Schedule C Instructions Form 5500

Schedule C Instructions Form 5500 - Except for those persons for whom you. Except for those persons for whom you. Except for those persons for whom. Fiduciary regulatory | april 01, 2022 form 5500 schedule c: Web schedule c (form 5500) 2017 v.170203 2. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2021 form 5500. Eligible indirect compensation disclosure guide this. The instructions to schedule c. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than.

Except for those persons for whom you. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2021 form 5500. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Except for those persons for whom. Web what is form 5500 schedule c? This is effective for plan years. Web schedule b (form 5500) part 2 8 hr., 39 min. Provide, to the extent possible, the following information for. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web insights & research fiduciary regulatory report :

This is effective for plan years. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Information on other service providers receiving direct or indirect compensation. Web schedule c (form 5500) 2022 page. Schedule e (form 5500) (nonleveraged esop) 13. Eligible indirect compensation disclosure guide this. The instructions to schedule c. Fiduciary regulatory | april 01, 2022 form 5500 schedule c: Information on other service providers receiving direct or indirect compensation.

Free Printable Schedule C Tax Form Printable Form 2022

Fiduciary regulatory | april 01, 2022 form 5500 schedule c: Web schedule c (form 5500) 2022 page. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. Specifications to be removed before printing instructions to printers schedule c (form 5500),.

schedule c instructions 2022 Fill Online, Printable, Fillable Blank

The schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. Information on other service providers receiving direct or indirect compensation. Eligible indirect compensation disclosure guide this. The instructions to schedule c. Except for those persons for whom.

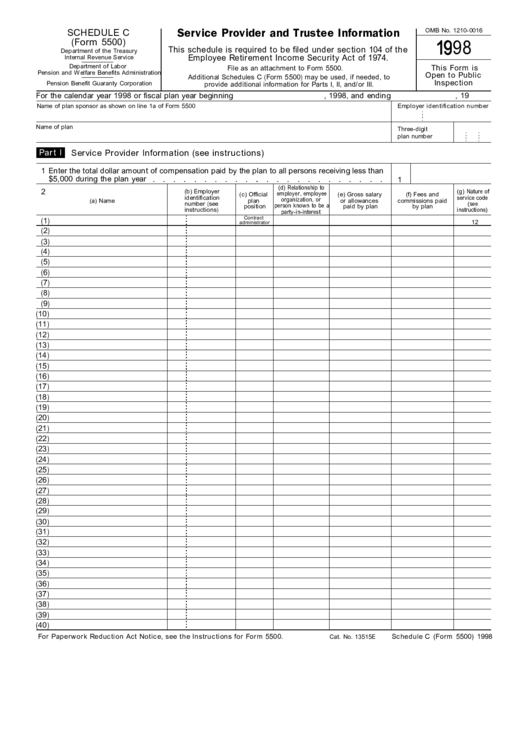

Schedule C (Form 5500) Service Provider And Trustee Information

For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than. Web schedule c (form 5500) 2017 v.170203 2. Specifications to be removed before printing instructions to printers schedule c (form 5500), page 3 of 4 (page 4 is. Provide, to the extent possible, the following information for. Information.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Information on other service providers receiving direct or indirect compensation. Provide, to the extent possible, the following information for. Web what is form 5500 schedule c? The schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. Web insights & research fiduciary regulatory report :

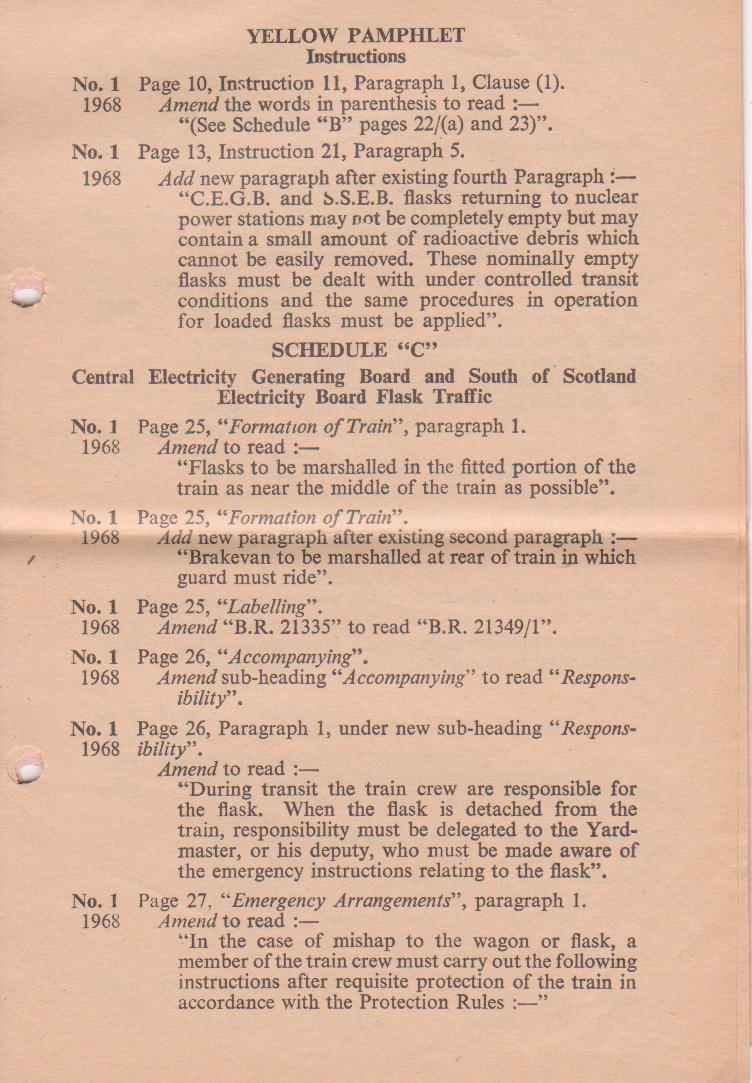

Schedule C instructions Edge Hill Station

Except for those persons for whom. This is effective for plan years. Web similarly, a u.s. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively.

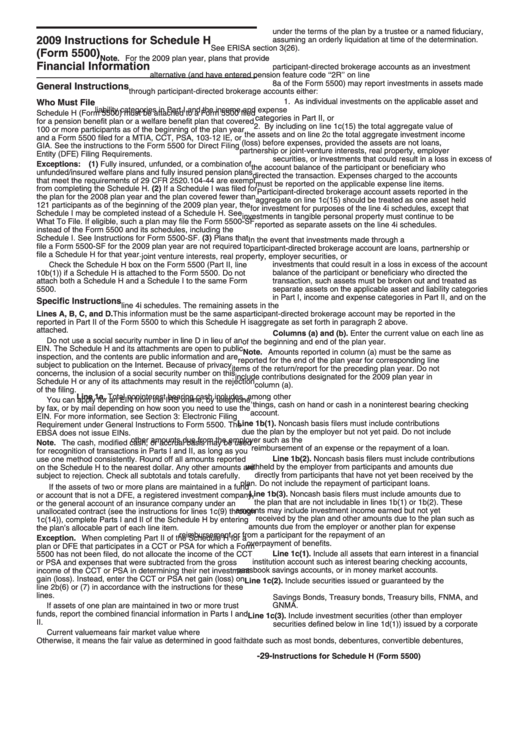

Instructions For Schedule H (Form 5500) Financial Information 2009

Web similarly, a u.s. The instructions to schedule c. Information on other service providers receiving direct or indirect compensation. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Eligible indirect compensation disclosure guide this.

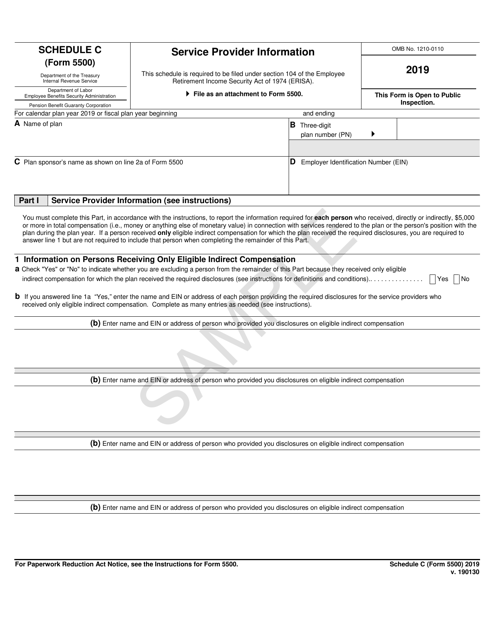

IRS Form 5500 Schedule C Download Fillable PDF or Fill Online Service

Web for schedule c reporting purposes, fees received in connection with a plan’s direct investment in a pooled investment fund (“top tier” fund) would be subject to schedule c. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. Information.

Form 5500 Instructions 5 Steps to Filing Correctly

This is effective for plan years. Web schedule b (form 5500) part 2 8 hr., 39 min. Web schedule c (form 5500) 2017 v.170203 2. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than. Web the instructions for the 2021 form 5500 will further explain the filing.

IRS Instructions 1040 (Schedule SE) 2019 Printable & Fillable Sample

Except for those persons for whom. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web schedule c (form 5500) 2019 v. Provide, to the extent possible, the following information for. Web schedule c (form 5500) 2017 v.170203 2.

What is an IRS Schedule C Form?

Except for those persons for whom you. Web schedule b (form 5500) part 2 8 hr., 39 min. Information on other service providers receiving direct or indirect compensation. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Information on other service providers receiving direct or indirect compensation.

See Pbgc’s August 29, 2022 Notice Of.

Web for schedule c reporting purposes, fees received in connection with a plan’s direct investment in a pooled investment fund (“top tier” fund) would be subject to schedule c. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Information on other service providers receiving direct or indirect compensation. Specifications to be removed before printing instructions to printers schedule c (form 5500), page 3 of 4 (page 4 is.

Web Similarly, A U.s.

Provide, to the extent possible, the following information for. Web schedule c (form 5500) 2017 v.170203 2. Except for those persons for whom you. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation.

Schedule C (Form 5500) 5 Hr., 16 Min.

The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2021 form 5500. Information on other service providers receiving direct or indirect compensation. Web the instructions to schedule c of form 5500 (the “instructions”) provide that gifts and business entertainment (hereinafter referred to only as “gifts”) provided to a manager of. The schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the.

Person Filing Form 8865 With Respect To A Foreign Partnership That Has Made An Mtm Election Described In Treas.

Web what is form 5500 schedule c? Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than. Web to form 5500 (service provider information) to disclose reportable “direct” and “indirect” compensation received by the plan’s service providers.