Schedule J Form 5471

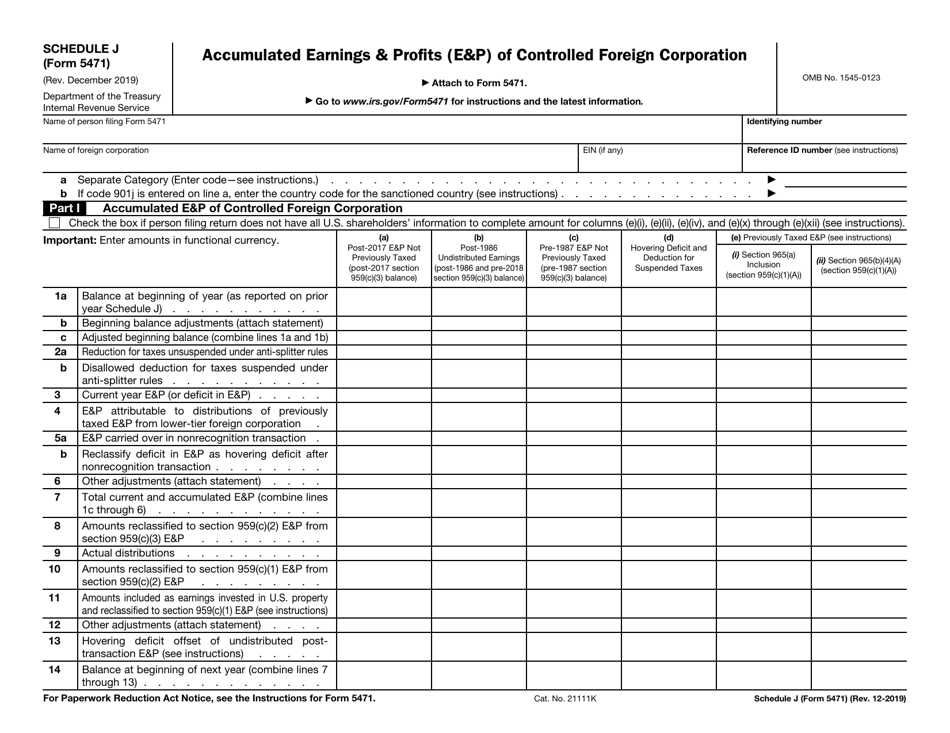

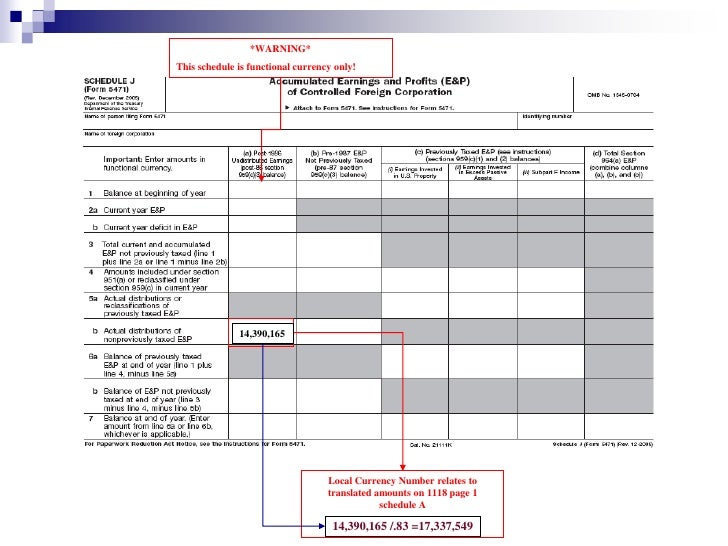

Schedule J Form 5471 - Web (new) 2021 schedule j of form 5471. Columns (a), (b), and (c) column (d) column (e) column (f) specific instructions related to lines 1 through 13. In most cases, special ordering rules under section 959 of the internal revenue code apply in. Schedule j contains information about the cfc's earnings and profits (e&p). Reference id number of foreign corporation. In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. December 2020) department of the treasury internal revenue service. Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2). Form 5471 filers generally use the same category of filer codes used on form 1118.

Exploring the (new) 2021 schedule j of form 5471: In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. Web schedule j (form 5471) (rev. Web (new) 2021 schedule j of form 5471. 4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)). Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Web schedule j of form 5471 has also added the following new columns: More importantly, schedule j tracks the corporations various. Columns (a), (b), and (c) column (d) column (e) column (f) specific instructions related to lines 1 through 13. Name of person filing form 5471.

More importantly, schedule j tracks the corporations various. Web (new) 2021 schedule j of form 5471. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Reference id number of foreign corporation. In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. Part i—accumulated e&p of controlled foreign corporation; Web schedule j (form 5471) (rev. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Accumulated earnings & profits (e&p) of controlled foreign corporation. December 2020) department of the treasury internal revenue service.

form 5471 schedule j 2019 Fill Online, Printable, Fillable Blank

More importantly, schedule j tracks the corporations various. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported.

I.R.S. Form 5471, Schedule J YouTube

When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. For instructions and the latest information. Web changes to separate schedule e (form 5471). Web schedule j (form 5471) (rev. Web (new) 2021 schedule j of form 5471.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Web changes to separate schedule e (form 5471). Schedule j contains information about the cfc's earnings and profits (e&p). More importantly, schedule j tracks the corporations various. Exploring the (new) 2021 schedule j of form 5471: Accumulated earnings & profits (e&p) of controlled foreign corporation.

A Deep Dive into the IRS Form 5471 Schedule J SF Tax Counsel

More importantly, schedule j tracks the corporations various. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

In most cases, special ordering rules under section 959 of the internal revenue code apply in. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule J SF

4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)). Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2). 2) hovering deficit and deduction for suspended taxes. Web schedule j (form 5471) (rev. Reference id number of foreign corporation.

IRS Form 5471 (Schedule J) 2018 2019 Fillable and Editable PDF Template

Web schedule j (form 5471) (rev. For instructions and the latest information. 2) hovering deficit and deduction for suspended taxes. Web changes to separate schedule e (form 5471). 4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)).

Schedule J Example Fill Online, Printable, Fillable, Blank pdfFiller

Accumulated earnings & profits (e&p) of controlled foreign corporation. Web schedule j (form 5471) (rev. Name of person filing form 5471. More importantly, schedule j tracks the corporations various. Reference id number of foreign corporation.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. For instructions and the latest information. Web (new) 2021 schedule j of form 5471. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Columns (a), (b), and.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

More importantly, schedule j tracks the corporations various. Reference id number of foreign corporation. Part i—accumulated e&p of controlled foreign corporation; In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. Web schedule j (form 5471) (rev.

Schedule J Contains Information About The Cfc's Earnings And Profits (E&P).

More importantly, schedule j tracks the corporations various. Columns (a), (b), and (c) column (d) column (e) column (f) specific instructions related to lines 1 through 13. Web schedule j of form 5471 has also added the following new columns: For instructions and the latest information.

In Most Cases, Special Ordering Rules Under Section 959 Of The Internal Revenue Code Apply In Determining How E&P Is Reported On Schedule J.

Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Web changes to separate schedule e (form 5471). 3) pti from section 965 (a) inclusion (section 959 (c) (1) (a)). Accumulated earnings & profits (e&p) of controlled foreign corporation.

2) Hovering Deficit And Deduction For Suspended Taxes.

Part i—accumulated e&p of controlled foreign corporation; Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Form 5471 filers generally use the same category of filer codes used on form 1118.

Name Of Person Filing Form 5471.

Reference id number of foreign corporation. Web (new) 2021 schedule j of form 5471. Web schedule j (form 5471) (rev. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms.