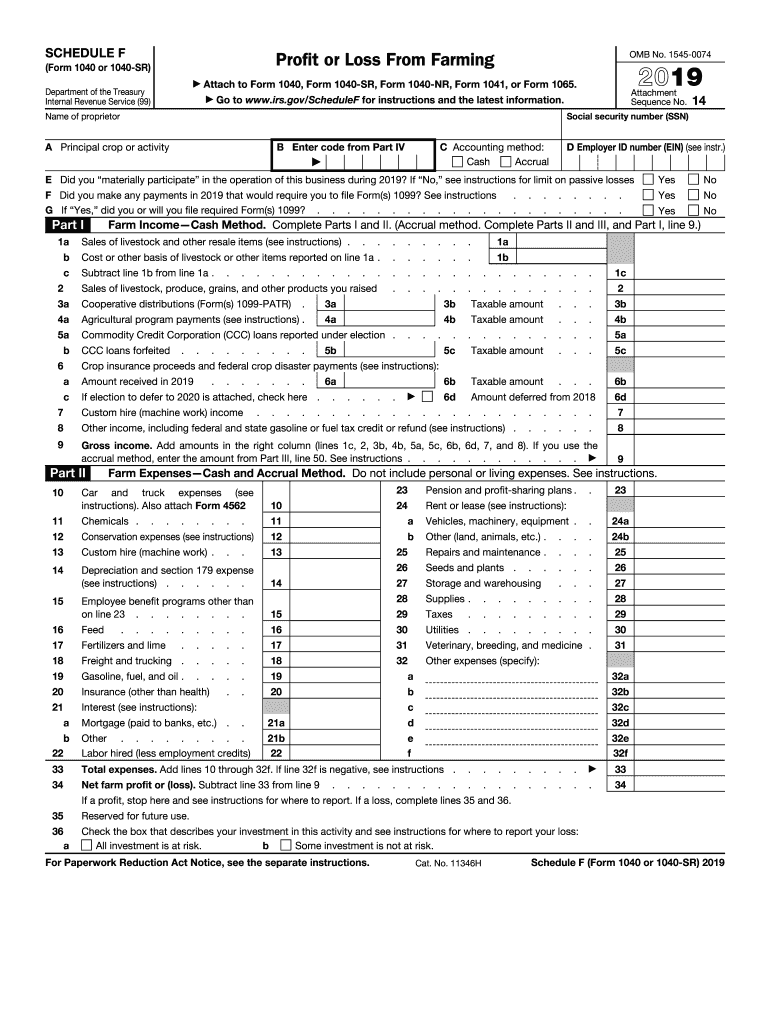

Schedule F Tax Form

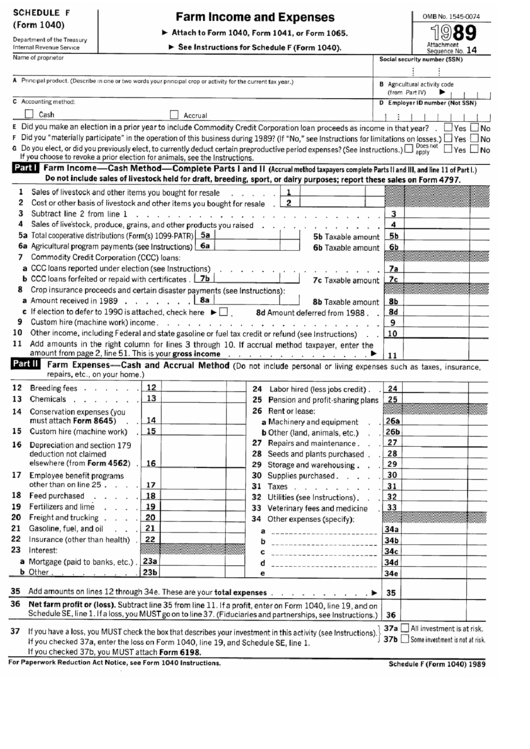

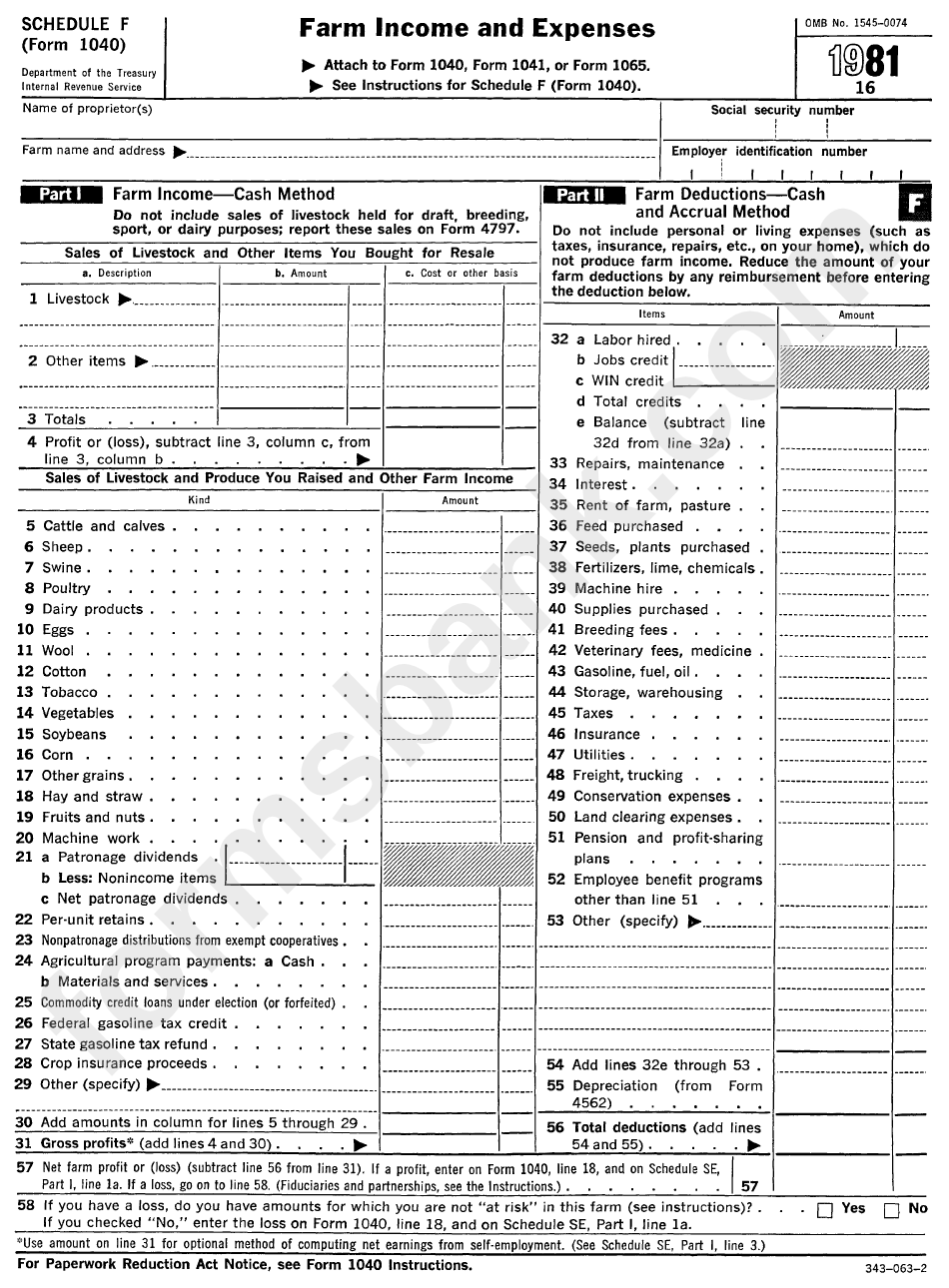

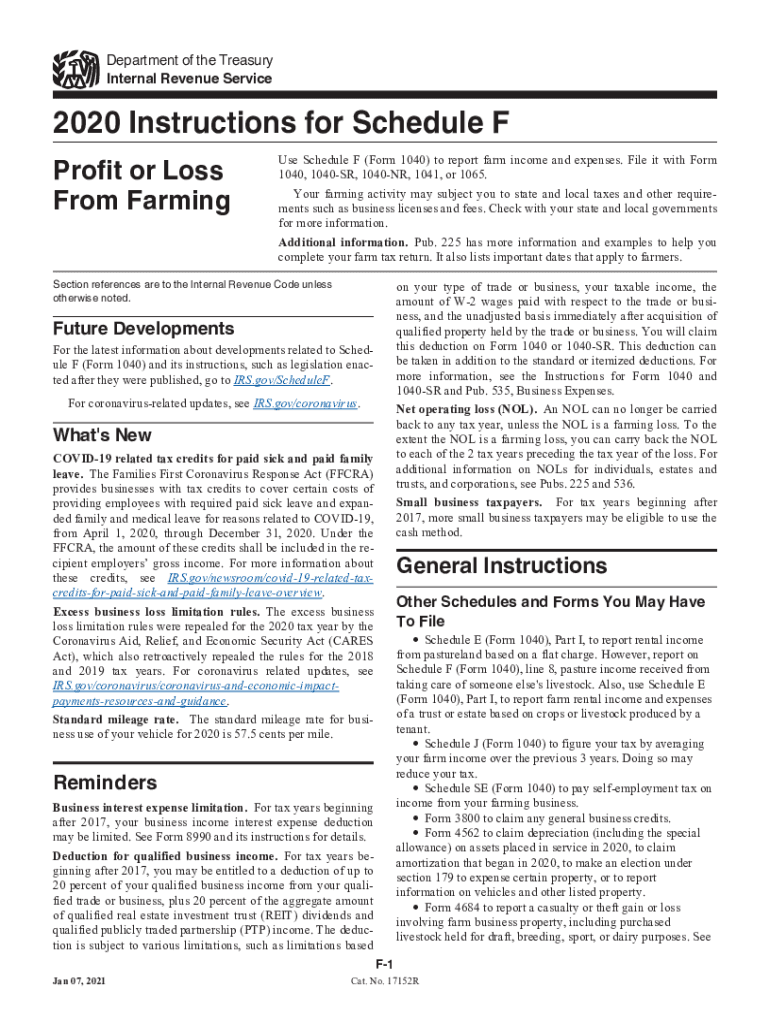

Schedule F Tax Form - Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Web use schedule f (form 1040) to report farm income and expenses. The end result is the net farm profit or loss amount transfered to form 1040. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Your taxable income amount is then transferred to your personal tax return. Web who uses schedule f to file taxes? This schedule must be included on form 1040 tax return, regardless of the type of farm income. You must be a farmer qualifying as a farmer doesn't just mean that you grow crops. The schedule f also helps you if you have farming losses. Read on for the scoop.

Web who uses schedule f to file taxes? Who must file form 1040 schedule f? You must be a farmer qualifying as a farmer doesn't just mean that you grow crops. Web but what is a schedule f tax form? Go to www.irs.gov/schedulef for instructions and the latest information. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. 14 name of proprietor social security. What is a schedule f tax form? Web schedule f is a two page tax form which lists the major sources of farm income and farm expense. Read on for the scoop.

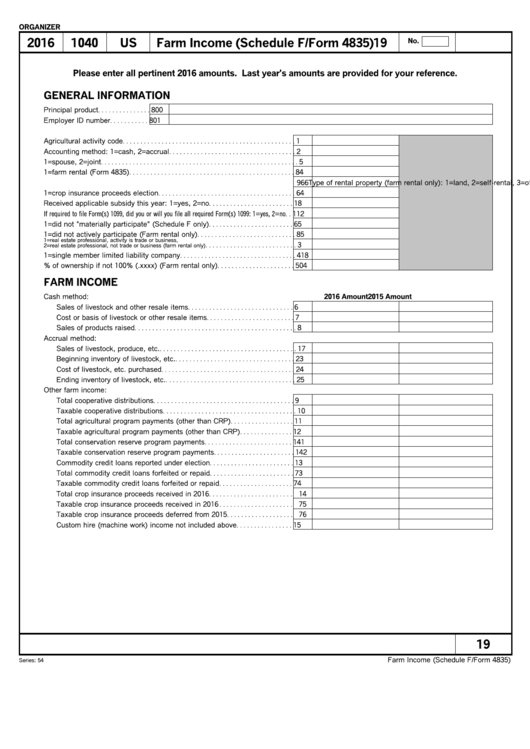

Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. What is a schedule f tax form? Web use schedule f (form 1040) to report farm income and expenses. Web schedule f is used to report taxable income earned from farming or agricultural activities. Livestock, produce, grains, greenhouse, nursery, floriculture, dairy, aquaculture, etc. 14 name of proprietor social security. The schedule f also helps you if you have farming losses. Who must file form 1040 schedule f? Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Schedule f, profit or loss from farming, helps farming businesses calculate profits or losses for the year.

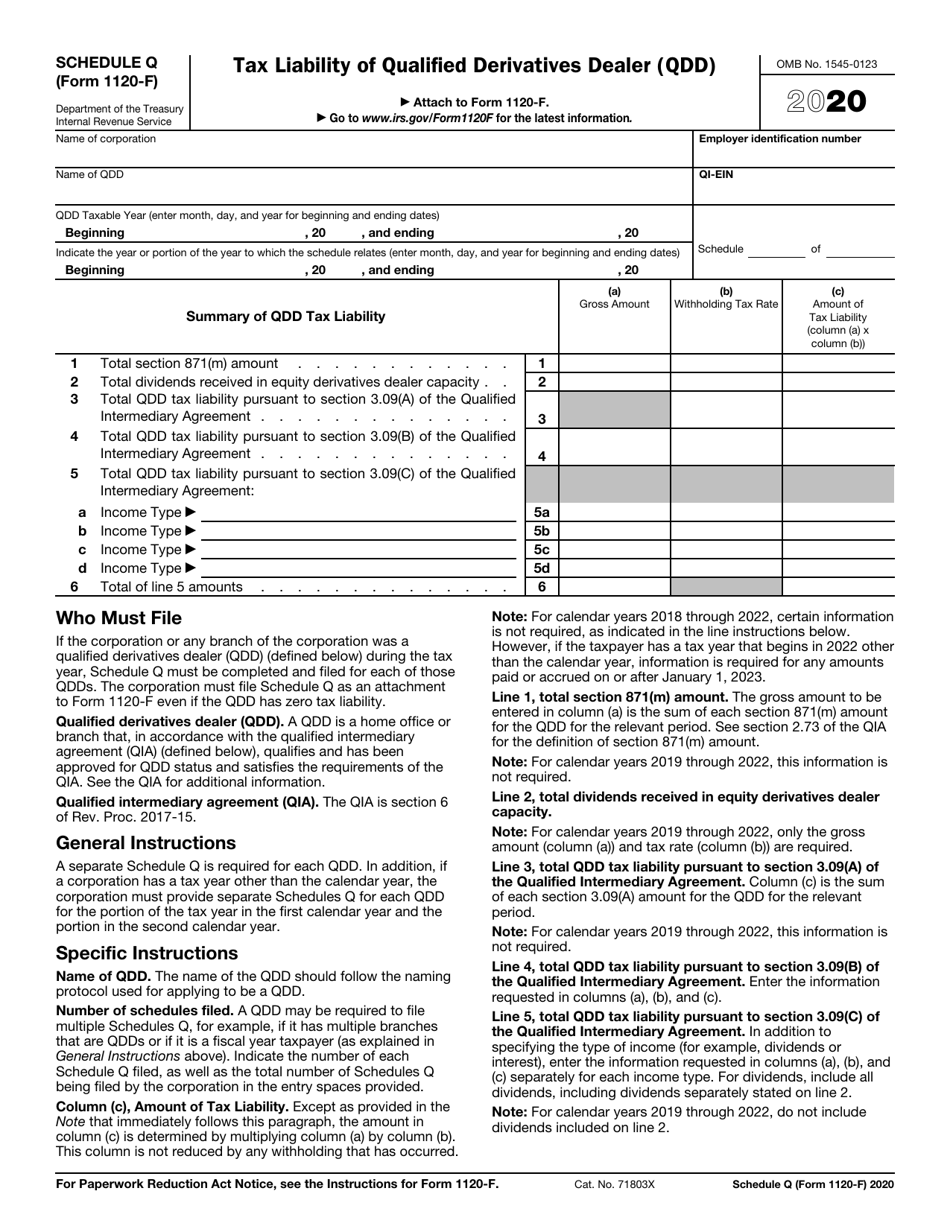

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Whether you should file schedule f with your tax return depends on three factors. Your taxable income amount is then transferred to your personal tax return. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Your farming activity may subject you to state and local taxes.

Shedule F (Form 1040) Farm And Expenses 1989 printable pdf

Web who uses schedule f to file taxes? Your taxable income amount is then transferred to your personal tax return. Livestock, produce, grains, greenhouse, nursery, floriculture, dairy, aquaculture, etc. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. What is a schedule f tax form?

Farm (Schedule F / Form 4835) printable pdf download

Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Web but what is a schedule f tax form? Use schedule f (form 1040) to report farm income and expenses. What is a schedule f tax form? Go to www.irs.gov/schedulef for instructions and the latest information.

Schedule F (Form 1040) Farm Tax Expenses 1981 printable pdf

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Read on for the scoop. Web schedule f is used to report taxable income earned from farming or agricultural activities. Use schedule f (form 1040) to report farm income and expenses. The schedule f also helps you.

Form R5404 Schedule F Download Fillable PDF or Fill Online Supplier

You must be a farmer qualifying as a farmer doesn't just mean that you grow crops. Who must file form 1040 schedule f? Web but what is a schedule f tax form? Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/schedulef for instructions.

IRS 1120F Form Tax Templates Online to Fill in PDF

Web use schedule f (form 1040) to report farm income and expenses. You must be a farmer qualifying as a farmer doesn't just mean that you grow crops. What is a schedule f tax form? 14 name of proprietor social security. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and.

IRS 1040 Schedule B 2013 Fill out Tax Template Online US Legal Forms

14 name of proprietor social security. The schedule f also helps you if you have farming losses. Web schedule f is used to report taxable income earned from farming or agricultural activities. The end result is the net farm profit or loss amount transfered to form 1040. Web information about schedule f (form 1040), profit or loss from farming, including.

2022 Form 1040nr Ez Example Calendar Template 2022

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. What is a schedule f tax form? This schedule must be included on form 1040 tax return, regardless.

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

File your schedule f with the appropriate forms: Who must file form 1040 schedule f? 14 name of proprietor social security. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Use schedule f (form 1040) to report farm income and expenses.

IRS 1040 Schedule F Instructions 2020 Fill out Tax Template Online

The end result is the net farm profit or loss amount transfered to form 1040. Web who uses schedule f to file taxes? Use schedule f (form 1040) to report farm income and expenses. Your taxable income amount is then transferred to your personal tax return. Go to www.irs.gov/schedulef for instructions and the latest information.

Livestock, Produce, Grains, Greenhouse, Nursery, Floriculture, Dairy, Aquaculture, Etc.

Who must file form 1040 schedule f? Whether you should file schedule f with your tax return depends on three factors. You own or operate a farm: Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file.

Web Use Schedule F (Form 1040) To Report Farm Income And Expenses.

Web schedule f is a two page tax form which lists the major sources of farm income and farm expense. Read on for the scoop. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. The end result is the net farm profit or loss amount transfered to form 1040.

Web But What Is A Schedule F Tax Form?

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. This schedule must be included on form 1040 tax return, regardless of the type of farm income. Schedule f, profit or loss from farming, helps farming businesses calculate profits or losses for the year. Go to www.irs.gov/schedulef for instructions and the latest information.

Web Schedule F Is Used To Report Taxable Income Earned From Farming Or Agricultural Activities.

What is a schedule f tax form? Use schedule f (form 1040) to report farm income and expenses. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Go to www.irs.gov/schedulef for instructions and the latest information.