Form 990 (2021) Page Is The Organization Described In Section 501(C)(3) Or 4947(A)(1) (Other Than A Private Foundation)?

(i) revenue included in form 990, part viii, line 1 $ . Complete, edit or print tax forms instantly. Schedule d (form 990) 2022 (continued) (column (d) must equal form 990, part x, column (b), line 10c.) two years back three years back four years back. Web c d e total.

Web Schedule C Is Used By Section 501 (C) Organizations And Section 527 Organizations To Furnish Additional Information On Political Campaign Activities Or.

Ad get ready for tax season deadlines by completing any required tax forms today. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign activities or. Complete, edit or print tax forms instantly. The long form and short forms provide the irs with information about the organization’s.

Section 501(C) Organizations, And Section 527 Organizations.

Purpose of schedule schedule c (form 990) is used by: • section 501(c) organizations, and • section 527 organizations. If you checked 12d of part i, complete sections a and d, and complete part v.). These organizations must use schedule c (form 990) to furnish.