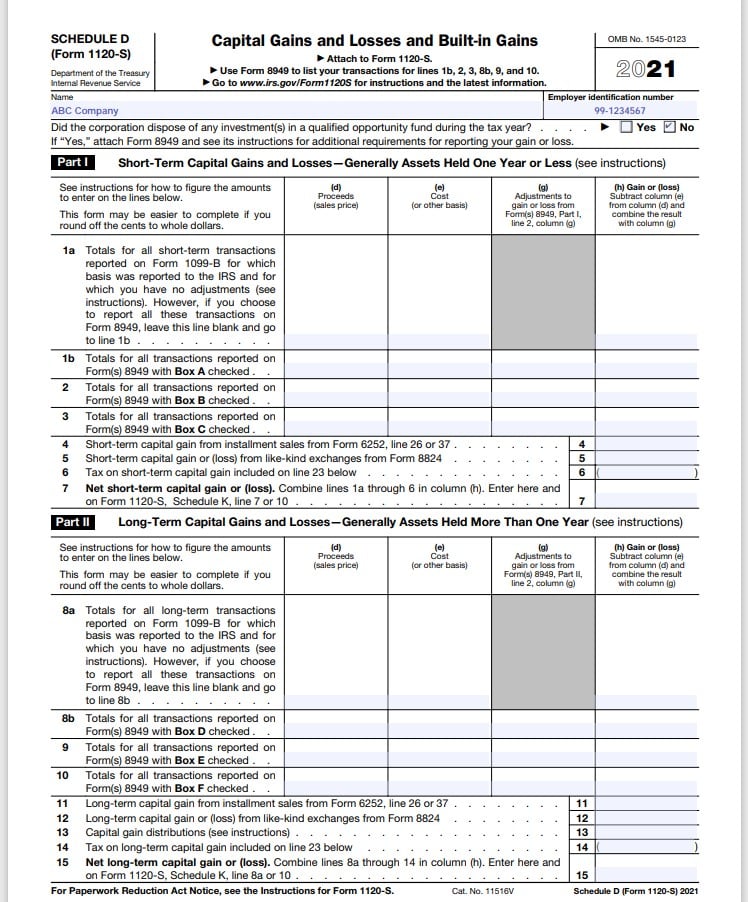

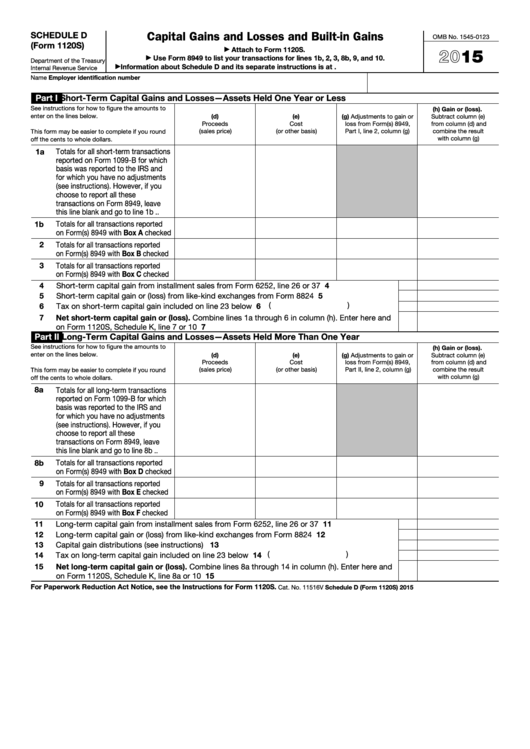

Schedule D Form 1120S

Schedule D Form 1120S - Web what is the form used for? The s corporation files a. Add lines 22a and 22b (see instructions for additional taxes). Other forms the corporation may have to. Save or instantly send your ready documents. Web what is the form used for? Web form 1120s department of the treasury internal revenue service u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Easily fill out pdf blank, edit, and sign them. Figure the overall gain or loss from transactions reported on form 8949.

Upload, modify or create forms. Try it for free now! Complete, edit or print tax forms instantly. Web what is the form used for? Easily fill out pdf blank, edit, and sign them. Web complete schedule d of form 1120s capital gains and losses. Web about schedule d (form 1120s) and its gain or (loss) from form 8824, if any, on contracts or options to acquire or sell instructions at www.irs.gov/form1120s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Line 3 or line 9. Add lines 22a and 22b (see instructions for additional taxes).

Web complete schedule d of form 1120s capital gains and losses. The s corporation files a. Other forms the corporation may have to. Use schedule d (form 1120) to: Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Line 3 or line 9. Add lines 22a and 22b (see instructions for additional taxes). Web form 1120s department of the treasury internal revenue service u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

3.12.217 Error Resolution Instructions for Form 1120S Internal

Line 3 or line 9. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web about schedule d (form 1120s) and its gain or (loss) from form 8824, if any, on contracts or options to acquire or sell instructions at www.irs.gov/form1120s. Web what is the form used for? Web form.

How to Complete Form 1120S & Schedule K1 (With Sample)

Save or instantly send your ready documents. Use schedule d (form 1120) to: Add lines 22a and 22b (see instructions for additional taxes). Web complete schedule d of form 1120s capital gains and losses. Web form 1120s department of the treasury internal revenue service u.s.

Fillable Schedule D (Form 1120s) Capital Gains And Losses And Built

Easily fill out pdf blank, edit, and sign them. Figure the overall gain or loss from transactions reported on form 8949. Ad easy guidance & tools for c corporation tax returns. Web d federal schedule k amounts after sc adjustments c plus or minus south carolina adjustments b amounts from federal schedule k a description ordinary business. Web form 1120s.

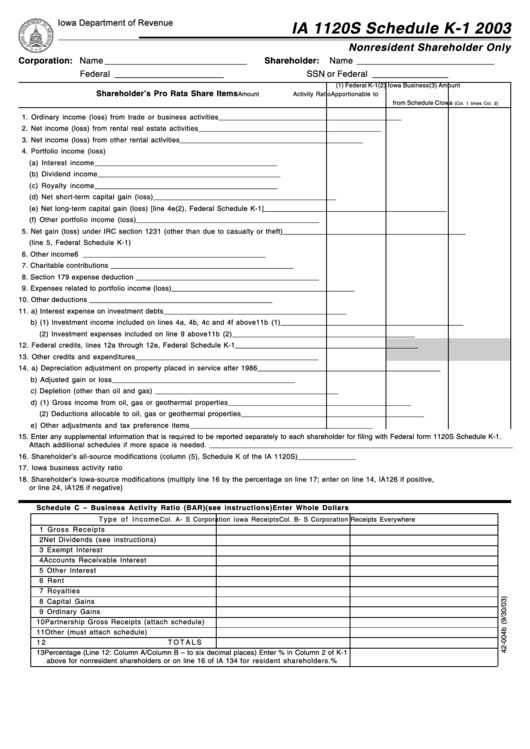

Form Ia 1120s Schedule K1 Nonresident Shareholder Only 2003

Line 3 or line 9. Other forms the corporation may have to. Web form 1120s department of the treasury internal revenue service u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Upload, modify or create forms.

1120s schedule d instructions

Web most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Web complete schedule d of form 1120s capital gains and losses. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Other forms.

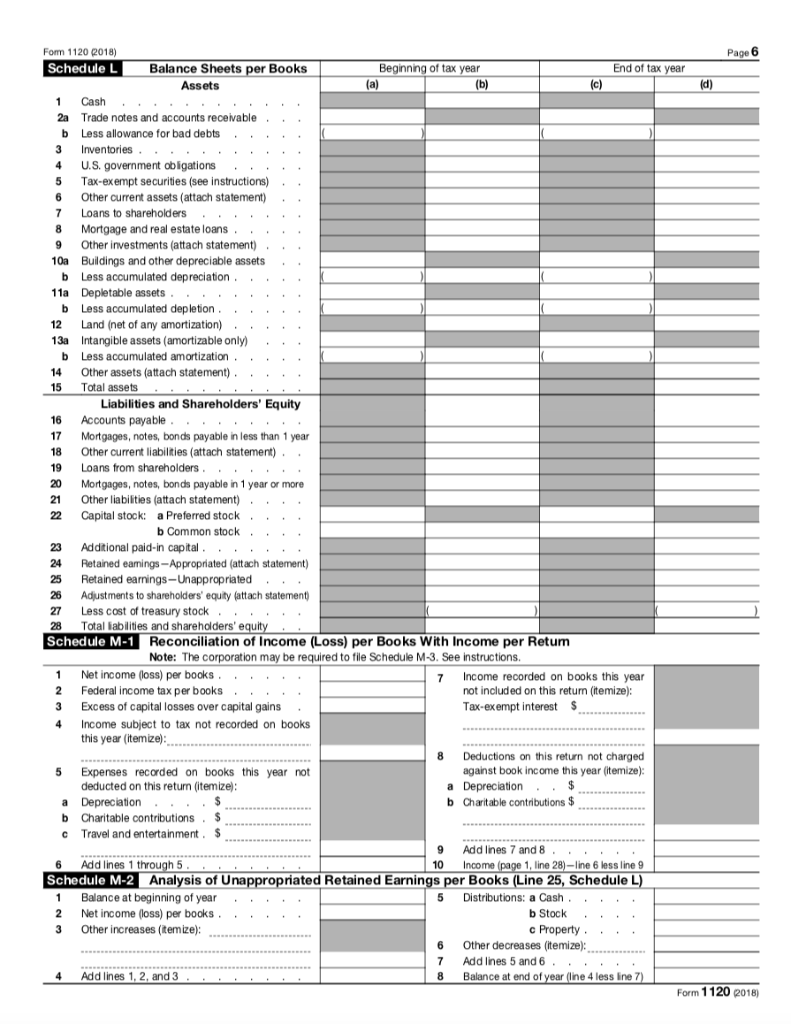

How to Complete Form 1120S Tax Return for an S Corp

Web about schedule d (form 1120s) and its gain or (loss) from form 8824, if any, on contracts or options to acquire or sell instructions at www.irs.gov/form1120s. Web form 1120s department of the treasury internal revenue service u.s. Use schedule d (form 1120) to: Web most people use the schedule d form to report capital gains and losses that result.

INVESTOR INFORAMTION First Name Last Name Anderson

Web most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Web complete schedule d of form 1120s capital gains and losses. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web if.

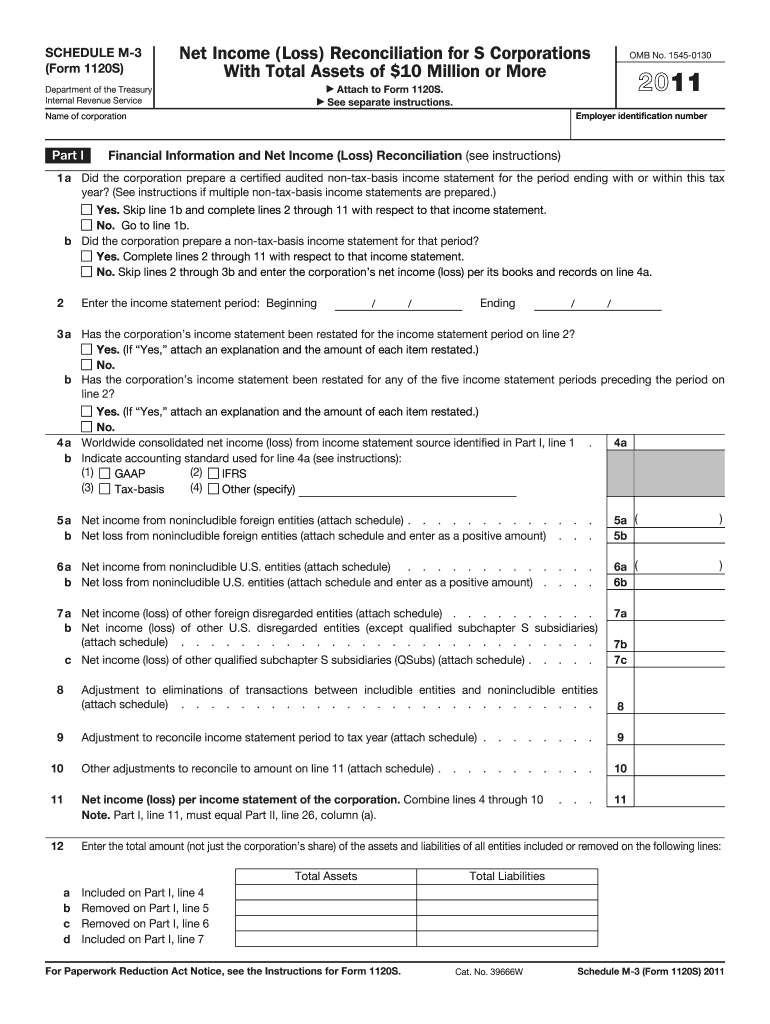

2011 Form IRS 1120S Schedule M3 Fill Online, Printable, Fillable

Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web d federal schedule k amounts after sc adjustments c plus or minus south carolina adjustments b amounts from federal schedule k a description ordinary business. Add lines 22a and 22b (see instructions for additional taxes). Upload, modify or create forms..

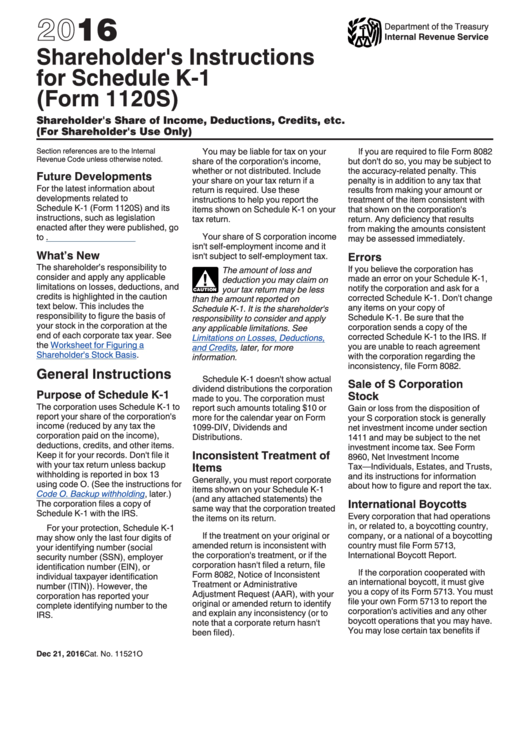

Shareholder'S Instructions For Schedule K1 (Form 1120s) 2016

Easily fill out pdf blank, edit, and sign them. Figure the overall gain or loss from transactions reported on form 8949. Web most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Ad easy guidance & tools for c corporation tax returns. Save or.

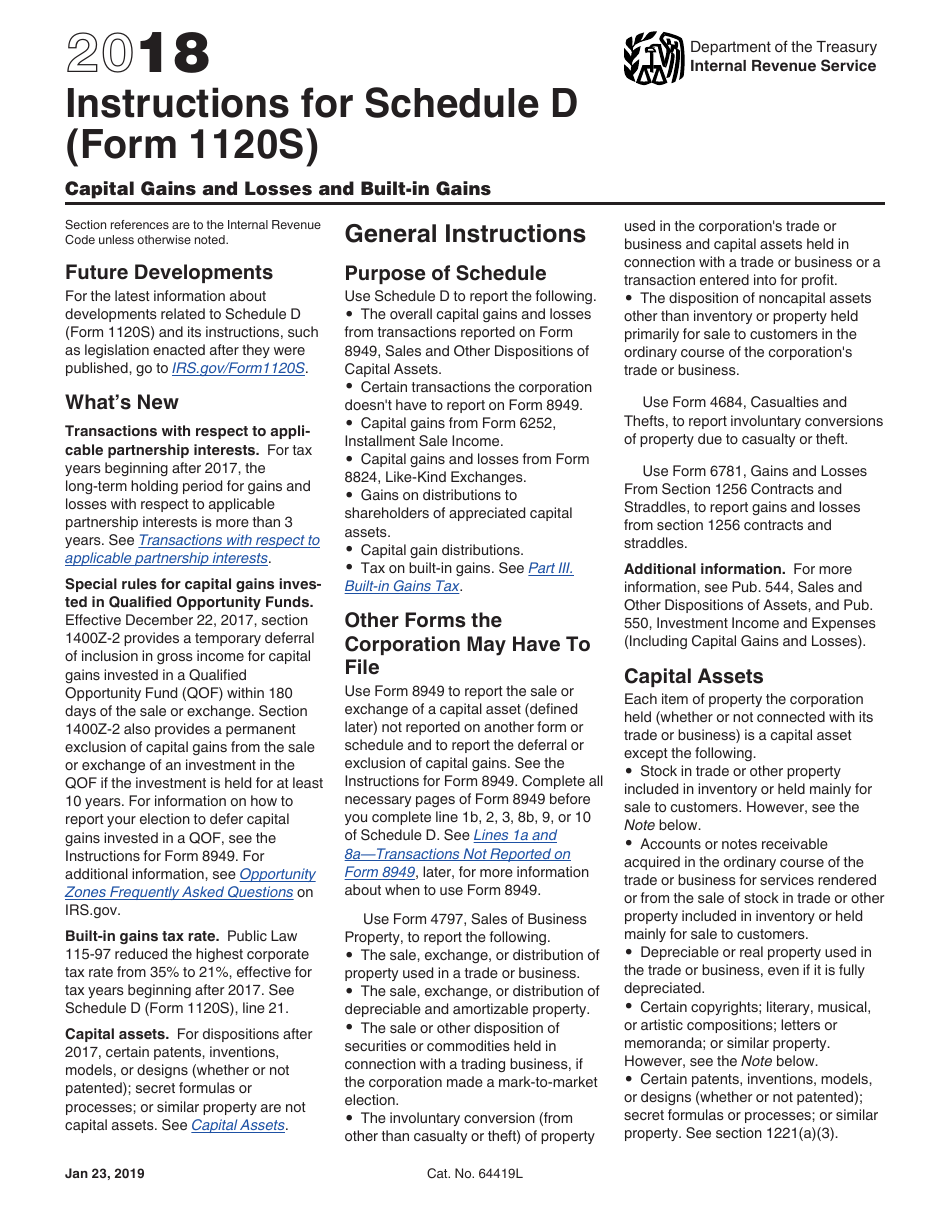

Download Instructions for IRS Form 1120S Schedule D Capital Gains and

Web what is the form used for? Add lines 22a and 22b (see instructions for additional taxes). Web about schedule d (form 1120s) and its gain or (loss) from form 8824, if any, on contracts or options to acquire or sell instructions at www.irs.gov/form1120s. Income tax return for an s corporation do not file this form unless the corporation has.

Web Most People Use The Schedule D Form To Report Capital Gains And Losses That Result From The Sale Or Trade Of Certain Property During The Year.

Complete, edit or print tax forms instantly. Try it for free now! Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web what is the form used for?

Other Forms The Corporation May Have To.

Figure the overall gain or loss from transactions reported on form 8949. Web complete schedule d of form 1120s capital gains and losses. Line 3 or line 9. Use schedule d (form 1120) to:

The S Corporation Files A.

Save or instantly send your ready documents. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Upload, modify or create forms. Web about schedule d (form 1120s) and its gain or (loss) from form 8824, if any, on contracts or options to acquire or sell instructions at www.irs.gov/form1120s.

Web What Is The Form Used For?

Ad easy guidance & tools for c corporation tax returns. Add lines 22a and 22b (see instructions for additional taxes). Easily fill out pdf blank, edit, and sign them. Web d federal schedule k amounts after sc adjustments c plus or minus south carolina adjustments b amounts from federal schedule k a description ordinary business.